Undiscovered Gems In Asia To Watch December 2025

As global markets exhibit mixed performances, with U.S. indices reaching record highs and small-cap stocks like the Russell 2000 Index showing modest gains, investors are increasingly looking towards Asia for potential opportunities amid broader market optimism. In this dynamic environment, identifying promising stocks often involves assessing companies that can leverage regional economic trends and technological advancements to drive growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saison Technology | NA | 1.32% | -10.74% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Tibet Development | 13.94% | -0.13% | 42.61% | ★★★★★★ |

| Quality Reliability Technology | 18.75% | 0.46% | -43.08% | ★★★★★★ |

| Chin Hsin Environ Engineering | 5.28% | 24.51% | 40.62% | ★★★★★☆ |

| Hi-Lex | 4.66% | 10.06% | 16.32% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 6.10% | 17.97% | 20.67% | ★★★★★☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Zhejiang Truelove Vogue (SZSE:003041)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Truelove Vogue Co., Ltd. is engaged in the research, development, design, manufacture, and sale of blankets, carpets, and bedding in China with a market capitalization of CN¥7.18 billion.

Operations: Zhejiang Truelove Vogue generates revenue primarily from the sale of blankets, carpets, and bedding. The company's financial performance is highlighted by its gross profit margin trend, which provides insight into its cost management and pricing strategies.

Zhejiang Truelove Vogue, a modestly sized player in the luxury sector, has seen its earnings soar by 216% over the past year, outpacing the industry average of -1.2%. Despite this impressive growth, a significant one-off gain of CN¥215 million influenced recent financial results. The company's net debt to equity ratio stands at 21.3%, deemed satisfactory and indicative of sound financial health. However, future prospects appear challenging with earnings projected to fall by nearly half annually over the next three years. Recent M&A activity could reshape its ownership structure significantly in the near term.

Ningbo Henghe Precision IndustryLtd (SZSE:300539)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Henghe Precision Industry Co., Ltd. operates in the precision manufacturing sector, specializing in producing high-quality components and products, with a market cap of approximately CN¥11.66 billion.

Operations: Ningbo Henghe Precision Industry Co., Ltd. generates revenue primarily through its precision manufacturing operations, with a market capitalization of around CN¥11.66 billion.

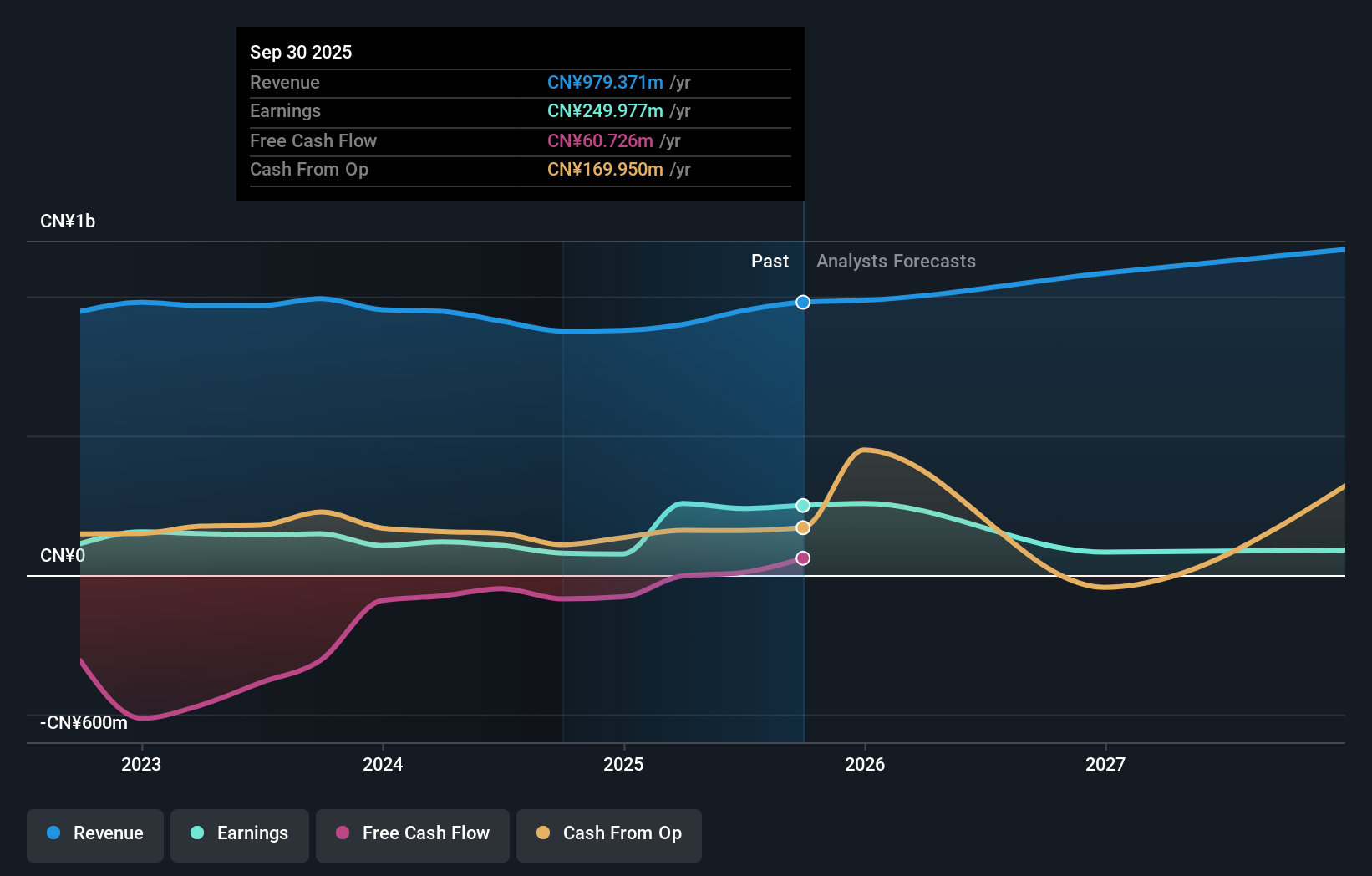

Ningbo Henghe Precision Industry, a nimble player in the precision industry, has seen its earnings grow by 67.6% over the past year, outpacing the broader Chemicals sector's 6.8%. The company reported sales of CNY 704.03 million for nine months ending September 2025, up from CNY 548.17 million in the previous year, with net income rising to CNY 37.5 million from CNY 24.25 million. Despite shareholder dilution over the past year and volatile share prices recently, Ningbo Henghe's debt-to-equity ratio improved significantly from 57.6% to a healthier 28.9%, indicating better financial stability moving forward.

- Unlock comprehensive insights into our analysis of Ningbo Henghe Precision IndustryLtd stock in this health report.

Learn about Ningbo Henghe Precision IndustryLtd's historical performance.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of sensors in China with a market cap of CN¥13.51 billion.

Operations: Ampron's primary revenue stream is from its sensitive components and sensor manufacturing segment, generating CN¥1.14 billion.

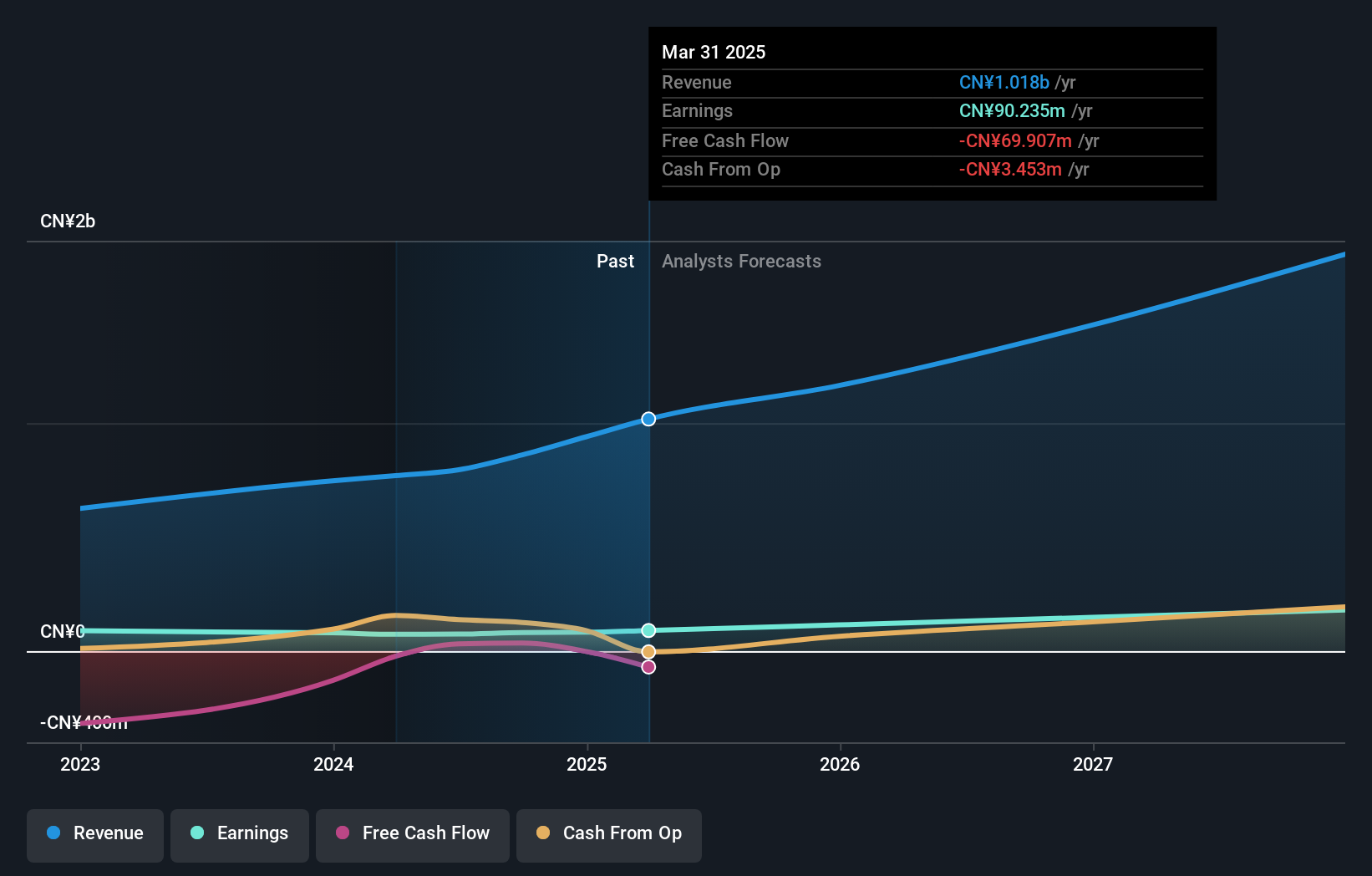

Ampron Technology, a small player in the electronics sector, has shown impressive earnings growth of 14.8% over the past year, surpassing the industry average of 9.4%. The company's net income for the first nine months of 2025 was CNY 73.13 million, compared to CNY 62.4 million in the previous year, aided by a one-off gain of CN¥18.9 million. Despite an increase in its debt-to-equity ratio from 11.7% to 38.2% over five years, its interest payments are well-covered by EBIT at an impressive rate of 8.8 times coverage, indicating solid financial management amidst volatility and growth prospects forecasted at over 26% annually.

- Click here to discover the nuances of Shenzhen Ampron Technology with our detailed analytical health report.

Gain insights into Shenzhen Ampron Technology's past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 2491 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報