December 2025's Intriguing Stocks Priced Below Estimated Value

As major stock indexes in the United States show mixed performance following two consecutive sessions of losses, investors are keeping a close eye on market movements and economic indicators. In this environment, identifying stocks priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.74 | $52.61 | 49.2% |

| UMB Financial (UMBF) | $117.16 | $233.30 | 49.8% |

| Sportradar Group (SRAD) | $23.41 | $45.62 | 48.7% |

| SmartStop Self Storage REIT (SMA) | $31.25 | $61.30 | 49% |

| Schrödinger (SDGR) | $17.84 | $35.41 | 49.6% |

| Prelude Therapeutics (PRLD) | $2.94 | $5.72 | 48.6% |

| Nicolet Bankshares (NIC) | $123.67 | $242.21 | 48.9% |

| Community West Bancshares (CWBC) | $22.63 | $44.11 | 48.7% |

| Clearfield (CLFD) | $29.94 | $58.39 | 48.7% |

| BioLife Solutions (BLFS) | $25.12 | $49.94 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

AAON (AAON)

Overview: AAON, Inc. operates in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment in the United States and Canada with a market cap of $6.17 billion.

Operations: The company's revenue segments include $0.26 billion from Basx, $0.80 billion from AAON Oklahoma, and $0.30 billion from AAON Coil Products.

Estimated Discount To Fair Value: 25.6%

AAON is trading at US$75.7, below its estimated fair value of US$101.75, indicating potential undervaluation based on cash flows. Analysts expect AAON's earnings to grow significantly over the next three years, outpacing the broader U.S. market growth rate. Despite recent net income declines and profit margin pressure, AAON forecasts robust revenue growth driven by strategic pricing actions and production recovery efforts, alongside leadership changes aimed at enhancing operational efficiency and strategic planning capabilities.

- Our comprehensive growth report raises the possibility that AAON is poised for substantial financial growth.

- Dive into the specifics of AAON here with our thorough financial health report.

Similarweb (SMWB)

Overview: Similarweb Ltd. offers digital data and analytics services to support critical business decisions across various regions, with a market cap of approximately $626.40 million.

Operations: The company's revenue is primarily generated from its Online Financial Information Providers segment, amounting to $275.43 million.

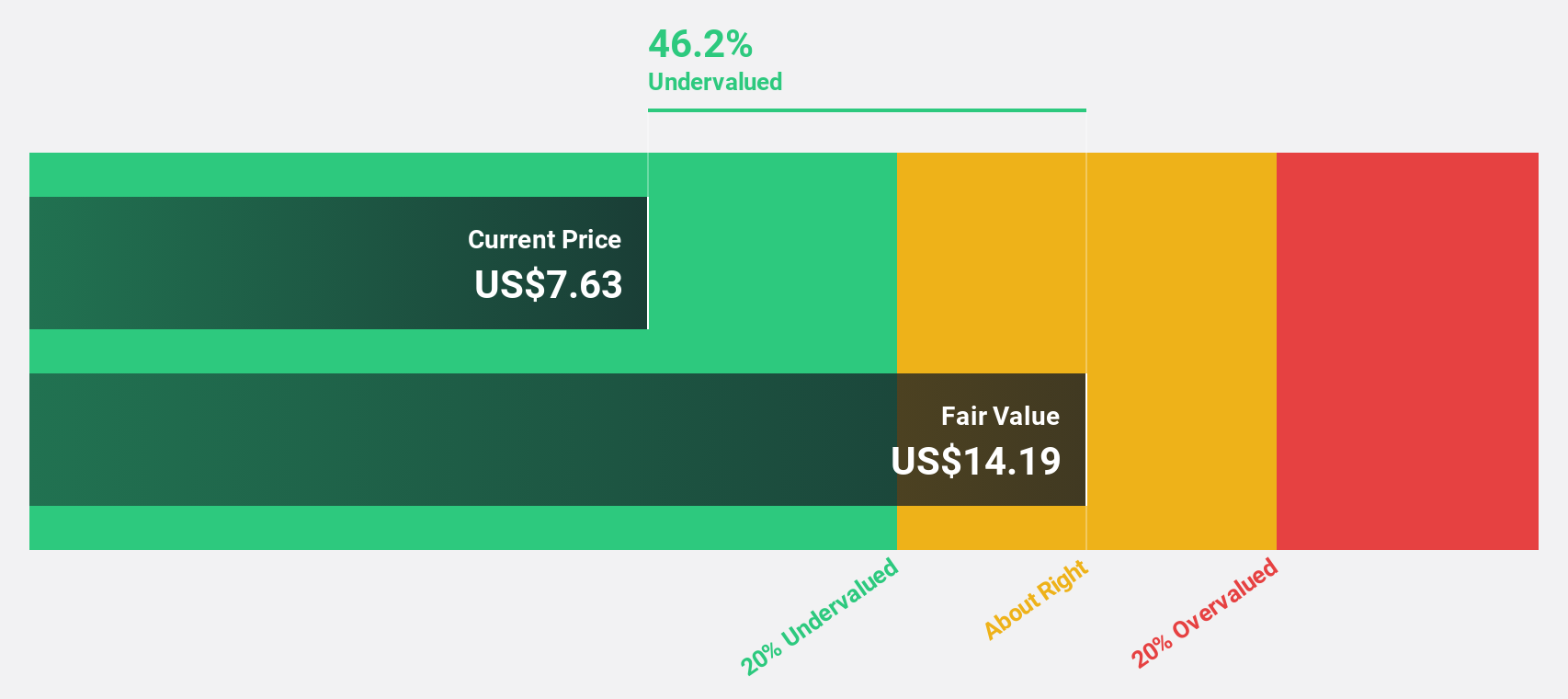

Estimated Discount To Fair Value: 26.3%

Similarweb, trading at US$7.26, is undervalued compared to its estimated fair value of US$9.85, with revenue expected to grow 13.5% annually, surpassing the broader U.S. market growth rate. Despite recent losses and a net loss of US$25.44 million for nine months in 2025, the company's innovative AI capabilities and strategic leadership changes position it for potential profitability within three years and high future return on equity projections at 49.5%.

- Our growth report here indicates Similarweb may be poised for an improving outlook.

- Take a closer look at Similarweb's balance sheet health here in our report.

Wolverine World Wide (WWW)

Overview: Wolverine World Wide, Inc. is involved in designing, manufacturing, sourcing, marketing, licensing and distributing footwear, apparel and accessories across various regions including the United States and several international markets; it has a market cap of approximately $1.47 billion.

Operations: The company's revenue segments include $439.30 million from the Work Group and $1.37 billion from the Active Group.

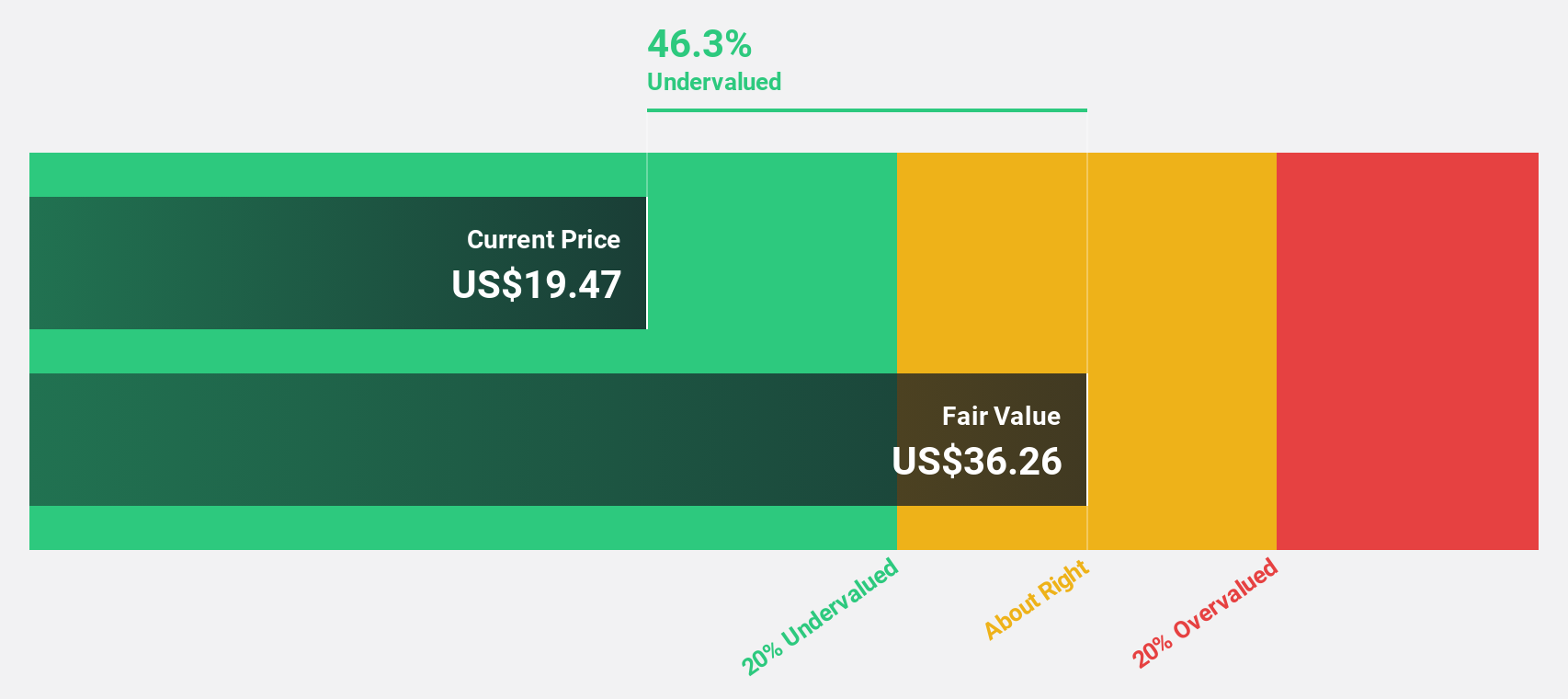

Estimated Discount To Fair Value: 38.5%

Wolverine World Wide, trading at US$17.92, is significantly undervalued compared to its estimated fair value of US$29.12. Despite revenue growth of 5.5% annually being slower than the U.S. market, the company's earnings are forecasted to grow at a robust 21.6% per year, outpacing market expectations and indicating strong cash flow potential. However, debt coverage by operating cash flow remains a concern amidst strategic leadership changes and product innovations aimed at driving future profitability.

- In light of our recent growth report, it seems possible that Wolverine World Wide's financial performance will exceed current levels.

- Get an in-depth perspective on Wolverine World Wide's balance sheet by reading our health report here.

Next Steps

- Click this link to deep-dive into the 207 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報