Spotlight On 3 Penny Stocks With Market Caps Over $20M

Major stock indexes in the United States have shown mixed performance recently, with some rebounding after consecutive losses while others continue to face challenges. Despite these fluctuations, investors often look beyond the well-known names in search of opportunities that may not be immediately apparent. Penny stocks, though an outdated term, still represent a viable investment area for those seeking growth potential at lower price points. These smaller or newer companies can offer significant upside when backed by solid fundamentals and strong balance sheets.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.68 | $617.2M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.88 | $679.93M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8371 | $145.28M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.30 | $555.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.14 | $1.29B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.29 | $563.4M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Nephros (NEPH) | $4.87 | $51.75M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $1.00 | $7.26M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.08 | $92.44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 339 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Pioneer Power Solutions (PPSI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pioneer Power Solutions, Inc. designs, manufactures, integrates, refurbishes, distributes, sells, and services electric power systems and related solutions with a market cap of $51.37 million.

Operations: The company generates revenue from its Critical Power Solutions segment, which brought in $31.75 million.

Market Cap: $51.37M

Pioneer Power Solutions, with a market cap of US$51.37 million, is navigating the penny stock landscape by leveraging its Critical Power Solutions segment, which generated US$31.75 million in revenue. Although currently unprofitable with increasing losses over five years, Pioneer remains debt-free and has a stable cash runway exceeding one year. Recent strategic moves include launching PRYMUS to meet AI-driven power demands and forming an international partnership for EV charging expansion in the UAE. Despite challenges such as negative return on equity and volatility, Pioneer's initiatives signal potential growth avenues within high-demand sectors like AI and distributed energy solutions.

- Click here to discover the nuances of Pioneer Power Solutions with our detailed analytical financial health report.

- Examine Pioneer Power Solutions' earnings growth report to understand how analysts expect it to perform.

NET Power (NPWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NET Power Inc. is an energy technology company based in the United States with a market cap of $490.69 million.

Operations: Currently, NET Power Inc. does not report any revenue segments.

Market Cap: $490.69M

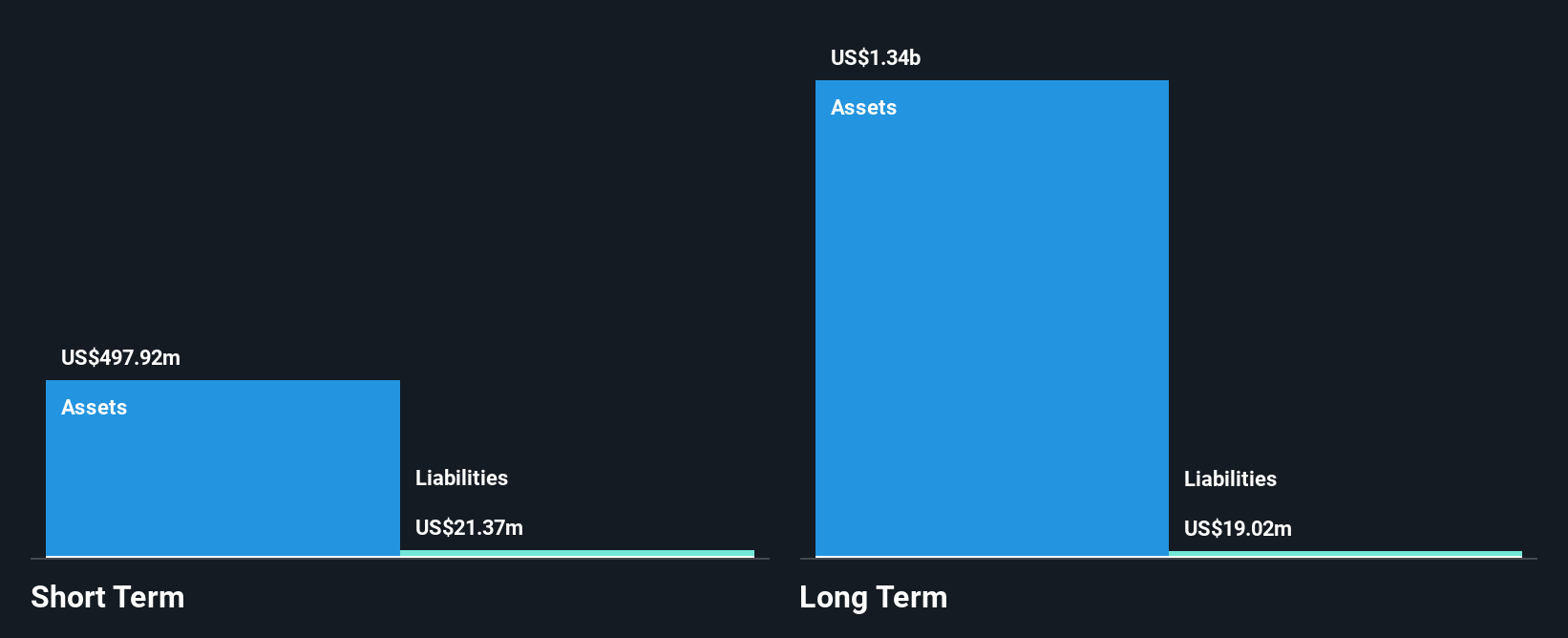

NET Power Inc., with a market cap of US$490.69 million, operates as a pre-revenue entity in the energy technology sector, reporting no significant revenue streams. The company faces challenges with substantial recent losses, including a net loss of US$411.5 million for Q3 2025 and an unprofitable status over the past five years. Despite these hurdles, NET Power maintains a stable cash runway exceeding one year and is debt-free, though its share price remains highly volatile. A relatively inexperienced management team and board may impact strategic direction as they navigate this volatile penny stock environment.

- Click here and access our complete financial health analysis report to understand the dynamics of NET Power.

- Gain insights into NET Power's past trends and performance with our report on the company's historical track record.

Innovative Food Holdings (IVFH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innovative Food Holdings, Inc. distributes specialty food and related products to various establishments across the United States, with a market cap of $24.11 million.

Operations: The company's revenue is primarily derived from the delivery of specialty foods, which generated $75.89 million.

Market Cap: $24.11M

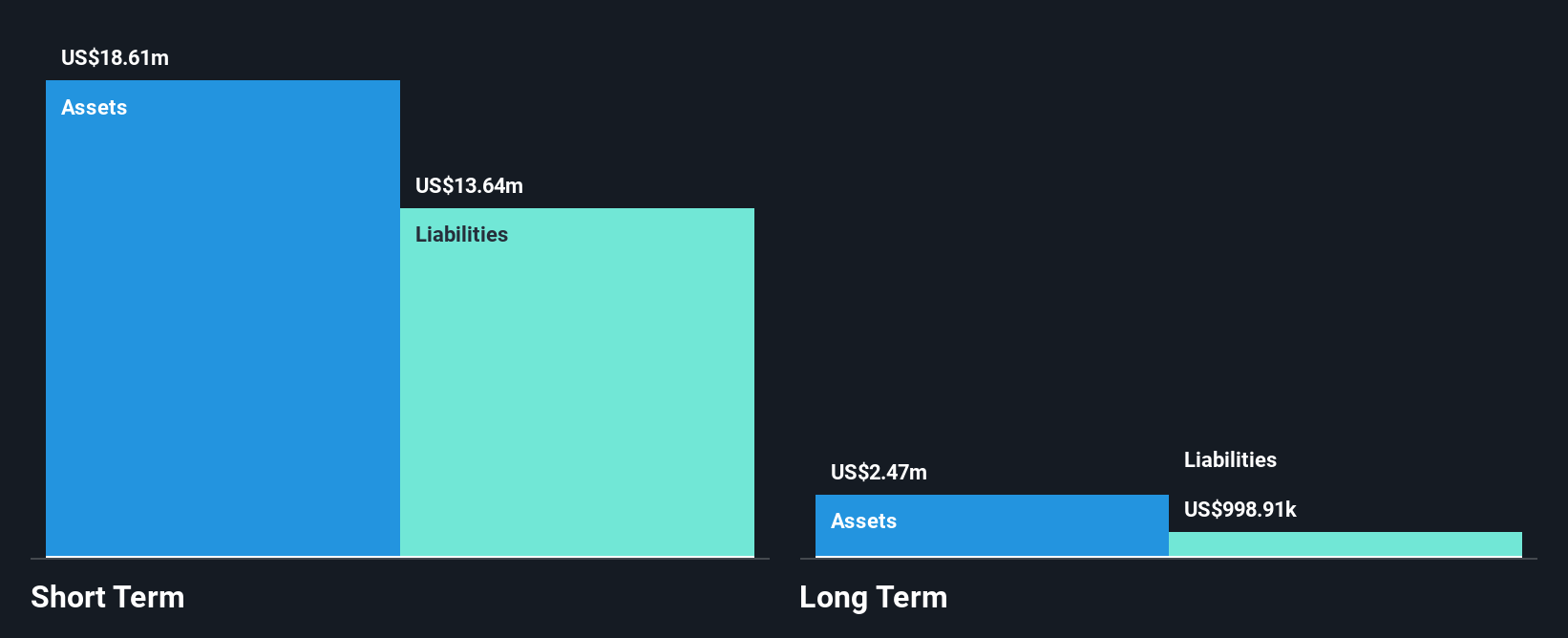

Innovative Food Holdings, Inc., with a market cap of US$24.11 million, reported Q3 2025 sales of US$16.42 million but faced a net loss of US$1.72 million, reflecting challenges in profitability despite revenue generation from specialty food distribution. The company's short-term assets exceed both its long-term and short-term liabilities, indicating solid liquidity management; however, negative operating cash flow raises concerns about debt coverage. Recent leadership changes aim to enhance growth and operational efficiency under new CEO Gary Schubert's guidance. Despite stable weekly volatility over the past year, share price fluctuations remain high in this penny stock environment.

- Click to explore a detailed breakdown of our findings in Innovative Food Holdings' financial health report.

- Gain insights into Innovative Food Holdings' historical outcomes by reviewing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 336 US Penny Stocks now.

- Seeking Other Investments? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報