Spotlight On Dividend Stocks For December 2025

As the U.S. stock market navigates mixed performances with major indices experiencing fluctuations, investors are closely monitoring the rebound in precious metals and shifts in technology stocks. Amid these dynamic conditions, dividend stocks continue to attract attention for their potential to provide steady income streams and resilience during periods of market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.74% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.39% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.67% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.75% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.26% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.03% | ★★★★★★ |

| Ennis (EBF) | 5.42% | ★★★★★★ |

| Dillard's (DDS) | 4.94% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.06% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.50% | ★★★★★★ |

Click here to see the full list of 120 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

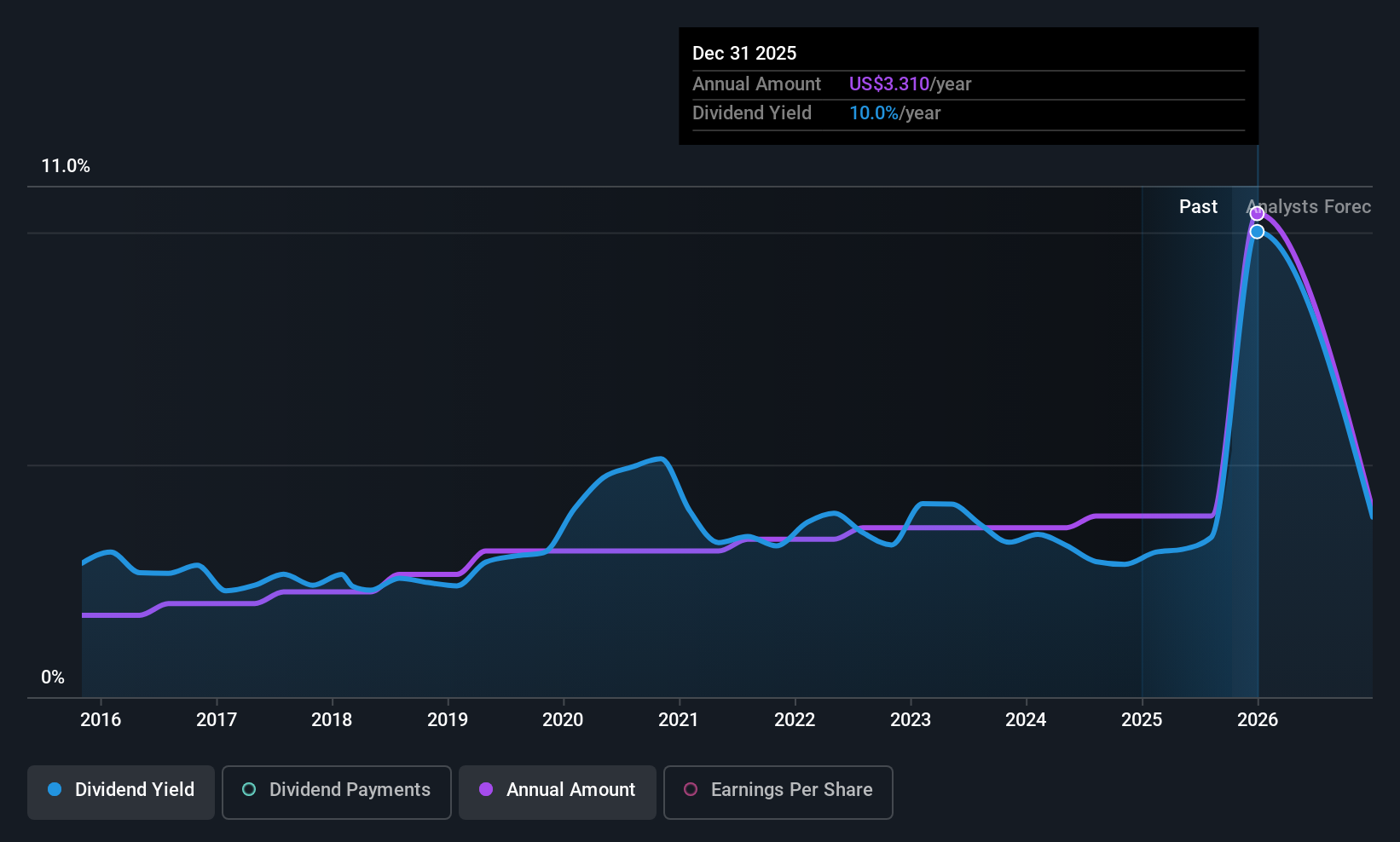

First Community Bankshares (FCBC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Community Bankshares, Inc. operates as the financial holding company for First Community Bank, offering a range of banking products and services, with a market cap of $616.48 million.

Operations: First Community Bankshares generates revenue primarily through its community banking segment, which accounted for $164.26 million.

Dividend Yield: 3.7%

First Community Bankshares offers a reliable dividend yield of 3.68%, supported by a sustainable payout ratio of 46%. Dividends have grown consistently over the past decade, although the yield is below the top tier in the US market. Recent financials show stable earnings, with net income slightly declining year-over-year. A special cash dividend of $1 per share was announced for January 2026, underscoring its commitment to returning value to shareholders despite recent charge-offs and earnings fluctuations.

- Take a closer look at First Community Bankshares' potential here in our dividend report.

- The valuation report we've compiled suggests that First Community Bankshares' current price could be inflated.

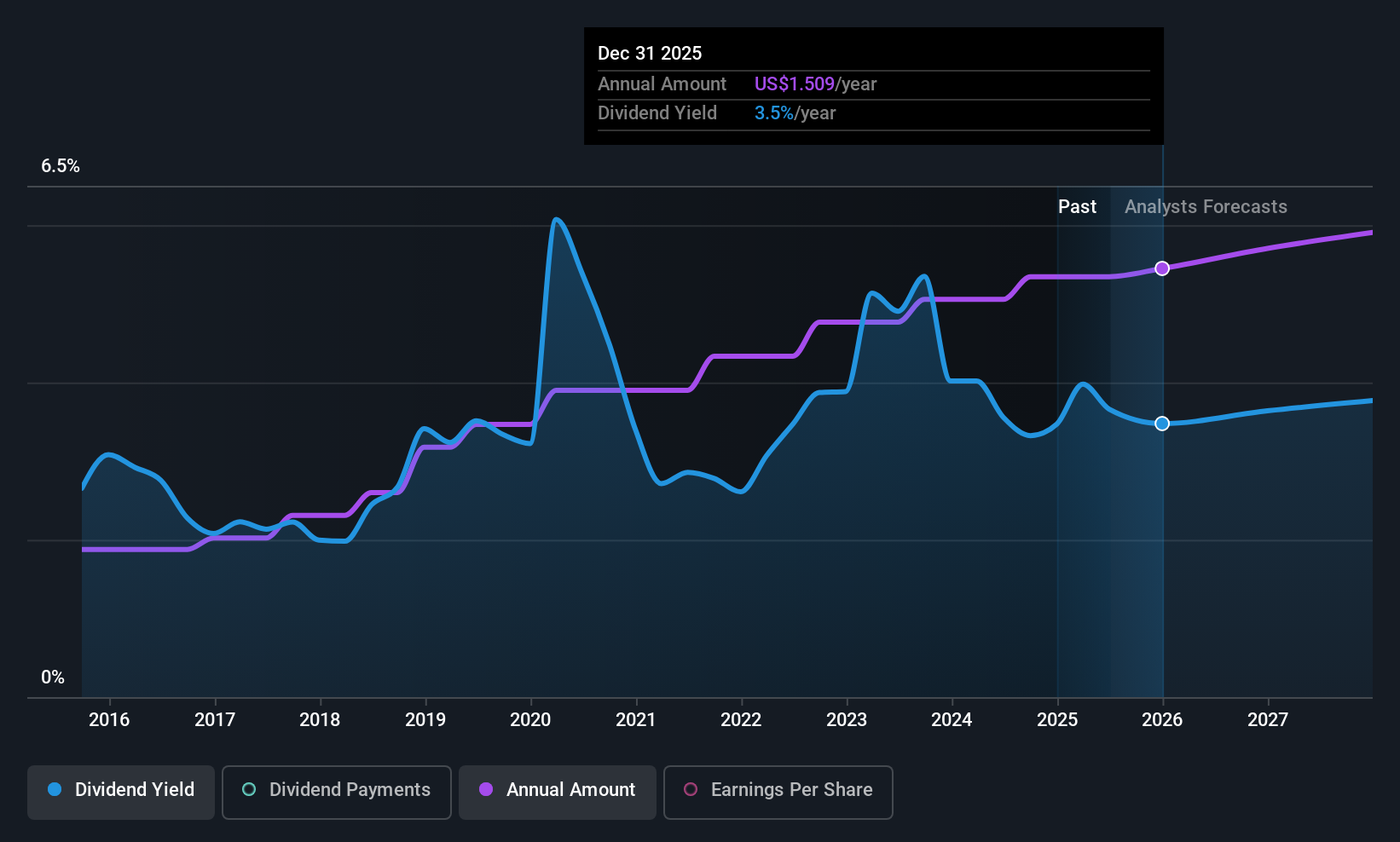

Fifth Third Bancorp (FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services across the United States, with a market cap of approximately $31.99 billion.

Operations: Fifth Third Bancorp generates its revenue through three primary segments: Commercial Banking ($3.37 billion), Wealth and Asset Management ($633 million), and Consumer and Small Business Banking ($4.84 billion).

Dividend Yield: 3.3%

Fifth Third Bancorp declared a quarterly cash dividend of US$0.40 per share, maintaining its history of stable and reliable dividend payments over the past decade. Despite a yield lower than the top 25% in the U.S., dividends are well-covered by a payout ratio of 44.8%. Recent board changes include Priscilla Almodovar's appointment, potentially enhancing governance with her extensive leadership experience. The bank's expansion into high-growth markets aligns with its strategic growth initiatives.

- Click here and access our complete dividend analysis report to understand the dynamics of Fifth Third Bancorp.

- Our expertly prepared valuation report Fifth Third Bancorp implies its share price may be lower than expected.

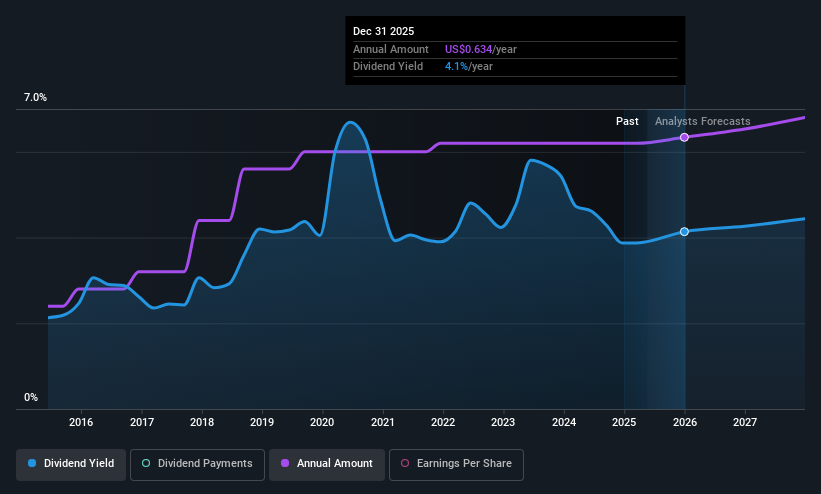

Huntington Bancshares (HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States, with a market cap of $27.56 billion.

Operations: Huntington Bancshares generates revenue through its key segments: Commercial Banking, which contributes $2.81 billion, and Consumer & Regional Banking, which accounts for $5.10 billion.

Dividend Yield: 3.5%

Huntington Bancshares maintains a stable dividend, recently declaring a US$0.155 per share payout, consistent with previous quarters. The dividend yield of 3.53% is below the top quartile in the U.S., but well-covered by earnings with a 42.8% payout ratio. Recent expansions in North Carolina and South Carolina reflect strategic growth efforts, while leadership changes aim to strengthen regional operations following its merger with Veritex Holdings Inc., enhancing market presence and operational scale.

- Navigate through the intricacies of Huntington Bancshares with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Huntington Bancshares is priced lower than what may be justified by its financials.

Next Steps

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 117 more companies for you to explore.Click here to unveil our expertly curated list of 120 Top US Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報