IPO News | Blue Cursor (300058.SZ) Second Filing Hong Kong Stock Exchange Ranked Among the Top Ten Global Marketing Communications Companies in 2024

Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 30, Beijing Blue Cursor Data Technology Group Co., Ltd. (abbreviation: Blue Cursor, 300058.SZ) submitted a listing application to the main board of the Hong Kong Stock Exchange. Huatai International, Guotai Junan International, and Huaxing Capital were its co-sponsors. This is the second time this year that the company has submitted a listing application to the Hong Kong Stock Exchange on June 25. According to Frost & Sullivan's data, according to 2024 revenue, the blue cursor is the largest Chinese marketing company and the only Chinese company among the top ten marketing communication companies in the world, ranking 10th.

Company profile

According to the prospectus, Blue Cursor was founded in 1996 and focuses on providing one-stop technology-driven marketing services for customers in different industries to meet the marketing needs of customers in the business life cycle.

According to Frost & Sullivan's data, according to 2024 revenue, the blue cursor has taken a leading position in several market segments of the marketing industry: the company is the largest Chinese marketing service provider and the only Chinese company among the top ten marketing communication companies in the world, ranking 10th; the company is the largest overseas cross-border marketing service provider in China; the company is the third largest domestic integrated marketing service provider in China; and the company is the largest digital advertising agency service provider in China.

The following table shows the company's marketing services by business segment:

During the track record period, the company's marketing services have reached nearly 200 countries and regions around the world, serving more than 100,000 customers, including more than 100 Fortune China 500 companies.

In 2023, the blue cursor released the “All in AI” strategy, pioneered the marketing industry's layout of artificial intelligence and actively embraced a new round of technological innovation. The company is committed to restructuring the business and promoting business growth with AI as the core. The company has developed Blue AI, an AI application engine specially built for the marketing industry. With Blue AI, the company cleaned and labeled more than 120 million pieces of exclusive data in the marketing field to form a marketing database. Based on this, the company continues to incubate Blue AI agents around key business aspects such as data insight, content generation, project execution and settlement. As of September 30, 2025, the company has formed 137 Blue AI agents that can be applied in actual marketing scenarios, significantly improving the level of automation and intelligence of all service processes and operational efficiency.

As one of the first Chinese marketing companies to explore overseas markets, Blue Cursor regards globalization as one of its core development strategies, and has always implemented this strategy in the development process. In 2024, the company launched the “Global Overseas 2.0” strategy to promote the upgrading of overseas cross-border marketing business from a traditional model based on agency business to a business model based on the following: localized operation and technology-driven, relying on its own capabilities to expand global customers and improve service quality and efficiency, and accelerate the release of the scale effect of global business.

With its professional ability and service reputation, the Blue Light brand is trusted by global customers and has also won many awards, including being selected as one of the “Fortune China” Top 500 and China's Top 500 Private Enterprises.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately 36.683 billion yuan (RMB, same below), 52,616 billion yuan, 60.797 billion yuan, and 51,801 billion yuan, respectively. During the track record period, the company's revenue mainly came from providing overseas cross-border marketing services, domestic integrated marketing services, and domestic full-case advertising services.

Gross profit and gross profit margin

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross profit of about 1.708 billion yuan, 1,789 billion yuan, 1,530 billion yuan, and 1,341 billion yuan, respectively, with corresponding gross margins of 4.7%, 3.4%, 2.5%, and 2.6%.

Profit for the year/period

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded annual/period profits of about 2.177 billion yuan, 112 million yuan, -297 million yuan, and 230 million yuan respectively.

Industry Overview

Marketing refers to a series of marketing activities delivered around a customer's brand or product. It covers all marketing services from preliminary research and strategic positioning to creative planning, event execution, and performance monitoring. Its purpose is to help brands achieve market growth and sustainable development.

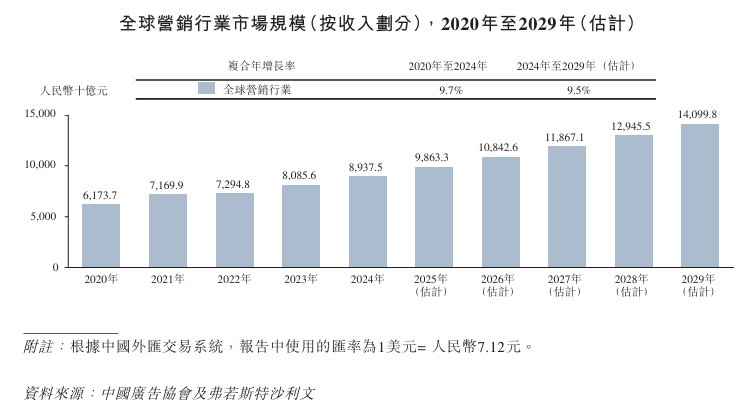

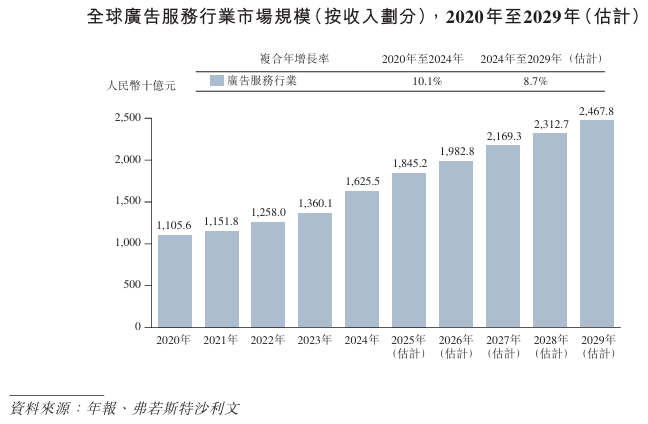

Driven by the advancement of digital transformation, the growing popularity of artificial intelligence solutions, and the growing demand for end-to-end services in various industries, the global marketing industry is growing steadily.

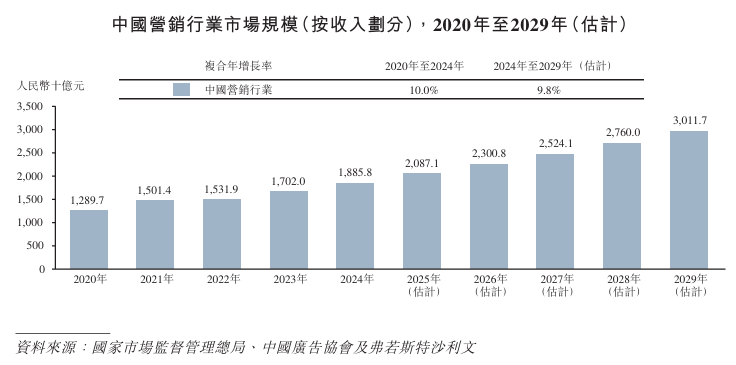

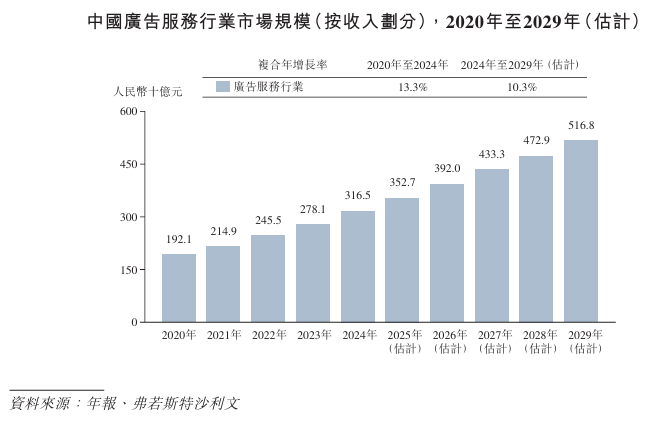

The Chinese marketing industry continues to grow and is expected to maintain its growth trend in the face of policy incentives, growing corporate demand for brand building and digital transformation, and changing consumer expectations for cultural fit, emotional resonance, and cost performance.

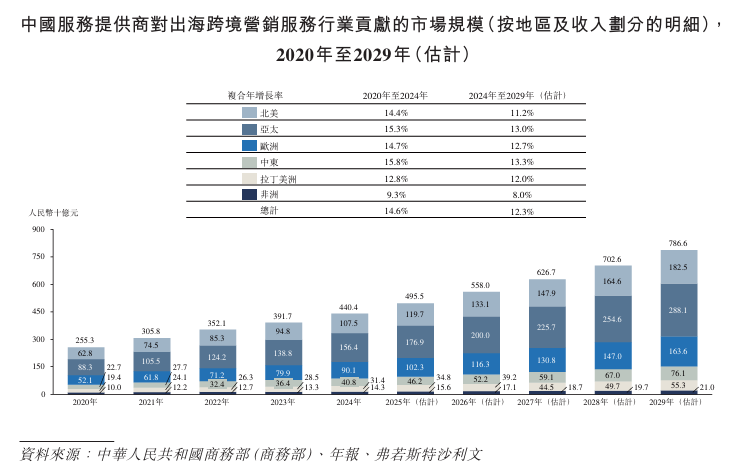

Overseas cross-border marketing services refer to marketing activities carried out by Chinese companies in overseas markets. It involves using multiple digital channels to achieve brand awareness, product promotion, and user acquisition. Key features include cross-language communication, cultural adaptation, multi-platform delivery, and data-driven optimization. It is widely used in e-commerce, games, mobile applications, and consumer goods.

The growth of China's overseas cross-border marketing service industry is mainly driven by the increase in advertising budgets for outbound industries such as cross-border e-commerce, games, and mobile apps. The rapid expansion of global media platforms has further encouraged Chinese companies to expand their investment in social and programmatic advertisers.

As Chinese brands increasingly pursue global expansion, their focus on localized content, performance optimization, and private domain operations will deepen, and the market will shift from broad-based spending to a full-funnel growth model to support continued demand and the industry is expected to maintain a strong growth momentum.

From 2020 to 2024, the growth of the overseas cross-border marketing service industry in the Asia-Pacific region has always been in a leading position in the market, far surpassing other regions. North America and Europe are close behind. Although North America slightly surpassed Europe in size, the two regions had similar growth rates, with a compound annual growth rate of over 14.0% from 2020 to 2024. Notably, the Middle East, despite its small base, is still the fastest growing region.

From 2024 to 2029, North America is expected to maintain its leading position, while the Asia-Pacific region will continue to be one of the fastest growing regions in the overseas cross-border marketing service industry, and the Middle East and Latin America will also experience rapid expansion.

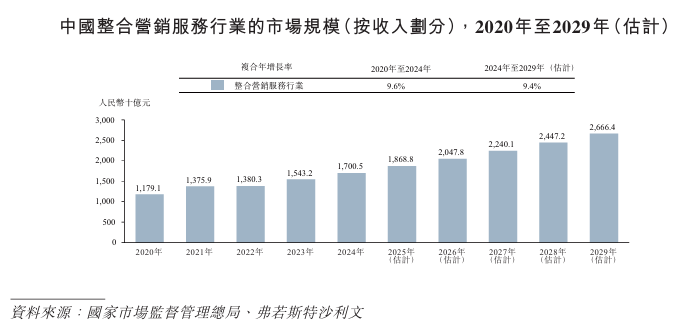

Integrated marketing services refer to planning and execution of the entire marketing process in a comprehensive and multi-dimensional manner through collaborative strategy, creativity, technology, activation and analysis. This includes strategic brand and consumer insight development, creative content generation and visual communication, omnichannel media distribution, and marketing technology enablement. In addition, it also includes experiential marketing, CRM-driven accurate enterprise marketing, native scenario activation, sales and trade marketing, and measurement and post-event optimization.

The development of integrated marketing services in China is mainly driven by three interrelated factors. First, continuous consumption upgrades and rising corporate brand demand are driving increased marketing investment. Second, the deep penetration and continuous innovation of digital technologies such as AI, big data, short video platforms, and e-commerce live streaming have made the marketing model more efficient, more targeted and scalable. Third, there is a growing demand for integrated end-to-end solutions that provide a seamless consumer experience throughout the journey.

The growth of the global advertising services industry is mainly due to the widespread promotion of digital processes by enterprises, the surge in e-commerce activities, and the accelerated integration of cross-border marketing strategies. Looking ahead, the continued application of artificial intelligence advertising tools and the pursuit of solutions integrating creativity, media, and data by global brands will continue to drive market expansion.

The significant growth of the advertising services market in China has been driven by China's rapid digital transformation, increasing adoption of data-driven advertising by brands, and the popularity of short videos and e-commerce platforms. Brands increasingly rely on professional advertising service providers to cope with fragmented online channels to achieve more flexible and accurate marketing strategies.

Looking ahead, the growing demand for integrated marketing solutions and increased competition among platforms seeking monetization will drive continued growth. Continued evolution in content formats and consumer engagement models will further encourage brands to outsource more of their business to specialized agencies that can deliver performance-based multi-platform advertising campaigns.

Board Information

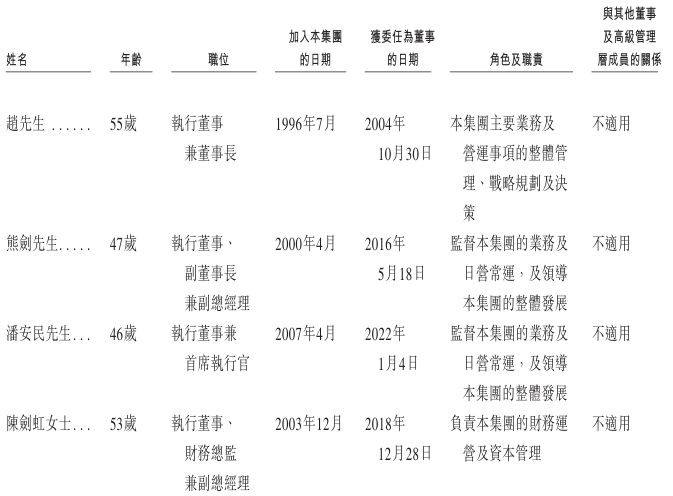

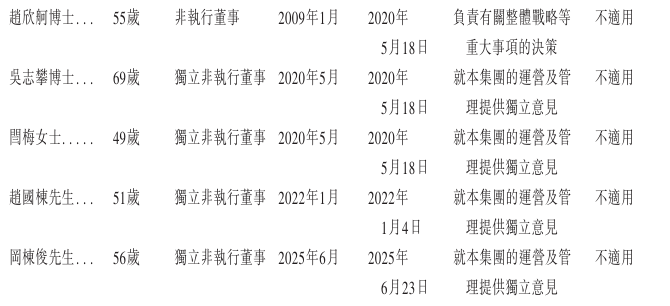

The board of directors will be composed of 9 directors, including 4 executive directors, 1 non-executive director and 4 independent non-executive directors.

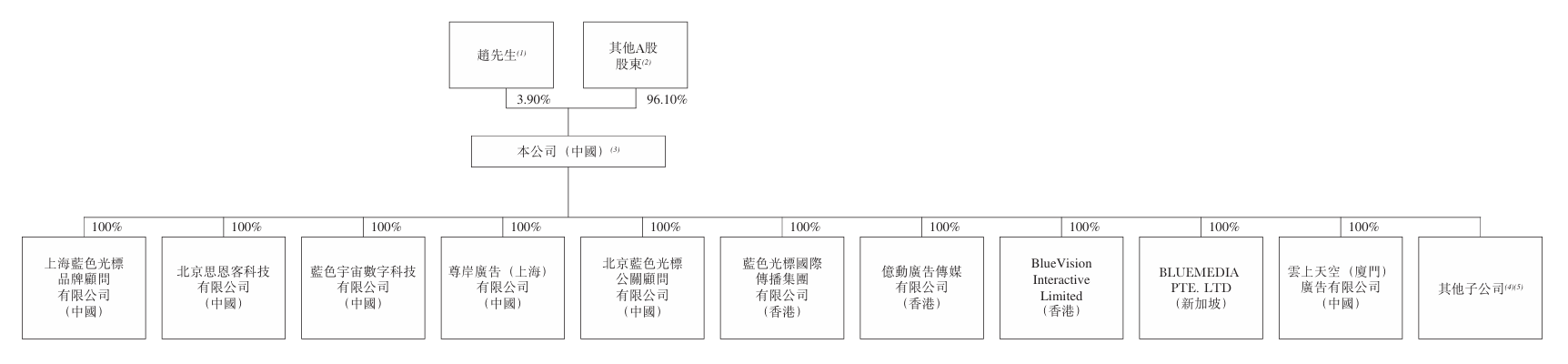

Shareholding structure

Mr. Zhao Wenquan holds 3.90% of the shares, and the other A-share shareholders together hold 96.10% of the shares.

As of the last practical date, Mr. Zhao Wenquan, the founder, executive director and chairman of the company, held a total of 140,000,000 A shares, accounting for about 3.90% of the company's total issued share capital and shareholders' voting rights.

As of the last practical date, the largest A-share shareholder after Mr. Zhao by the other A-share shareholders was La Cala (300773.SZ), which held approximately 2.62% of the company's total issued A shares. Mr. Sun Taoran is the founder of La Cala and currently serves as its chairman. The company's employees are also among the other A-share shareholders.

Intermediary team

Co-sponsors: Huatai Financial Holdings (Hong Kong) Limited, Guotai Junan Finance Co., Ltd., Huaxing Securities (Hong Kong) Co., Ltd.

Company Legal Adviser: Related to Hong Kong and US Law: Pu Heng Law Firm (Hong Kong) Limited Liability Partnership; Related to Chinese Law: Beijing Commerce Law Firm.

Co-sponsor legal advisers: relating to Hong Kong and US law: Jiayuan Law Firm; relating to Chinese law: Tianyuan Law Firm.

Auditor and reporting accountant: Tianji Hong Kong Certified Public Accountants Limited.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Compliance Advisor: Guotai Junan Finance Co., Ltd.

Nasdaq

Nasdaq 華爾街日報

華爾街日報