TSX Penny Stocks To Watch In December 2025

As the Canadian market navigates a landscape of sector-specific opportunities and challenges, diversification remains a key strategy for investors heading into 2026. While penny stocks may seem like an outdated concept, they continue to offer intriguing possibilities for those seeking affordable entry points with growth potential. In this article, we'll explore three Canadian penny stocks that stand out due to their financial strength and potential for stability and upside in the evolving market environment.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.17 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.25 | CA$247.83M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.18 | CA$115.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.47M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$50.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.29 | CA$858.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.28 | CA$166.37M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 388 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

C21 Investments (CNSX:CXXI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C21 Investments Inc. is an integrated cannabis company that cultivates, processes, distributes, and sells cannabis and hemp-derived consumer products in the United States, with a market cap of CA$53.09 million.

Operations: C21 Investments generates revenue through its cannabis cultivation segment, which reported $33.04 million in sales.

Market Cap: CA$53.09M

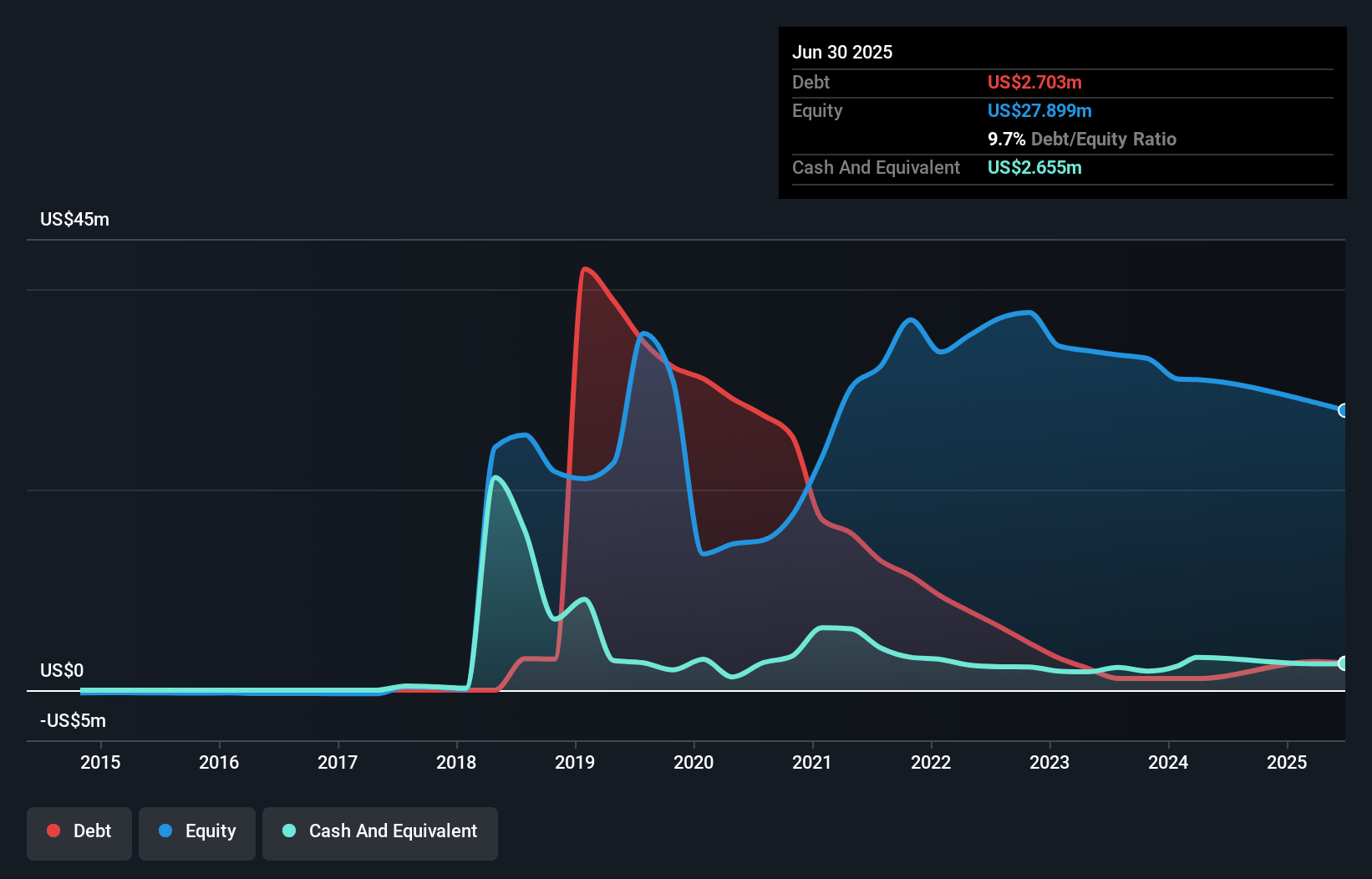

C21 Investments Inc. has demonstrated revenue growth, with recent quarterly sales reaching US$8.47 million, up from the previous year. Despite being unprofitable, the company maintains a positive free cash flow and sufficient cash runway for over three years. Its financial position is bolstered by having more cash than total debt and a reduced debt-to-equity ratio from 157.1% to 4.7% over five years. However, challenges persist with short-term assets not covering long-term liabilities and ongoing losses impacting return on equity negatively at -10.42%. The experienced management team provides some stability amid high share price volatility.

- Get an in-depth perspective on C21 Investments' performance by reading our balance sheet health report here.

- Learn about C21 Investments' historical performance here.

EMP Metals (CNSX:EMPS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMP Metals Corp. is involved in the exploration and evaluation of mineral properties, with a market cap of CA$51.07 million.

Operations: EMP Metals Corp. has not reported any revenue segments.

Market Cap: CA$51.07M

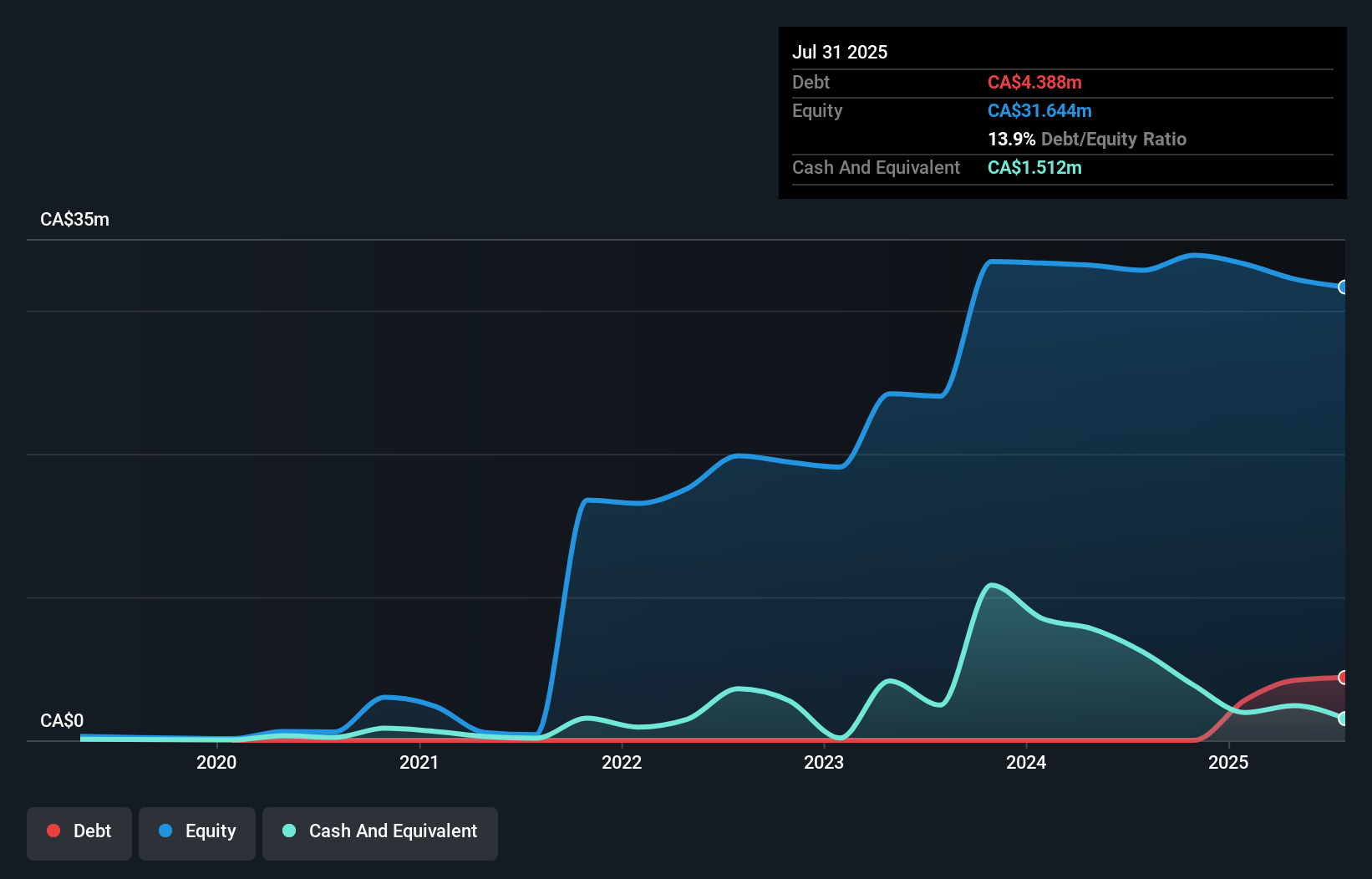

EMP Metals Corp., with a market cap of CA$51.07 million, is pre-revenue and focused on lithium extraction through its Project Aurora. Recent developments include completing exterior construction for its demonstration plant in Saskatchewan, which aims to refine ultra-high purity lithium chloride using advanced Gen II DLE technology. Financially, the company faces challenges as short-term assets (CA$1.8M) do not cover short-term liabilities (CA$4.8M), though it has raised additional capital through private placements totaling CAD 2.1 million. Despite being unprofitable with increasing losses over five years, EMP's management team brings experience and stability to the venture.

- Take a closer look at EMP Metals' potential here in our financial health report.

- Gain insights into EMP Metals' past trends and performance with our report on the company's historical track record.

Invesque (TSX:IVQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Invesque Inc. is a health care real estate company operating in North America, with a market cap of CA$109.69 million.

Operations: The company's revenue is primarily derived from Owner Occupied Properties at $93.33 million and Seniors Housing and Care Investment Properties at $9.91 million.

Market Cap: CA$109.69M

Invesque Inc., with a market cap of CA$109.69 million, is navigating financial challenges amid declining revenues and profitability issues. Recent earnings show a stark decrease in sales to US$6.38 million for the third quarter, from US$41.04 million the previous year, alongside a net loss of US$33.16 million. Despite reducing its debt-to-equity ratio significantly over five years and maintaining experienced management and board teams, Invesque faces less than one year of cash runway at current free cash flow levels. The company plans to redeem USD 27.3 million in debentures early next year, reflecting ongoing efforts to manage its debt obligations effectively.

- Click here to discover the nuances of Invesque with our detailed analytical financial health report.

- Understand Invesque's track record by examining our performance history report.

Key Takeaways

- Explore the 388 names from our TSX Penny Stocks screener here.

- Contemplating Other Strategies? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報