Discover 3 Dividend Stocks Offering Yields Up To 7.8%

As the U.S. stock market experiences a dip at the start of a holiday-shortened week, with major indexes like the Nasdaq and Dow Jones closing lower, investors are keenly observing how these fluctuations might impact their portfolios. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.74% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.39% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.67% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.75% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.26% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.03% | ★★★★★★ |

| Ennis (EBF) | 5.42% | ★★★★★★ |

| Dillard's (DDS) | 4.94% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.06% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.50% | ★★★★★★ |

Click here to see the full list of 120 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

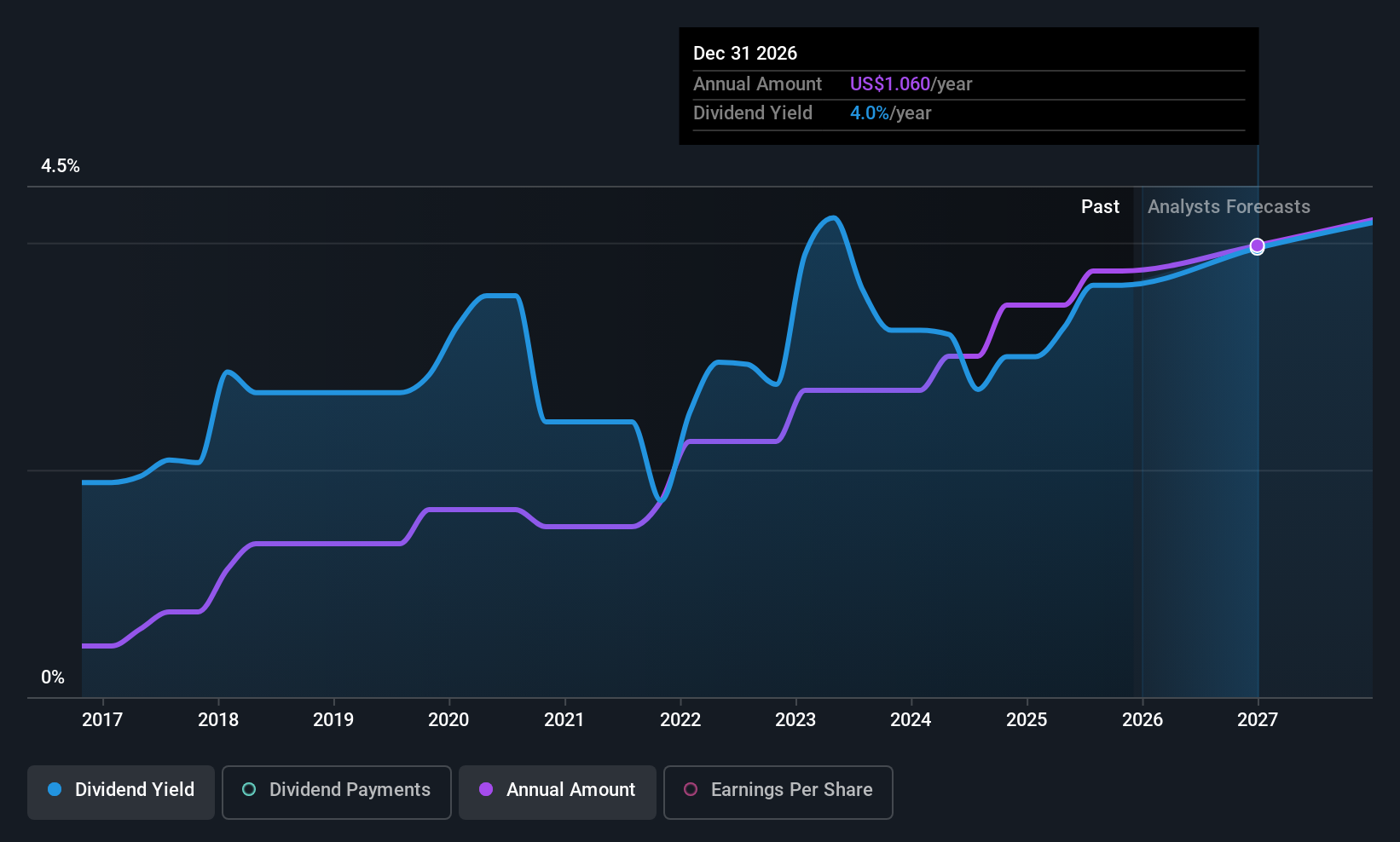

MetroCity Bankshares (MCBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering banking products and services in the United States with a market cap of $683.65 million.

Operations: MetroCity Bankshares, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $147.35 million.

Dividend Yield: 3.7%

MetroCity Bankshares offers a stable dividend history with reliable payments over the past decade and a growing dividend trend. Its dividends are well-covered by earnings, with a current payout ratio of 35.9% and forecasted coverage at 34.9% in three years, suggesting sustainability. While its dividend yield of 3.73% is below the top tier in the US market, it trades at good value compared to peers, supported by consistent earnings growth and stable financial performance.

- Click to explore a detailed breakdown of our findings in MetroCity Bankshares' dividend report.

- Upon reviewing our latest valuation report, MetroCity Bankshares' share price might be too pessimistic.

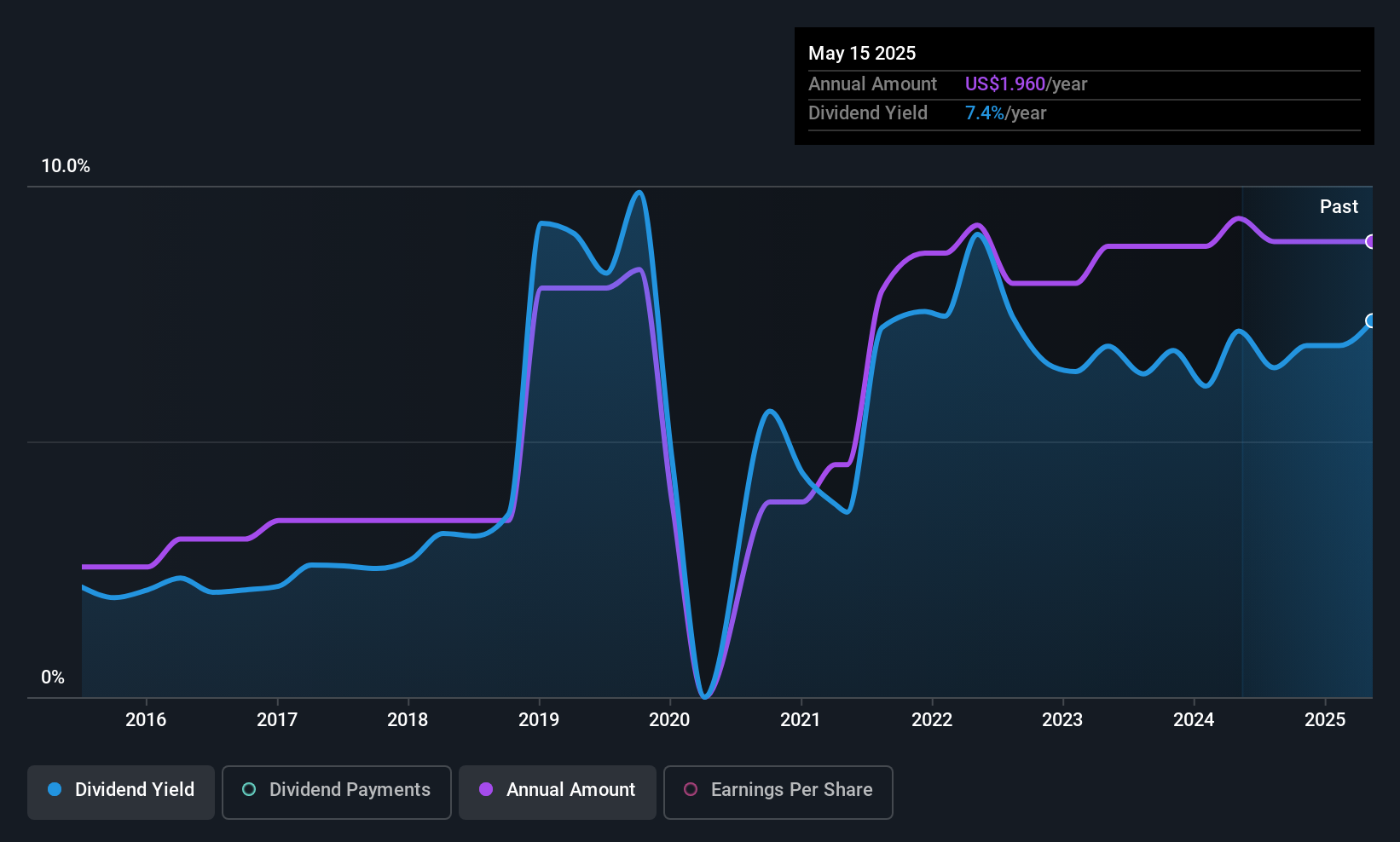

Ethan Allen Interiors (ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. is an interior design company that manufactures and retails home furnishings both in the United States and internationally, with a market cap of approximately $585.01 million.

Operations: Ethan Allen Interiors Inc. generates revenue through its Retail segment, which accounts for $518.95 million, and its Wholesale segment, contributing $359.96 million.

Dividend Yield: 7.9%

Ethan Allen Interiors declared a US$0.39 quarterly dividend, maintaining its yield in the top 25% of US payers. However, its dividend history is volatile with past annual drops over 20%, raising concerns about reliability despite recent growth. The payout ratios—84.2% earnings and 86.3% cash flow—indicate coverage but suggest potential sustainability issues if earnings decline as forecasted by 2.4% annually over three years, amidst recent sales and net income decreases.

- Dive into the specifics of Ethan Allen Interiors here with our thorough dividend report.

- According our valuation report, there's an indication that Ethan Allen Interiors' share price might be on the expensive side.

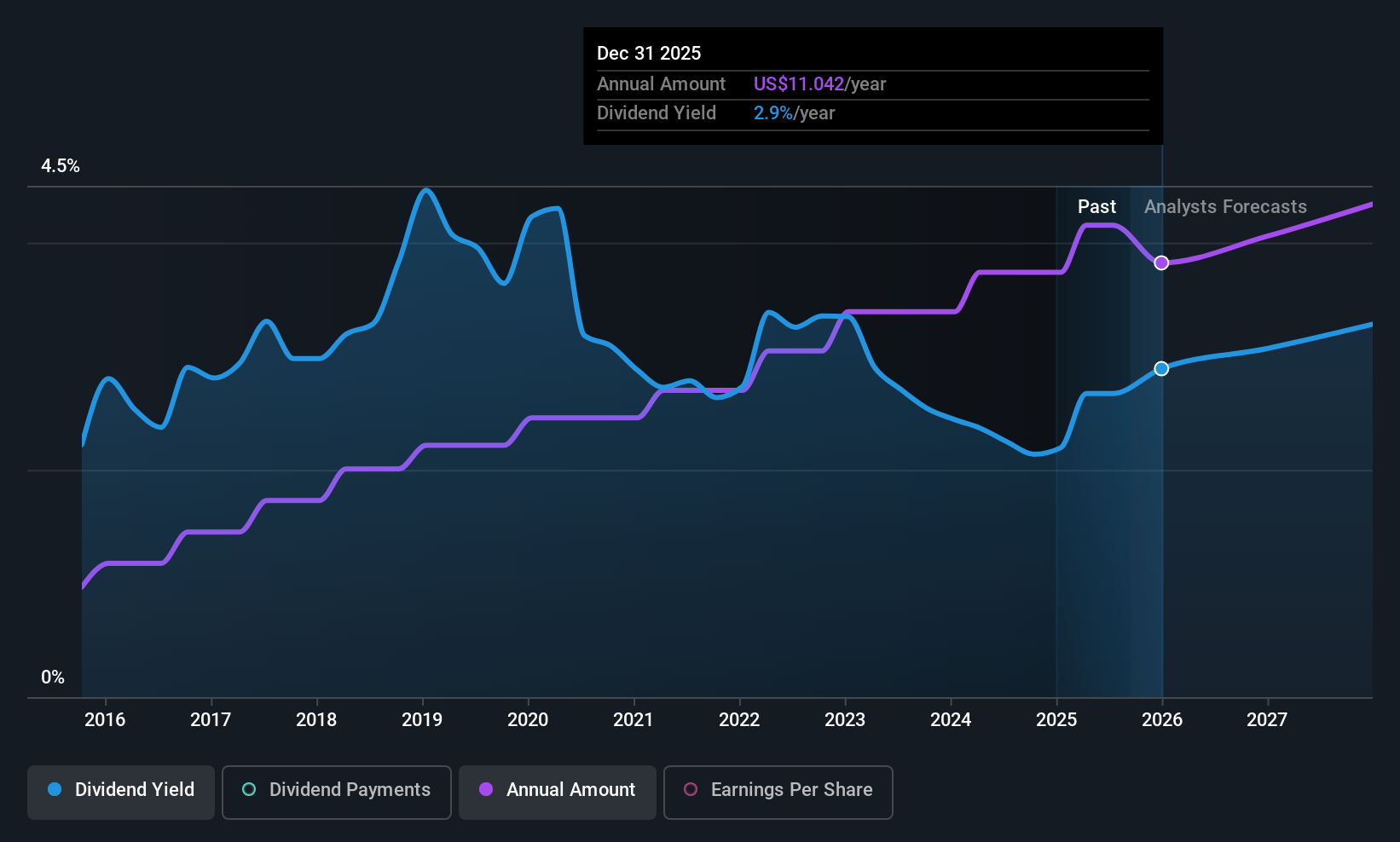

Watsco (WSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Watsco, Inc. is involved in the distribution of air conditioning, heating, and refrigeration equipment and related parts across the United States, Canada, Latin America, and the Caribbean with a market cap of $13.28 billion.

Operations: Watsco generates revenue through its wholesale distribution of electronics, amounting to $7.41 billion.

Dividend Yield: 3.4%

Watsco's dividend of US$3.00 per share, yielding 3.44%, is stable and reliable, with payments covered by earnings and cash flows at an 88% payout ratio. Despite a slight decline in recent sales and net income, the company's dividends have consistently grown over the past decade without volatility. Trading below fair value offers potential for capital appreciation, but its yield remains lower than top-tier US dividend payers' average of 4.39%.

- Get an in-depth perspective on Watsco's performance by reading our dividend report here.

- Our valuation report unveils the possibility Watsco's shares may be trading at a premium.

Make It Happen

- Embark on your investment journey to our 120 Top US Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報