Brødrene A & O Johansen And 2 Other Undiscovered Gems In Europe

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive sentiment about future earnings and economic prospects, investors are increasingly on the lookout for potential opportunities in small-cap stocks. In this environment, identifying companies with strong fundamentals and unique market positions can be crucial for those seeking to uncover hidden gems like Brødrene A & O Johansen and two other promising European stocks.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Brødrene A & O Johansen (CPSE:AOJ B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Brødrene A & O Johansen A/S, along with its subsidiaries, operates in the sale and distribution of technical installation materials and tools for construction companies across Denmark, Sweden, Norway, and internationally with a market cap of DKK2.55 billion.

Operations: The company generates revenue primarily from its B2B and B2C segments, with the B2B segment contributing DKK4.95 billion and the B2C segment adding DKK1.05 billion.

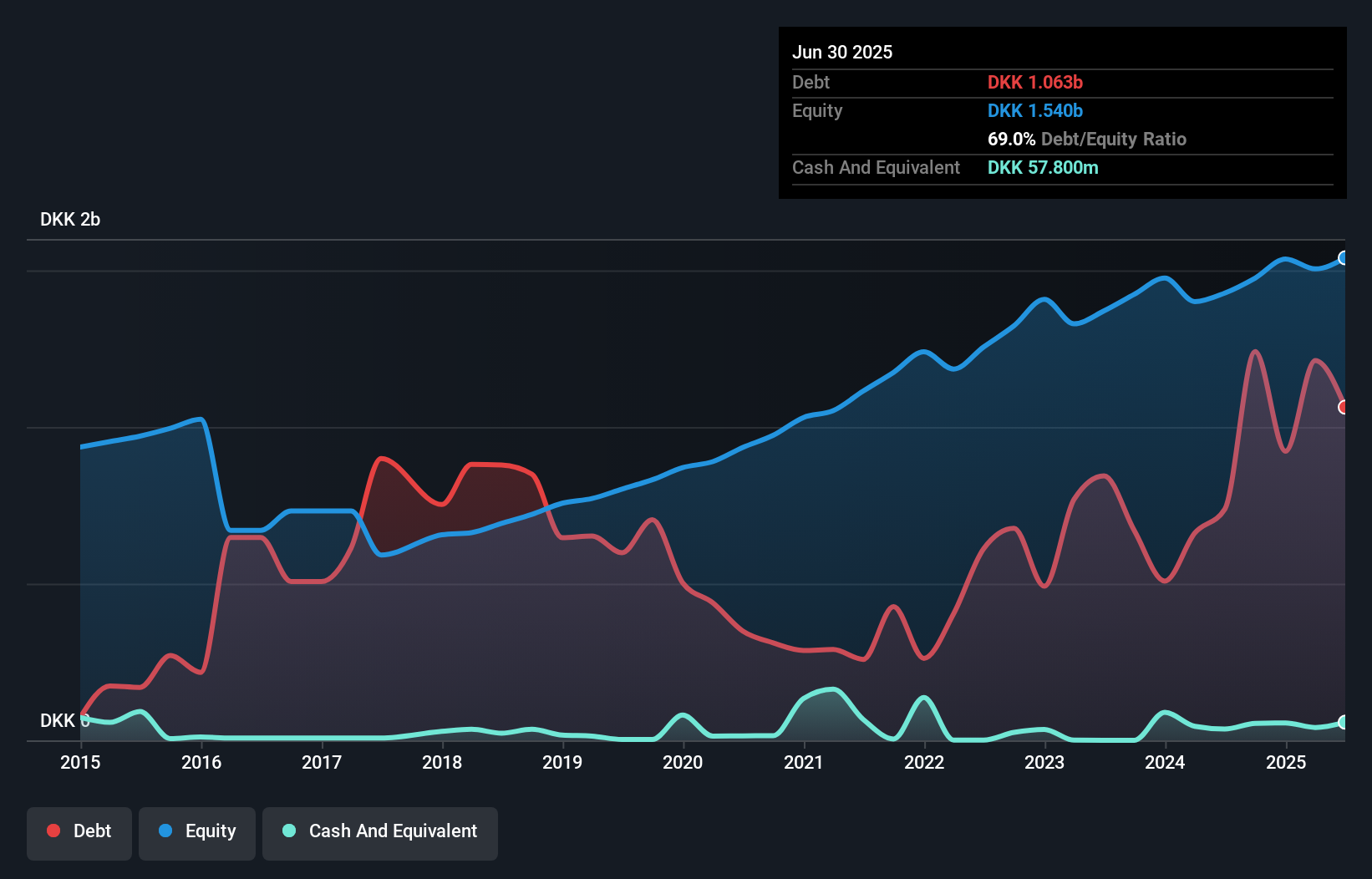

Brødrene A & O Johansen, a notable player in the trade distributors industry, showcases a mixed bag of financial metrics. Over the past year, earnings surged by 22.2%, outpacing industry growth of just 0.1%. However, its net debt to equity ratio stands at 65.6%, which is considered high and has increased from 32% over five years. Despite this leverage, interest payments are well covered with EBIT covering them 7.3 times over. Recent results show sales for Q3 reached DKK 1,465 million compared to DKK 1,326 million last year while net income dipped slightly to DKK 39.6 million from DKK 46 million previously.

NOTE (OM:NOTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: NOTE AB (publ) is a company that offers electronics manufacturing services across various countries including Sweden, Finland, the United Kingdom, Bulgaria, Estonia, and China with a market capitalization of approximately SEK5.19 billion.

Operations: NOTE AB generates revenue primarily from Western Europe, contributing SEK2.89 billion, and the Rest of World segment, adding SEK995.31 million.

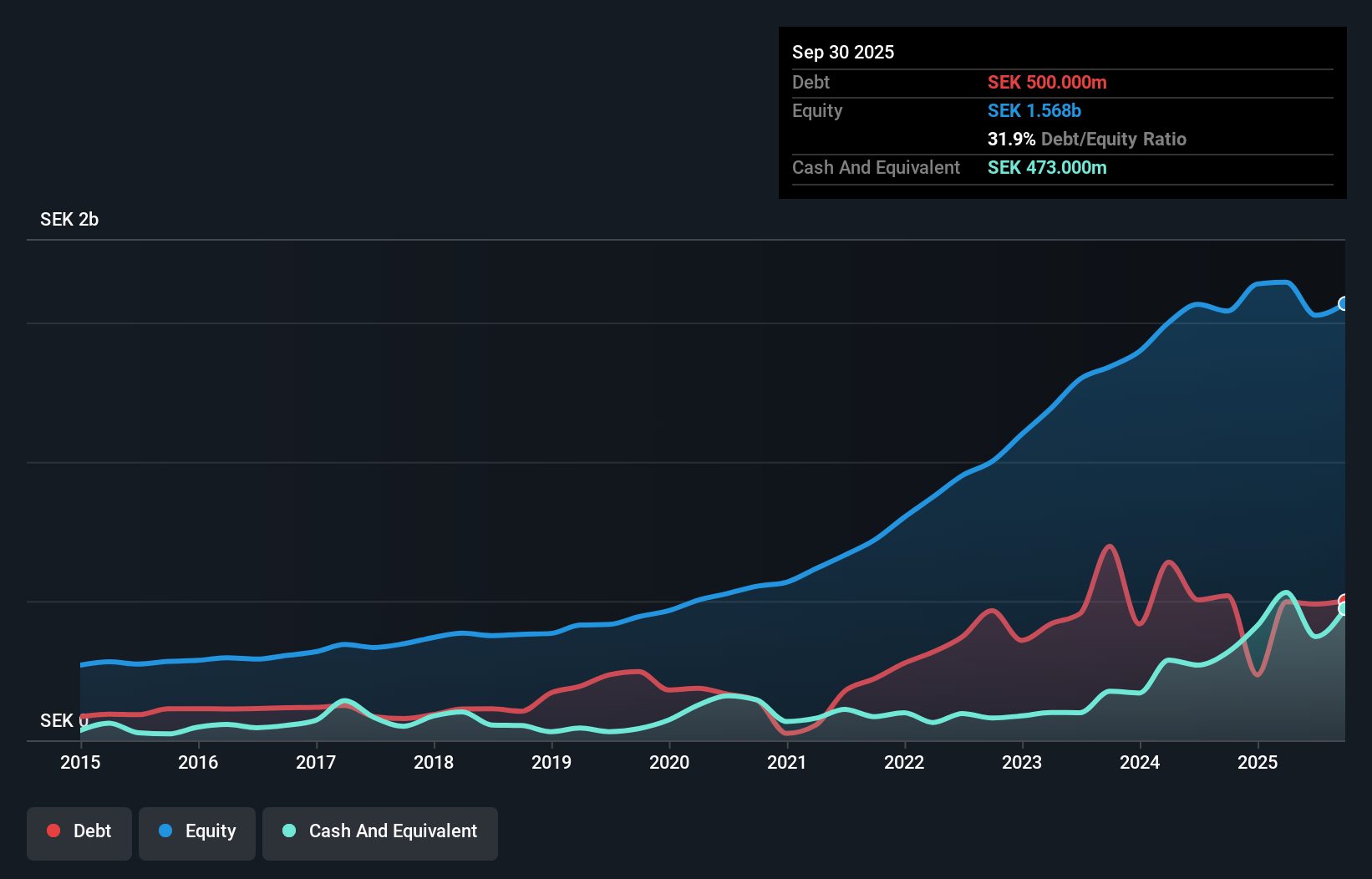

NOTE, a nimble player in electronics manufacturing services, is trading at about 26.7% below its fair value estimate, suggesting potential upside. With a net debt to equity ratio of 1.7%, the financial structure appears robust while EBIT covers interest payments 18.8 times over, indicating strong debt management. Recent earnings show growth with net income rising to SEK 54 million from SEK 43 million year-on-year for Q3. Strategic moves like shifting production from China to Europe could reduce costs and boost margins in key segments like Security & Defense and Greentech, though reliance on large customers poses risks amid economic pressures.

Svedbergs Group (OM:SVED B)

Simply Wall St Value Rating: ★★★★★★

Overview: Svedbergs Group AB (publ) is engaged in the development, manufacturing, and marketing of bathroom products across the Nordic region, the United Kingdom, and the Netherlands, with a market capitalization of SEK 3.63 billion.

Operations: The company's revenue streams are primarily derived from Roper Rhodes (SEK 1.17 billion), Thebalux (SEK 412.10 million), and Svedbergs (SEK 399.30 million). Cassoe and Macro Design contribute SEK 84.10 million and SEK 173.40 million, respectively, to the total revenue.

Svedbergs Group, a notable player in the building industry, has demonstrated impressive financial health with its debt to equity ratio halving from 86.7% to 43.7% over five years. The company outpaced the industry with earnings growth of 57.5% last year and is trading at a value below fair estimate by 26.6%. Recent developments include expanding their UK presence through a new distribution center, enhancing logistics and customer service capabilities. For Q3 2025, sales reached SEK 528 million with net income climbing to SEK 48 million from SEK 28 million the previous year, showcasing robust operational performance and strategic growth initiatives.

- Click here to discover the nuances of Svedbergs Group with our detailed analytical health report.

Examine Svedbergs Group's past performance report to understand how it has performed in the past.

Make It Happen

- Unlock our comprehensive list of 304 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報