3 Global Stocks Conceivably Trading Up To 48.5% Below Intrinsic Value

As global markets continue to show resilience with U.S. indices hitting record highs and positive sentiment buoyed by economic growth and AI optimism, investors are keenly observing opportunities for undervalued stocks amidst the fluctuating landscape. In this environment, identifying stocks trading below their intrinsic value can be particularly appealing, as they may offer potential for appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.40 | CN¥32.50 | 49.5% |

| YIT Oyj (HLSE:YIT) | €3.078 | €6.05 | 49.1% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.50 | NOK66.01 | 49.2% |

| Kuraray (TSE:3405) | ¥1594.50 | ¥3161.62 | 49.6% |

| Kamux Oyj (HLSE:KAMUX) | €2.22 | €4.41 | 49.7% |

| Gentili Mosconi (BIT:GM) | €3.30 | €6.54 | 49.5% |

| Elekta (OM:EKTA B) | SEK57.05 | SEK113.78 | 49.9% |

| Dynavox Group (OM:DYVOX) | SEK102.70 | SEK203.06 | 49.4% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥259.79 | CN¥516.30 | 49.7% |

| Aidma Holdings (TSE:7373) | ¥3165.00 | ¥6305.80 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

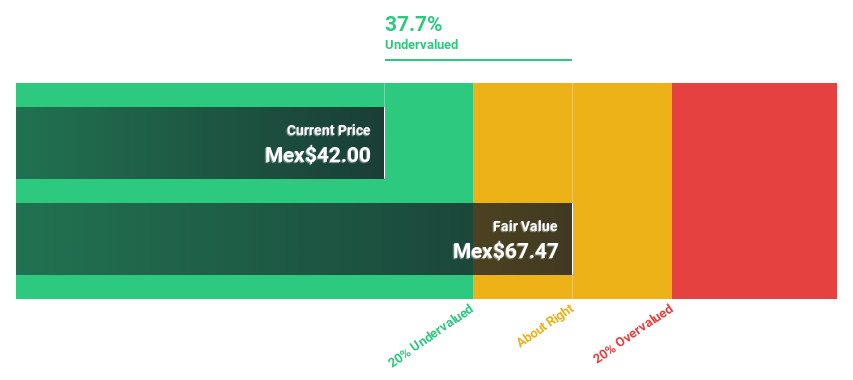

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, operates in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems with a market cap of MX$45.26 billion.

Operations: The company's revenue segments include Corporate, generating MX$5.46 billion.

Estimated Discount To Fair Value: 43.6%

Megacable Holdings S. A. B. de C. V.'s recent earnings report shows a rise in net income to MX$627.82 million for Q3 2025, up from MX$500.26 million the previous year, highlighting operational improvements despite low return on equity forecasts of 12.2%. The stock trades at MX$52.74, significantly below its estimated fair value of MX$93.54, indicating undervaluation based on discounted cash flow analysis, although dividend coverage and interest payment coverage remain concerns.

- In light of our recent growth report, it seems possible that Megacable Holdings S. A. B. de C. V's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Megacable Holdings S. A. B. de C. V stock in this financial health report.

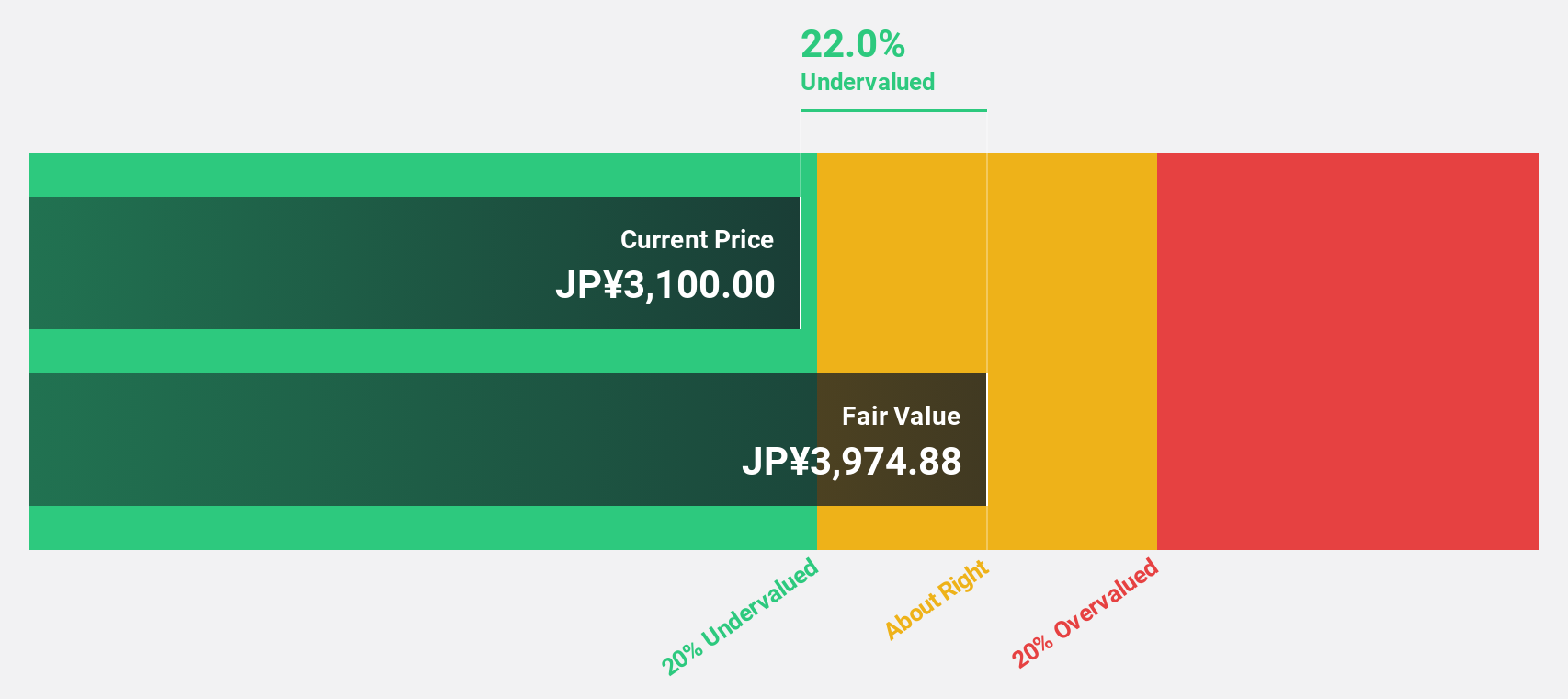

Global Security Experts (TSE:4417)

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market cap of ¥48.45 billion.

Operations: The company's revenue is primarily derived from its Cybersecurity Business, which generated ¥9.75 billion.

Estimated Discount To Fair Value: 43.7%

Global Security Experts is trading at ¥3220, significantly below its estimated fair value of ¥5718.18, highlighting its undervaluation based on discounted cash flow analysis. Despite a highly volatile share price recently, the company shows promising growth prospects with revenue expected to grow 24.7% annually and earnings projected to rise significantly by 34.2% per year, outpacing the JP market's average growth rates in both metrics.

- The growth report we've compiled suggests that Global Security Experts' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Global Security Experts.

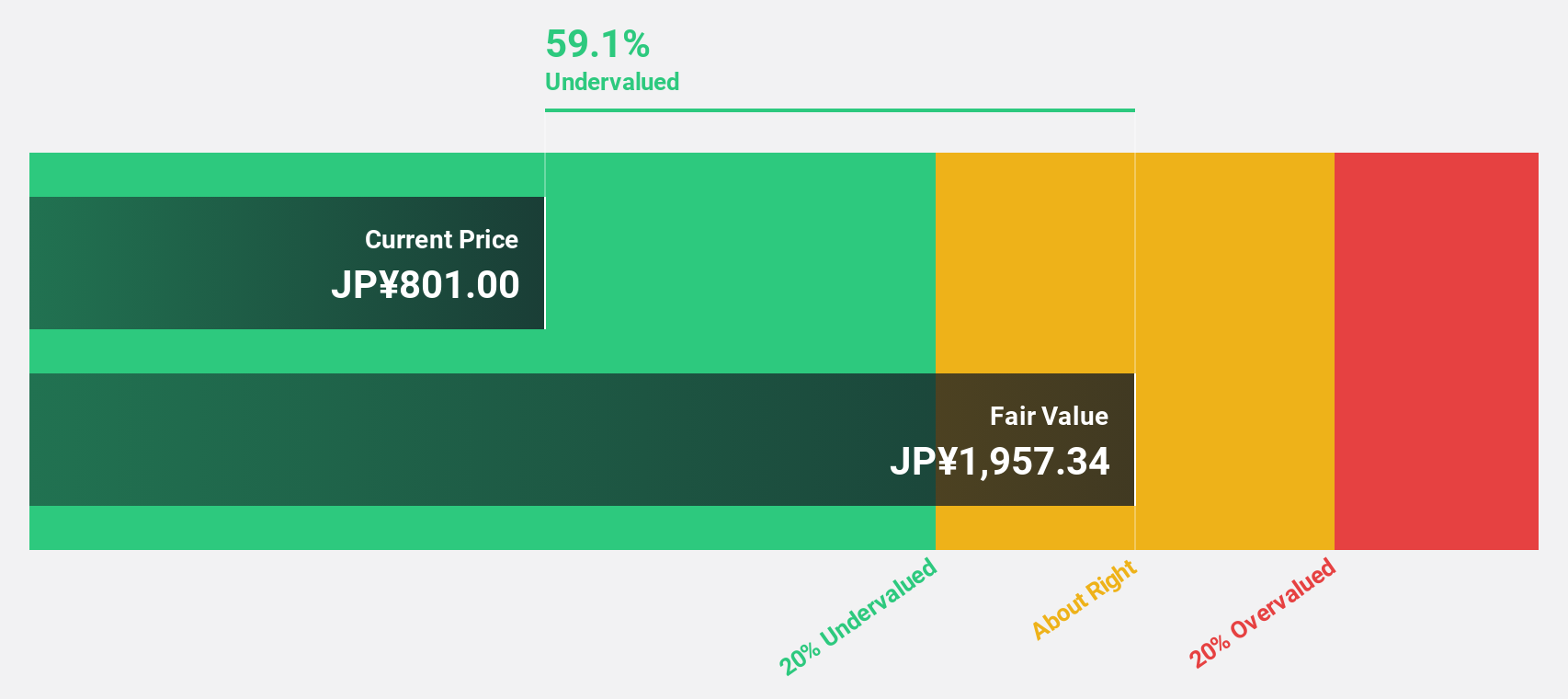

Takara Bio (TSE:4974)

Overview: Takara Bio Inc. operates in the fields of reagents, equipment, contract services, and genetic medicine across Japan, China, other parts of Asia, the United States, Europe, and globally with a market cap of ¥97.90 billion.

Operations: The company's revenue segments include Drug Discovery Company, which generated ¥44.08 billion.

Estimated Discount To Fair Value: 48.5%

Takara Bio is trading at ¥813, well below its estimated fair value of ¥1578.44, suggesting undervaluation based on discounted cash flow analysis. The company faces challenges with lowered earnings guidance and a dividend cut due to anticipated net losses and sluggish market conditions. However, it is expected to become profitable within three years with earnings growth projected at 70.22% annually, outpacing the JP market's average revenue growth rate of 4.6%.

- The analysis detailed in our Takara Bio growth report hints at robust future financial performance.

- Click here to discover the nuances of Takara Bio with our detailed financial health report.

Next Steps

- Unlock our comprehensive list of 483 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報