Global Growth Companies With High Insider Ownership To Watch

As global markets continue to show resilience, with U.S. indices hitting record highs and optimism surrounding artificial intelligence fueling positive sentiment, investors are keenly observing growth companies that demonstrate strong potential amidst these favorable conditions. In the current economic landscape, where insider ownership can signal confidence in a company's future prospects, identifying stocks with high insider stakes becomes increasingly relevant for those looking to align their investments with market momentum.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's explore several standout options from the results in the screener.

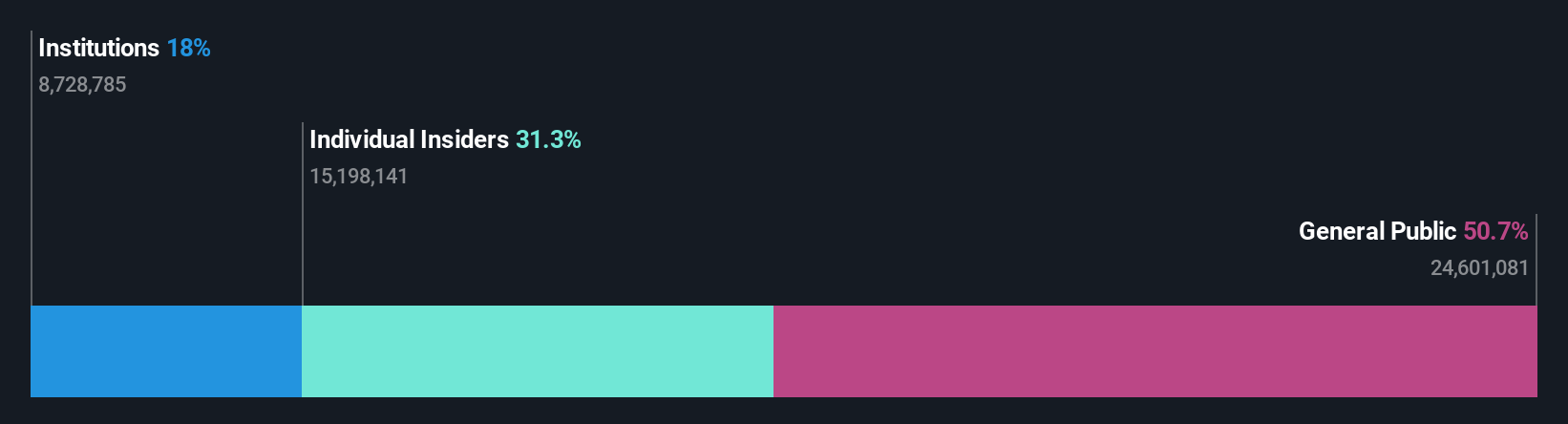

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ABL Bio Inc. is a biotech research company that develops therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of approximately ₩10.99 billion.

Operations: The company generates revenue from its biotechnology startups segment, amounting to approximately ₩88.44 million.

Insider Ownership: 26.1%

Revenue Growth Forecast: 12.6% p.a.

ABL Bio is expected to achieve profitability within three years, surpassing average market growth. Despite a highly volatile share price recently, its revenue growth forecast of 12.6% annually outpaces the Korean market's 10.8%. However, return on equity is projected to remain low at 2.6%. The recent private placement involving Eli Lilly indicates strong investor interest and strategic partnerships, although no significant insider trading has been reported in the last three months.

- Click here to discover the nuances of ABL Bio with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that ABL Bio is trading beyond its estimated value.

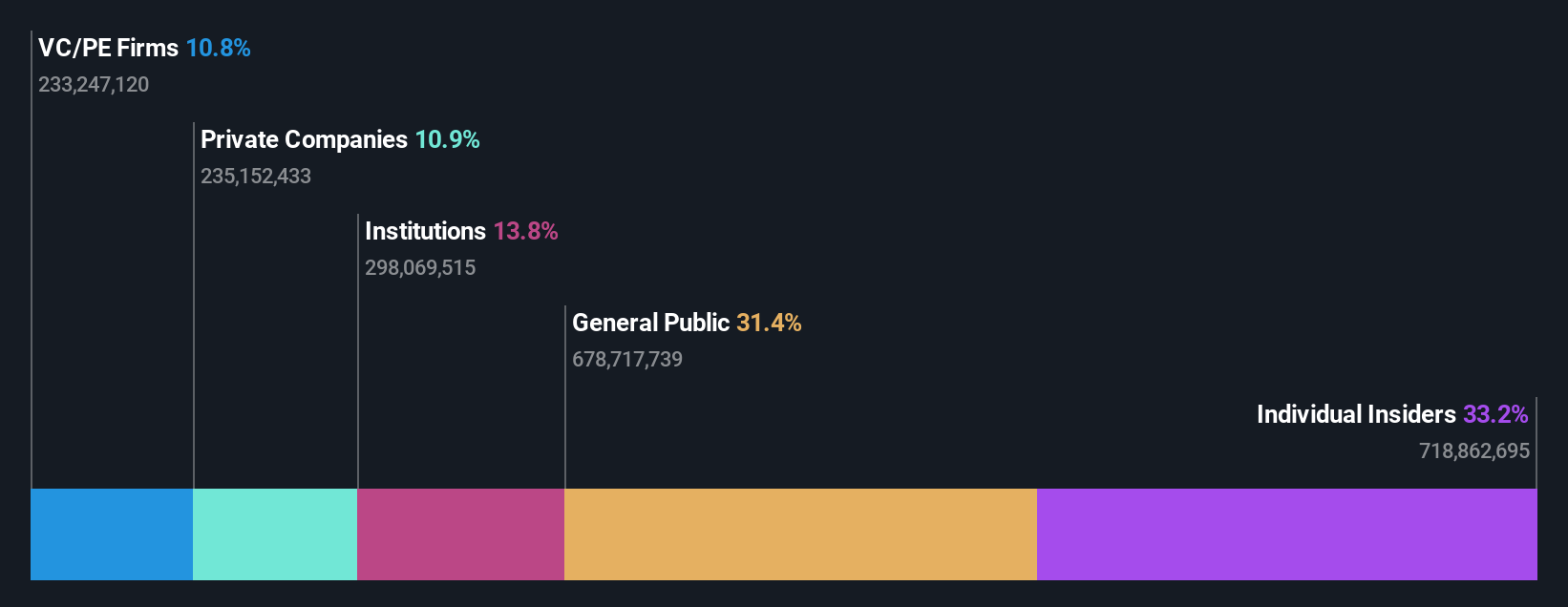

Trina Solar (SHSE:688599)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trina Solar Co., Ltd. is involved in the research, development, production, and sales of photovoltaic modules across various global markets, with a market cap of CN¥39.83 billion.

Operations: Trina Solar generates revenue through the research, development, production, and sales of photovoltaic modules across China, Europe, North and Latin America, the United States, Japan, the Asia Pacific region, the Middle East, and Africa.

Insider Ownership: 30.9%

Revenue Growth Forecast: 15.1% p.a.

Trina Solar's insider ownership aligns with its potential for profitability within three years, outpacing the Chinese market's growth rate. Despite recent removal from the SSE 180 Index and a volatile share price, analysts predict a 30.2% stock price increase. The company faces challenges with debt coverage by operating cash flow and reported significant net losses recently. However, it remains competitively valued compared to peers, though return on equity is expected to be low at 18.1%.

- Take a closer look at Trina Solar's potential here in our earnings growth report.

- Our valuation report unveils the possibility Trina Solar's shares may be trading at a discount.

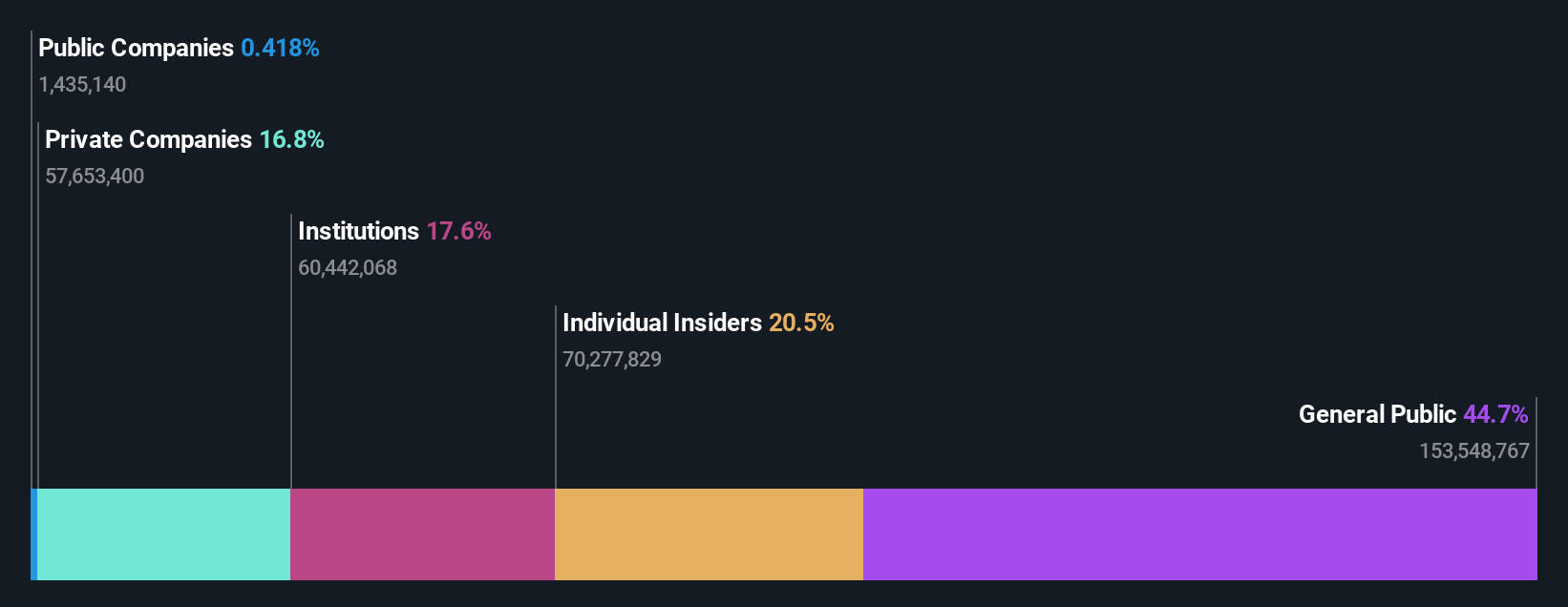

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating in China, Southeast Asia, and the Americas, with a market cap of approximately CN¥51.49 billion.

Operations: Sharetronic Data Technology Co., Ltd. generates its revenue primarily from the provision of wireless IoT products across regions including China, Southeast Asia, and the Americas.

Insider Ownership: 20.5%

Revenue Growth Forecast: 33.4% p.a.

Sharetronic Data Technology demonstrates strong growth potential with revenue and earnings forecasted to outpace the Chinese market significantly. Insider ownership supports alignment with shareholder interests, although recent share price volatility is notable. The company's earnings grew 28.4% over the past year, and it trades at a favorable value relative to industry peers. However, challenges exist in debt coverage by operating cash flow, and return on equity is projected to be modest at 16.8%.

- Navigate through the intricacies of Sharetronic Data Technology with our comprehensive analyst estimates report here.

- The analysis detailed in our Sharetronic Data Technology valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 857 Fast Growing Global Companies With High Insider Ownership by using our screener here.

- Interested In Other Possibilities? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報