Exploring Three Undiscovered Gems In The Middle East Market

As most Gulf markets experience gains buoyed by expectations of further Federal Reserve interest rate cuts, the Middle East continues to be a focal point for investors seeking opportunities amidst fluctuating oil prices and evolving fiscal reforms. In this dynamic environment, identifying promising stocks often involves looking beyond headline indices to discover companies with strong fundamentals and potential for growth in sectors that may benefit from these economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Anonim Türk Sigorta Sirketi operates in the insurance industry within Turkey and has a market capitalization of TRY46.64 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue primarily from its Motor Vehicles and Sickness/Health insurance segments, contributing TRY15.85 billion and TRY14.74 billion, respectively. The company also derives significant income from Motor Vehicles Liability insurance, amounting to TRY11.46 billion.

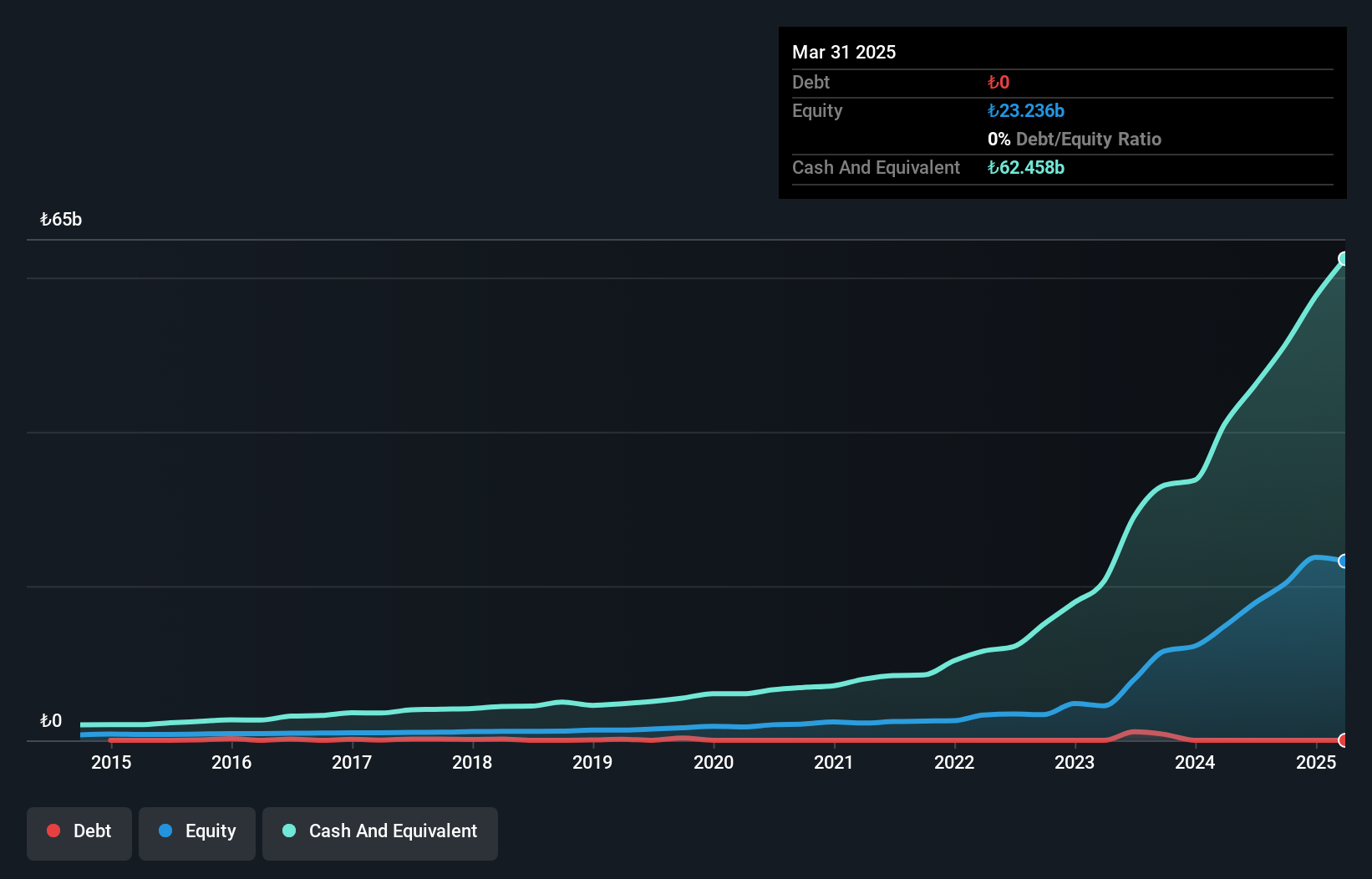

Anadolu Sigorta, a notable player in the Middle Eastern insurance sector, has shown robust financial performance despite being a smaller entity. Over the past five years, its earnings have grown at an impressive 59% annually. The company reported net income of TRY 3.74 billion for Q3 2025, up from TRY 2.60 billion in the previous year, with basic earnings per share rising to TRY 1.87 from TRY 1.30 last year. Trading at approximately 30% below its fair value estimate suggests potential undervaluation while maintaining high-quality earnings and remaining debt-free enhances its financial stability and appeal to investors seeking growth opportunities within this region's dynamic market landscape.

Torunlar Gayrimenkul Yatirim Ortakligi (IBSE:TRGYO)

Simply Wall St Value Rating: ★★★★★★

Overview: Torunlar Gayrimenkul Yatirim Ortakligi is a Turkish real estate investment company with a market capitalization of TRY70.78 billion, focusing on the development and management of residential, office, and commercial properties.

Operations: Torunlar Real Estate Investment Partnership generates revenue primarily from its residential and office projects, with the 5. Levent Project contributing TRY5.88 billion and Mall of Istanbul AVM adding TRY2.82 billion. The company's net profit margin is a crucial metric to consider when evaluating its financial performance.

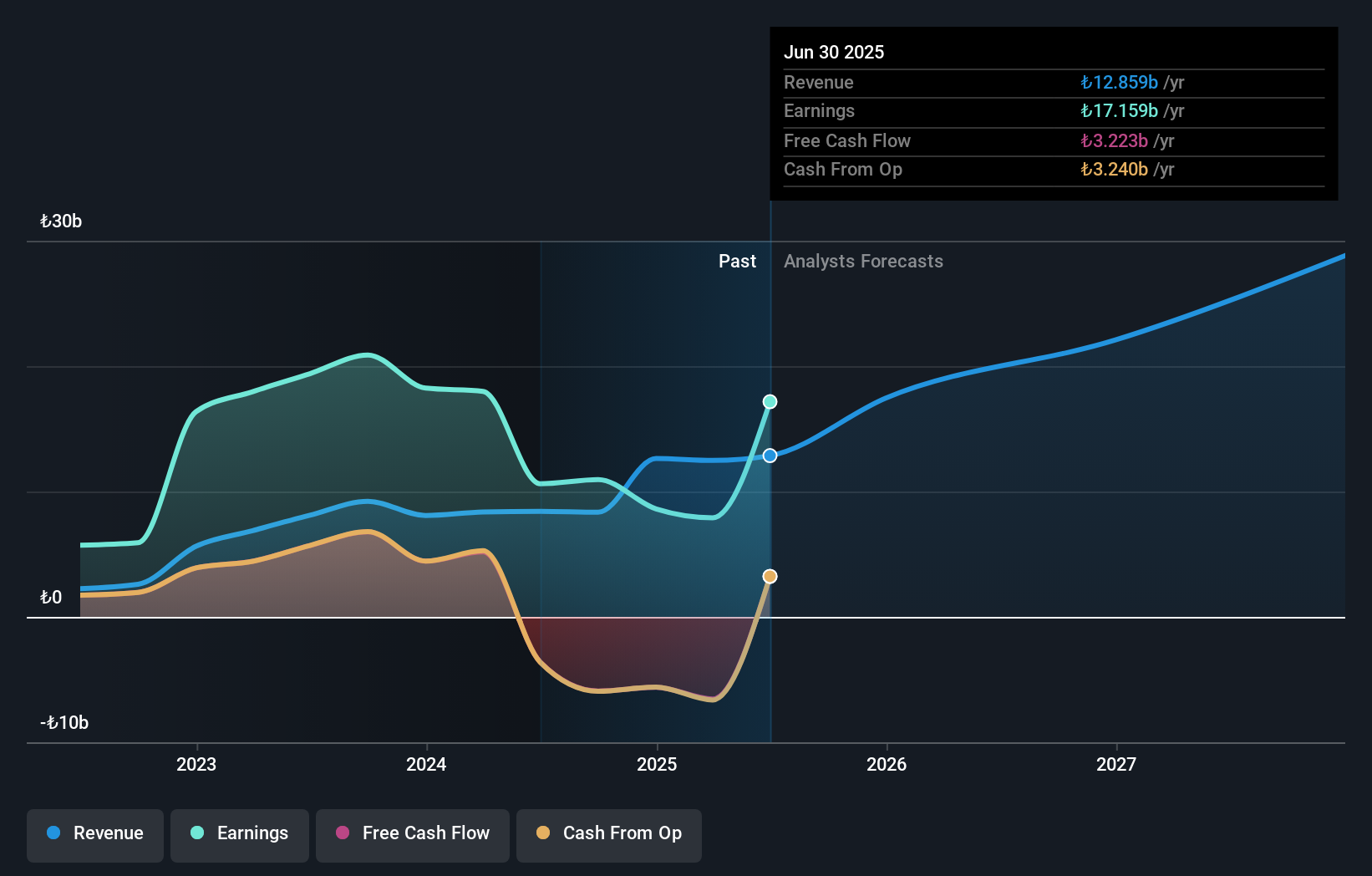

In the dynamic landscape of Middle Eastern stocks, Torunlar Gayrimenkul Yatirim Ortakligi stands out with notable financial metrics. Over the past year, earnings surged by 49.9%, surpassing the REITs industry average, which saw a -66.4% change. The company boasts a robust balance sheet with cash exceeding total debt and a reduced debt-to-equity ratio from 60.6% to just 0.6% over five years. Despite a large TRY9 billion one-off gain affecting recent results, its price-to-earnings ratio of 4.2x presents an attractive valuation compared to Turkey's market average of 18.3x, indicating potential value for investors seeking growth opportunities in this region.

Wesure Global Tech (TASE:WESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wesure Global Tech Ltd, along with its subsidiaries, focuses on developing and marketing technologies for digital platforms within the insurance and finance sectors globally, with a market cap of ₪1.78 billion.

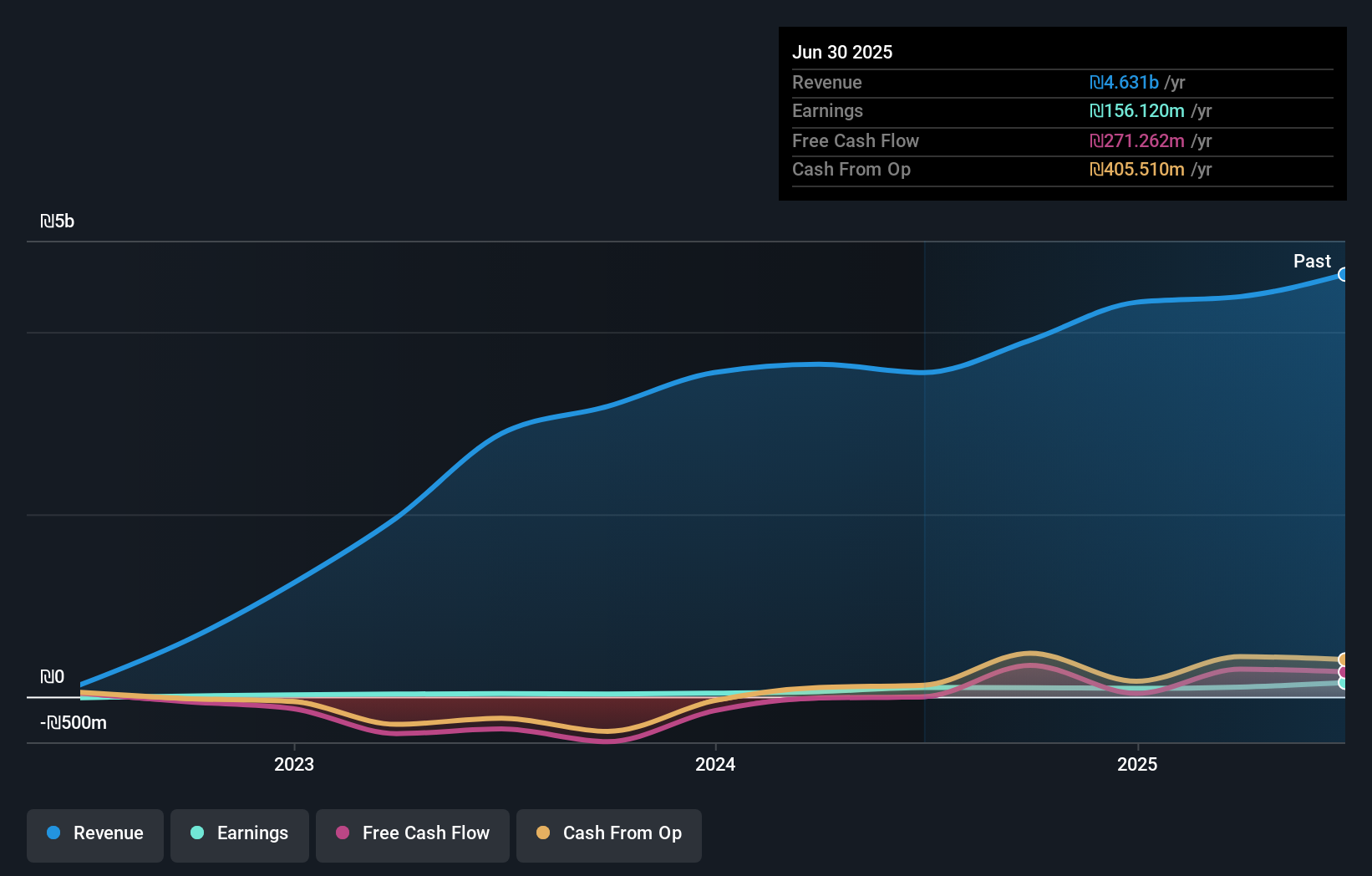

Operations: Wesure Global Tech generates revenue primarily from its general insurance segment, with Ayalon Insurance contributing ₪2.29 billion and Wesure Insurance adding ₪413.97 million. The life insurance and long-term savings segment also plays a significant role, bringing in ₪1.30 billion.

Wesure Global Tech, a dynamic player in the Middle East, is making waves with its robust financial performance and strategic moves. The company's earnings grew by 16.7% over the past year, outpacing the insurance industry average of 13%. Its price-to-earnings ratio stands at 10.4x, offering good value compared to the IL market's 15.9x benchmark. Wesure's debt-to-equity ratio has risen from 32.8% to 57.9% over five years, yet it holds more cash than total debt, ensuring stability and flexibility for future growth initiatives like their recent ILS150 million private placement involving key investors such as Migdal Index Fund Israel and Menora Mivtachim Index Fund.

- Dive into the specifics of Wesure Global Tech here with our thorough health report.

Assess Wesure Global Tech's past performance with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 180 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報