3 Undiscovered Gems In The United Kingdom To Consider For Your Portfolio

As the United Kingdom's FTSE 100 index faces headwinds from weak trade data out of China, and broader market sentiment remains cautious amid global economic uncertainties, investors are increasingly looking for opportunities beyond the blue-chip stocks. In this climate, identifying undiscovered gems within the UK market can offer potential diversification benefits and resilience against external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 15.73% | 53.22% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

BioPharma Credit (LSE:BPCR)

Simply Wall St Value Rating: ★★★★★★

Overview: BioPharma Credit PLC is an investment trust that primarily invests in interest-bearing debt assets, with a market cap of $1.03 billion.

Operations: The primary revenue stream for BioPharma Credit PLC comes from its investments in debt assets secured by royalties, generating $154.66 million. The company's market cap stands at approximately $1.03 billion.

BioPharma Credit, a nimble player in the UK market, stands out with its debt-free status and high-quality earnings. Over the past year, it has seen an impressive 12.6% earnings growth, outpacing the Capital Markets industry average of 1.7%. The company appears to be trading at a compelling value, currently priced 24.2% below its estimated fair value. With levered free cash flow reaching US$140 million as of June 2024 and consistently positive over recent years, BioPharma Credit seems well-positioned for continued stability and potential growth within its niche sector.

- Unlock comprehensive insights into our analysis of BioPharma Credit stock in this health report.

Gain insights into BioPharma Credit's past trends and performance with our Past report.

City of London Investment Group (LSE:CLIG)

Simply Wall St Value Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market capitalization of £185.93 million.

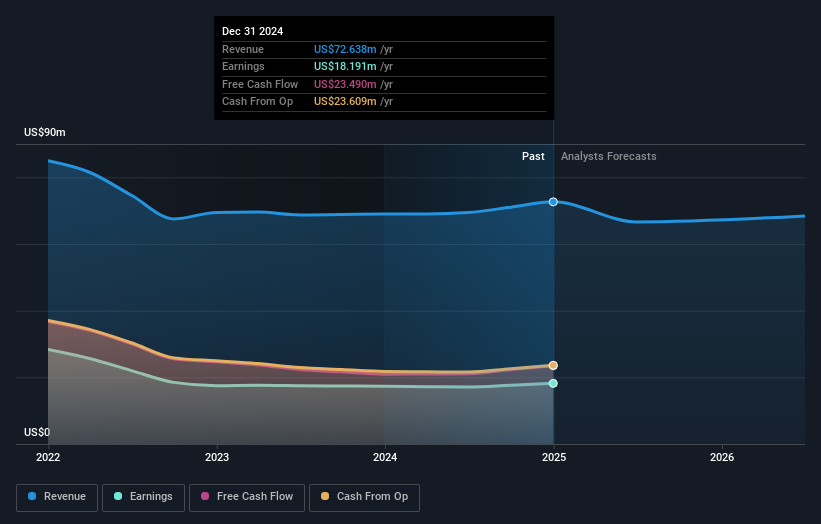

Operations: The company generates revenue primarily through its asset management segment, which reported $73.04 million.

City of London Investment Group, a nimble player in the financial sector, showcases solid fundamentals with its debt-free status and a price-to-earnings ratio of 12.7x, which is more attractive than the UK market average of 16.1x. Its earnings growth outpaced the broader Capital Markets industry at 15% over the past year, highlighting robust performance and high-quality earnings. Despite significant insider selling recently, it remains profitable with positive free cash flow. The recent appointment of Ben Stocks as Director and a declared dividend of 22 pence per share reflect confidence in its ongoing strategic direction.

- Delve into the full analysis health report here for a deeper understanding of City of London Investment Group.

Learn about City of London Investment Group's historical performance.

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc is a maritime transport company serving Ireland, the United Kingdom, and Continental Europe with a market cap of £805.25 million.

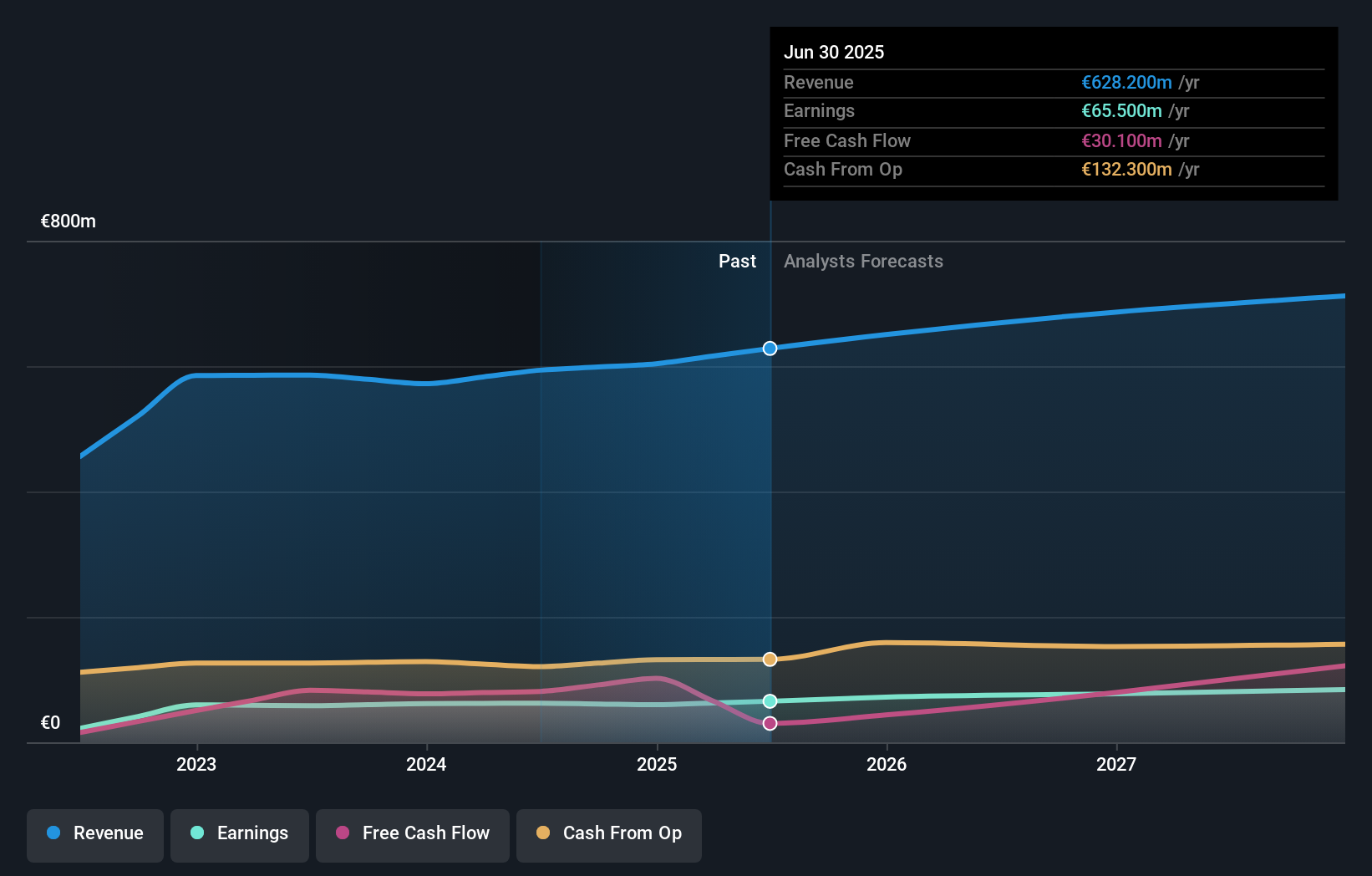

Operations: The company generates revenue primarily from its Ferries segment (€441.90 million) and Container and Terminal segment (€219.60 million).

Irish Continental Group (ICG) stands out with a satisfactory net debt to equity ratio of 39.8%, reflecting prudent financial management over the past five years as it reduced from 75.6% to 45.7%. The company is trading at a notable discount, valued at 61.7% below its estimated fair value, and boasts high-quality earnings, with interest payments well covered by EBIT at 7.9 times coverage. Recent revenue growth of €573 million for the ten months ending October shows a healthy increase from €521 million in the previous year, highlighting robust performance amidst industry challenges.

- Take a closer look at Irish Continental Group's potential here in our health report.

Evaluate Irish Continental Group's historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 54 UK Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報