3 Premier UK Dividend Stocks To Consider

As the FTSE 100 index faces headwinds from weak trade data out of China, investors are increasingly looking for stability and resilience in their portfolios. In such volatile times, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive consideration for those navigating the current market landscape.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.05% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.35% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.58% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.79% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.11% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.84% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.61% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.63% | ★★★★★☆ |

| Begbies Traynor Group (AIM:BEG) | 3.84% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.52% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

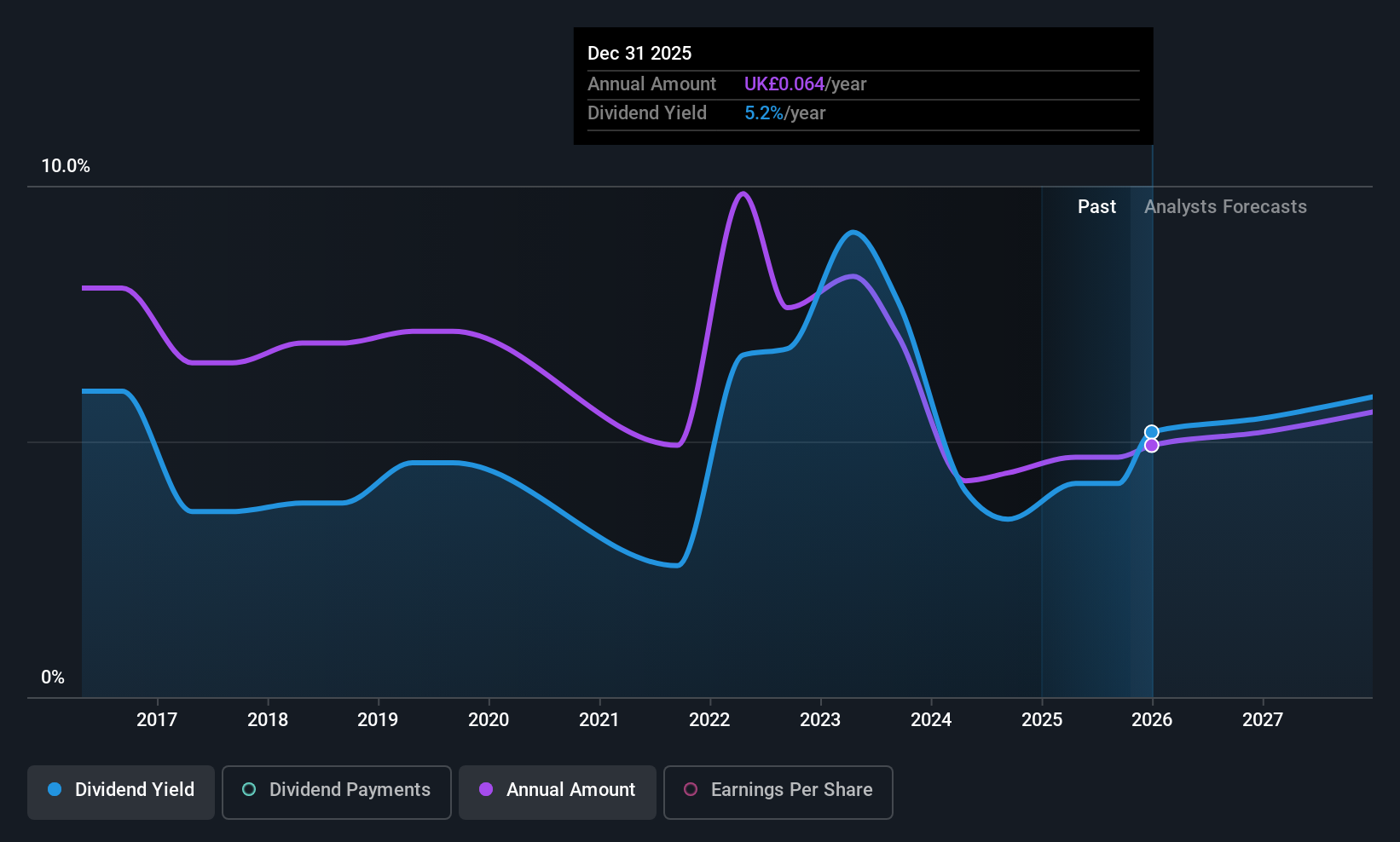

Eurocell (LSE:ECEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eurocell plc operates in the manufacture, distribution, and recycling of PVC building products such as windows, doors, and roofline items across the United Kingdom and the Republic of Ireland with a market cap of £125.37 million.

Operations: Eurocell plc generates its revenue primarily from two segments: Profiles, contributing £208.80 million, and Building Plastics, contributing £211.40 million.

Dividend Yield: 4.9%

Eurocell's dividend payments have shown volatility over the past decade, despite recent growth. With a cash payout ratio of 21.6%, dividends are well covered by cash flows, though earnings coverage is tighter at an 83.1% payout ratio. The dividend yield of 4.9% lags behind top-tier UK payers but remains attractive given Eurocell trades below estimated fair value. Recent executive changes may impact future financial strategies as Will Truman transitions to CFO in early 2026.

- Take a closer look at Eurocell's potential here in our dividend report.

- Our valuation report unveils the possibility Eurocell's shares may be trading at a discount.

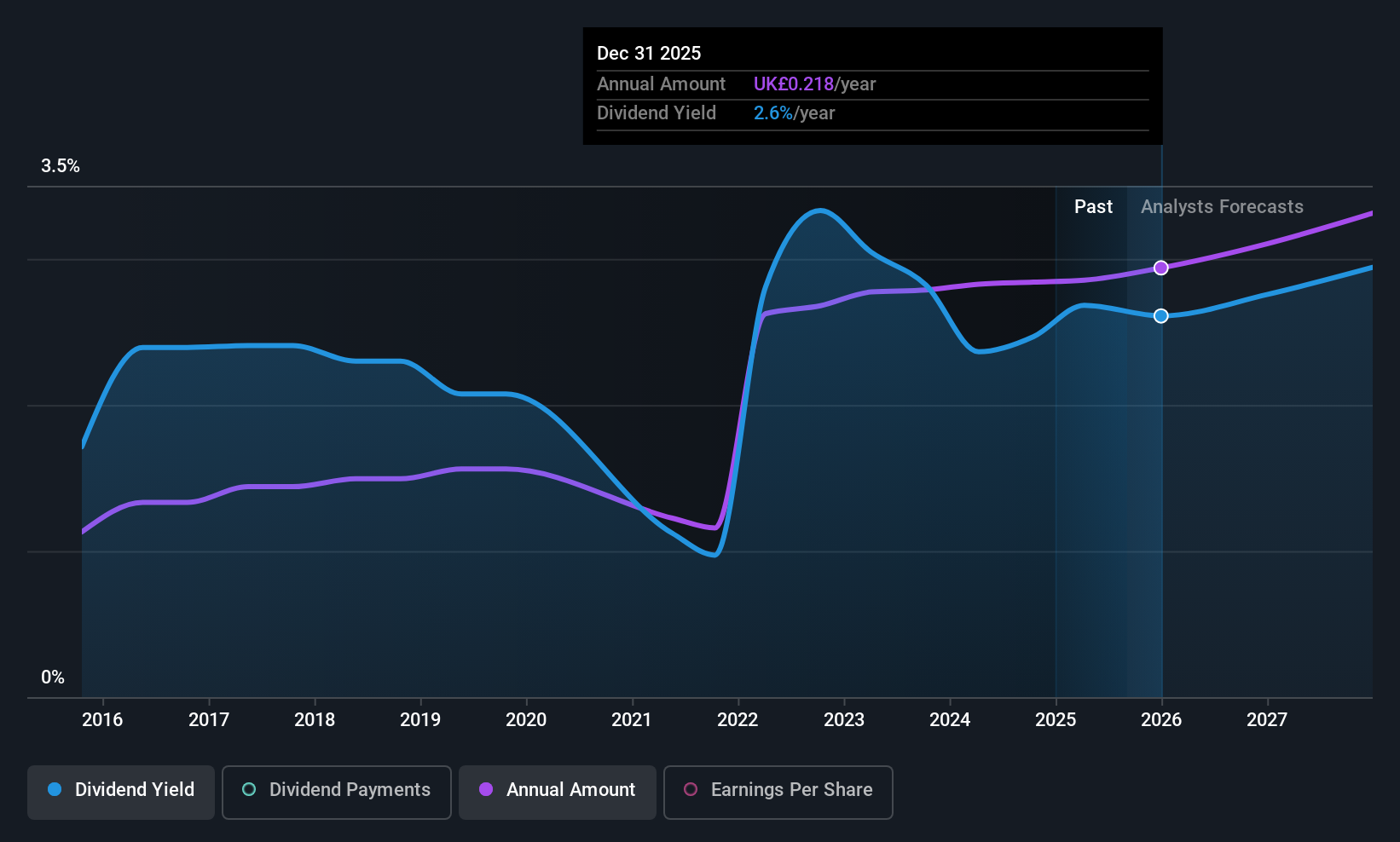

Howden Joinery Group (LSE:HWDN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Howden Joinery Group Plc supplies kitchen, joinery, and hardware products across the United Kingdom, France, Belgium, and the Republic of Ireland with a market cap of £4.49 billion.

Operations: The primary revenue segment for Howden Joinery Group Plc is Howden Joinery, generating £2.35 billion.

Dividend Yield: 3.2%

Howden Joinery Group's dividends are well supported by both earnings and cash flows, with payout ratios of 45.8% and 34.9%, respectively. Despite a history of increasing dividends over the past decade, payments have been volatile and unreliable, impacting sustainability perceptions. The current yield of 3.16% is below top-tier UK dividend payers but remains competitive given its solid coverage by financial metrics, albeit with potential concerns about future consistency due to past volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of Howden Joinery Group.

- The valuation report we've compiled suggests that Howden Joinery Group's current price could be inflated.

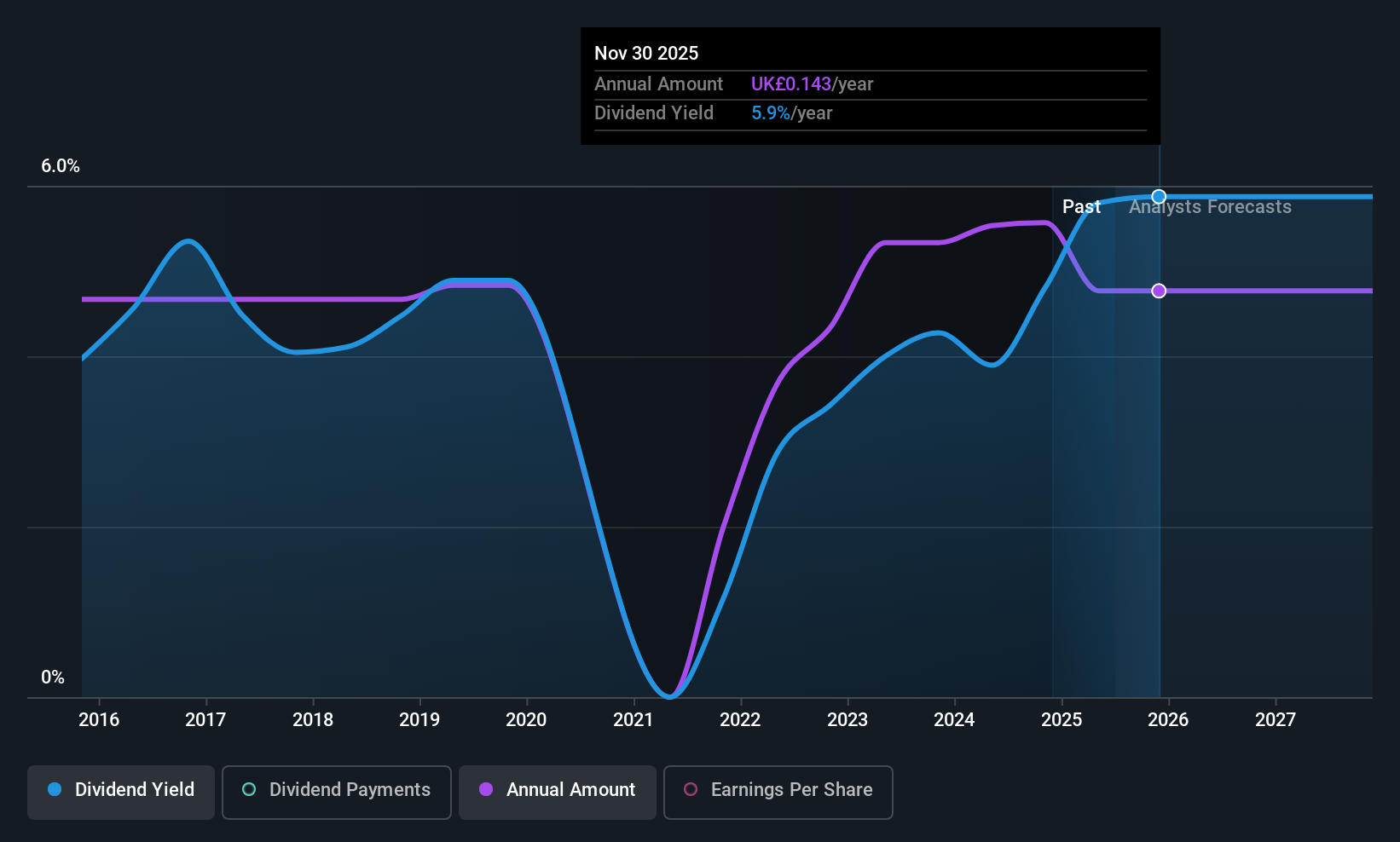

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SThree plc is a specialist recruitment firm operating in the sciences, technology, engineering, and mathematics sectors across multiple countries including the UK, Europe, the US, and parts of Asia with a market cap of £240.88 million.

Operations: SThree plc's revenue segments are comprised of £285.13 million from the USA, £422.24 million from DACH, £320.10 million from the Rest of Europe, £40.00 million from the Middle East & Asia, and £310.85 million from the Netherlands (including Spain).

Dividend Yield: 7.5%

SThree offers a high dividend yield of 7.54%, placing it among the top UK dividend payers, yet its sustainability is questionable due to poor cash flow coverage and volatile payment history. While dividends are covered by earnings with a payout ratio of 65.1%, the high cash payout ratio (147.9%) raises concerns. The stock trades at a favorable price-to-earnings ratio compared to the market, though declining profit margins and forecasted earnings contraction suggest caution for investors prioritizing stability.

- Dive into the specifics of SThree here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that SThree is priced lower than what may be justified by its financials.

Where To Now?

- Click this link to deep-dive into the 50 companies within our Top UK Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報