Top European Dividend Stocks To Consider In December 2025

As the pan-European STOXX Europe 600 Index edges closer to record highs amid optimism about future earnings and economic prospects, dividend stocks remain an attractive option for income-focused investors. In this environment, selecting stocks with strong fundamentals and consistent dividend payouts can provide a reliable income stream while navigating Europe's evolving market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.09% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.10% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.04% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.31% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.17% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.89% | ★★★★★☆ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

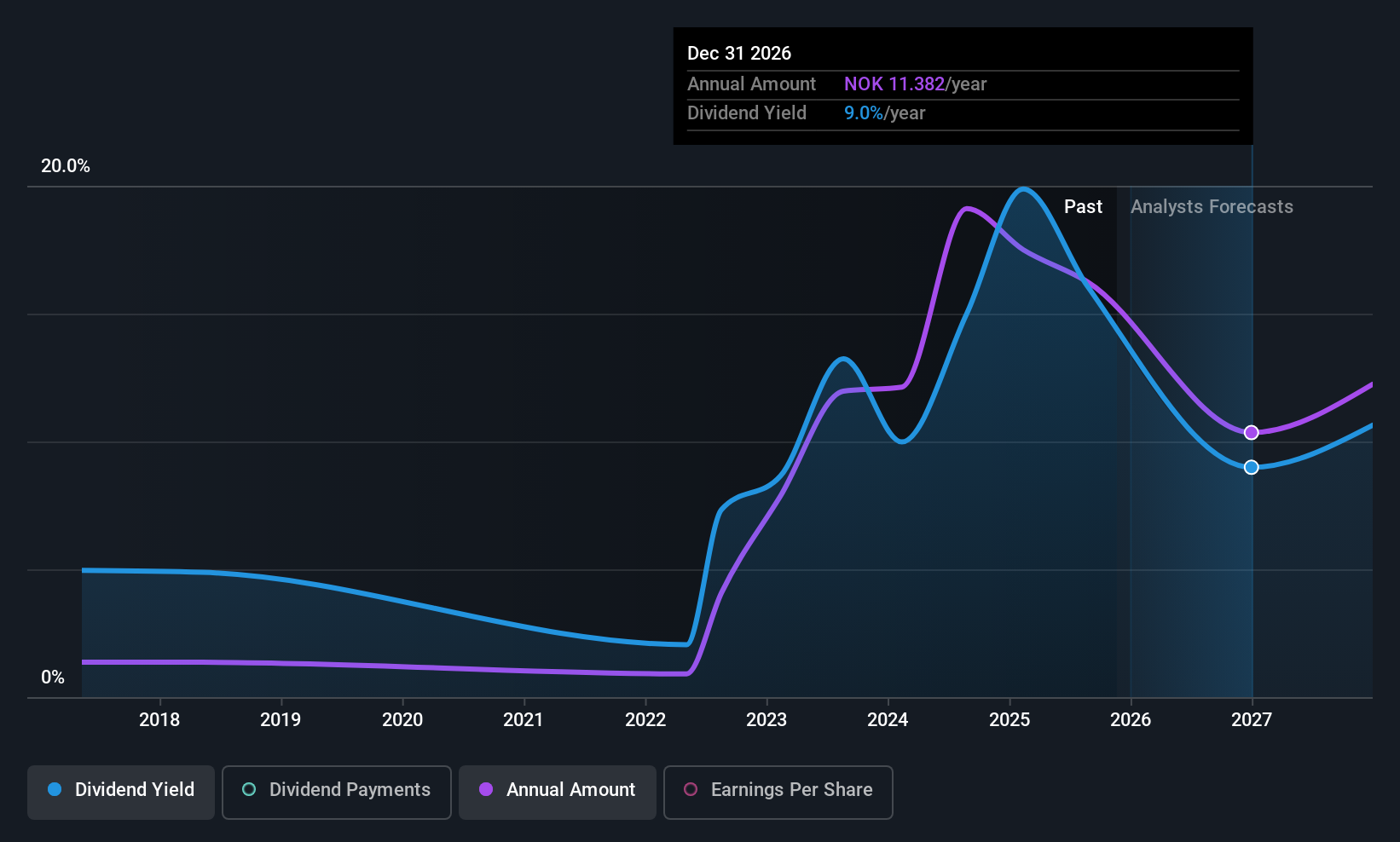

Odfjell (OB:ODF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Odfjell SE specializes in the transportation and storage of bulk liquid chemicals, acids, edible oils, and other specialty products across various regions including North America, South America, Europe, the Middle East, Asia, Africa, and Australasia with a market cap of NOK9.91 billion.

Operations: Odfjell SE's revenue segments focus on providing transportation and storage services for bulk liquid chemicals, acids, edible oils, and specialty products across multiple global regions.

Dividend Yield: 14.2%

Odfjell's dividend yield is among the top 25% in Norway, yet its track record shows volatility over the past nine years. Despite recent earnings declines, dividends are covered by both earnings and cash flows, with payout ratios of 59.4% and 81.9%, respectively. The company's strategic alliance with Nissen Kaiun aims to enhance fleet capacity, potentially supporting future revenue growth. However, high debt levels and fluctuating profit margins may impact dividend reliability moving forward.

- Click here to discover the nuances of Odfjell with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Odfjell's share price might be too pessimistic.

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Afry AB offers engineering, design, and advisory services across the infrastructure, industry, and energy sectors globally with a market cap of SEK16.89 billion.

Operations: Afry AB's revenue segments include SEK3.81 billion from the Energy sector.

Dividend Yield: 4%

AFRY's dividend yield ranks in the top 25% of Swedish payers, yet its history shows volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 73.2% and 32.5%, respectively. Recent leadership changes and a focus on strategic M&A could support future growth, but inconsistent earnings may affect dividend stability. The company's revenue guidance for 2028 is set at SEK 35 billion, indicating potential long-term growth prospects.

- Navigate through the intricacies of Afry with our comprehensive dividend report here.

- Our valuation report here indicates Afry may be undervalued.

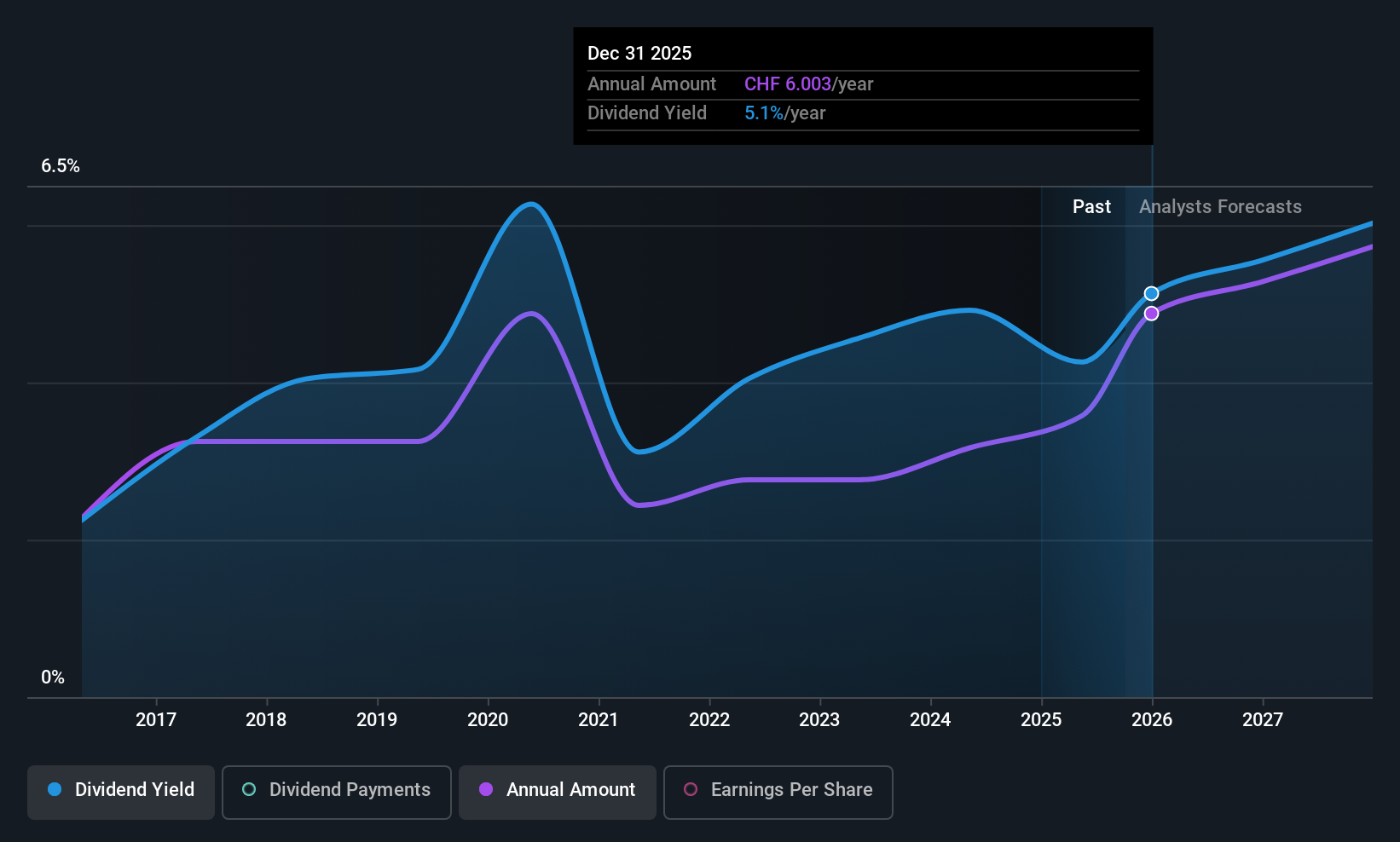

Orell Füssli (SWX:OFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security printing and technology, book retailing, and publishing across multiple continents, with a market cap of CHF232.26 million.

Operations: Orell Füssli AG generates revenue through its primary segments: Book Retailing (CHF127.49 million), Security Printing (CHF95.80 million), and Industrial Systems (CHF22.73 million).

Dividend Yield: 3.7%

Orell Füssli's dividend payments are well-covered by earnings and cash flows, with payout ratios of 44.9% and 58.5%, respectively. However, the dividend history has been volatile over the past decade, with significant annual drops exceeding 20%. Despite this instability, dividends have grown over ten years. Trading at a significant discount to its estimated fair value suggests potential for capital appreciation, though its current yield is slightly below top-tier Swiss payers.

- Dive into the specifics of Orell Füssli here with our thorough dividend report.

- Our expertly prepared valuation report Orell Füssli implies its share price may be lower than expected.

Taking Advantage

- Navigate through the entire inventory of 195 Top European Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報