Asian Growth Companies With High Insider Ownership December 2025

As 2025 draws to a close, Asian markets have shown resilience amid global economic shifts, with China's stock indices experiencing gains and Japan's market buoyed by optimism in technology sectors. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business and may align well with investor interests seeking stability and potential upside in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ingenic Semiconductor Co., Ltd. is involved in the research, development, design, and sale of integrated circuit chip products both in China and internationally, with a market capitalization of approximately CN¥53.55 billion.

Operations: Ingenic Semiconductor Co., Ltd. focuses on the research, development, and sale of integrated circuit chip products across domestic and international markets.

Insider Ownership: 16.4%

Earnings Growth Forecast: 33.8% p.a.

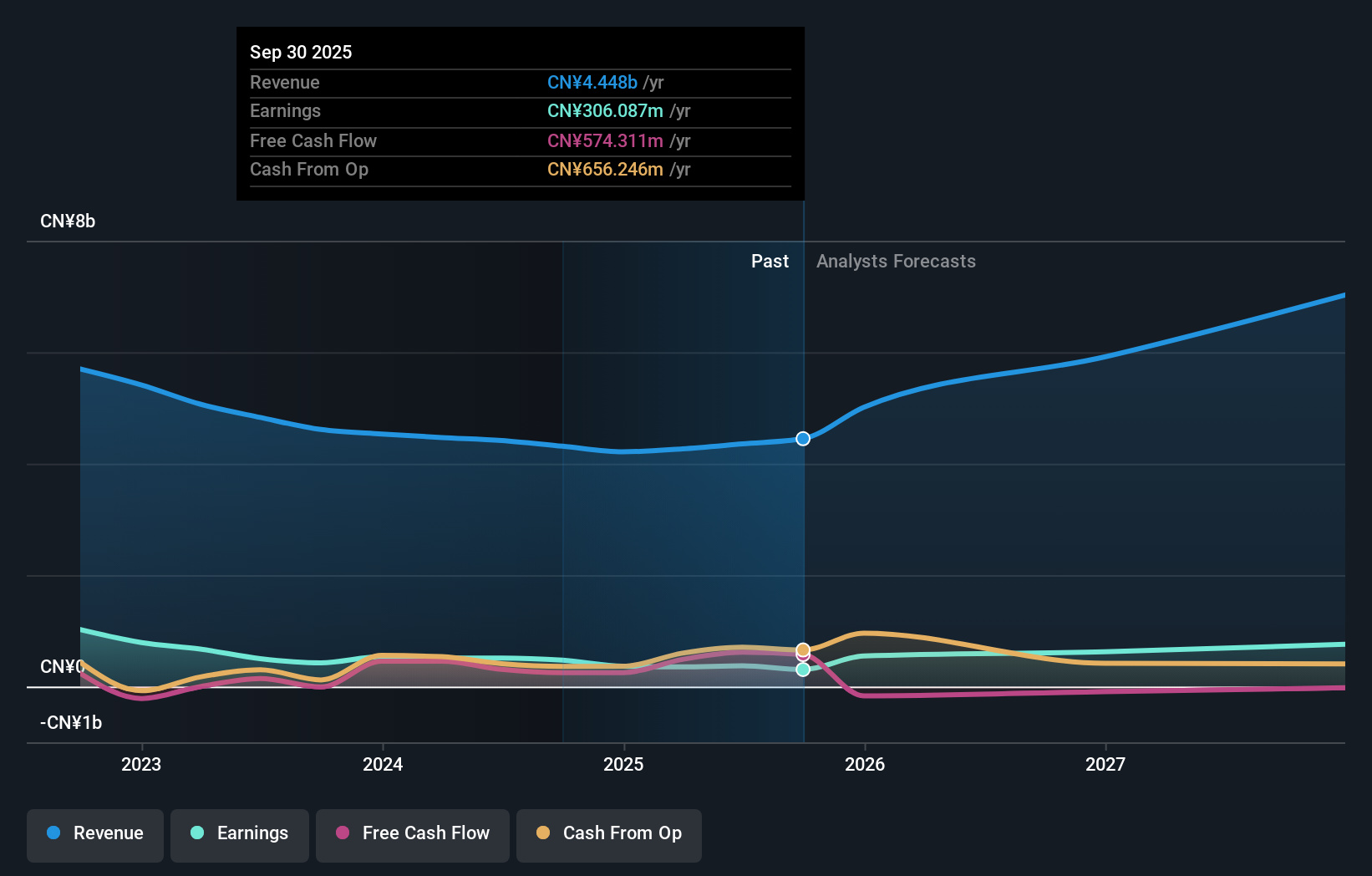

Ingenic Semiconductor Ltd. is experiencing strong revenue growth, projected at 20.7% annually, outpacing the Chinese market's 14.6%. The company's earnings are forecast to grow significantly at 33.8% per year, surpassing the market average of 27.6%. Despite this growth potential, recent results show a decline in net income and profit margins compared to last year and a volatile share price over the past three months without significant insider trading activity recently noted.

- Unlock comprehensive insights into our analysis of Ingenic SemiconductorLtd stock in this growth report.

- In light of our recent valuation report, it seems possible that Ingenic SemiconductorLtd is trading beyond its estimated value.

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hangzhou Changchuan Technology Co., Ltd, along with its subsidiaries, is engaged in the research, development, production, and sale of integrated circuit equipment and high-frequency communication materials both in China and internationally, with a market cap of CN¥67.25 billion.

Operations: Hangzhou Changchuan Technology Co., Ltd generates revenue through its activities in the development, production, and sale of integrated circuit equipment and high-frequency communication materials across domestic and international markets.

Insider Ownership: 31.9%

Earnings Growth Forecast: 29.2% p.a.

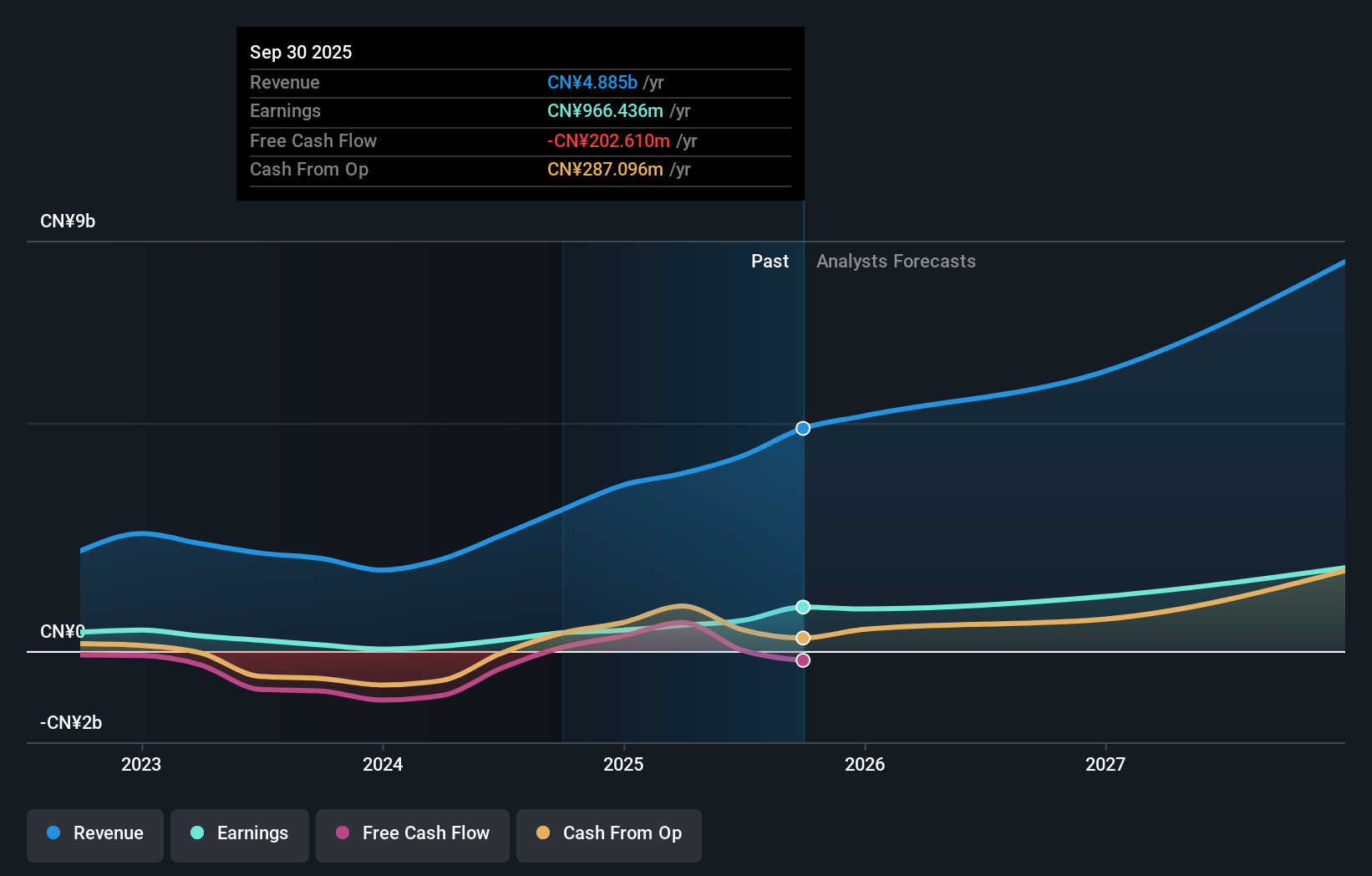

Hangzhou Changchuan Technology Ltd. is experiencing robust revenue growth, forecasted at 24% annually, outpacing the Chinese market's 14.6%. Earnings are expected to grow significantly at 29.2% per year, exceeding the market average of 27.6%. Recent results show a substantial increase in net income and sales for the first nine months of 2025 compared to last year. However, its share price has been highly volatile recently and lacks notable insider trading activity over three months.

- Dive into the specifics of Hangzhou Changchuan TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Hangzhou Changchuan TechnologyLtd is priced higher than what may be justified by its financials.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gold Circuit Electronics Ltd. is a Taiwan-based company that designs, manufactures, processes, and distributes printed circuit boards with a market cap of NT$339.22 billion.

Operations: The company's revenue is primarily derived from the manufacturing and sales of printed circuit boards, amounting to NT$53.45 billion.

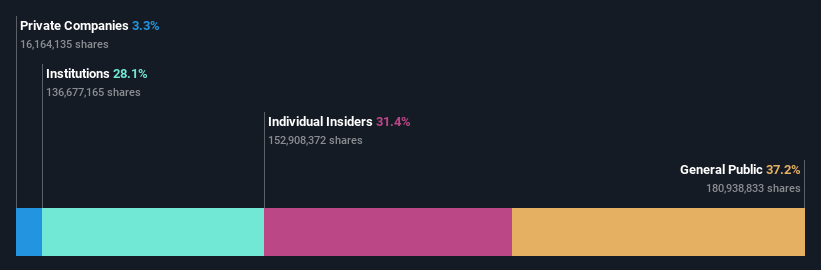

Insider Ownership: 31.4%

Earnings Growth Forecast: 37.2% p.a.

Gold Circuit Electronics is poised for significant growth, with earnings projected to rise 37.22% annually, surpassing Taiwan's market average of 20.5%. Revenue is expected to grow at 29.4% per year, also outpacing the market's 13.9%. Recent financial results show a substantial increase in sales and net income for Q3 and the first nine months of 2025 compared to last year. Despite high earnings quality, its share price has been highly volatile recently without notable insider trading activity over three months.

- Click to explore a detailed breakdown of our findings in Gold Circuit Electronics' earnings growth report.

- The valuation report we've compiled suggests that Gold Circuit Electronics' current price could be inflated.

Taking Advantage

- Gain an insight into the universe of 630 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報