Earnings Not Telling The Story For Divi's Laboratories Limited (NSE:DIVISLAB)

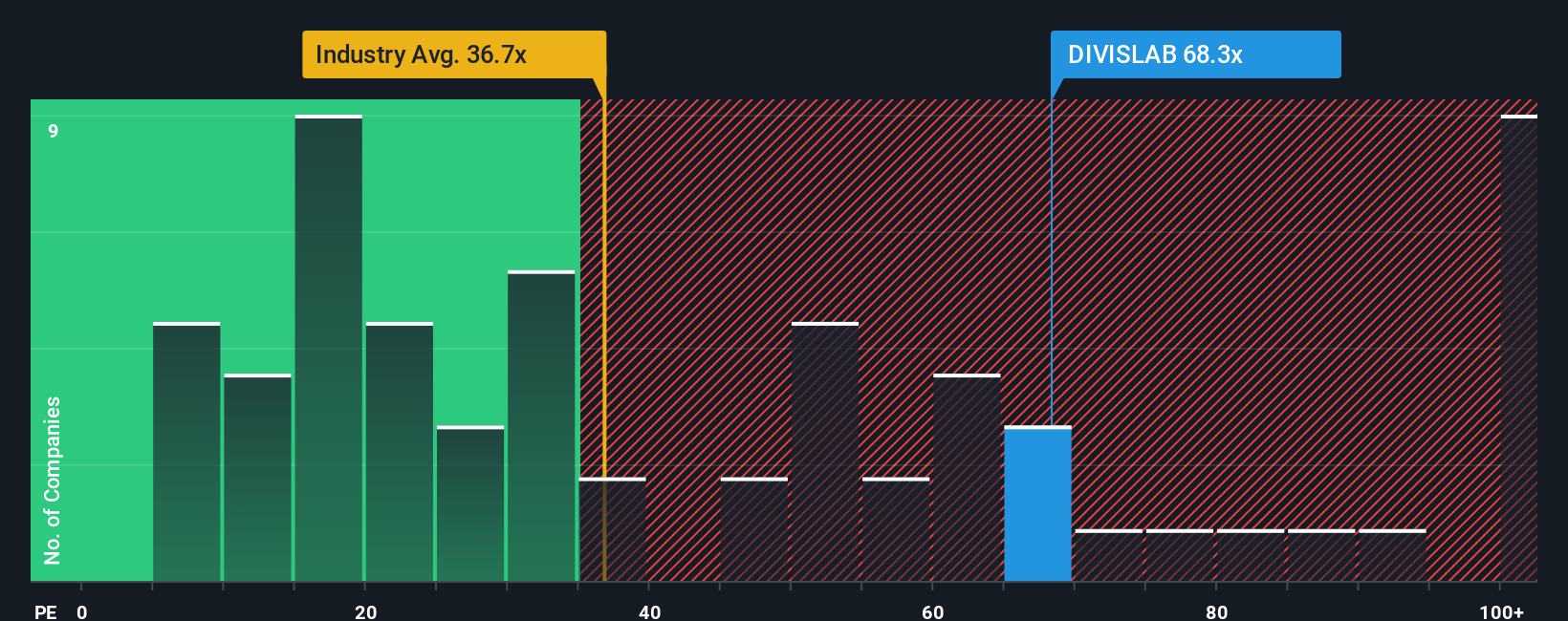

Divi's Laboratories Limited's (NSE:DIVISLAB) price-to-earnings (or "P/E") ratio of 68.3x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 25x and even P/E's below 14x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Divi's Laboratories has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Divi's Laboratories

How Is Divi's Laboratories' Growth Trending?

In order to justify its P/E ratio, Divi's Laboratories would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. Still, incredibly EPS has fallen 17% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 15% per annum over the next three years. That's shaping up to be materially lower than the 20% per year growth forecast for the broader market.

In light of this, it's alarming that Divi's Laboratories' P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Divi's Laboratories' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Divi's Laboratories currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Divi's Laboratories (including 1 which shouldn't be ignored).

Of course, you might also be able to find a better stock than Divi's Laboratories. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報