IPO News | Lexin Outdoors Announced Three Times, Hong Kong Stock Exchange focuses on fishing-related equipment manufacturing

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 29, Lexin Outdoor International Co., Ltd. (abbreviation: Lexin Outdoor) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CICC is its sole sponsor. This is the third time the company has submitted a statement to the Hong Kong Stock Exchange.

Company profile

According to the prospectus, Lexin Outdoor focuses on fishing gear and has established a comprehensive and diverse product portfolio, which mainly includes beds, chairs and other accessories, such as fishing chairs, fishing beds, fishing rod holders, fishing carts and fishing boxes; bags, such as shoulder bags, fishing fishing bags and fishing rod bags; and tents, such as fishing gear tents, social and awnings.

The company's products are suitable for a variety of fishing scenarios, such as carp fishing, game fishing, luya fishing, fly fishing and ice fishing.

According to Frost & Sullivan, Lexin Outdoor is the world's largest fishing equipment manufacturer in terms of 2024 revenue, with a market share of 23.1%. Based on 2024 revenue, the company's market share in the global fishing tackle manufacturing market is 1.3%.

The company operates a dual business model, combining OEM/ODM manufacturing capabilities with growing OBM business to meet diverse market needs.

During the track record period, the company's revenue mainly came from the OEM/ODM model, accounting for 94.1%, 90.2%, 92.3% and 93.1% of the company's total revenue in 2022, 2023, 2024 and the eight months ended August 31, 2025, respectively.

Furthermore, the company strategically expanded into its own brand business and acquired the famous British carp fishing brand Solar in 2017. The company sells its products to more than 40 countries, including mature markets with rich fishing traditions such as the UK and the US, as well as rapidly growing markets such as China and Southeast Asia.

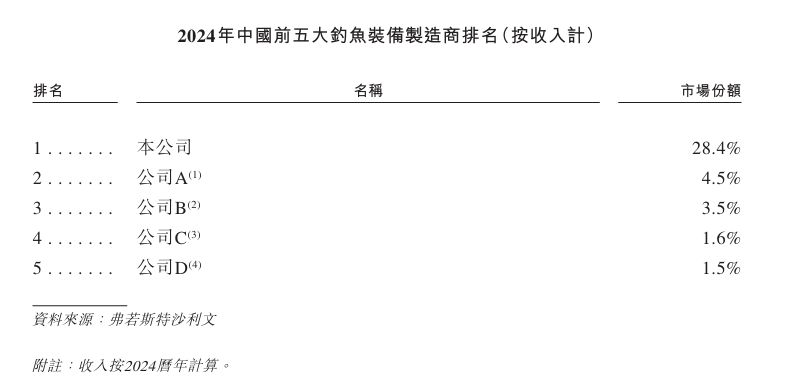

In China's fishing equipment manufacturing industry, the company's market share has grown steadily from 23.4% in 2022 to 28.4% in 2024.

The company operates three factories in Deqing County, Zhejiang Province, China, with a total construction area of 63,637.7 square meters and a total production capacity of 6.2 million units. In 2022, 2023, 2024 and the eight months ended August 31, 2025, the utilization rates of the company's factories were 86.0%, 78.9%, 80.2% and 78.3%, respectively.

Financial data

revenue

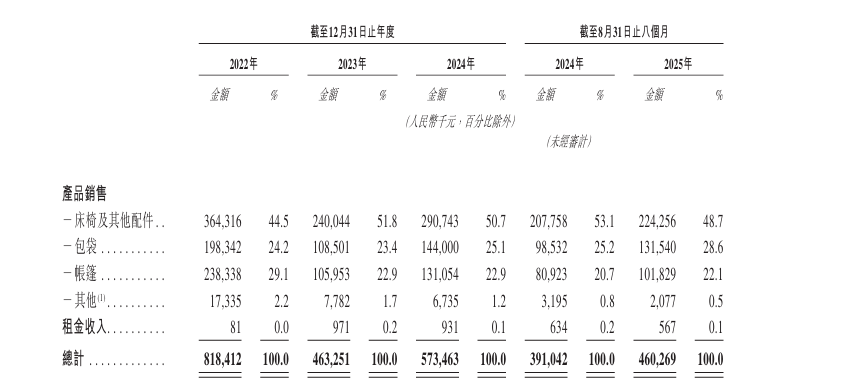

In the eight months ended August 31 in 2022, 2023, 2024, and 2025, the company achieved revenue of approximately 818 million yuan (RMB, same below), 463 million yuan, 573 million yuan, and 460 million yuan, respectively.

Profit during the year/period

In 2022, 2023, 2024, and 2025 for the eight months ended August 31, the company recorded year/period profits of about 114 million yuan, 49.01 million yuan, 59.05 million yuan, and 56.241,000 yuan respectively.

gross profit margin

For the eight months ended August 31 in 2022, 2023, 2024, and 2025, the company's gross margins were 23.2%, 26.6%, 26.6%, and 27.7%.

Industry Overview

Overview of the global outdoor equipment industry

According to Frost & Sullivan's data and public data from authorities, in terms of retail sales, the market size of the global outdoor equipment industry grew from RMB 524.3 billion in 2019 to RMB 645.8 billion in 2024, with a compound annual growth rate of 4.3%.

Fishing is a popular outdoor activity. In 2024, the global fishing equipment market will account for about 21.8% of the global outdoor equipment market in terms of retail sales.

The market size of the global fishing tackle industry

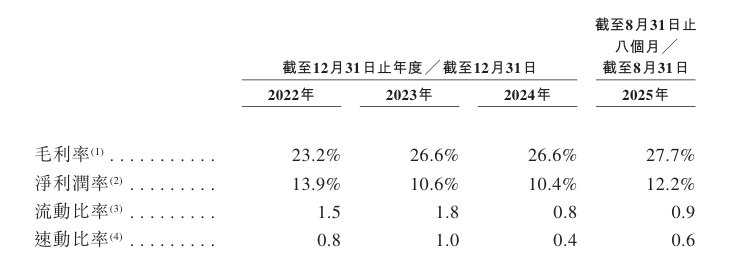

According to Frost & Sullivan, in terms of retail sales, the market size of the global fishing tackle industry increased from RMB 120.4 billion in 2019 to RMB 140.9 billion in 2024, with a compound annual growth rate of 3.2%.

With the rise of fishing activity, fishing is expected to become a major growth area for the industry. Among various fishing equipment products, tents, awnings, chairs, bed chairs and fishing bags are the main equipment products required by consumers. The global fishing tackle market is expected to continue to maintain a compound annual growth rate of 7.1% from 2025 to 2029, and the market size is expected to reach RMB 194.1 billion in retail sales by 2029.

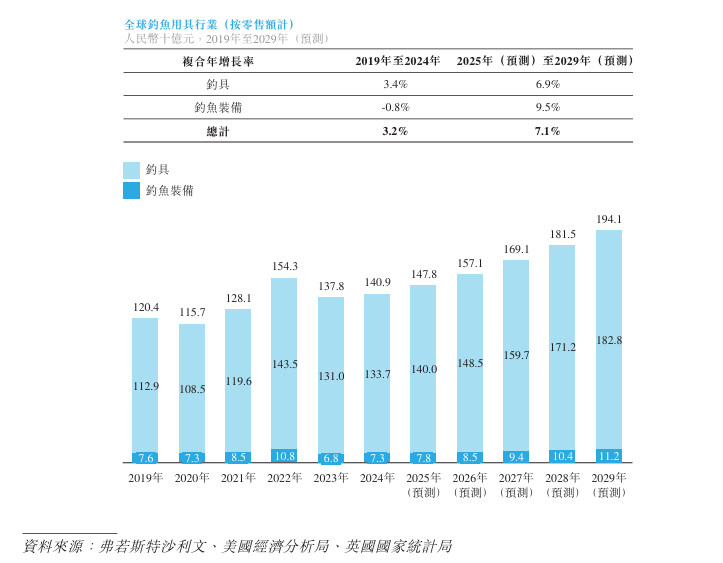

North America, East Asia, Europe and Southeast Asia are major consumer markets for fishing gear. North America is the world's largest fishing tackle market, with the largest market share of 31.8% in terms of retail sales in 2024. East Asia, represented by China, accounted for 29.9% of the market share in terms of retail sales in 2024, while Europe was 21.7%. Southeast Asia is close to the ocean, and fishing activities are becoming increasingly popular, making it one of the regions where consumption of fishing equipment is growing rapidly.

Market size of China's fishing tackle industry

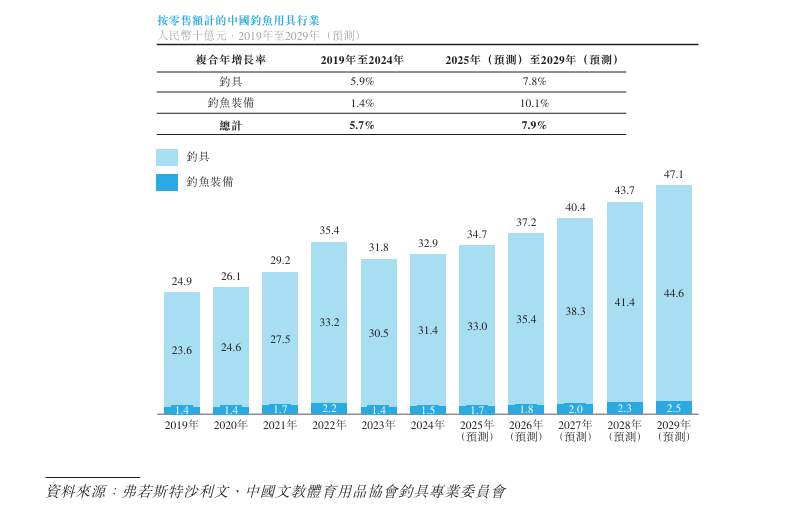

According to Frost & Sullivan, in terms of retail sales, the market size of China's fishing tackle industry grew from RMB 24.9 billion in 2019 to RMB 32.9 billion in 2024, with a compound annual growth rate of 5.7%.

It is expected that the market size of China's fishing tackle industry will continue to grow at a CAGR of 7.9% from 2025 to 2029.

China is the world's largest fishing tackle manufacturer. According to 2024 revenue, China's share of the global fishing tackle manufacturing industry is over 70%.

According to Frost & Sullivan, in terms of 2024 revenue, the company is the world's largest fishing equipment manufacturer, with a market share of 23.1%. The global fishing equipment manufacturing industry is relatively concentrated. In terms of 2024 revenue, the top five fishing equipment manufacturers account for 34.7% of the market share.

According to the same source, China's fishing equipment manufacturing industry is relatively concentrated. In terms of 2024 revenue, the top five fishing equipment manufacturers account for 39.4% of the market share. In terms of revenue in 2024, the company is the largest fishing equipment manufacturer in China, with a market share of 28.4%.

Board Information

The board of directors of the company consists of 7 directors, including 2 executive directors, 2 non-executive directors and 3 independent non-executive directors.

Shareholding structure

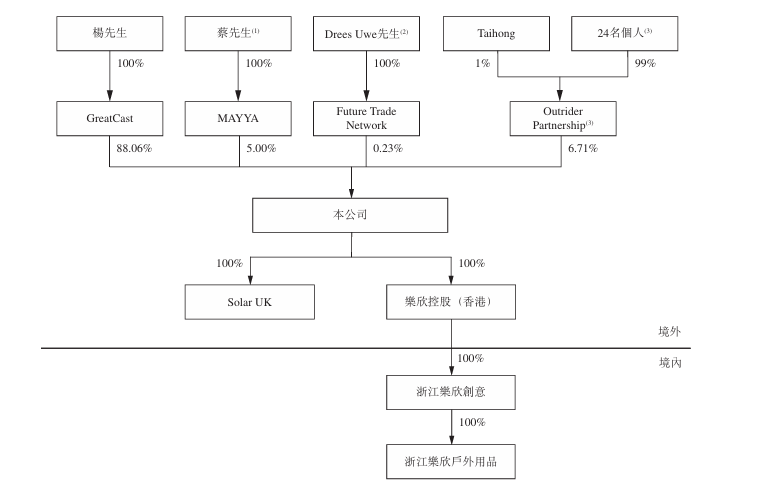

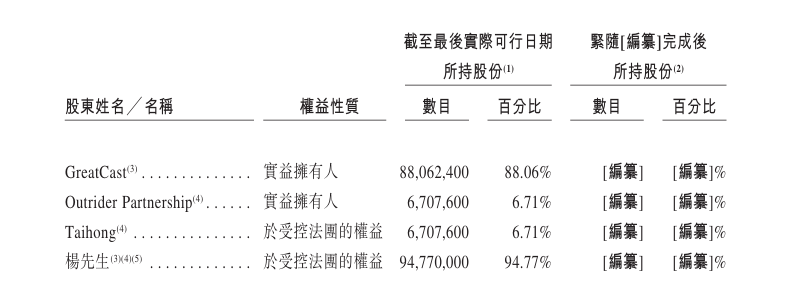

As of December 22, 2025, Mr. Yang held 100% interest in GreatCast (a limited company incorporated under the laws of the British Virgin Islands). Therefore, according to the Securities and Futures Ordinance, Mr. Yang is deemed to have an interest in shares held by GreatCast, which is 88.06% of the company's shares.

Intermediary team

Sole sponsor: China International Finance Hong Kong Securities Limited.

Company Legal Advisors: Hong Kong and US Law: Gao Weishen Law Firm; Related Chinese Law: Guo Hao (Hangzhou) Law Firm; Cayman Islands Law: Kai Bo Law Firm.

Sole sponsor legal adviser: Regarding Hong Kong and US law: Haiwen Law Firm Limited Liability Partnership; relating to Chinese law: Beijing Commerce Law Firm.

Reporting accountant: KPMG.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Compliance Advisor: Guotai Junan Finance Co., Ltd.

Nasdaq

Nasdaq 華爾街日報

華爾街日報