Some Shareholders Feeling Restless Over Tata Consumer Products Limited's (NSE:TATACONSUM) P/S Ratio

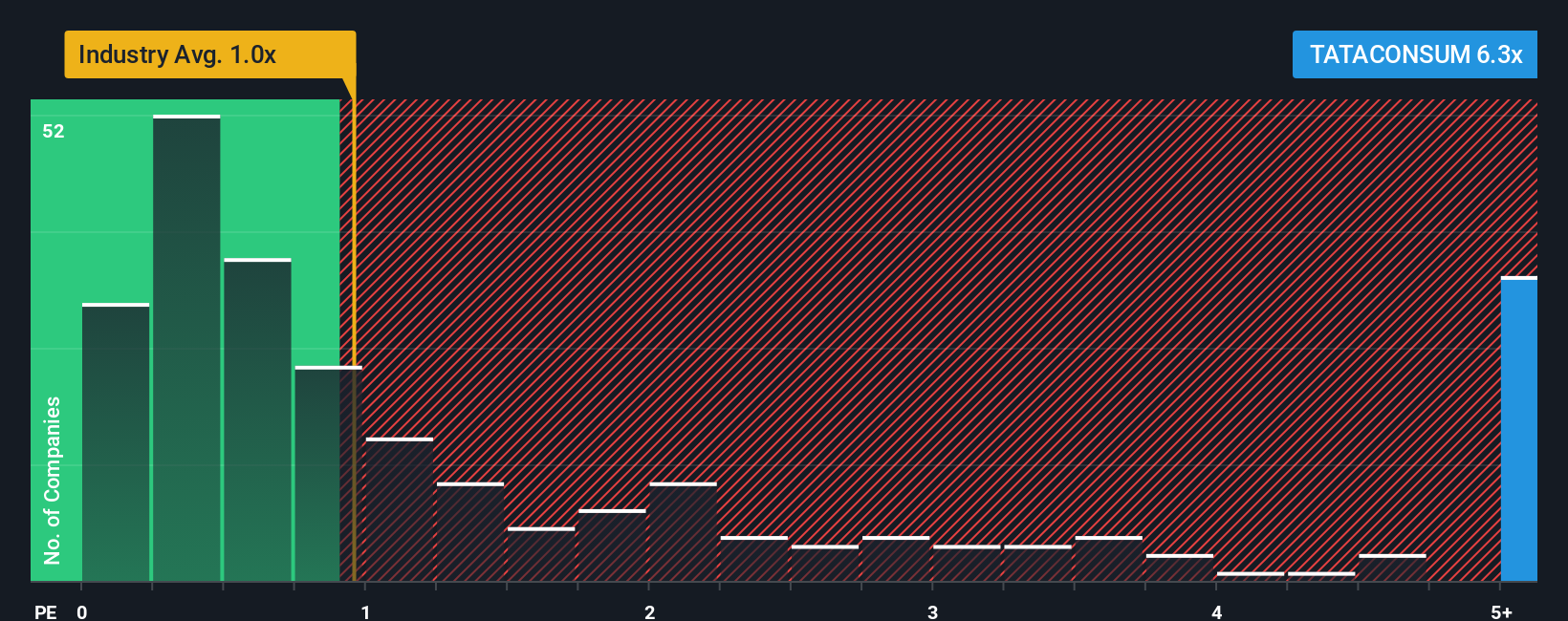

When you see that almost half of the companies in the Food industry in India have price-to-sales ratios (or "P/S") below 1x, Tata Consumer Products Limited (NSE:TATACONSUM) looks to be giving off strong sell signals with its 6.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Tata Consumer Products

What Does Tata Consumer Products' P/S Mean For Shareholders?

Recent times haven't been great for Tata Consumer Products as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tata Consumer Products.What Are Revenue Growth Metrics Telling Us About The High P/S?

Tata Consumer Products' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% per year over the next three years. With the industry predicted to deliver 12% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Tata Consumer Products is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Tata Consumer Products' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Tata Consumer Products with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報