3 Promising Growth Companies With Insider Ownership Up To 14%

As the U.S. stock market experiences a slight pullback following a recent winning streak, investors are closely watching for potential opportunities amid fluctuating indices and retreating precious metals prices. In this context, growth companies with significant insider ownership can be particularly appealing, as they often signal confidence from those who know the business best and may offer resilience during market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.7% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Underneath we present a selection of stocks filtered out by our screen.

Gloo Holdings (GLOO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gloo Holdings, Inc. designs and develops a vertical technology platform for the faith and flourishing ecosystem, with a market cap of $512.46 million.

Operations: The company generates revenue through its Gloo Segment, which accounts for $67.52 million.

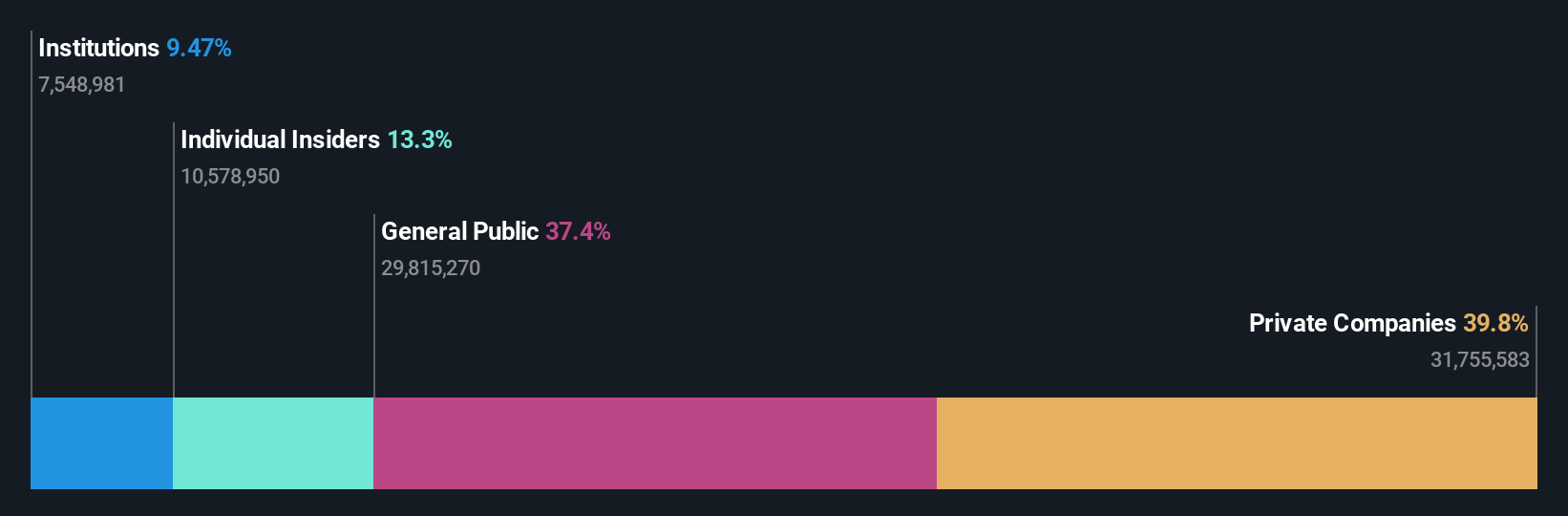

Insider Ownership: 13.3%

Gloo Holdings has experienced significant insider buying recently, reflecting confidence in its growth potential. The company reported a substantial revenue increase to US$32.55 million for Q3 2025, up from US$6.12 million the previous year, though it still faces net losses. Gloo's revenue is projected to grow at an impressive rate of 38.9% annually, outpacing the market average. Despite being illiquid and having negative equity, its forecasted profitability within three years suggests promising long-term prospects.

- Unlock comprehensive insights into our analysis of Gloo Holdings stock in this growth report.

- According our valuation report, there's an indication that Gloo Holdings' share price might be on the expensive side.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of approximately $868.43 million.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, which generated $272.81 million.

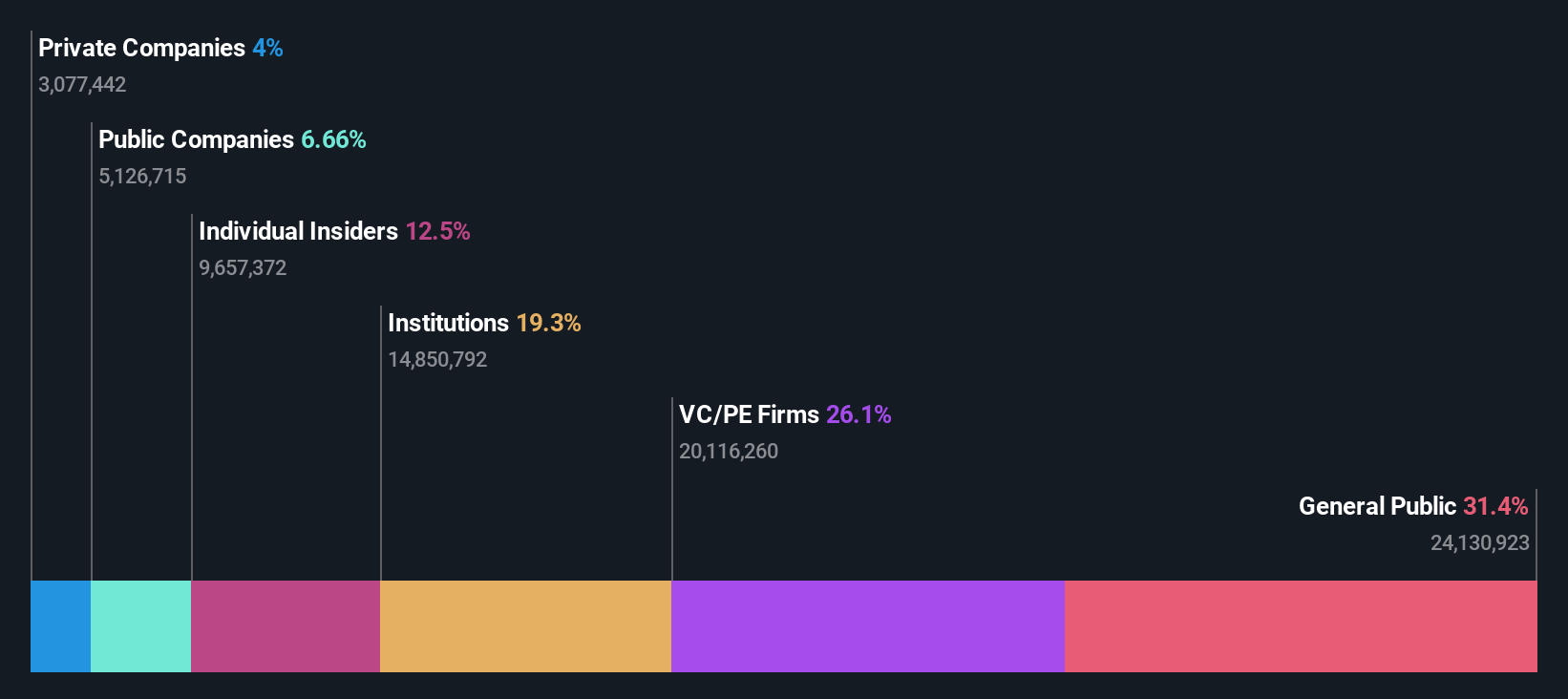

Insider Ownership: 12.6%

MNTN's recent addition to the S&P Global BMI Index underscores its growing market presence. Despite no substantial insider buying recently, MNTN has demonstrated robust revenue growth, reporting US$70.02 million for Q3 2025, up from US$57.13 million a year ago. The company's strategic alliances, such as with Northbeam and PubMatic, enhance its performance marketing capabilities in the rapidly expanding CTV sector. Forecasted profitability within three years highlights its potential for sustained growth amidst high insider ownership concerns.

- Take a closer look at MNTN's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of MNTN shares in the market.

Similarweb (SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers digital data and analytics services to support critical business decisions across various regions, including the United States, Europe, the Asia Pacific, the United Kingdom, and Israel, with a market cap of $616.05 million.

Operations: The company's revenue segment consists of $275.43 million from online financial information providers.

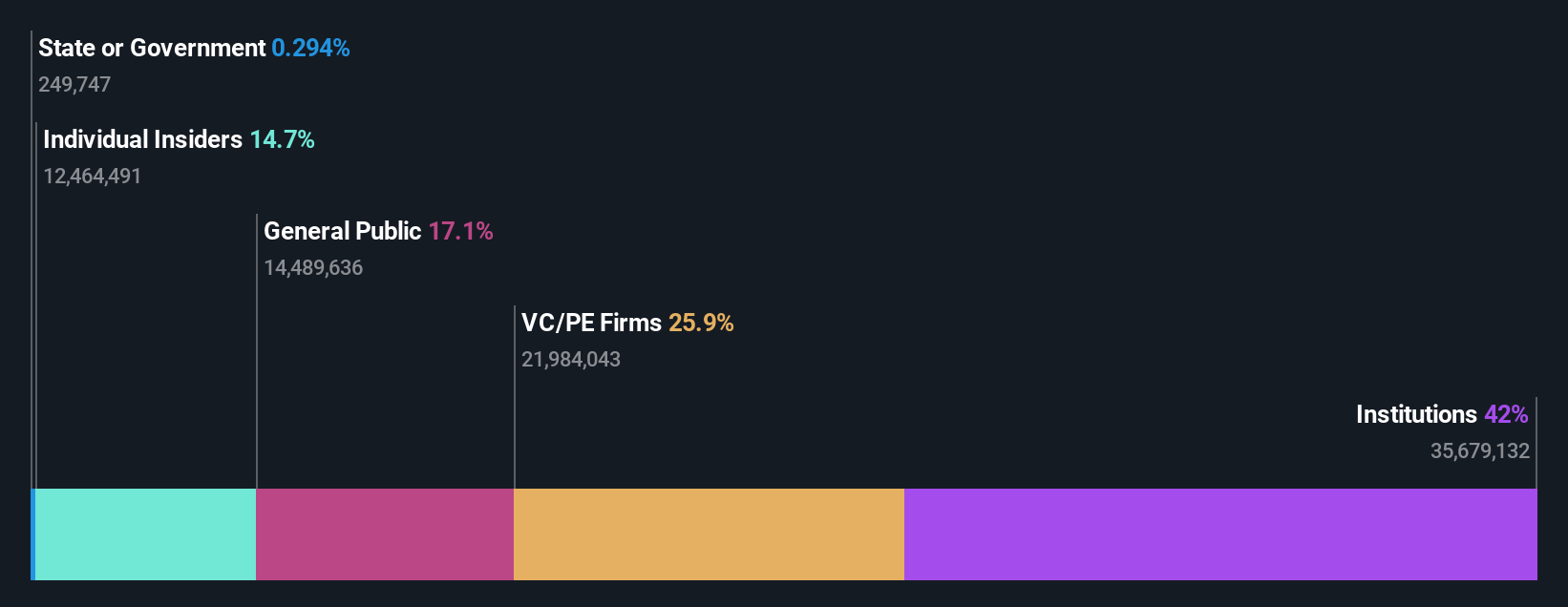

Insider Ownership: 14.4%

Similarweb's insider ownership aligns with its growth trajectory, as it forecasts profitability within three years and a robust earnings growth of 100.27% annually. Despite trading below fair value, its revenue is expected to grow at 13.5% per year, surpassing the US market average. Recent advancements in generative AI capabilities enhance competitive intelligence offerings, positioning Similarweb to capitalize on digital marketing trends and enterprise adoption amidst strategic executive changes and product expansions.

- Navigate through the intricacies of Similarweb with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Similarweb implies its share price may be lower than expected.

Seize The Opportunity

- Explore the 208 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報