Three Compelling Dividend Stocks To Consider

As the U.S. stock market navigates a holiday-shortened week with major indexes slipping and precious metals retreating from record highs, investors are keeping a close eye on potential opportunities amidst fluctuating conditions. In this environment, dividend stocks can offer a compelling option for those seeking steady income and resilience against market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.72% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.37% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.70% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.23% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.98% | ★★★★★★ |

| Ennis (EBF) | 5.47% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.54% | ★★★★★☆ |

| Dillard's (DDS) | 4.95% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.04% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 116 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

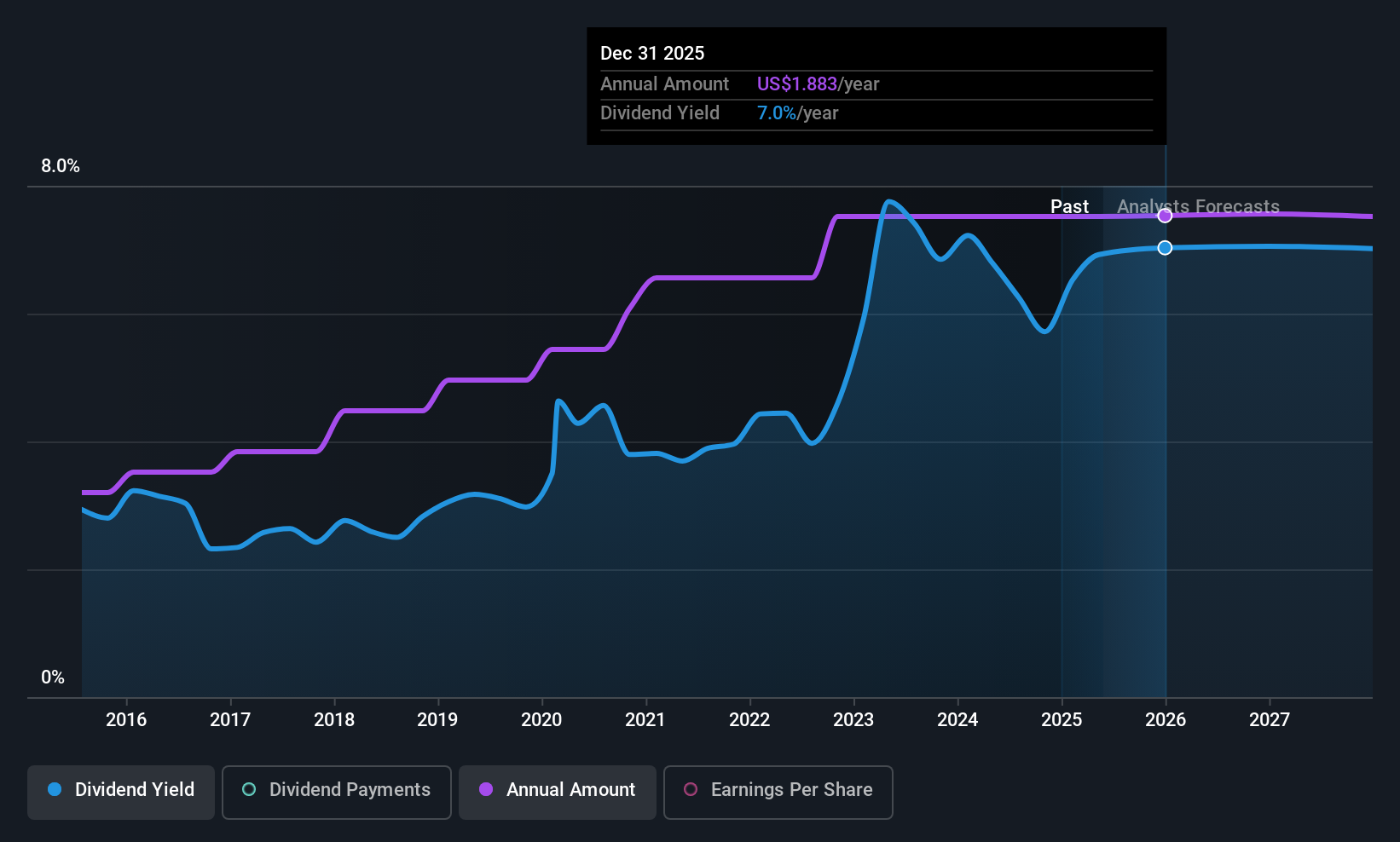

First Interstate BancSystem (FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering a variety of banking products and services across the United States with a market cap of approximately $3.70 billion.

Operations: First Interstate BancSystem, Inc. generates revenue primarily from its Community Banking segment, which accounts for $953.70 million.

Dividend Yield: 5.2%

First Interstate BancSystem offers a high and reliable dividend yield of 5.23%, placing it in the top 25% of U.S. dividend payers. The company's dividends are currently covered by earnings with a payout ratio of 79%, expected to improve to 65.6% in three years, suggesting sustainability. Despite recent activist investor pressure over past acquisitions, its stable and growing dividends over the last decade remain attractive for income-focused investors.

- Take a closer look at First Interstate BancSystem's potential here in our dividend report.

- Our valuation report unveils the possibility First Interstate BancSystem's shares may be trading at a discount.

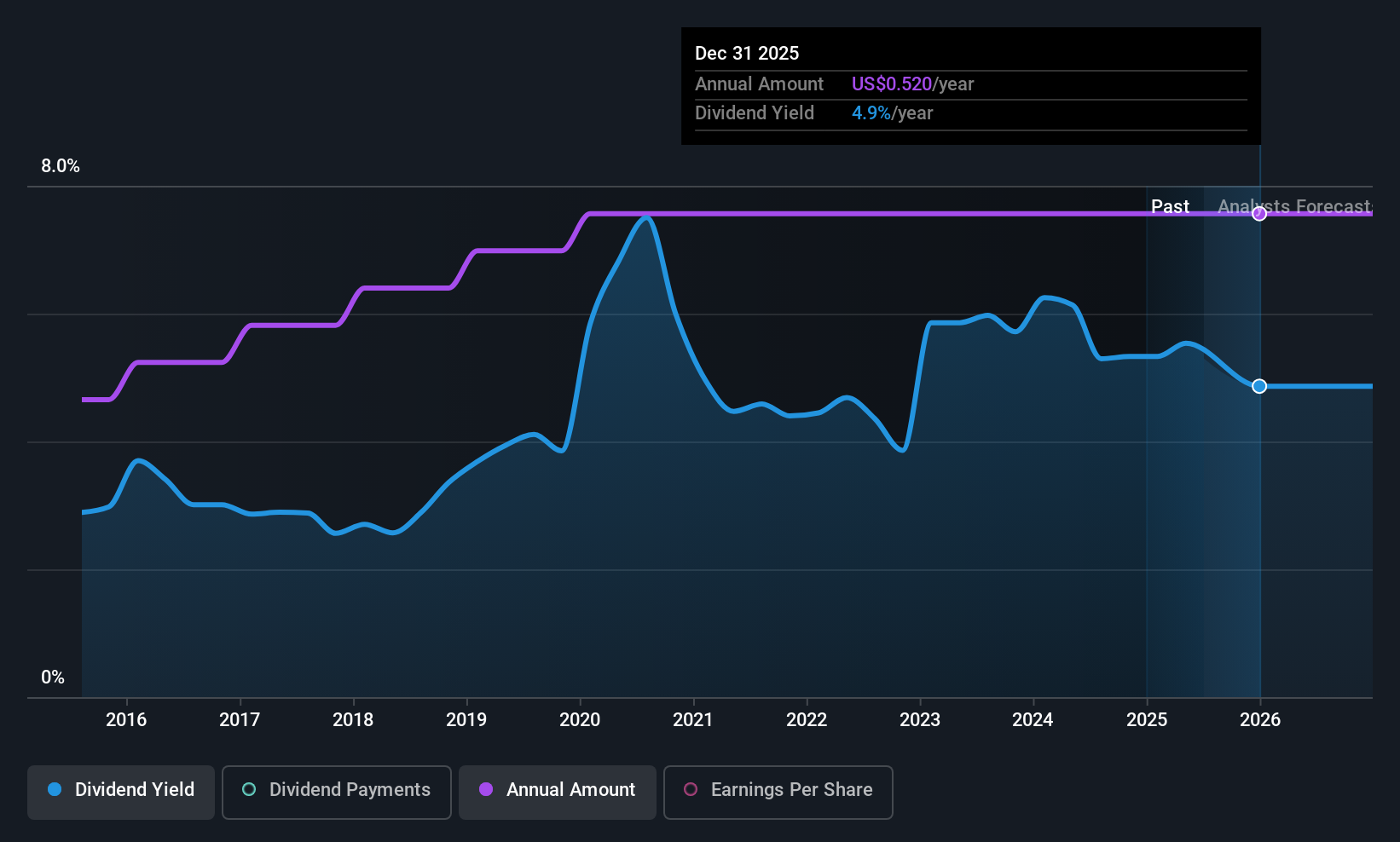

Heritage Commerce (HTBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Heritage Commerce Corp is the bank holding company for Heritage Bank of Commerce, offering a range of commercial and personal banking services in California, with a market cap of $766.99 million.

Operations: Heritage Commerce Corp generates revenue through its primary segments: Banking, which contributes $176.07 million, and Factoring, which adds $11.61 million.

Dividend Yield: 4.1%

Heritage Commerce's dividend yield of 4.15% is reliable but below the top 25% of U.S. payers. Dividends have been stable and growing over the past decade, with a current payout ratio of 73.7%, forecasted to improve to 51.6% in three years, indicating sustainability. A recent merger agreement with CVB Financial Corp., valued at approximately $810 million, may influence future dividend policies as the transaction progresses towards completion in mid-2026.

- Dive into the specifics of Heritage Commerce here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Heritage Commerce shares in the market.

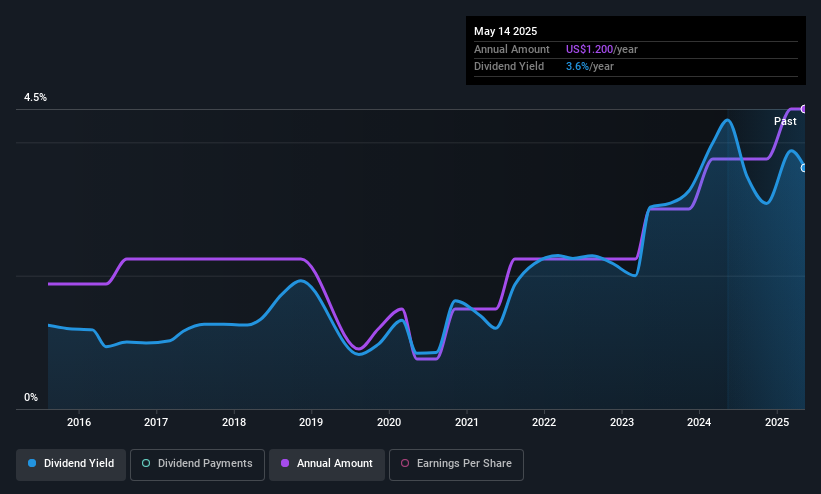

Fresh Del Monte Produce (FDP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fresh Del Monte Produce Inc. operates globally through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables, with a market cap of approximately $1.71 billion.

Operations: Fresh Del Monte Produce Inc. generates revenue primarily from Fresh and Value-Added Products at $2.63 billion, followed by Bananas at $1.49 billion, and Other Products and Services at $199 million.

Dividend Yield: 3.3%

Fresh Del Monte Produce's dividend yield of 3.35% is lower than the top U.S. payers, but its dividends are well-covered by earnings and cash flows, with a payout ratio of 69.6% and cash payout ratio of 32.5%. Despite a volatile dividend history, recent strategic partnerships like the one with THACO Agri aim to enhance global sourcing and operational efficiency, potentially stabilizing future payouts amidst production challenges in the banana industry.

- Delve into the full analysis dividend report here for a deeper understanding of Fresh Del Monte Produce.

- The valuation report we've compiled suggests that Fresh Del Monte Produce's current price could be quite moderate.

Key Takeaways

- Get an in-depth perspective on all 116 Top US Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報