3 Stocks Estimated To Be Priced Below Value In December 2025

As the major stock indexes in the United States continue to log weekly gains, with the S&P 500, Dow Jones Industrial Average, and Nasdaq all showing positive momentum over a holiday-shortened week, investors remain keenly focused on identifying stocks that may be undervalued. In this environment of rising indices and record highs for precious metals like gold and silver, discerning investors are increasingly interested in stocks that offer potential value opportunities amidst broader market optimism.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.87 | $52.65 | 49% |

| UMB Financial (UMBF) | $118.90 | $233.21 | 49% |

| Sportradar Group (SRAD) | $23.10 | $45.62 | 49.4% |

| SmartStop Self Storage REIT (SMA) | $31.52 | $61.42 | 48.7% |

| Schrödinger (SDGR) | $18.31 | $35.46 | 48.4% |

| Perfect (PERF) | $1.73 | $3.43 | 49.5% |

| Nicolet Bankshares (NIC) | $123.66 | $242.21 | 48.9% |

| Dingdong (Cayman) (DDL) | $2.88 | $5.76 | 50% |

| Community West Bancshares (CWBC) | $22.69 | $44.11 | 48.6% |

| Columbia Banking System (COLB) | $28.59 | $56.94 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

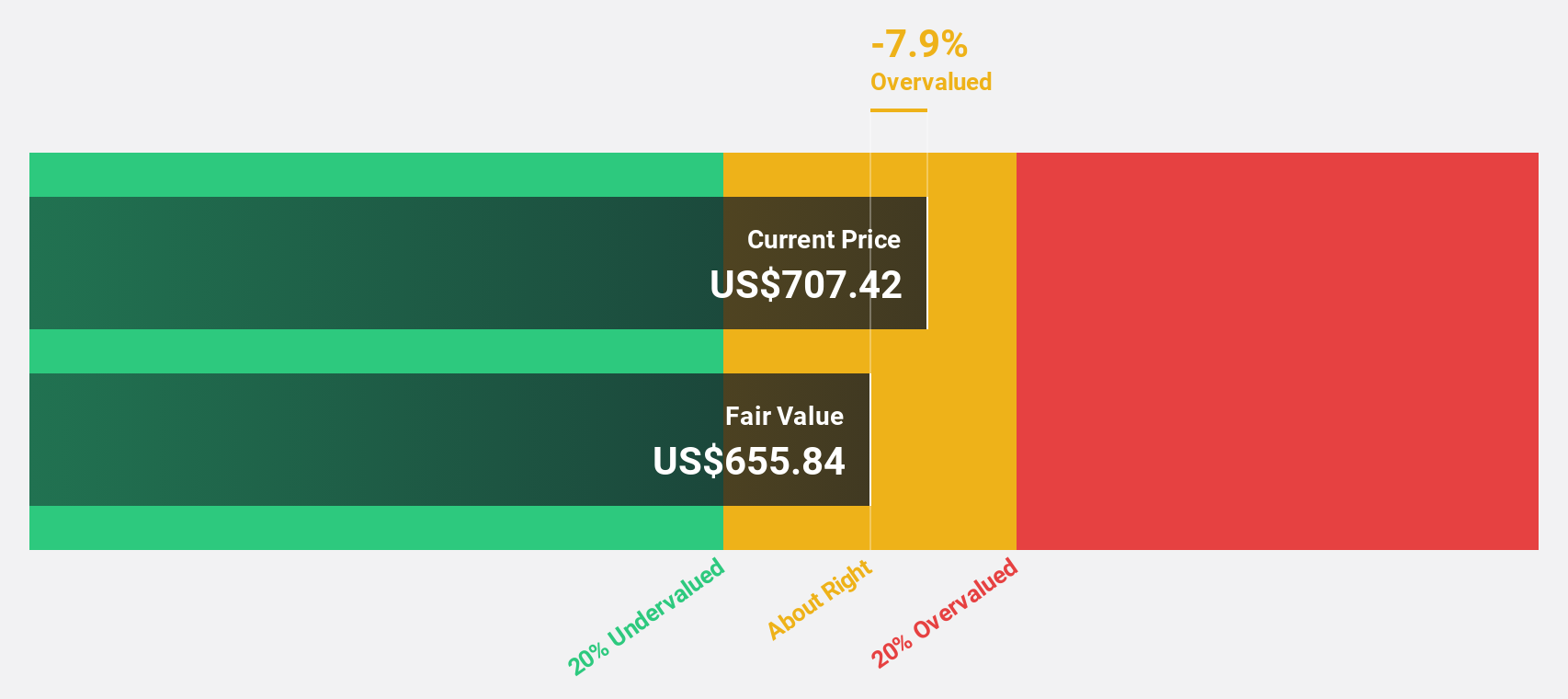

Seagate Technology Holdings (STX)

Overview: Seagate Technology Holdings plc provides data storage technology and infrastructure solutions across various international markets, with a market cap of approximately $62.36 billion.

Operations: The company's revenue is primarily generated from the manufacture and distribution of storage solutions, amounting to $9.56 billion.

Estimated Discount To Fair Value: 19.7%

Seagate Technology Holdings is trading at US$286.22, below its estimated fair value of US$356.6, indicating potential undervaluation based on cash flows. The company reported strong earnings growth of 102.1% over the past year and forecasts revenue growth of 11.7% annually, outpacing the broader U.S. market's 10.7%. However, it carries a high level of debt and has experienced significant insider selling recently, which may be concerns for investors evaluating its financial position.

- Our comprehensive growth report raises the possibility that Seagate Technology Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Seagate Technology Holdings' balance sheet health report.

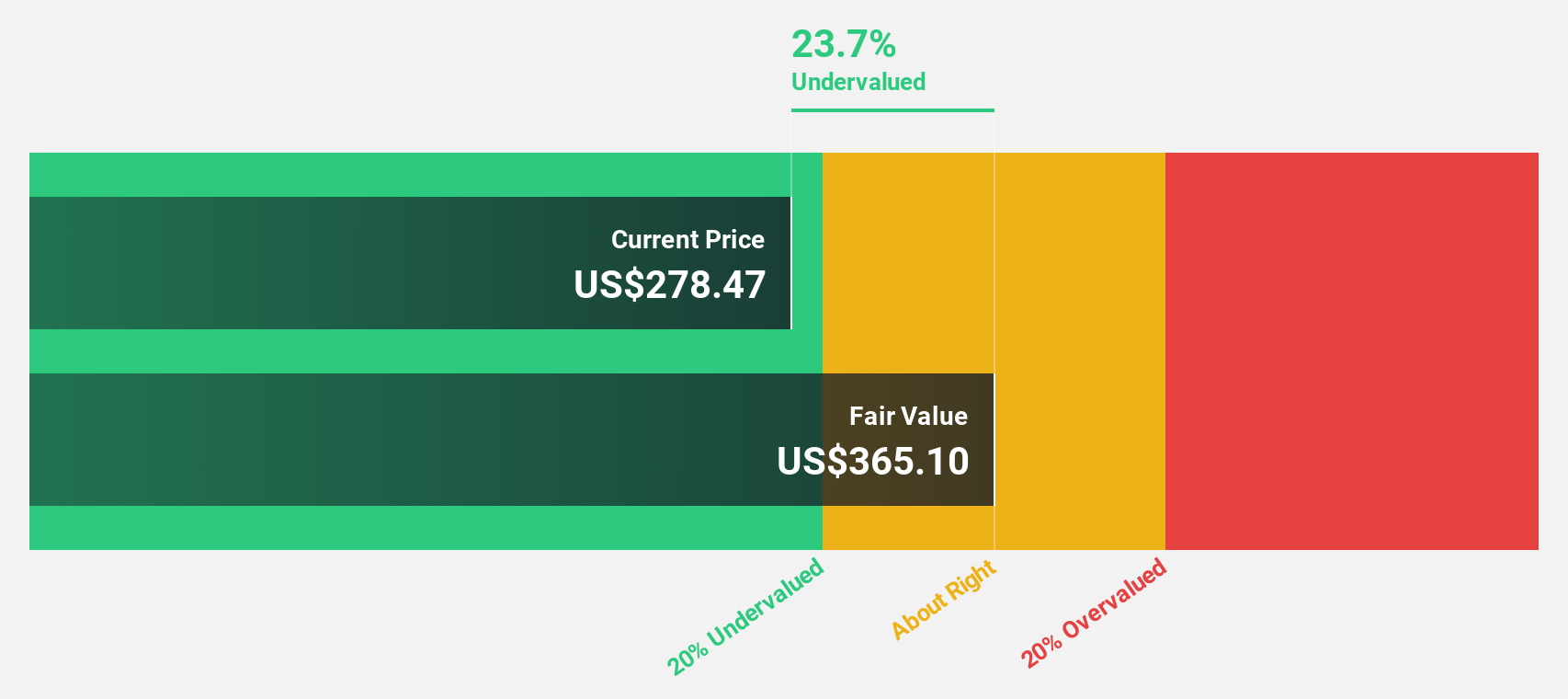

Coupang (CPNG)

Overview: Coupang, Inc., along with its subsidiaries, operates a retail business through mobile applications and internet websites in South Korea and internationally, with a market cap of approximately $44.33 billion.

Operations: Coupang's revenue is primarily derived from its Product Commerce segment, which generated $29.07 billion, and its Developing Offerings segment, which contributed $4.60 billion.

Estimated Discount To Fair Value: 33.5%

Coupang is trading at US$24.27, significantly below its estimated fair value of US$36.52, suggesting undervaluation based on cash flows. Earnings are forecast to grow 42.6% annually, outpacing the broader U.S. market's growth rate of 16.2%. However, recent legal challenges regarding cybersecurity issues may pose risks to investor confidence and future financial performance despite a strategic partnership aimed at enhancing its retail media network ecosystem in Taiwan.

- Our growth report here indicates Coupang may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Coupang.

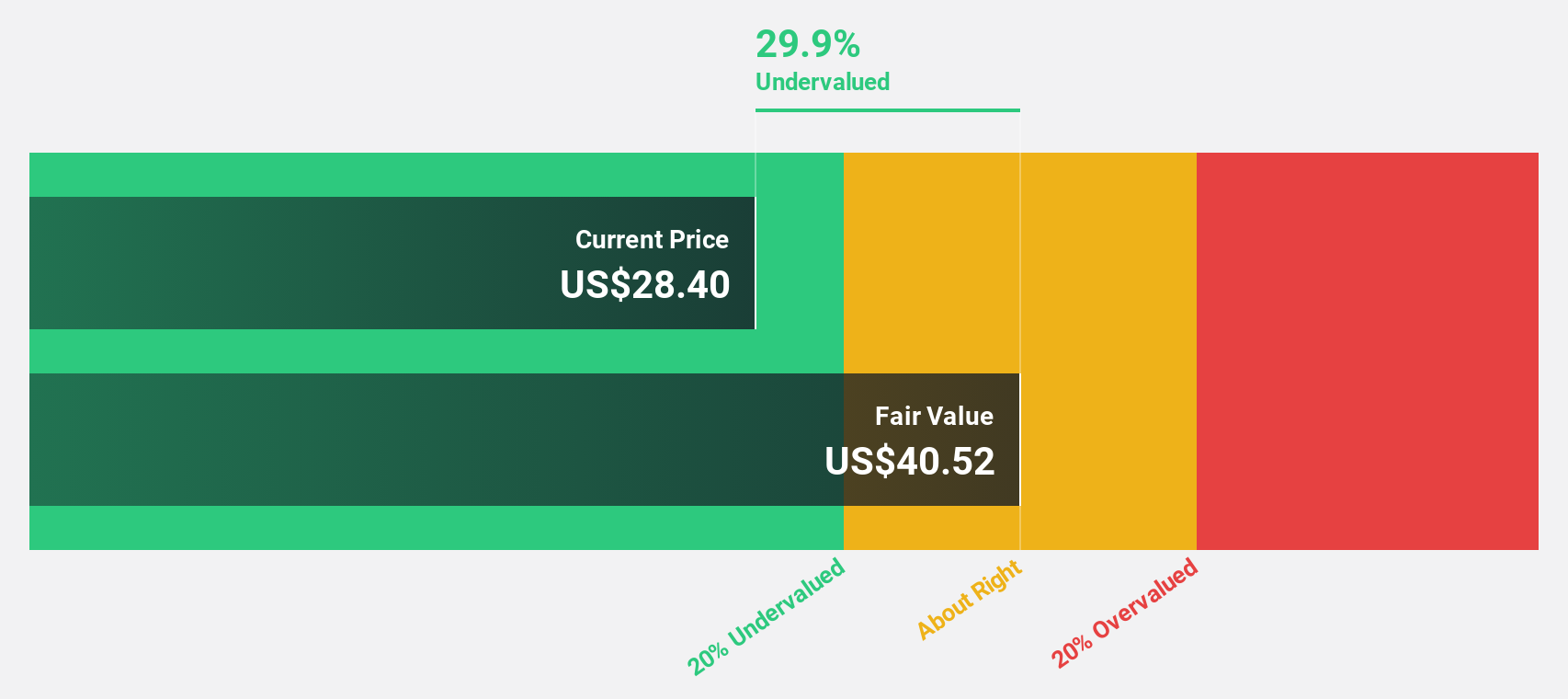

Spotify Technology (SPOT)

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $120.43 billion.

Operations: The company generates revenue primarily from its Premium segment, which accounts for €15.04 billion, and its Ad-Supported segment, contributing €1.86 billion.

Estimated Discount To Fair Value: 25.8%

Spotify Technology is trading at $584.35, considerably below its estimated fair value of $787.24, highlighting potential undervaluation based on cash flows. Earnings have grown significantly over the past year and are projected to continue outpacing the U.S. market with a 27.9% annual growth rate forecasted over three years. Despite these positives, ongoing legal challenges concerning streaming fraud could impact investor sentiment and financial stability in the future.

- Our expertly prepared growth report on Spotify Technology implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Spotify Technology here with our thorough financial health report.

Key Takeaways

- Gain an insight into the universe of 205 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報