Undiscovered Gems In Global And 2 Other Hidden Stocks With Strong Potential

Amid record highs for the S&P 500 and Dow Jones Industrial Average, the global market is experiencing a mix of optimism fueled by AI advancements and concerns over consumer confidence. In this environment, identifying stocks with strong potential requires focusing on companies that can navigate economic shifts, demonstrate resilience in their business models, and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. is a company engaged in the development and production of electronic components, with a market cap of CN¥12.03 billion.

Operations: Beijing Yuanliu Hongyuan Electronic Technology generates revenue primarily from the sale of electronic components. The company's financial performance is highlighted by a gross profit margin of 45%, indicating efficient cost management in production.

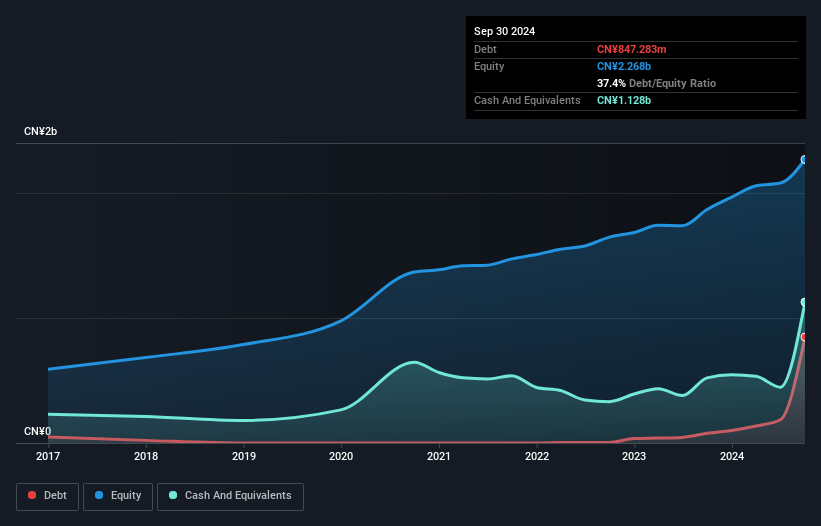

Yuanliu Hongyuan, a smaller player in the electronics sector, has been showing promising financial health. The company boasts a price-to-earnings ratio of 48.4x, which is below the industry average of 56.4x, indicating potential value. Over the past year, earnings grew by an impressive 62.2%, far outpacing the industry's growth rate of 9.4%. Additionally, with more cash than total debt and positive free cash flow trends, its financial footing seems solid. Recent results show sales for nine months at CNY 1.43 billion and net income at CNY 222 million; both figures are up from last year's numbers by notable margins.

Aurisco PharmaceuticalLtd (SHSE:605116)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aurisco Pharmaceutical Co., Ltd. is involved in the research, development, production, and sales of specialized complex APIs, pharmaceutical intermediates, and preparations globally with a market capitalization of approximately CN¥9.93 billion.

Operations: Aurisco Pharmaceutical Co., Ltd. generates revenue primarily through the sales of specialized complex APIs, pharmaceutical intermediates, and preparations. The company has a market capitalization of approximately CN¥9.93 billion.

Aurisco Pharma, a nimble player in the pharmaceutical sector, has seen its earnings jump 24.6% over the past year, outpacing the industry's modest 3.8% growth. The company boasts high-quality earnings and maintains a price-to-earnings ratio of 23.4x, which is attractive compared to China's market average of 45x. Notably, Aurisco's debt is well-managed with interest payments covered 33 times by EBIT and more cash than total debt on hand. Recent buybacks saw them repurchase nearly a million shares for CNY 20.68 million, reflecting confidence in their financial health and future prospects as they continue to grow robustly in revenue and net income figures this year at CNY 1,237 million and CNY 353 million respectively compared to last year’s numbers.

- Click to explore a detailed breakdown of our findings in Aurisco PharmaceuticalLtd's health report.

Learn about Aurisco PharmaceuticalLtd's historical performance.

Actions Technology (SHSE:688049)

Simply Wall St Value Rating: ★★★★★☆

Overview: Actions Technology Co., Ltd. is a fabless semiconductor company focused on the research, development, and sale of audio SoC and integrated chips in China, with a market cap of approximately CN¥9.51 billion.

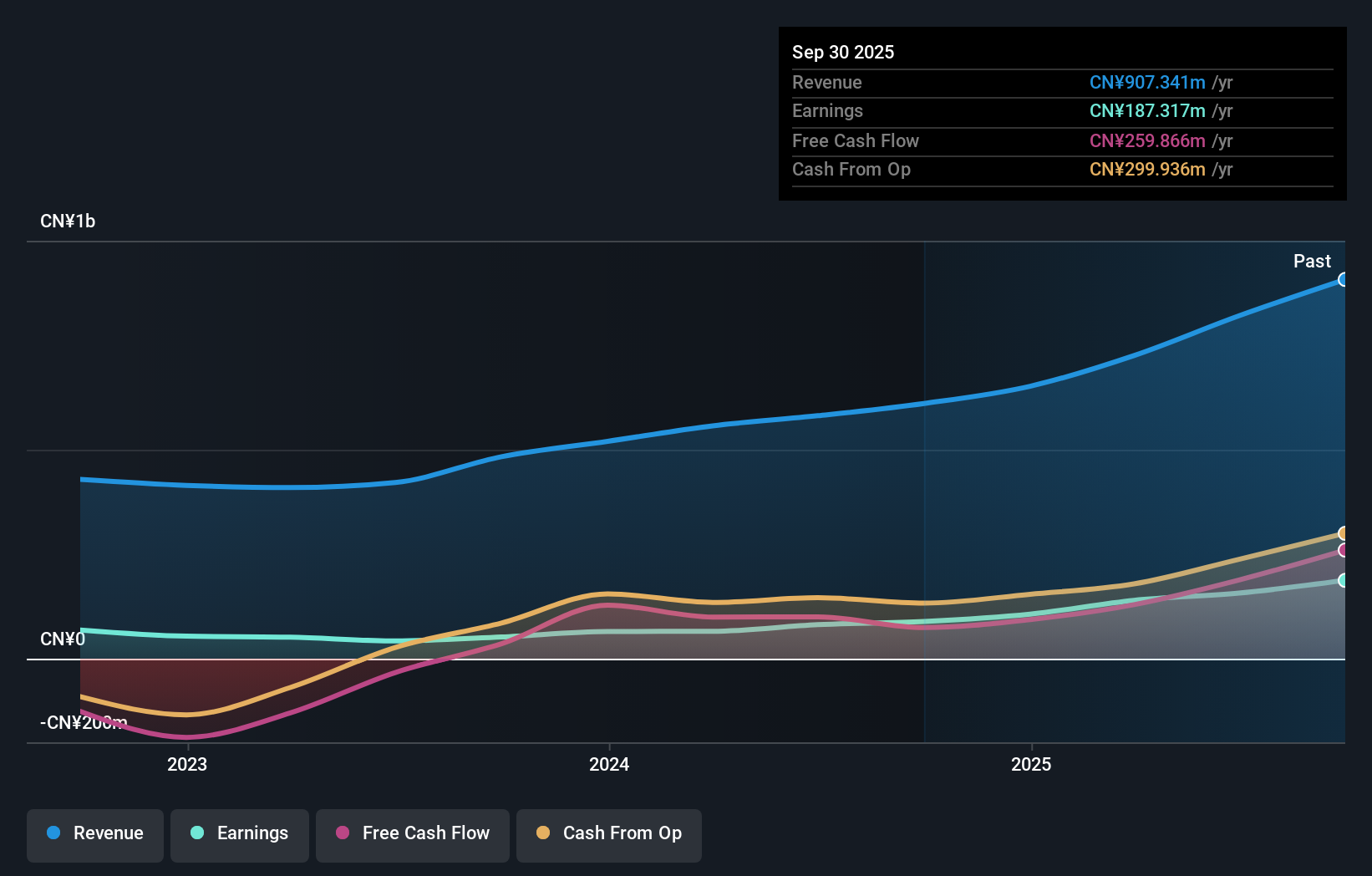

Operations: Actions Technology generates revenue primarily from its semiconductor segment, amounting to CN¥907.34 million. The company's financial performance is highlighted by a net profit margin trend worth noting, which can provide insights into profitability dynamics over time.

In the semiconductor space, Actions Technology has been making waves with its impressive financial performance. Over the past year, earnings soared by 110%, significantly outpacing the industry average of 11%. The company reported a net income of CNY 151.65 million for the first nine months of 2025, up from CNY 70.91 million in the same period last year. Trading at a value below its estimated fair price and boasting high-quality earnings, it seems well-positioned financially with more cash than total debt and positive free cash flow. Future growth is projected at an annual rate of nearly 29%.

- Take a closer look at Actions Technology's potential here in our health report.

Evaluate Actions Technology's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 2989 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報