Undiscovered Gems in the Middle East for December 2025

As the Middle East markets face challenges from declining oil prices, with most Gulf indices retreating amid concerns of a global supply glut, investors are keenly observing how these economic shifts impact small-cap stocks in the region. In this environment, identifying promising stocks requires a focus on companies that demonstrate resilience and adaptability to fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ADNH Catering (ADX:ADNHC)

Simply Wall St Value Rating: ★★★★★★

Overview: ADNH Catering PLC operates in the United Arab Emirates, offering catering and support services, with a market capitalization of AED 1.69 billion.

Operations: ADNH Catering generates revenue primarily from catering services, contributing AED 805.13 million, and support services, adding AED 485.15 million.

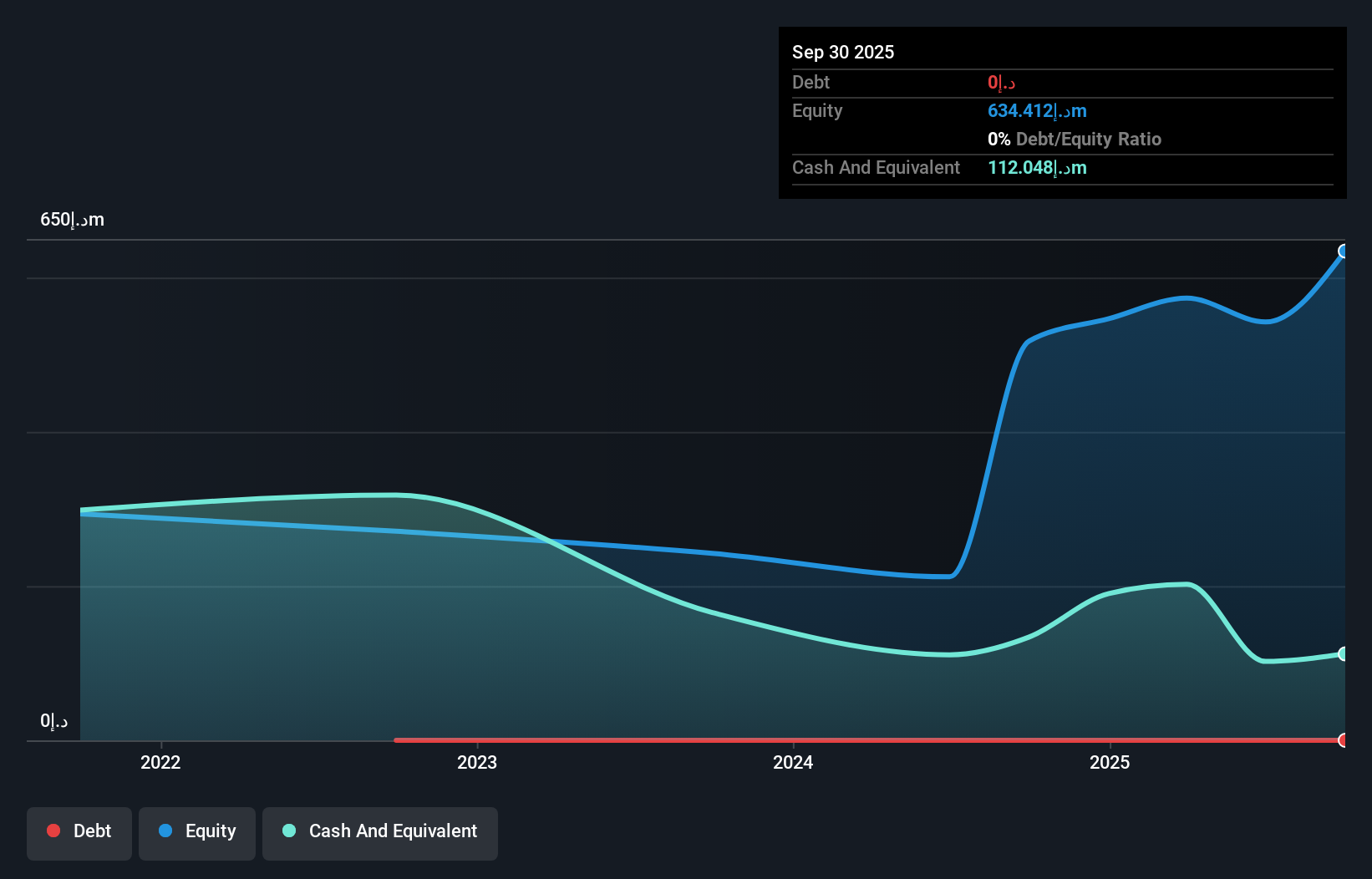

ADNH Catering stands out with its debt-free status for five years, showcasing financial prudence. Earnings surged by 16.7% over the past year, surpassing the Hospitality industry's 4.2%. The company's Price-To-Earnings ratio at 10.4x is attractive compared to the AE market's 11.7x, indicating potential value for investors. Despite a challenging five-year period with earnings decreasing by an average of 17.3% annually, recent guidance suggests revenue growth targets of up to 10%. With a dividend payout of AED180 million planned for full-year 2025 and high-quality earnings reported, ADNH seems poised for steady performance in the near term.

- Navigate through the intricacies of ADNH Catering with our comprehensive health report here.

Explore historical data to track ADNH Catering's performance over time in our Past section.

Analyst I.M.S. Investment Management Services (TASE:ANLT)

Simply Wall St Value Rating: ★★★★★★

Overview: Analyst I.M.S. Investment Management Services Ltd is a publicly owned investment manager with a market capitalization of ₪2.09 billion.

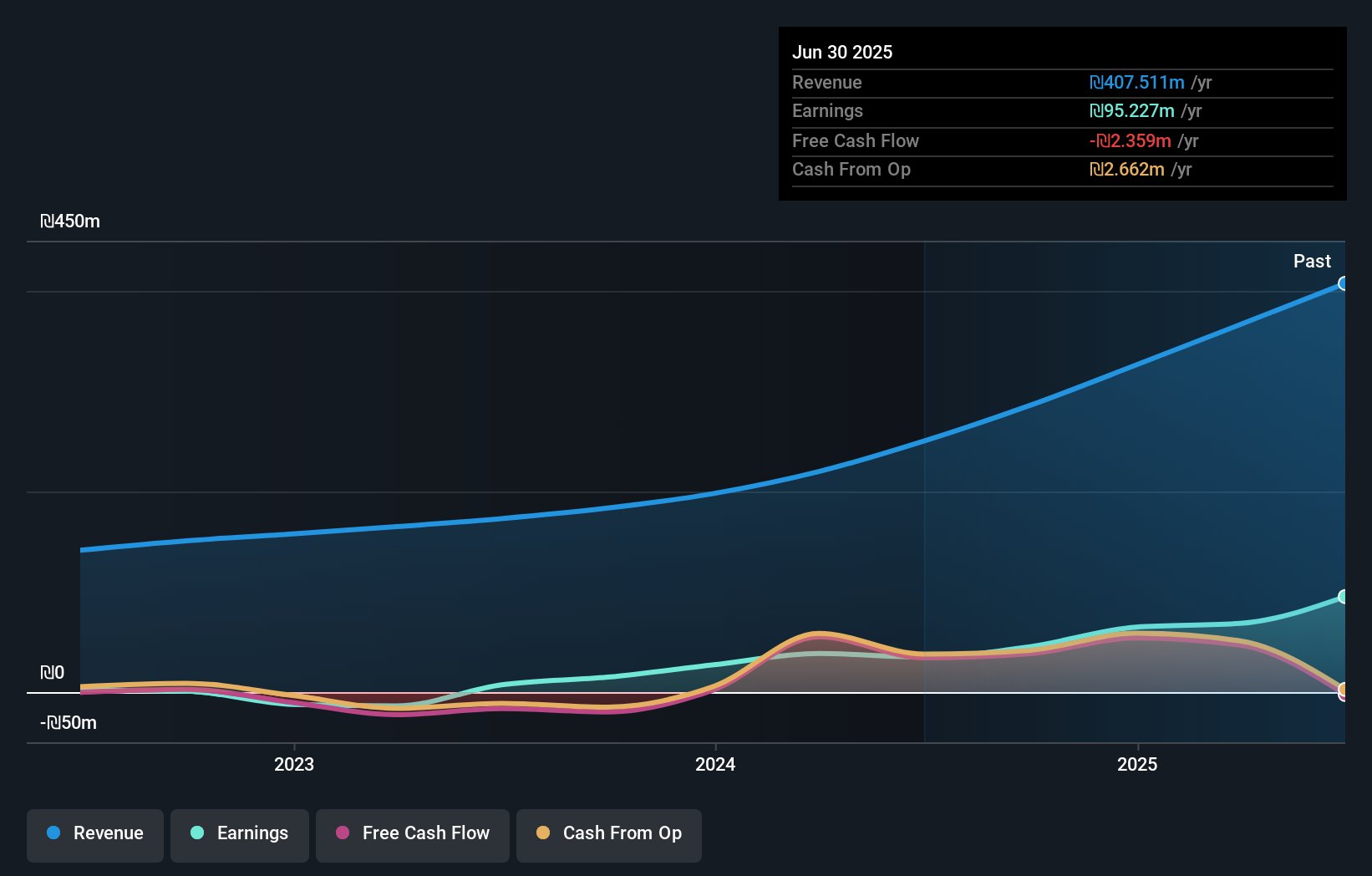

Operations: Analyst I.M.S. generates revenue primarily from investment management, amounting to ₪455.90 million, with a net profit margin of 12%. The company also records investments for its own account at ₪40.14 million, while consolidation adjustments reduce total revenue by ₪40.14 million.

In the Middle East's financial landscape, Analyst I.M.S. stands out with impressive earnings growth of 132% over the past year, far surpassing the industry average of 28.7%. The company reported third-quarter revenue of ILS 135.44 million, up from ILS 87.05 million a year ago, and net income increased to ILS 28.89 million from ILS 18.86 million previously. With no debt on its books and a high level of non-cash earnings, this firm seems well-positioned for future growth in its sector while maintaining profitability without concerns over interest payments or cash runway issues.

Orbit Technologies (TASE:ORBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Orbit Technologies Ltd is engaged in the development, manufacturing, and sale of communication products globally, with a market capitalization of ₪1.05 billion.

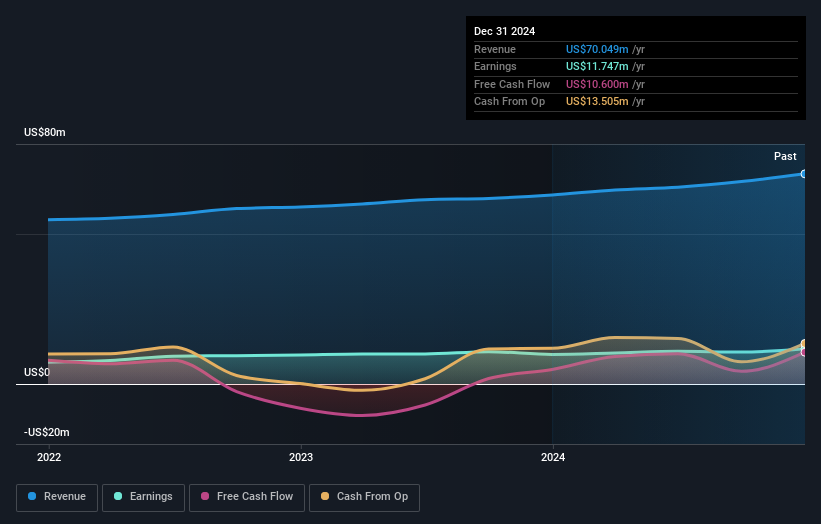

Operations: Orbit Technologies generates revenue primarily from the development, marketing, and production of advanced communication systems, amounting to $79.91 million.

Orbit Technologies, a nimble player in the Aerospace & Defense sector, has shown promising financial resilience. With a Price-to-Earnings ratio of 25.5x, it sits comfortably below the industry average of 27.2x. Over the last five years, earnings have grown at an annual rate of 19.5%, underscoring its steady performance despite not outpacing industry peers' growth rate of 58.2%. Orbit remains debt-free and boasts high-quality non-cash earnings, reflecting robust financial health. Recent developments include Kratos Defense's acquisition agreement for $360 million, suggesting strategic value recognition by larger players in the field.

- Click here to discover the nuances of Orbit Technologies with our detailed analytical health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 181 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報