Year-end inventory of US stocks: In the third year of the bull market, tech giants will no longer dance alone. Under the main theme of market rotation, 2026 may usher in an inflection point

The Zhitong Finance App learned that the US stock market has basically determined to achieve double digit growth for the third year in a row in 2025. During the year, not only tech giants that supported the rise in US stocks benefited from the AI boom, but more companies in the AI value chain were also favored. At the same time, value stocks such as banking and healthcare have once again attracted investors' attention, while the sharp rise in precious metals has taken the lead in gold and silver mining stocks. Looking ahead to 2026, US stock gains will face multiple tests, and volatility is expected to continue throughout the year. In a situation where AI's boost to US stocks may weaken, cyclical stocks may become the new “protagonists.”

1. Looking back at 2025

1. US stocks have repeatedly reached new highs during the year, and AI is still the main engine

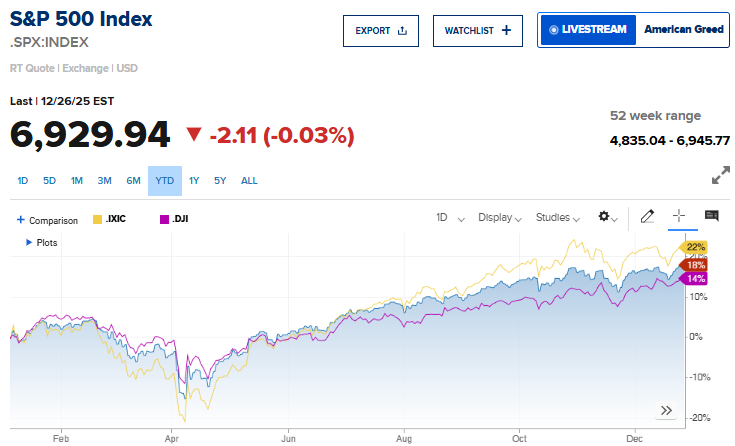

Driven by multiple factors such as the artificial intelligence (AI) boom, expectations of monetary policy easing, corporate profits that continue to exceed expectations, and mitigation of geopolitical risks (such as easing trade frictions), US stocks achieved double-digit gains for the third year in a row. According to the data, as of December 24, the S&P 500 index rose about 18% during the year, and once rose to 6945.77 points in the intraday period on December 26, a record high; the Nasdaq Composite Index, which mainly focuses on technology stocks, rose about 22%, while the Dow Jones Index rose about 14%.

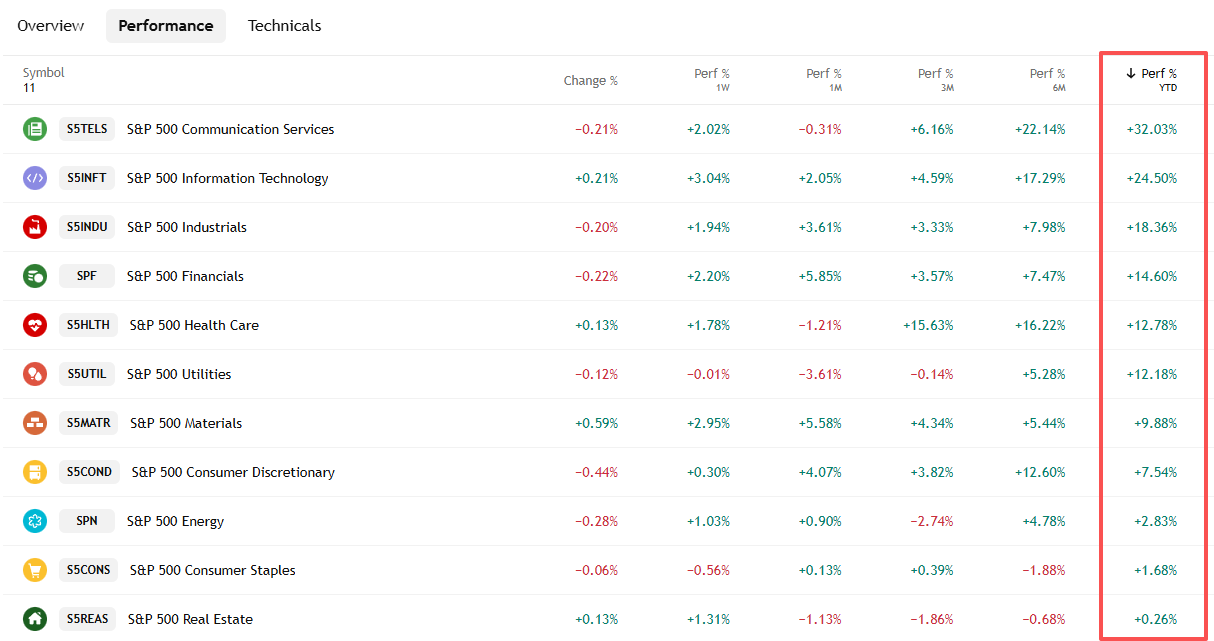

Specifically, among the 11 segments of the S&P 500 index, the communications services sector and the information technology sector had the highest gains, rising by about 32% and 25%, respectively. Among them, Warner Bros. Exploration (WBD.US) in the communications services sector has risen more than 172% so far this year, supported by news of the acquisition. In the information technology sector, SanDisk (SNDK.US), Western Digital (WDC.US), Micron (MU.US), and Seagate (STX.US) topped the top four, with year-on-year increases of about 613%, 304%, 239%, and 238%, respectively. Due to the continued weakness of the US real estate market since this year, the real estate sector rose less than 1% during the year. The essential consumer goods sector weakened as inflation and tariffs weakened consumer confidence and spending, with an increase of only 1.68% during the year.

Judging from the overall trend of the year, the two major pullbacks in the US stock market occurred from the end of February to the beginning of April and November, respectively. The “low cost AI shock wave” brought about by DeepSeek continued to put pressure on the valuations of large technology stocks and the “hawkish monetary policy stance” of the Federal Reserve suspending interest rate cuts at the time, causing a major rift in the US stock bull market logic in late February and the beginning of a correction. However, after recovering part of the decline in mid-late March, US President Trump, who had just taken office, announced the imposition of so-called “equal tariffs” on all trading partners on “Liberation Day” in early April. This policy was viewed by the market as “self-harming” trade protectionism and became the trigger for the collapse of US stocks. Investors fell into a panic sell-off, causing the three major US stock indices to record their biggest one-day decline in nearly five years on April 3 and 4. The US stock market value evaporated a record 6.6 trillion US dollars in just two days on April 3 and 4.

However, Trump later announced the suspension of equal tariffs and negotiations with trading partners to eliminate most of the pressure faced by the market. US stocks gradually stabilized and rose steadily until the end of October, driven by the continued fermentation of AI themes, expectations of monetary easing by the Federal Reserve, and the “soft landing” narrative of the economy, and repeatedly reached new highs during this period.

By November, due to market concerns about the AI bubble under high valuations, US stocks continued to adjust during this month. The biggest decline in the Nasdaq index reached 8.8% in November, and finally reduced the decline to 1.5%. Take Nvidia (NVDA.US), the “star” of this AI craze. After hitting a record high of $212.178 on October 29, the stock price continued to adjust, with a cumulative decline of 12.6% throughout November. Since December, although they have rebounded from November lows, the overall performance of US stocks has been relatively lackluster. Divisions within the Federal Reserve have intensified pressure on the prospects for interest rate cuts, concerns about the AI bubble have not been completely eliminated, and the decline in market liquidity at the end of the year prompted investors to remain cautious. Some investors chose to profit from large technology stocks that had risen too much.

2. From tech giants dancing alone to full bloom

The “Big Seven US stocks” have clearly split this year, rather than a “collective boom” like the previous two years. At the same time, investors are also looking from large technology stocks to the broader AI value chain. Furthermore, the US initial public offering (IPO) market recovered steadily in 2025, and AI and digital asset companies are popular. Value stocks such as healthcare and banking, as well as gold and silver mining stocks, have also performed well this year.

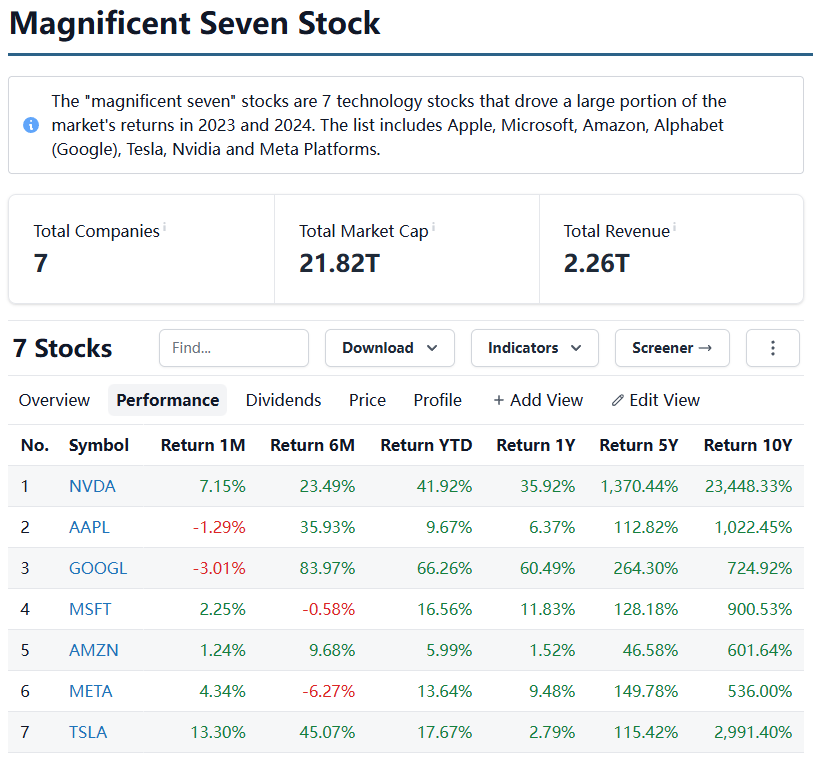

(1) The performance of the “Big Seven US Stock Companies” is divided

In the past three years, AI has reshaped market pricing logic. The “Magnificent 7 (Magnificent 7)”, which is thought to be the most capable of bringing huge returns to investors in the context of the biggest technological change since the Internet era, is the core driving the US stock market to new highs over the past three years. The “Big Seven” include Apple (AAPL.US), Microsoft (MSFT.US), Google (GOOGL.US), Tesla (TSLA.US), Nvidia (NVDA.US), Amazon (AMZN.US), and Meta Platforms (META.US). However, in 2025, there was a clear division within the “Big Seven”, which highlighted the fact that US stocks were more complicated under the overall prosperity.

Nvidia

In 2023, Nvidia stunned the world with an increase of about 239%, and in 2024, it achieved an impressive return of about 171%, and held the top position of the “Big Seven” with a crushing attitude for two consecutive years. The core driving force behind this is generative AI's blowout growth in computing power. Meanwhile, with its almost monopoly GPU ecosystem, Nvidia has increased data center business revenue several times, and profits and cash flow have skyrocketed at the same time. The market generally believes that Nvidia is the “master switch” and the most core infrastructure base for the entire AI era.

As a “shovel seller” in the AI era, Nvidia was still in a leading position in the second half of the computing power race. Entering 2025, Nvidia has risen by about 42% so far, outperforming the “Big Seven” average. For investors, Nvidia's stock price truly reflects the global boom in AI investment. As the core focus of the “AI storm” that has swept the world over the past three years, every Nvidia financial report, and even every product iteration, has the dominant power to influence the direction of the global market.

Driven by the impact of DeepSeek at the beginning of the year, the Trump administration's tariff policy, and the introduction of a ban on sales of H20 chips to China (causing billions of dollars of depreciation), Nvidia's stock price fluctuated downward in the first four months of this year, and did not actually break out of the slump until April 25. Its market capitalization surpassed $4 trillion in July — becoming the first company to surpass $4 trillion in market capitalization, and hit $5 trillion just 3 months later. However, as market concerns that the AI bubble might burst and damage computing power demand gradually heated up in the fourth quarter, the stock price of Nvidia, which is at the core of the AI computing power industry chain, experienced a sharp correction, with a cumulative drop of more than 12% in November. Furthermore, concerns about Nvidia's “circular investment” — that is, Nvidia invests in its customer OpenAI, and the latter then uses funds to buy Nvidia chips — has also fueled discussions about the AI bubble. Combined, the company's current competitive environment is clearly more severe than in previous years. These factors have become a negative catalyst for Nvidia's stock price.

At a time when Nvidia has achieved such significant returns over the past three years, the market's focus is turning to Google, which sees it as Nvidia's strong competitor in the field of AI computing power. Google has risen more than 66% so far this year, better than the 58% increase in 2023 and 36% in 2024, making it the top annual increase among the “Big Seven”.

There are three main reasons for Google's impressive performance this year: first, its search and advertising business successfully integrated AI functions into products to improve advertising efficiency and user stickiness; second, the growth of the cloud business accelerated under the AI workload; third, the excellent performance of its own Gemini model and self-developed AI chip (i.e. TPU) layout made the market re-evaluate its position in the AI ecosystem and no longer regard it as OpenAI's “catcher.” It is worth mentioning that the competition between TPU and Nvidia platforms involves not only computing power itself, but also supply chain issues, and which company can make its own architecture more widely adopted by external customers.

With a strong business undertone, Google took the lead in the second half of the 2025 AI competition. Compared to targets such as Nvidia, which had a huge increase in the early stages, Google's “non-overdraft” growth between 2023 and 2024 freed up huge fundamental space for the 2025 explosion. As concerns about the “AI bubble” intensify, funds are being accurately locked in to giants such as Google that have both strong cash flow and AI monetization capabilities. Google has become the core anchor point for investors to “defend and attack” in the midst of market turmoil and capture the actual output of AI. Buffett, the “stock god,” opened a position on Google in the third quarter before he was about to retire, and once the stock was opened, it ranked among Berkshire Hathaway's top ten biggest stocks, which may confirm the extent to which the capital favors Google. In addition to achieving leaps and bounds in the field of AI, Google avoided the worst outcome of being forcibly split in an antitrust lawsuit brought by the US Department of Justice and removed one of the major threats it faced.

Tesla

Tesla's increase from 2025 to now is second only to Google and Nvidia among the “Big Seven”, with an increase of about 18%. Tesla's stock price showed a trend of holding back and then rising this year. In January-April, Tesla CEO Elon Musk's political positions and disputes triggered consumer dissatisfaction, and increased competition in the electric vehicle market led to weak delivery data and pressure on profits. The stock once fell by more than 50% from the beginning of the year. By the second half of the year, as Tesla FSD made a breakthrough in regulatory approval in core markets such as Europe and China, the Trump administration plans to relax autonomous driving regulations, superimpose the implementation of Robotaxi (autonomous taxi) services and show a clear commercialization path. Optimus is in a leading position in the humanoid robot market, which continues to rise in popularity, and Tesla's stock price rebounded strongly.

However, at the same time, with global electric vehicle sales growing, Tesla's basic electric vehicle sales performance continued to be sluggish this year, and may face a situation where sales decline for the second year in a row. This has raised concerns among some investors. Fortunately, FSD, RoboTaxi, and Optimus are carriers of AI in the physical world, and their continued progress shows Tesla's role as a leader in technological innovation in the AI era, and also makes investors optimistic about the company's future growth prospects.

Microsoft

Microsoft's increase from 2025 to now is about 17%, ranking in the middle of the “Big Seven”. Although Microsoft's rise was not as explosive as Nvidia and Google, as a leader in AI commercialization, its market value continued to stand at a historically high level in 2025.

Microsoft's AI advantage stems from how it integrates AI technology into every layer of its technology—from Azure and Office, to developer tools, enterprise software, and consumer products like Bing and Edge. The most obvious manifestation of this deep integration is Copilot. Microsoft's generative AI assistant set is used in productivity applications such as Microsoft 365, operating systems such as Windows, and workflows such as GitHub Copilot. 2025 was the year of large-scale popularization of Copilot and showed a clear and efficient commercialization path. Microsoft successfully monetized subscription fees, proving that AI investment can be directly converted into earnings per share (EPS). At the same time, thanks to the deep integration of AI and cloud services, Microsoft's cloud business Azure will maintain a growth rate of more than 30% in 2025, far exceeding the industry average, but the gap with Amazon's AWS, which has the largest market share, will continue to narrow.

Strong cash flow from steady growth in basic business enables Microsoft to maintain strong capital expenditure while maintaining stable shareholder returns. This also allowed Microsoft to stand alone at a time when concerns about the AI bubble heats up, and is still favored by some investors. However, although Microsoft has a huge advantage in the cloud business and corporate AI layout, since its stock price already fully reflected high expectations for generative AI in the early stages, the results for each subsequent quarter had to be examined under “extremely high standards,” causing the stock price to show more of a “high level fluctuation to absorb expectations” rather than a sharp rise again.

Meta

As an established AI “top student”, Meta achieved an increase of about 194% in 2023 — second only to Nvidia among the “Big Seven”, and still had an increase of about 65% in 2024, indicating that its cost reduction and focus on investing in AI advertising and Reels monetization strategies have been recognized by the market. However, by 2025, Meta's increase had narrowed to about 14%, and the trend fluctuated throughout the year.

The trend of Meta's stock price was basically the same as the general market in the first four months of this year. The subsequent rise was mainly driven by its strong fundamentals, and AI investment has also begun to pay off in the advertising business (AI-driven advertising tools are widely used, and advertising efficiency and effectiveness have improved). However, the company's third-quarter earnings report released at the end of October accrued a non-cash income tax charge of 15.9 billion US dollars due to the “Big and American Act,” causing net profit for the quarter to plummet 83% year over year. Although management emphasized that it was “one-off” and “did not affect cash flow,” huge book losses seriously dampened market confidence. Furthermore, aggressive capital expenditure plans have raised concerns in the market — the company announced that capital expenditure in 2026 will be “significantly higher” than in 2025, and plans to invest around $600 billion in AI by 2028. This reminds investors of the company's aggressive investment in the metaverse (Reality Labs business, which still lost more than $4.4 billion in Q3 2025) in the previous few years, and worried whether the company was “burning money” too much for a long-term strategy with uncertain returns.

Overall, Meta's performance in 2025 was the result of a game between a “strong present” and a “expensive future.” While the market acknowledges the enabling role of AI in Meta's existing business, it also fears that its expensive, ongoing capital expenditure plans with uncertain payback cycles will erode shareholders' profits and bring financial risks.

apple

Apple's increase in 2025 was only about 10%, showing an overall trend of low opening and high growth. The stock price once fell by more than 33% in the first half of the year, with a cumulative decline of more than 19% (bottom of the “Big Seven”), but it rebounded strongly in the second half of the year and achieved an increase of more than 30%.

For most of the first half of the year, Apple's stock price did not perform well due to poor AI progress, pressure on sales in Greater China, and the Trump administration's tariff policy that may damage the company's profits. However, in the second half of the year, the situation was reversed. Consumer demand for iPhone 17 series smartphones is driving performance growth. When the market is concerned about the sustainability of big tech giants' AI spending, Apple is viewed as a “safe haven” due to its prudent capital expenditure strategy.

According to reports, Apple does not need to bear huge AI expenses for independent research and development (the estimated capital expenditure for this fiscal year is only 14 billion US dollars, far lower than Microsoft's 94 billion US dollars and Meta's 70 billion US dollars), but it can provide AI functions to hundreds of millions of users by leveraging AI models from other companies. This “asset-light plus high cash reserves” model made Apple a safe haven target in technology stocks, and its stock price repeatedly reached new highs during the year.

Investors see Apple as a unique defensive choice, which not only avoids the risk of excessive investment, but also continues to benefit from its ecological and hardware advantages as AI technology matures and becomes popular. However, Apple's valuation level has risen to an all-time high, which has become a major concern for investors at present.

Amazon

Amazon was the worst performer among the “Big Seven” in 2025, with an increase of only about 6% for the whole year. Although fundamentals are still strong, the stock price's poor performance was mainly due to market concerns about high AI investment, fierce cloud competition, and slowing retail growth, which temporarily overshadowed its impressive performance growth.

As AWS faces increasingly intense competitive pressure and is slow in integrating AI and cloud services, its growth rate is lower than Microsoft's Azure and Google Cloud. Meanwhile, Amazon's aggressive AI capital expenditure — which is expected to reach $125 billion in 2025 — is being invested in AWS' self-developed chips, AI models, and infrastructure to protect the long-term competitiveness of its cloud computing business, but it has also raised concerns that profits and cash flow will be eroded. Amazon has also been affected by the Trump administration's tariff policy. Many of its own products on the company's e-commerce platform come from overseas, and a large number of third-party sellers are also located overseas. Tariff increases mean rising product costs and a more complicated business environment.

(2) Investors' attention spills over, and more AI concept stocks are sought after

As the AI competition enters the second half, capital is spreading from tech giants that had seen huge increases in the early stages to a broader AI value chain, covering hardware, cloud computing and data centers, model development, applications, and the most basic power sector. Here is the performance of some AI concept stocks in 2025.

It is worth mentioning that since OpenAI and Google are leading the way in building an AI ecosystem based on big models, they have spawned the so-called “OpenAI Chain” and “Google Chain” formed by their respective partners. Among them, the main members of the “OpenAI Chain” include Nvidia, AMD, Microsoft, Oracle, CoreWeave, etc., while the main members of the “Google Chain” include Broadcom, MongoDB, Lumentum, TTM Technologies, etc.

In the second half of this year, the performance of “Google Chain” quickly caught up with the “OpenAI Chain” because the lack of profitability of OpenAI and the need for rapid expansion to pay huge expenditure commitments are being increasingly questioned by the industry, and Google is becoming a strong competitor covering the entire AI industry chain with strong financial resources. Google's advantage isn't limited to the Gemini 3 model performing better than ChatGPT-5. The company has huge cash reserves, and also has many related businesses such as Google Cloud and TPU chip manufacturing, which is getting better. If its AI data, talent pool, distribution network, and successful subsidiaries such as YouTube and Waymo are taken into consideration, then Google's full-stack advantage will undoubtedly become more prominent.

The gap between champion and runner-up is not only about honor, but will also have a significant financial impact on the company and its partners. For example, if users switch to Gemini and the growth of ChatGPT slows down, it will be more difficult for OpenAI to bear the procurement costs of Oracle cloud computing services and Nvidia and AMD chips. However, the decline of OpenAI's “king” aura will not necessarily cause the “OpenAI chain” to weaken for a long time. Objectively speaking, companies such as Oracle and AMD don't fully rely on OpenAI — they are deeply involved in high-demand fields, and their products can find customers even when they leave OpenAI.

Oracle is one of the most popular AI concept stocks to talk about. With many benefits such as the historic scale expansion of data centers in the AI boom and the partnership with OpenAI, the company's stock price once soared by more than 40% on September 10, and the market capitalization growth reached about 270 billion US dollars at one point, the biggest increase in the company's history in a single day. The reason why Oracle skyrocketed on the same day was because it gave extremely explosive cloud service performance growth expectations in its earnings report. The company said that unconfirmed performance obligations (RPO) reached 455 billion US dollars at the end of August, surging 3 times in just 3 months, and claims that there are more “multi-billion dollar big orders” under discussion. Soon this figure will exceed 500 billion US dollars.

However, after all, this fantasy was difficult to resist actual torture. As a series of risks such as negative free cash flow, huge debt, and excessive customer concentration were gradually revealed, the Oracle Credit Default Swap (CDS) price soared to a high level since the financial crisis, and investors sold the stock in a panic. Since the September high, Oracle's stock price has been reduced by more than 40% cumulatively. The dramatic ups and downs in Oracle's stock price reveal this harsh reality — in the AI era, it's not enough to just have hard-core technology; the real moat lies in profitable technical capabilities, and the market is beginning to test AI narratives with real money-making capabilities.

Several companies in the storage industry also benefited from the AI boom in 2025 and achieved impressive gains. In 2025, as global AI infrastructure construction enters a period of explosion, the storage industry ushered in a “supercycle”. The core logic is that, on the one hand, AI servers require far more storage capacity and bandwidth than ordinary servers. On the other hand, the industry's production capacity is skewed towards high-end storage products (such as HBM), squeezing the production capacity of traditional storage products, thus triggering a wave of price increases in the entire storage industry. In this context, SanDisk, which focuses on NAND flash storage, became the brightest star in this “supercycle”, becoming the number one stock in the S&P 500 index with an increase of about 613% during the year; the stock price of Micron Technology, which focuses on “memory” (mainly DRAM/HBM), rose nearly 239% during the year, and Western Digital, which focuses on “hard drives” (mainly HDDs), and Seagate Technology's stock prices rose by about 304% and 238%, respectively. This “supercycle” of the storage industry is expected to continue throughout 2026, as confirmed by Micron Technology's extremely optimistic performance outlook in the financial report released this month.

Furthermore, as tech giants compete for huge sums of money to build AI data centers, the energy infrastructure circuit has ushered in explosive growth against the backdrop of traditional US power grids being difficult to carry intensive energy loads. Companies focusing on advanced energy generation are on the cusp, and the impressive stock price performance of companies such as Oklo and Bloom Energy is the most direct proof of this trend. Nuclear power technology company Oklo relied on micro nuclear reactor technology, while clean energy company Bloom Energy's stock price increased by about 260% and 300%, respectively, during the year with its solid oxide fuel cell (SOFC) system. These two companies, once regarded as “marginal energy players,” are now making a splash, showing that Wall Street is beginning to redefine the logic of energy stocks — where AI ends with computing power, and the end of computing power is electricity. In the AI era, whoever has stable, clean, and locally deployed electricity will be the ultimate winner in the AI economy.

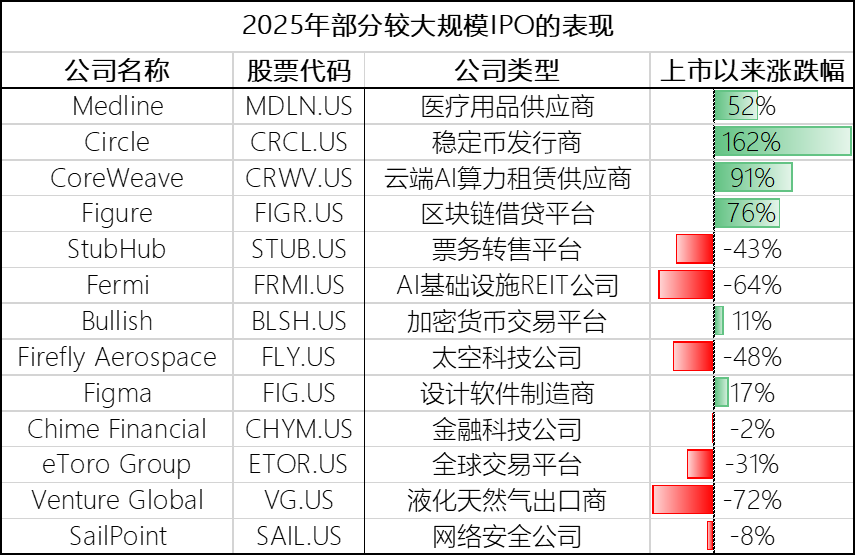

(3) The IPO market is picking up, and AI and digital asset IPOs are popular

After nearly three years of downturn, the US stock IPO market recovered in 2025, boosted by expectations of interest rate cuts and a more favorable trading environment. According to Dealogic data, US stock IPOs have raised nearly US$75.3 billion so far this year, the largest since 2021. However, hopes for a full recovery were thwarted by tariff fluctuations, a prolonged government shutdown, and a correction in AI stocks in the fourth quarter, and the IPO index still outperformed the S&P 500 index by a large margin in 2025.

Medical supplies giant Medline (MDLN.US) led this year's US stock IPO and raised 6.3 billion US dollars, setting the record for the largest IPO since 2021. The IPO list also includes several high-profile unicorn companies, as well as companies in the technology, fintech, and aerospace sectors. The response to the IPOs of high-profile companies such as Klarna (KLAR.US) and StubHub (STUB.US) was moderate. Stablecoin issuer Circle (CRCL.US), blockchain lending platform Figure (FIGR.US), and cloud AI computing power leasing leader CoreWeave (CRWV.US) are popular due to growing market demand for digital assets and AI. Firefly Aerospace (FLY.US), a space technology company that went public in the “first year of the explosion,” when commercial space was recognized by the industry as large-scale and closed loop of commercialization, also achieved outstanding performance in the early stages of listing.

(4) Banking and healthcare stocks have regained attention, precious metals soared, and gold and silver mining stocks

In addition to technology stocks and broader AI concept stocks, value stocks such as bank stocks and healthcare stocks have also regained investors' attention at a time when tech stocks are highly valued, and soaring precious metals prices have taken over gold and silver mining stocks.

The SPDR Healthcare Select Industry Index ETF (XLV) has risen about 13% since this year. Some of the ETF's major holdings, such as LLY.US (LLY.US), Johnson & Johnson (JNJ.US), and Amgen (AMGN.US), have all experienced significant increases this year. The strong performance of healthcare stocks this year, especially in the fourth quarter, was due to the easing of concerns about drug pricing and tariff risks, attractive valuations, strong clinical trial results, unexpected acceleration in AI-enabled R&D pipelines, and an overall recovery in mergers and acquisitions between biotech companies and major pharmaceutical companies. Performance growth is also the core logic driving the influx of hedge funds into the healthcare sector. In the third quarter, America's largest public healthcare companies outperformed other industries. Increased use of new drugs and specialty drugs, continued growth in demand for diet pills, and strong growth in hospital visits all boosted profits.

Major bank stocks are also preparing to end 2025 on a strong footing — share prices hit record highs, larger balance sheets, and enjoy unprecedented regulatory freedom over the past 15 years. The key index tracking the major US banks and 20 other largest lenders — the KBW Bank Index (BKX) — has risen more than 32% since this year, outperforming the S&P 500 index by a large margin. In addition to Citibank (C.US), the stock prices of other major banks — J.P. Morgan Chase (JPM.US), Bank of America (BAC.US), Wells Fargo (WFC.US), Goldman Sachs (GS.US), and Morgan Stanley (MS.US) — all hit record highs this year. According to S&P Global data, the total market capitalization of these six major banks has now reached 2.37 trillion US dollars, while at the end of 2024 it was only 1.77 trillion US dollars, which means that the market capitalization has increased by more than one-third in less than 12 months.

Increased merger and acquisition activity and increased market volatility in 2025 will drive significant increases in fees for Wall Street investment banking business and trading departments. According to Dealogic data, although tariff-related market fluctuations in the spring of this year froze the capital market for a while and the IPO was postponed due to the shutdown of the US federal government in the fall, the scale of the global investment banking business is still expected to increase by 10% compared to 2024 for the whole year, reaching the highest level since 2021. Furthermore, the report pointed out that regulators such as the Federal Reserve have reached an agreement to relax bank capital requirements. The revised plan to the final rules of the Basel III Agreement will reduce the overall capital increase of most large banks to between 3% and 7%. This figure is far lower than the 19% increase in the 2023 proposal, and also lower than the 9% proposed in the compromise version last year. Banks with large trading business portfolios may increase their capital even less, or even decline. This is certainly a boon for the banking industry.

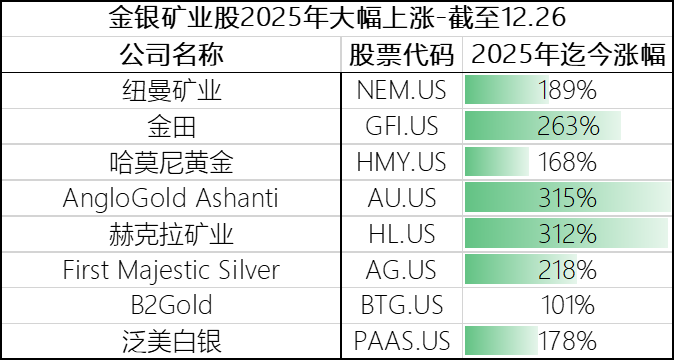

Furthermore, the impressive performance of precious metals in 2025 also led to a rise in gold and silver mining stocks. The data shows that since 2025, the cumulative increase in the spot price of gold has exceeded 71%, and the spot price of silver has increased even more — more than 143%, which is nearly double the increase of gold. Thanks to this, a number of gold and silver mining stocks, including Newman Mining (NEM.US) and Goldfield (GFI.US), have achieved sharp increases.

II. Outlook 2026

1. Wall Street is bullish on the S&P 500 Index as high as 8100 points

Towards the end of the year, the agency's forecast for the 2026 US stock market has basically been released. Overall, Wall Street's forecast for the 2026 S&P 500 index is in the 7100-8100 point range. The average target point is 7,490 points, with room for an increase of about 8% compared to the closing point on December 26. With US stocks likely to close higher this year, if the trend of US stocks in 2026 matches the forecast, it will be the fourth year in a row that US stocks will rise.

Despite differences in target points, the general consensus among institutions is that US stocks are expected to continue to rise, driven by the continuation of the wave of AI investment, the shift in monetary policy easing, and the spread of profit growth. But they also warned that inflation, overvalued valuations, and tariff tension could still trigger a market correction.

Investment bank Oppenheimer gave Wall Street's most optimistic forecast, saying that as earnings per share continue to grow in double digits, the S&P 500 index will rise to 8,100 points by the end of 2026. Deutsche Bank has set an S&P 500 target of 8,000 points by the end of 2026. The bank's confidence stems from its expectations that profit growth will “spread”. Morgan Stanley is also optimistic. It is expected that the S&P 500 index will rise to 7,800 points in the next year. Based on core logic such as broadening corporate profit growth and deepening AI themes, Citi has set a benchmark target of 7,700 points for the S&P 500 index at the end of 2026. J.P. Morgan's stock strategy team set a target of 7,500 points for the S&P 500 index at the end of 2026. At the same time, it was pointed out that if the Federal Reserve continues to implement interest rate cuts, this benchmark index is expected to break through 8,000 points in the next year. According to UBS Global Research, the AI-driven rise in US stocks will continue until 2026, so the target for the S&P 500 index by the end of next year is 7,500 points. HSBC also set the target point for the S&P 500 index at 7,500 points by the end of 2026. Barclays targets 7,400 points for the S&P 500 at the end of 2026, and said that despite weak macroeconomic growth, large technology stocks have performed strongly, and the monetary and fiscal environment continues to improve.

Notably, there are still institutions that are cautious about the outlook for US stocks in 2026. The target point for the S&P 500 index at the end of 2026 given by Bank of America is only 7,100 points. Bank of America strategists expect earnings per share of the S&P 500 index to increase by about 14% in 2026, but the index itself is expected to increase by less than 3%. This combination (strong profits and moderate exponential growth) indicates that the economy is working well, but the valuation is high enough that it cannot be expected to drive returns through a large price-earnings expansion.

Steve Sosnick, chief strategist at Yingtou Securities, also set a year-end target of 6,500 points for the 2026 S&P 500 index. This forecast means that the stock index will fall about 6% from the current level, which is in stark contrast to the positions of the various institutions mentioned above that are bullish on US stocks. The reasons why Steve Sosnick bucked the trend and was bearish on US stocks in 2026 include: there have only been two bear years in history, both of which occurred in the second year of the presidential term; the new chairman of the Federal Reserve usually experiences market tests around the first time in office. He also warned that if there is a pullback in the leading industry leading the recent rise in US stocks, it will be difficult to make up for losses due to sector rotation alone. “Even if it just stagnates, it will take a huge amount of capital rotation to offset the impact.”

Wall Street's current optimistic expectations for US stocks in 2026 are causing concern among some market observers. The concentration of sell-side strategists from major institutions on the 2026 year-end target points given by the S&P 500 index reached the highest level in nearly a decade. This highly consistent view is often viewed as an inverse indicator in the market — when all market participants are betting in the same direction, this state of imbalance often corrects itself. Moreover, the current risks in the market are already obvious — the inflation rate is still higher than the Federal Reserve's target level, and the market's expectations of monetary policy easing may fall short at any time; the unemployment rate has continued to rise in recent months; and huge AI investments have yet to bring real profits.

2. The volatility of US stocks is expected to continue until 2026, and the rise is facing multiple tests

Over the past 18 months, US stocks have shown the characteristics of a sharp sell-off and rapid rebound. Surrounded by many risk factors, this trend is likely to continue until 2026. The stock market continues to fluctuate due to investors' FOMO (fear of missing out), concerns about the bursting of the AI bubble, and policy uncertainty of the Trump administration.

(1) The risk of an AI bubble still exists

In 2025, the difficulty of investing in AI tracks has increased significantly. Although the world's leading technology companies have begun large-scale capital expenditure cycles and achieved profit growth, driving US stocks all the way up to historical record ranges, the “lying and winning” easy profit stage has come to an end. In the second half of the year, the market began to clearly differentiate. Concerns about overvaluation, negative macroeconomic factors, and wary sentiment about the beginning of an AI bubble have dominated the market, causing many rounds of sharp fluctuations.

From the point of view of Wall Street institutions, AI is still one of the core logics that supports their confidence in US stocks. The “Genesis Plan” being promoted by the Trump administration may further spread AI dividends, extending the scope of benefits from core tech giants to a wider range of industries and enterprises, especially those that can use AI and related technology to increase profit margins and productivity.

However, concerns about the AI bubble will still disrupt US stocks in 2026. According to a survey conducted by Deutsche Bank in early December, more than half of the 440 asset managers surveyed listed the AI bubble as their biggest concern in 2026. Jim Reid, head of global economics and research at Deutsche Bank, who presided over the survey, said the results showed very clearly that “the risk of an AI/tech bubble has overtaken everything.”

Risks in the field of AI mainly focus on technology implementation time and return on investment. If the promotion of AI technology falls short of expectations, or if the pricing capacity of tech giants falls short of expectations as market competition intensifies, the profit expectations of related companies may be drastically lowered. The market may also question whether capital expenditure in the AI sector has peaked without generating equal profits. Given the high weight of AI concept stocks in major mainstream indices, even if the market only partially re-evaluates the AI investment theme, it may have a broad impact.

Therefore, US stocks may currently be at an important inflection point. High volatility and high valuations mean that there is a risk of adjustment in US stocks. In view of the booming development of upstream AI investment and the fact that the downstream commercial application of AI has not been falsified, whether the AI bubble will burst is yet to be implemented in the commercial application of AI, and market uncertainty has increased as a result. If AI commercial applications are implemented, it means that large-scale upstream investment by AI companies will not be pure debt, but rather a type of asset, which is expected to realize profits, so the molecular side of valuation — profit will also rise. Conversely, the risk of bad debts in AI's upstream capital expenditure will be transmitted to the entire market. The overall decline in the interest rate curve will resonate with high fluctuations in US stocks, and the risk of economic recession will be fully released.

(2) Corporate profits are expected to continue to grow

In the current context where stock valuations have climbed to historic highs and further upward space is limited, profit growth will become another core factor determining market performance. Stock market bulls pointed out that the profit prospects for US companies are optimistic. Tarkinder Dillon, head of earnings research at the London Stock Exchange Group (LSEG), said that the profits of S&P 500 companies are expected to increase by more than 15% in 2026, based on a 13% increase in 2025.

At the same time, the driving force for profit growth will no longer be limited to a few giants in technology and technology-related fields, but will be driven by a wider range of companies. This is because fiscal stimulus policies and loose monetary policies provide strong support for the economy and consumer spending. Taginder Dillon pointed out that in 2024, the profit growth rate of the “Big 7 US Stock Companies” reached 37%, while the profit growth rate of the rest of the companies in the S&P 500 index was only 7%. By 2026, this gap is expected to close substantially — the profits of the top seven companies by market capitalization are expected to increase by 23%, while the remaining companies in the index are expected to grow by 13%. Christina Hooper, chief market strategist at Inshman Group, also said, “If earnings growth on the other 493 stocks in the S&P 500 index can be improved — we are already seeing some signs — this will definitely help the stock market achieve double-digit returns next year.”

(3) Uncertainty about the Federal Reserve's policy

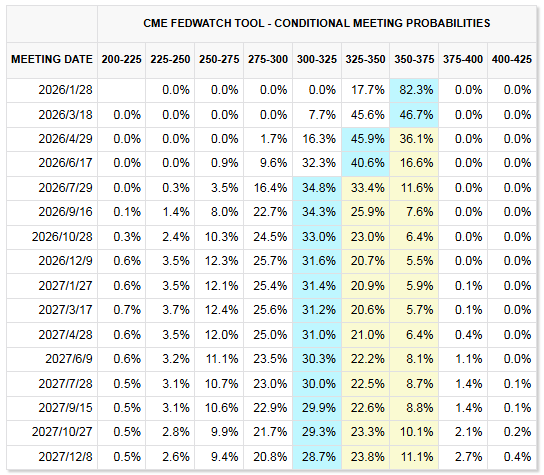

The Federal Reserve cut interest rates for the third time in the year in December, lowering the federal funds rate target range to 3.50%-3.75%. Federal Reserve Chairman Powell did not rule out the possibility of further interest rate cuts in his speech. Meanwhile, the Federal Reserve announced the monthly purchase of 40 billion US dollars of short-term treasury bonds starting December 12. This move may help improve market liquidity, and improving liquidity is the “fuel” that drives asset prices.

According to CME's “Federal Reserve Watch” tool, traders currently expect the Federal Reserve to cut interest rates twice in 2026. This is in line with the predictions of most Wall Street investment banks, but more than the median rate forecast in the latest bitmap for Fed officials to only cut interest rates once. Among Wall Street's major investment banks, Goldman Sachs, Morgan Stanley, Bank of America, Wells Fargo, Nomura, and Barclays all predict that the Federal Reserve will cut interest rates by 50 basis points in 2026, reducing the federal funds rate target range to 3.00%-3.25%. Meanwhile, differences within the Federal Reserve are intensifying, reflecting the increasing difficulty of balancing the dual missions. In the future, any policy signals from the Federal Reserve will be carefully weighed by the market. Additionally, a candidate for the new Federal Reserve Chairman will soon be nominated to replace Powell, whose term as chairman ends in May 2026. Trump has previously stated that the next chairman of the Federal Reserve will support “drastic interest rate cuts.” The market will pay special attention to whether the new chairman of the Federal Reserve will “listen” to Trump, as this will damage the independence that the Federal Reserve is proud of. The independence of the Federal Reserve has long been regarded as one of the key factors in maintaining macroeconomic stability. Whenever political forces try to interfere with central bank policies, they often cause inflation to get out of control or damage to market confidence.

For US stocks in 2026, what the market is really concerned about is not whether the Federal Reserve will cut interest rates, but whether interest rate cuts will come fast enough and clearly enough. If inflation continues to cool down, the Federal Reserve will gradually cut interest rates in 2026, and costs for businesses and investors will decrease accordingly. Under such circumstances, even if the price of US stocks is not low, it is easier for the market to stay high rather than fall right away. However, if inflation recurs and interest rate cuts are repeatedly postponed or even suspended, the situation will become more difficult. Once the easing policy does not arrive as scheduled, investors may begin to worry about “whether the stock price has risen too high”, thus triggering an adjustment in US stocks.

(4) The midterm election “curse” may be broken

2026 happens to be the midterm election year of US President Trump's second term, and the midterm election year has never been known for calm and quiet. This is also the reason why some bears don't have much hope for US stocks in 2026.

Historically, stock market performance in the midterm election year, the second year of a presidential term, is often the weakest in the four-year presidential term cycle. Since 1948, the average increase in the S&P 500 index in the midterm election year was only 4.6%, and only recorded positive returns 58% of the time. In contrast, according to data compiled by Ned Davis Research, the year before the presidential election, the third year of the presidential term, was the strongest period in history in this four-year cycle, with an average increase of about 17.2%.

However, the upcoming midterm election year probably won't follow this script. Jeffrey Hirsch, editor-in-chief of “The Stock Trader's Yearbook,” pointed out that the mid-term election year for the second presidential term is often more beneficial to the stock market. Historical data shows that since 1949, the average annual increase in the S&P 500 index has been about 8% to 12% in the sixth year of the presidential term, that is, in the midterm election year of the second presidential term. This historical pattern also supports Jeffrey Hirsch's basic prediction for 2026. He said that inflation concerns are expected to “persist but will not intensify,” Trump's policy changes will bring “complex but positive results,” the new chairman of the Federal Reserve will achieve a “seamless transition,” and the labor market will remain “relatively stable,” while the AI boom continues to advance.

Trump is also motivated to push US stocks higher through various policies next year, because most of the assets of American households are linked to the stock market, and a stronger stock market may help Trump gain more support in the midterm elections.

History also shows that the period before the midterm elections often provided potential buying opportunities for the stock market. Since 1934, the S&P 500 index has declined by around 21% from peak to bottom before or during the midterm elections. And any fluctuation should lay the foundation for a strong rebound that followed — an average increase of close to 46% from the midterm election low in the second year of the presidential cycle to the high in the third year.

(5) Bank of Japan raises interest rates

The Bank of Japan raised interest rates by 25 basis points this month, raising the benchmark interest rate to a 30-year high. At the same time, the Bank of Japan sent a signal that it would raise interest rates further in the future, but failed to give clear guidance on the timing of future monetary tightening, and the recent continued weakness of the yen has also made traders increase their bets on the Bank of Japan's interest rate hike to support the yen.

The Bank of Japan's interest rate hike is related to the liquidity of the global market. Since Japan's long-term low interest rates and even negative interest rates have spawned a large number of Japanese yen arbitrage transactions, that is, low-interest yen is exchanged for dollars and euros to invest in European and American stock markets, bond markets, emerging markets, etc. According to the data, by the end of 2024, Japanese investors held nearly 700 trillion yen (about 4.5 trillion US dollars) of overseas securities investments, with overseas bonds and stocks each accounting for half. This huge size means that once the Bank of Japan's aggressive interest rate hike causes the yen to appreciate sharply, investors in arbitrage trading will be forced to sell off overseas assets.

Among them, the US market is particularly vulnerable to shocks. Japan is the largest overseas holder of US debt. If Japanese investors decide to withdraw their capital to the country due to rising domestic bond yields, the US bond market will lose a critical buyer. However, fluctuations in US bond yields will directly affect the valuation of US stocks. Manish Cabra, an American stock strategist at Société Générale, believes that “the Bank of Japan's hawkish actions pose a greater threat to the US stock market than the Federal Reserve or US domestic policies.” He estimated that every 1 percentage point increase in the 10-year US Treasury yield could trigger a 10% to 12% drop in the S&P 500 index.

However, this mainly depends on whether it will cause drastic changes in market expectations and large exchange rate fluctuations. Some analysts believe that the risk of the reversal of the “tsunami” of yen reversal in July 2024 is not high. The impact of yen arbitrage trading on global assets is reversed or relatively mild. There are two reasons: first, the Bank of Japan's interest rate hike is relatively moderate, and the Fed is in a cycle of cutting interest rates and stopping contraction, which will complement the liquidity of the US dollar; second, high-risk arbitrage positions have declined sharply after the impact of July 2024. Combined, the spread between the US and Japan has been narrowing for a long time, making it difficult for the “tsunami” to make a comeback in the short term.

(6) Geopolitical risks

Although geopolitical risks are latent, they are extremely damaging to the stock market. Various conflicts affecting the energy market, or disruptions in key supply chains such as semiconductors and rare earths, may trigger panic selling in the market.

Trade policy is also an uncertain factor, especially when tariffs are back in the political spotlight. Alec Philip, chief US political economist at Goldman Sachs, pointed out that as the 2026 midterm elections approach, American voters' concerns and even anxiety about the cost of living have placed Trump's aggressive tariff policy under the “crossfire” of politics and law. Trade barriers are more likely to be lowered rather than raised in the next few months.

Goldman Sachs predicts that the court will rule early next year that most of the tariffs imposed by Trump under the International Emergency Economic Powers Act (IEEPA) are illegal because they have exceeded the law. This will cause most of the tariffs currently in force to lapse. Even if the White House tried to use section 122 of the 1974 Trade Act as a temporary remedy, it faced extreme restrictions (150 days only, 15% tax cap), far lower than Trump's current aggressive tax rate. Due to the lengthy alternative Section 301 investigation, Goldman Sachs expects the effective tariff rate to drop by about 2 percentage points by the end of 2026.

For the market, the point of the problem is not to predict the final outcome of the policy — especially when Trump is known for not playing cards according to common sense, but rather about pricing this uncertainty. Historical experience shows that even if the long-term impact of geopolitical shocks on the economy is manageable, they often lead to increased market volatility, a stronger dollar, and a correction in the stock market. For a market currently priced according to a stable trend, the impact of such events will be further amplified.

3. Under the main theme of AI engines or deceleration of market rotation, cyclical stocks are expected to become “protagonists”

After experiencing strong gains over the past three years, whether the AI engine can continue to push US stocks higher is a matter of concern for many investors. Many market participants believe that the AI wave is still expected to boost US stocks in 2026. Candace Browning, head of global research at Bank of America, said that fears that the AI bubble is about to burst have been exaggerated, and AI investment is expected to continue to grow at a steady rate in 2026. The bank believes that AI is booming but has not yet entered the bubble stage. According to analysis of historical bubbles, the US stock technology sector is still stable.

BlackRock, the world's largest asset management company, also expects AI to continue to dominate the market in 2026, but it also warned that speculative trading and leveraged operations will increase market risks and may cause investors to experience a volatile market similar to the sharp sell-off in November this year. Jean Boivin, head of the BlackRock think tank, believes that the AI boom is far from speculative fanaticism. This cycle is driven by actual corporate investment, profit, and productivity growth, rather than the irrational boom that defined the internet bubble in the early 2000s.

Mark Hackett, chief market strategist at Nationwide, the largest financial services agency in the US, also said that he doesn't think there is a “bubble or risk of an imminent collapse” in AI-related transactions, but at the same time added that “the growth rate of related sectors may be slowing down, and valuations are already at a high level.”

At a time when the AI boom is likely to weaken next year, the market is forming an increasingly clear consensus — market rotation will be the main investment theme in the new year, and the tech giants that have led the US stock market in the past few years may become “supporting actors.” A number of Wall Street strategists, including Bank of America and Morgan Stanley, are advising clients to pay more attention to traditional sectors such as healthcare, industry, and energy in their 2026 portfolios rather than the “Big Seven Tech” such as Nvidia and Amazon. Behind this shift are growing doubts about the high valuations of technology stocks and huge returns on AI investments.

Strategas Asset Management LLC Chairman Jensen DiCena Trennart believes that 2026 will see a “big rotation” towards sectors such as finance and non-essential consumer goods that have underperformed this year. Michael Wilson, chief US equity strategist at Morgan Stanley, also shared a similar view, and he predicted that the market would expand in breadth. Michael Wilson said, “We think big tech stocks can still perform well, but they will lag behind new leading areas of growth, especially consumer goods and small to medium stocks.”

In fact, this consensus has been reflected in previous market trends. The flow of capital shows that investors are shifting from tech giants to undervalued cyclical stocks, small-cap stocks, and economically sensitive sectors. Since the market hit a short-term low on November 20, the Russell 2000 small-cap index has risen 11%, while the “Big Seven US” index has risen by only half.

Goldman Sachs pointed out that although cyclical stocks have rebounded sharply, the market has yet to fully absorb the economic prospects that may appear in the US in 2026. The bank predicts that the US GDP growth rate will reach 2.5% next year, which is higher than the 2.0% market consensus, and believes that this means that the cyclical sector still has room to rise. Goldman Sachs said, “At the sector level, we expect the acceleration of economic growth in 2026 to give the greatest boost to earnings per share growth in cyclical sectors, including industry, materials and non-essential consumer goods.”

Nicholas Brooks, head of economic and investment research at investment firm ICG, said that for cyclical stocks, the ideal market scenario is a moderate slowdown in job growth, a slight rise in unemployment, and an easing of inflation data. He said, “If we can continue to maintain this state of the 'blonde girl economy' — the labor market growth rate slows but there is no cliff-style decline, then the stock market should start very strong in 2026.”

Therefore, investors may wish to adapt to market rotation trends, diversify their investments, and avoid focusing only on the “Big Seven US stocks” and other AI concept stocks that are already highly valued. With good luck, the US stock market may return again in 2026.

Nasdaq

Nasdaq 華爾街日報

華爾街日報