Bittium Oyj (HEL:BITTI) Stocks Shoot Up 38% But Its P/S Still Looks Reasonable

Bittium Oyj (HEL:BITTI) shares have continued their recent momentum with a 38% gain in the last month alone. This latest share price bounce rounds out a remarkable 316% gain over the last twelve months.

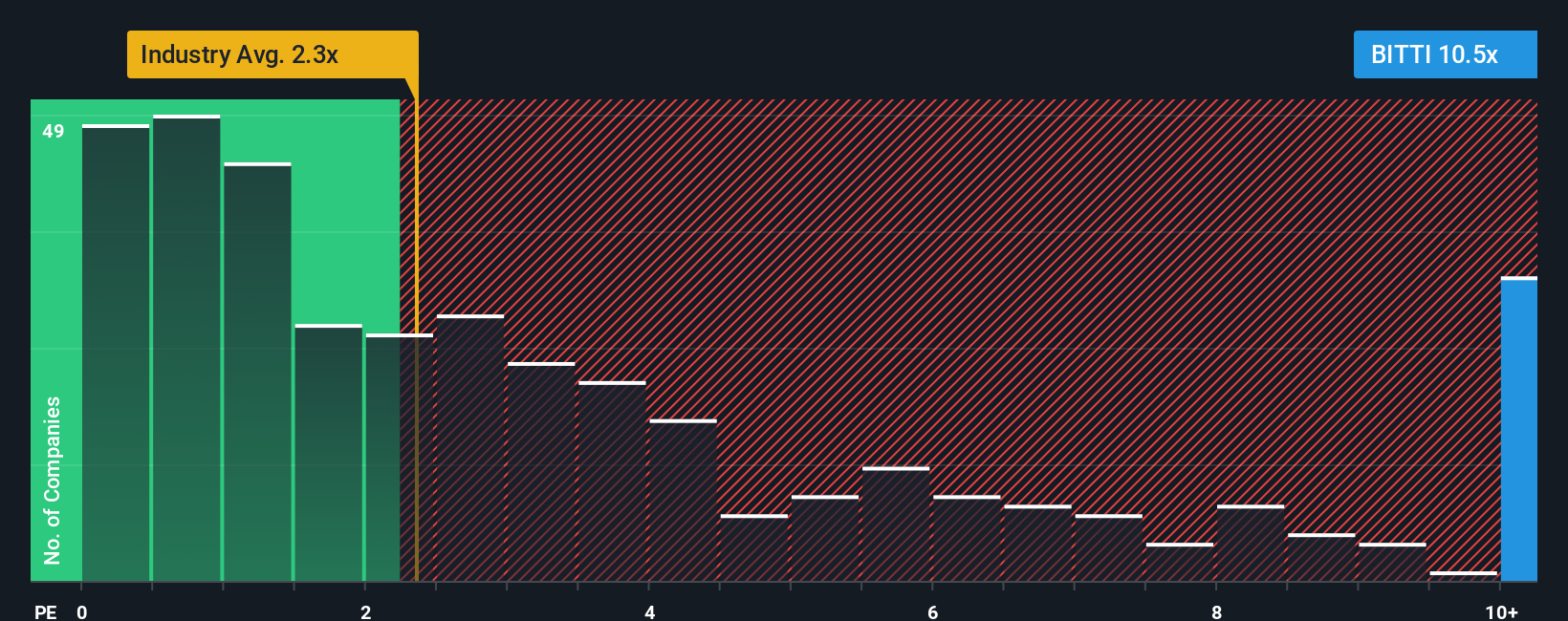

Since its price has surged higher, given around half the companies in Finland's Software industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Bittium Oyj as a stock to avoid entirely with its 10.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Bittium Oyj

What Does Bittium Oyj's Recent Performance Look Like?

Recent times have been advantageous for Bittium Oyj as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bittium Oyj will help you uncover what's on the horizon.How Is Bittium Oyj's Revenue Growth Trending?

Bittium Oyj's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 23% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 14% per annum, which is noticeably less attractive.

With this information, we can see why Bittium Oyj is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Bittium Oyj's P/S Mean For Investors?

Shares in Bittium Oyj have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Bittium Oyj's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Bittium Oyj that you need to take into consideration.

If you're unsure about the strength of Bittium Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報