Middle Eastern Dividend Stocks To Enhance Your Portfolio

As Middle Eastern markets navigate thin trading and geopolitical tensions, the UAE's Dubai index has managed to mark its fifth consecutive weekly gain, buoyed by a rebound in oil prices. In this environment, dividend stocks can offer stability and potential income streams for investors looking to enhance their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.62% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.18% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.57% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.53% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.54% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.99% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.54% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.13% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.33% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

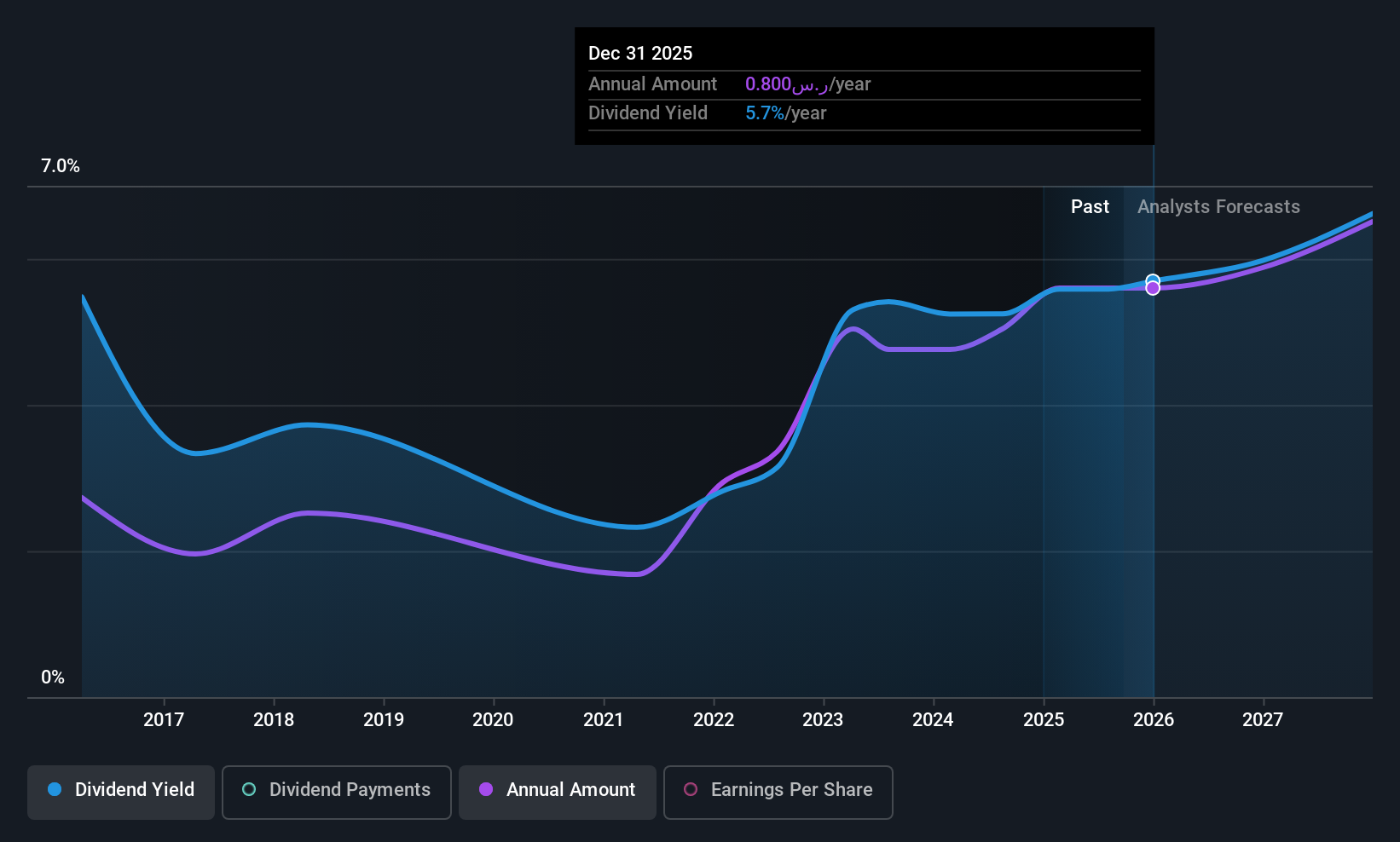

Saudi Investment Bank (SASE:1030)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi Investment Bank offers commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional clients in Saudi Arabia, with a market cap of SAR16.25 billion.

Operations: The Saudi Investment Bank's revenue is primarily derived from Retail Banking (SAR1.39 billion), Corporate Banking (SAR1.49 billion), Asset Management and Brokerage (SAR271.08 million), and Treasury and Investments, including Business Partners (SAR1.10 billion).

Dividend Yield: 6.2%

Saudi Investment Bank's dividend yield of 6.15% ranks it among the top 25% of dividend payers in Saudi Arabia, supported by a sustainable payout ratio of 55.7%. However, the bank has experienced volatility in its dividends over the past decade, with significant annual drops. Despite this instability, dividends are forecast to remain covered by earnings over the next three years. The stock trades at a favorable price-to-earnings ratio of 9.1x compared to the market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Saudi Investment Bank.

- Insights from our recent valuation report point to the potential undervaluation of Saudi Investment Bank shares in the market.

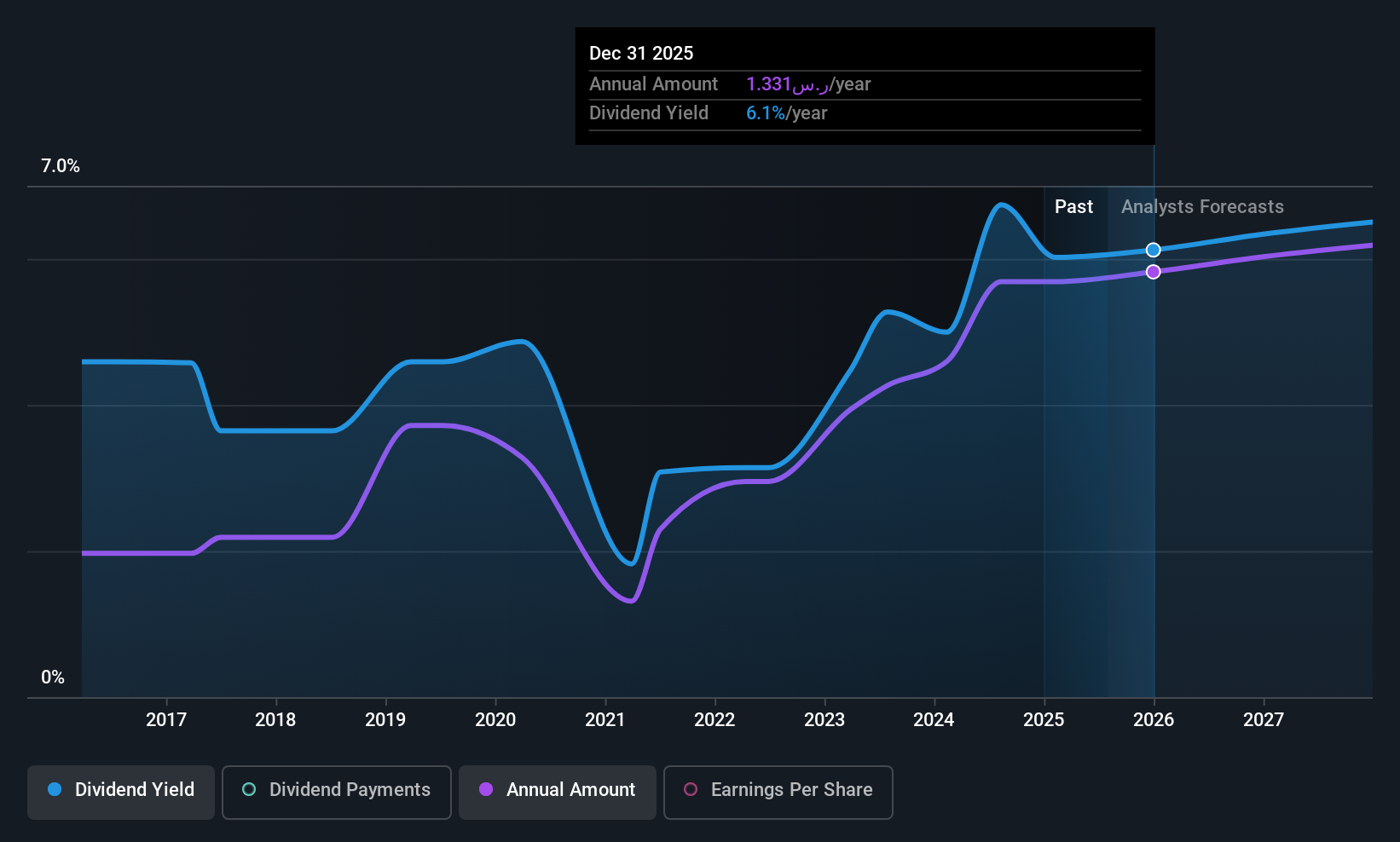

Arab National Bank (SASE:1080)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arab National Bank offers a range of banking products and services across the Kingdom of Saudi Arabia, other GCC countries, the Middle East, Europe, North America, Latin America, Southeast Asia, and internationally with a market cap of SAR42.42 billion.

Operations: Arab National Bank's revenue segments include Corporate Banking at SAR6.85 billion, Retail Banking at SAR1.48 billion, Treasury operations at SAR913.28 million, and Investment and Brokerage Services contributing SAR536 million.

Dividend Yield: 6.1%

Arab National Bank's dividend yield of 6.13% places it in the top 25% of Saudi Arabian dividend payers, with a sustainable payout ratio of 49.6%. While dividends have grown over the past decade, they have been volatile and unreliable. Earnings growth has been robust at 21.9% annually over five years, supporting future dividend coverage forecasts at a 51% payout ratio. The stock trades below peers with a price-to-earnings ratio of 8.1x and is considered good value relative to the market average.

- Click to explore a detailed breakdown of our findings in Arab National Bank's dividend report.

- Our comprehensive valuation report raises the possibility that Arab National Bank is priced lower than what may be justified by its financials.

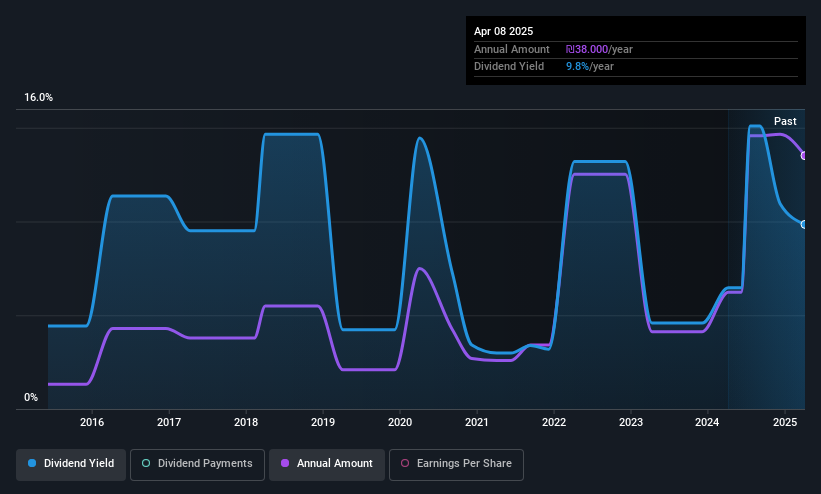

Computer Direct Group (TASE:CMDR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Direct Group Ltd. operates in the computing and software sector in Israel with a market cap of ₪1.73 billion.

Operations: Computer Direct Group Ltd.'s revenue is primarily derived from three segments: Infrastructure and Computing (₪1.35 billion), Outsourcing of Business Processes and Technology Support Centers (₪434.20 million), and Technological Solutions and Services, Management Consulting, and Value-Added Services (₪2.73 billion).

Dividend Yield: 7.5%

Computer Direct Group offers a compelling dividend yield of 7.54%, ranking in the top 25% of Israeli dividend payers. Despite a volatile and unstable dividend history, the current payout ratio of 61.3% suggests dividends are well covered by earnings, while a low cash payout ratio of 32.2% indicates strong cash flow support. Recent earnings growth, with net income rising to ILS 26.23 million for Q3, underscores potential stability in future payouts despite past inconsistencies.

- Dive into the specifics of Computer Direct Group here with our thorough dividend report.

- Our valuation report here indicates Computer Direct Group may be undervalued.

Where To Now?

- Unlock our comprehensive list of 61 Top Middle Eastern Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報