Baiosaitu-B (02315) was included in the Hong Kong Stock Connect list. High performance growth drives value revaluation

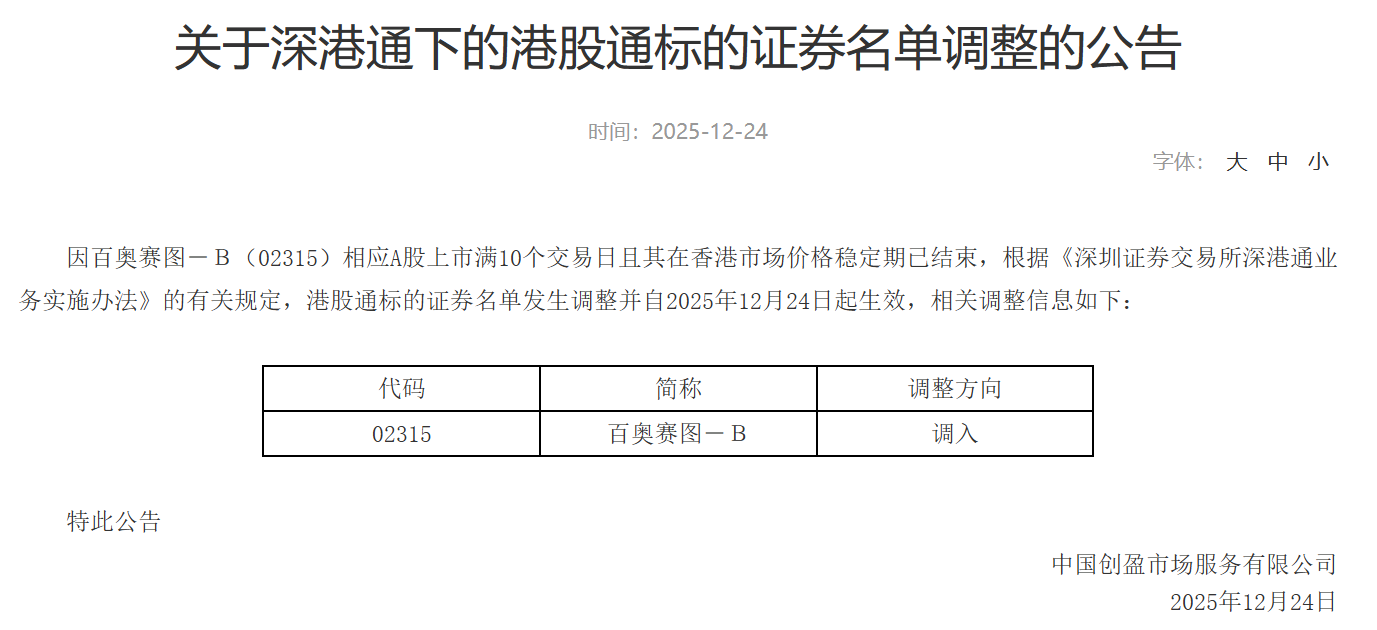

Recently, the Shanghai Stock Exchange and the Shenzhen Stock Exchange announced that Biosetu-B (02315) will be transferred to the Hong Kong Stock Connect stock list with effect from December 24, 2025. This move marks another important milestone after the company established an “A+H” dual capital market platform. Since then, its Hong Kong stock channel has been fully opened to mainland investors.

Looking back at market history, inclusion in the Hong Kong Stock Connect is often an important opportunity for listed companies to face revaluation. The continuous injection of southbound incremental capital has not only directly broadened the investor base, significantly increased stock liquidity and trading activity, but also effectively mitigated valuation discounts caused by insufficient liquidity.

At the same time, broader market attention will also prompt the company's investment logic to be examined more fully. As far as Baiosetu is concerned, entering the Hong Kong Stock Connect can be called “just the right time” — its “dual-engine” platform-based business model has passed the technical verification stage and is entering an accelerated cashing period for large-scale commercial implementation.

With scarce business models, deep technical moats, and recent significant performance benefits, the inclusion of the Hong Kong Stock Connect this time is expected to become a key catalyst for Baiaosetu's investment value to be re-evaluated a second time.

“Twin engines” enable strong growth in global new drug development performance

After more than ten years, Baiosetu has built a core technology “moat” that is difficult to replicate: a “whole-human antibody resource library” covering the starting point of new drug development and a “target humanized mouse model library” covering key verification links.

Through this systematization capability, Baiosetu transforms the traditional early drug discovery that is highly reliant on experience, with a long cycle and a very high failure rate, into a standardized, large-scale, and efficient R&D process, helping partners shorten candidate molecular screening cycles, greatly reduce early trial and error costs, and advance complex therapies to the pre-clinical stage with a higher success rate.

Up to now, Baiosetu has built a system covering more than 1,000 targets and more than one million whole-human antibody sequences, and has developed more than 1,700 humanized disease models, covering cutting-edge treatment fields such as dual antibodies, ADC, and cell therapy. The model scale is among the highest in the world; it has AAALAC-certified laboratory animal facilities in China and the US, with an annual production capacity of 800,000 animals, adding 200-300 innovative models every year, showing solid large-scale commercial potential.

A number of impressive performance data recently released by the company also provide strong evidence of the viability and growth of its platform-based business model.

In the first three quarters of 2025, the company achieved revenue of 941 million yuan, a sharp increase of 59.5% over the previous year; achieved net profit of 114 million yuan, successfully turning a loss into a profit over the previous year, indicating that its profit model has entered a healthy track.

In the same period, net cash flow from operating activities reached 263 million yuan, surging 162.2% year on year, and the financial situation was healthy and strong; R&D investment continued to increase, increasing 30.6% year on year to 313 million yuan, driving long-term sustainable development through innovation.

In the third quarter, the company continued its rapid growth trend, with revenue of 320 million yuan in a single quarter, a year-on-year increase of 78.34%.

This solid performance questionnaire clearly shows that the company's “twin-engine” platform-based innovation is no longer just a story on paper, but has entered a stage of strong growth with large-scale output and commercial value realization, laying a solid foundation for it to obtain revaluation in the capital market.

Global layout continues to deepen and growth potential is realized at an accelerated pace

Since its inception in 2009, Baiosetu has established “becoming a global birthplace of new medicines” as the company's long-term vision and continues to promote a global layout. Today, this strategy has moved from early exploration to a period of substantial harvest, and internationalization is becoming the core engine driving the company's development.

The Zhitong Finance App learned that as of the first half of 2025, the company had signed more than 280 authorized antibody molecule transfer projects and reached authorized development cooperation for the reNMICE® platform for more than 50 target projects. The partners covered 9 of the world's top ten pharmaceutical companies and many domestic and foreign pharmaceutical companies and biotechnology companies, and its technical strength was widely recognized by the global industrial ecosystem;

Currently, the company has branches in Boston, San Francisco, San Diego, Germany, and Heidelberg in Germany, with a global team of over 1,000 people. In the first half of 2025, overseas business accounted for nearly 70% of revenue, and internationalization became the core engine of performance growth.

In the second half of this year, the company continued to achieve many important cooperation results in the field of global cooperation. In September of this year, Baiosetu signed an antibody evaluation agreement with global technology giant Merck (Merck). The two sides will jointly explore nucleic acid drug delivery solutions based on whole-human antibodies, including cutting-edge technologies such as antibody-conjugated LNP. In the same month, the company and Tubulis, an innovative German biotechnology company, reached an antibody licensing agreement. The latter will use Baiosetu's RenMice whole-human antibody platform, combined with its proprietary connector and payload technology to develop innovative ADC therapies.

A series of collaborations with leading global companies not only brought definitive short-term revenue and long-term share expectations, but also verified the company's international competitiveness and commercial value in the field of antibody drug development and innovative delivery technology.

In the short term, the introduction of the Hong Kong Stock Connect has provided the company with an opportunity to improve liquidity and increase attention; in the medium to long term, the company itself has successfully built a scarce platform-based Biotech model. The technical barriers are deep, commercialization potential has been verified, and the fundamentals are on a clear upward channel. As the company ushered in a “double hit from Davis,” mainland investors are also expected to take advantage of the company's inclusion in the Hong Kong Stock Connect to share the long-term growth dividends of this innovative biotech company.

Nasdaq

Nasdaq 華爾街日報

華爾街日報