IonQ vs. Rigetti Computing: Which Quantum Stock Wins?

Key Points

IonQ is a larger, more established company than Rigetti.

Both stocks are up so far in 2025.

The market and demand for quantum computing are still largely to be determined.

IonQ (NYSE: IONQ) and Rigetti Computing (NASDAQ: RGTI) are two of the more prominent publicly traded stocks in the field of quantum computing.

What do they do?

Without wading too deep into the weeds of quantum computing, the main difference between the two companies is that IonQ uses a trapped-ion system, whereas Rigetti uses superconducting qubits. What's important is the real-life applications of these technologies and their commercial viability. Both companies are targeting similar industries, spanning from AI to finance to defense to cybersecurity to manufacturing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

How their financials compare

IonQ's latest quarterly report was largely positive. The company beat revenue expectations and increased its full-year revenue guidance to as much as $110 million. IonQ's operating costs still overshadow its revenue, however. Operating costs and expenses through the first nine months of the year were $473 million.

IonQ also completed a $2 billion capital raise through the sale of new shares, which diluted existing shareholders. While this program was necessary to raise the funds to keep IonQ's progress moving forward, dilution is always concerning for long-term investors.

Rigetti Computing is a far smaller company than IonQ with a market cap around $8.4 billion. The company reported revenue of just $5.2 million through the first nine months of 2025. Much like IonQ, its operating losses significantly outpaced revenue, coming in at $63.4 million for the first nine months of the year.

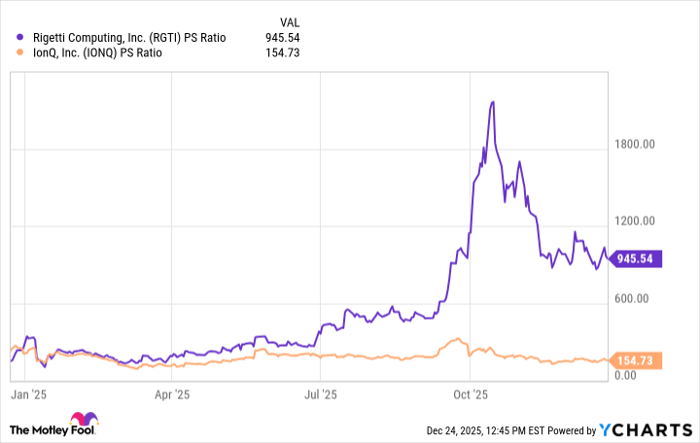

Rigetti's technology is promising, and its semiconductor business has real scalability potential. The company's price-to-sales ratio reflects that future hope. At this time, IonQ's valuation is more attractive than Rigetti's.

RGTI PS Ratio data by YCharts

Who will be the winner?

It's still too early to predict who will be the "winner" or if there will be only one. At this juncture, IonQ is more established and has significant partnerships to leverage. If you're looking for an even higher-risk, higher-reward investment, though, Rigetti could be the stock of the future.

Catie Hogan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends IonQ. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq 華爾街日報

華爾街日報