Asian Growth Companies With Strong Insider Ownership December 2025

As the Asian markets continue to navigate a complex economic landscape, characterized by mixed growth signals and cautious optimism, investors are increasingly looking towards companies with robust insider ownership as potential opportunities. In this context, stocks with strong insider involvement often indicate confidence in the company's future prospects and alignment of interests between management and shareholders, making them appealing for those seeking growth in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 116.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

MIXUE Group (SEHK:2097)

Simply Wall St Growth Rating: ★★★★☆☆

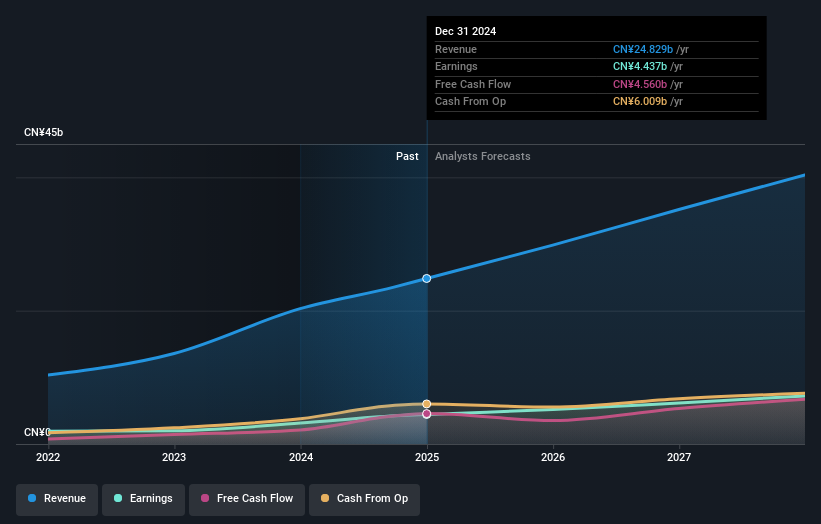

Overview: MIXUE Group engages in the production and sale of fruit drinks, tea drinks, ice cream, and coffee products both in Mainland China and internationally, with a market cap of approximately HK$160.12 billion.

Operations: The company's revenue is primarily derived from Sales of Goods and Equipment, with Sales of Goods contributing CN¥27.37 billion and Sales of Equipment adding CN¥949.98 million, alongside Franchise and Related Services which generate CN¥707.31 million.

Insider Ownership: 28.8%

Return On Equity Forecast: 24% (2028 estimate)

Mixue Group is expanding globally, recently opening its first store in Los Angeles, marking a significant step in its international strategy. The company operates around 4,700 stores outside China and plans further expansion across the Americas. While Mixue's revenue growth forecast of 14.7% per year outpaces the Hong Kong market average of 8.5%, its expected earnings growth of 15% annually also surpasses the market's 12.2%. High insider ownership aligns management interests with shareholders'.

- Take a closer look at MIXUE Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, MIXUE Group's share price might be too optimistic.

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology company focused on the research and development of novel antibody-based drugs and pre-clinical research services across China, the United States, and internationally, with a market cap of HK$22.87 billion.

Operations: The company's revenue is derived from several segments, including CN¥362.46 million from antibody development, CN¥497.82 million from animal models selling, CN¥66.09 million from gene editing, and CN¥274.47 million from pre-clinical pharmacology and efficacy evaluation services.

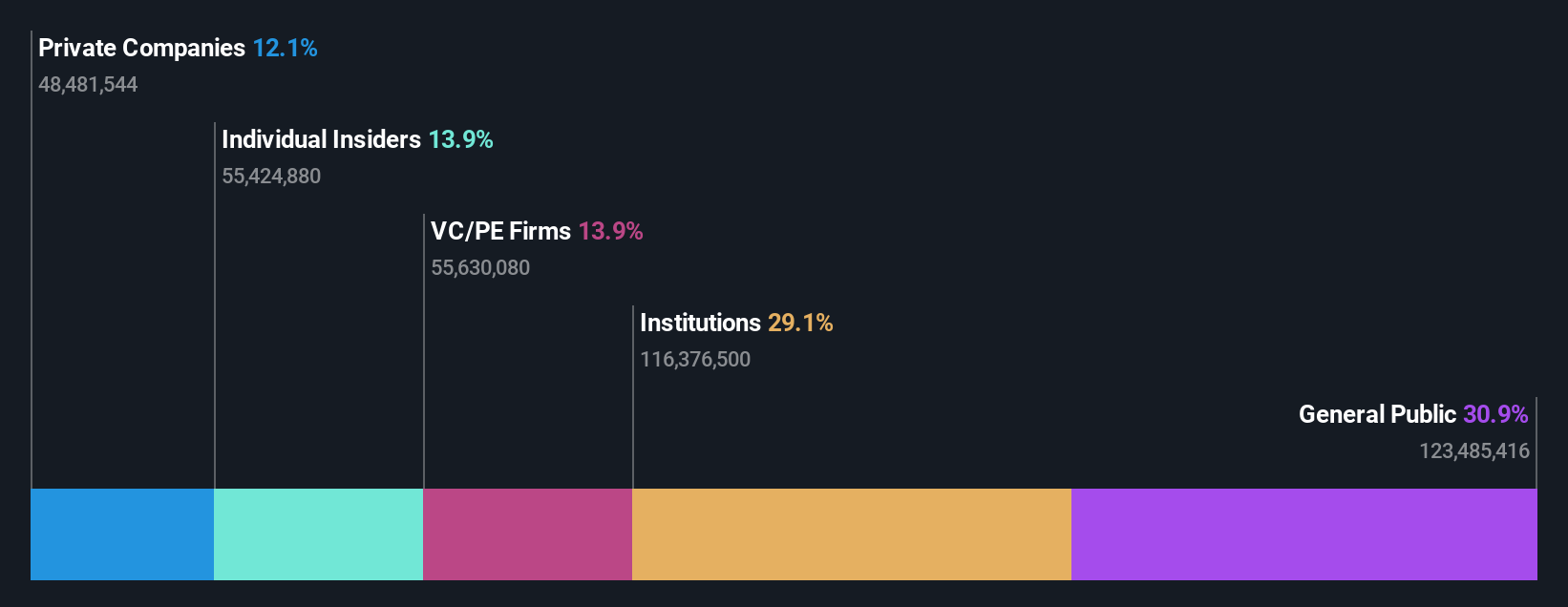

Insider Ownership: 14.1%

Return On Equity Forecast: 26% (2028 estimate)

Biocytogen Pharmaceuticals (Beijing) is experiencing significant growth, with earnings projected to increase by 55.8% annually, outpacing the Hong Kong market's 12.2%. The company's revenue is expected to grow at 18.7% per year, supported by its recent CNY 1.27 billion equity offering and successful IND clearance for IDE034 in partnership with IDEAYA Biosciences. Despite a volatile share price, insider ownership remains high, aligning management interests with shareholders'. Recent board changes may influence strategic direction.

- Click here to discover the nuances of Biocytogen Pharmaceuticals (Beijing) with our detailed analytical future growth report.

- According our valuation report, there's an indication that Biocytogen Pharmaceuticals (Beijing)'s share price might be on the expensive side.

Sieyuan Electric (SZSE:002028)

Simply Wall St Growth Rating: ★★★★★☆

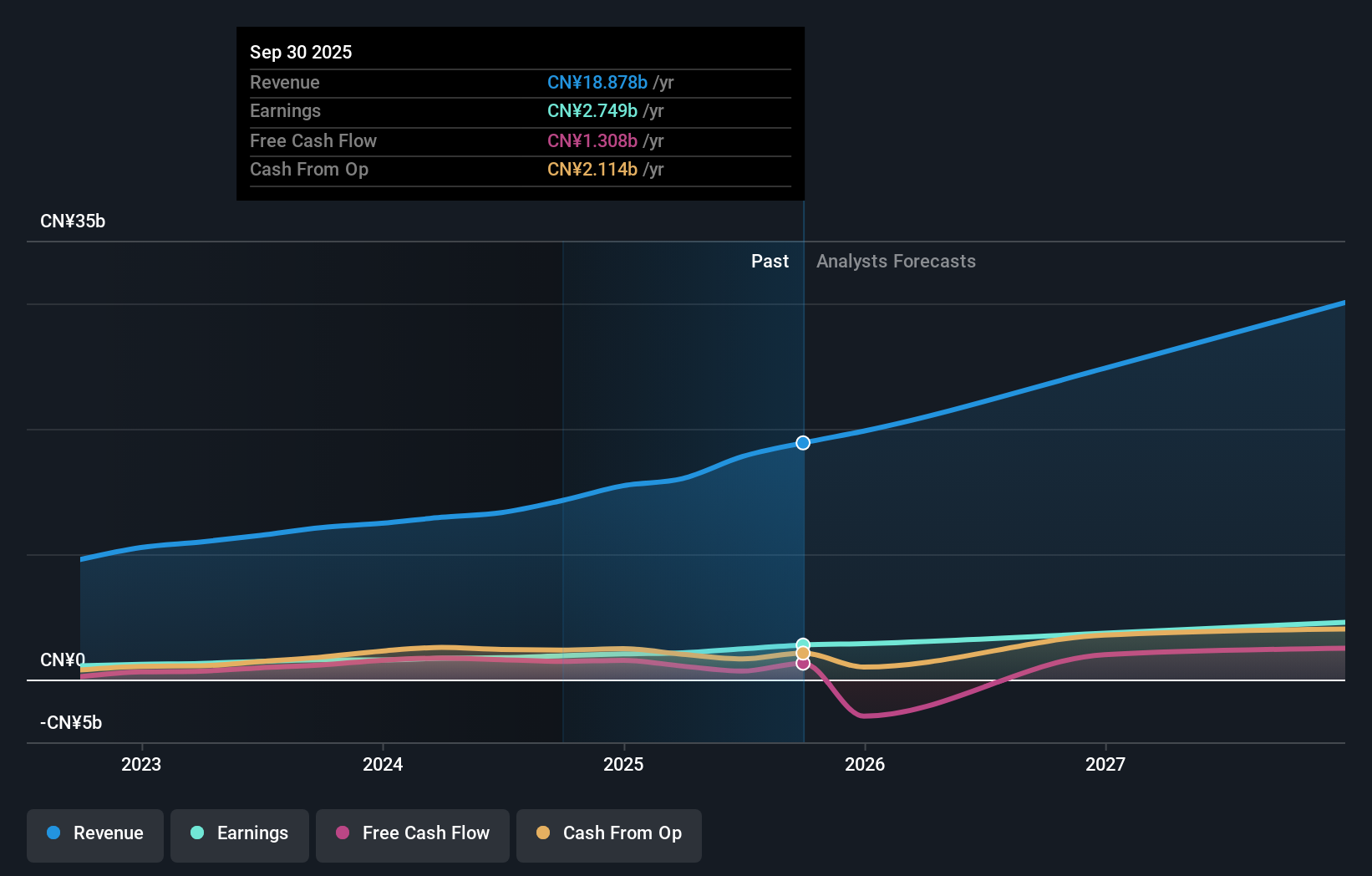

Overview: Sieyuan Electric Co., Ltd. is involved in the research, development, production, sale, and service of power transmission and distribution equipment both in China and internationally, with a market cap of approximately CN¥125.75 billion.

Operations: The company's revenue from the Distribution and Controls Equipment/Furniture segment is CN¥18.88 billion.

Insider Ownership: 35.1%

Return On Equity Forecast: 22% (2028 estimate)

Sieyuan Electric's earnings have grown by 44.5% over the past year, with future annual revenue growth expected at 22.5%, surpassing the Chinese market's average. Despite its volatile share price and recent removal from the FTSE All-World Index, its return on equity is projected to reach a high of 22.5% in three years. The company's price-to-earnings ratio of 45.7x remains below industry averages, and insider ownership continues to align management with shareholder interests.

- Click here and access our complete growth analysis report to understand the dynamics of Sieyuan Electric.

- Our expertly prepared valuation report Sieyuan Electric implies its share price may be too high.

Key Takeaways

- Navigate through the entire inventory of 632 Fast Growing Asian Companies With High Insider Ownership here.

- Interested In Other Possibilities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報