3 ASX Stocks That Could Be Trading Below Their Estimated Value

As the Australian stock market winds down for the year, with a slight dip attributed to pre-holiday profit-taking and Wall Street's recent highs, investors are keenly observing potential opportunities in undervalued stocks. In this environment, identifying stocks that may be trading below their estimated value can offer a strategic advantage for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wrkr (ASX:WRK) | A$0.12 | A$0.21 | 44% |

| Smart Parking (ASX:SPZ) | A$1.28 | A$2.26 | 43.5% |

| Resolute Mining (ASX:RSG) | A$1.285 | A$2.40 | 46.5% |

| Lynas Rare Earths (ASX:LYC) | A$12.57 | A$23.40 | 46.3% |

| LGI (ASX:LGI) | A$4.04 | A$7.68 | 47.4% |

| Kogan.com (ASX:KGN) | A$3.49 | A$6.87 | 49.2% |

| Cromwell Property Group (ASX:CMW) | A$0.49 | A$0.87 | 43.6% |

| Betmakers Technology Group (ASX:BET) | A$0.18 | A$0.34 | 46.6% |

| Alkane Resources (ASX:ALK) | A$1.30 | A$2.38 | 45.4% |

| Airtasker (ASX:ART) | A$0.33 | A$0.63 | 47.9% |

Let's explore several standout options from the results in the screener.

Light & Wonder (ASX:LNW)

Overview: Light & Wonder, Inc. is a cross-platform games company operating in the United States and internationally, with a market cap of A$12.63 billion.

Operations: The company generates revenue through its diverse segments, including $2.10 billion from Gaming, $321 million from iGaming, and $803 million from SciPlay.

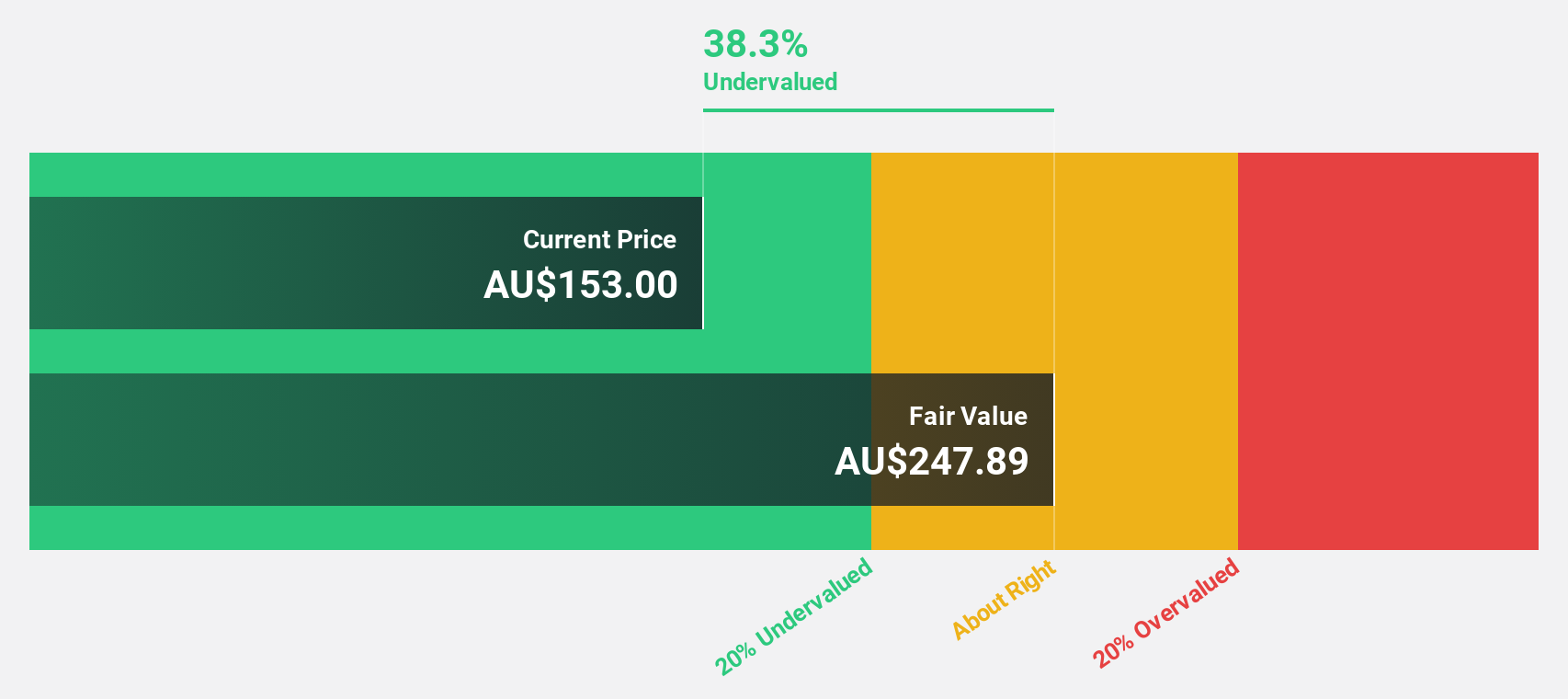

Estimated Discount To Fair Value: 34%

Light & Wonder is trading at A$158, significantly below its estimated fair value of A$239.23, suggesting undervaluation based on cash flows. Despite recent index exclusions and a transition to sole ASX listing, the company shows robust financial health with earnings growth of 35.3% last year and a forecasted annual profit increase of 15%, outpacing the Australian market's 12.2%. Additionally, it has initiated a substantial share buyback program to enhance shareholder value.

- Our growth report here indicates Light & Wonder may be poised for an improving outlook.

- Get an in-depth perspective on Light & Wonder's balance sheet by reading our health report here.

NRW Holdings (ASX:NWH)

Overview: NRW Holdings Limited, with a market cap of A$2.37 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: NRW Holdings Limited generates revenue through its key segments, with Mining contributing A$1.54 billion, MET at A$932.02 million, and Civil at A$823.72 million.

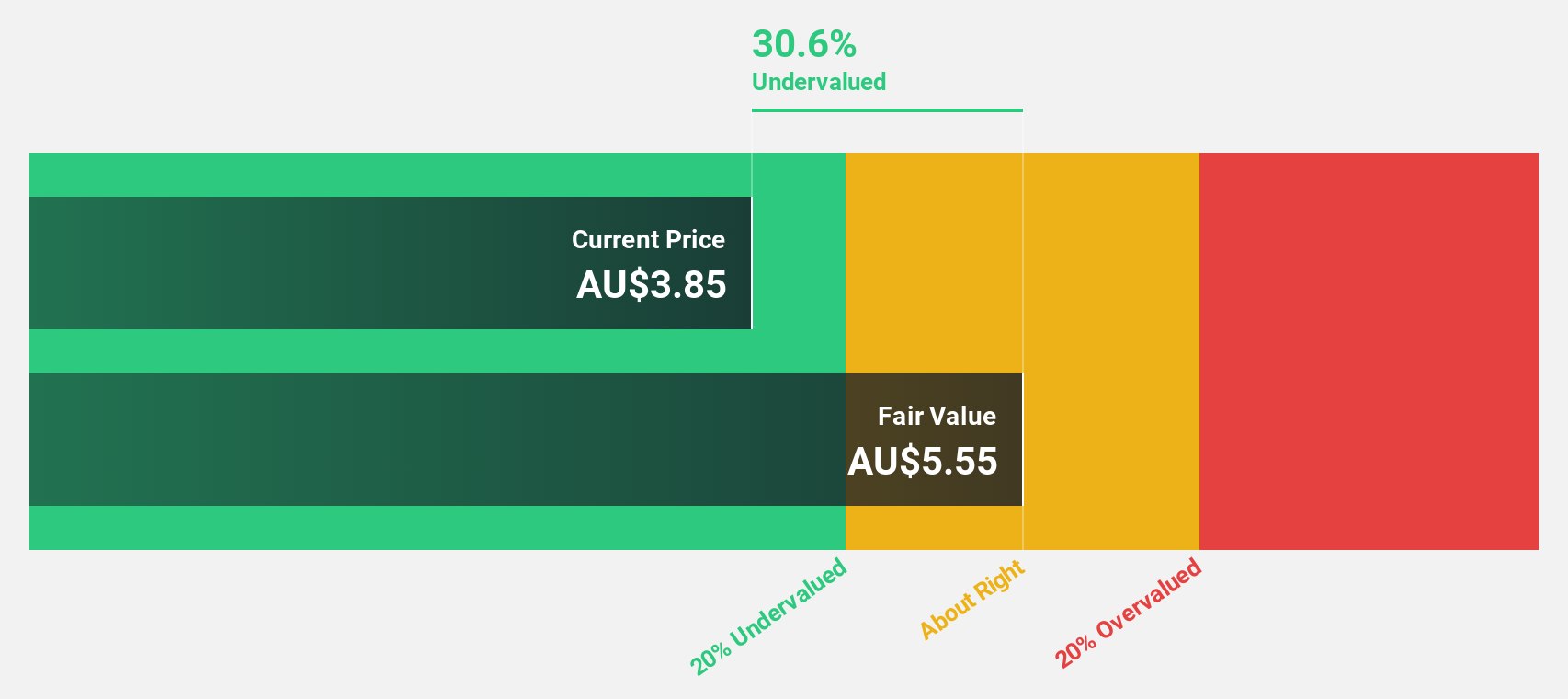

Estimated Discount To Fair Value: 42.7%

NRW Holdings is trading at A$5.15, significantly below its estimated fair value of A$8.98, indicating substantial undervaluation based on cash flows. Despite a decline in profit margins from 3.6% to 0.8%, earnings are projected to grow at 31.1% annually, outpacing the Australian market's growth rate of 12.2%. However, insider selling has been significant recently and dividends remain poorly covered by earnings, which could impact investor confidence moving forward.

- The growth report we've compiled suggests that NRW Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of NRW Holdings.

Vault Minerals (ASX:VAU)

Overview: Vault Minerals Limited is involved in the exploration, mine development, operations and sale of gold and gold/copper concentrate in Australia and Canada, with a market cap of A$5.68 billion.

Operations: Vault Minerals Limited generates revenue from several segments, including Deflector with A$477.79 million, Sugar Zone with A$0.23 million, Mount Monger contributing A$287.58 million and Leonora Operation at A$666.50 million in Australia and Canada.

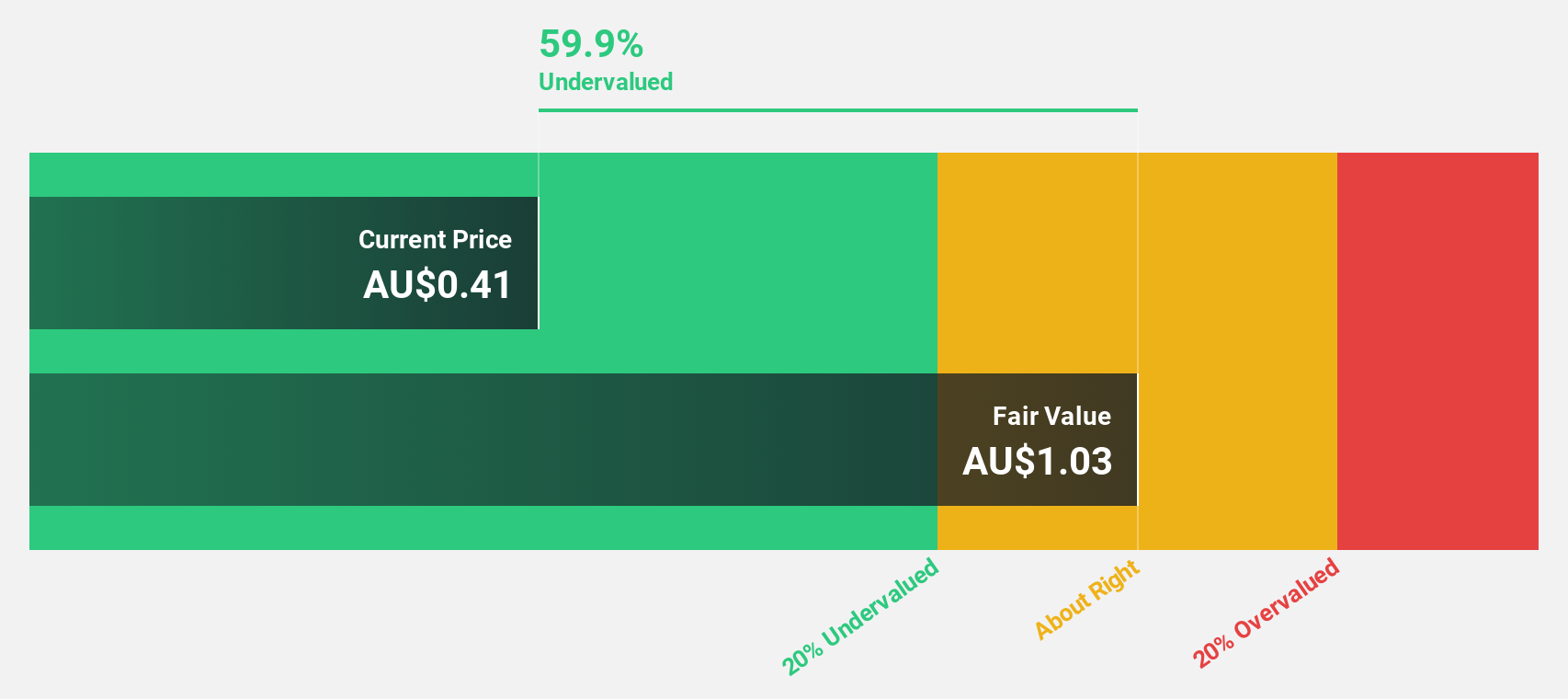

Estimated Discount To Fair Value: 20.9%

Vault Minerals is trading at A$5.44, below its estimated fair value of A$6.87, highlighting undervaluation based on cash flows. Earnings are forecast to grow at 17.9% annually, surpassing the Australian market's growth rate of 12.2%, while revenue growth is expected to outpace the market as well. The company recently became profitable and underwent a stock split on November 18, 2025; however, leadership changes may introduce some uncertainty in governance stability moving forward.

- Our earnings growth report unveils the potential for significant increases in Vault Minerals' future results.

- Dive into the specifics of Vault Minerals here with our thorough financial health report.

Key Takeaways

- Reveal the 36 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報