Zheshang Securities: What is the impact of the equity market's New Year's Eve market on the bond market?

The Zhitong Finance App learned that Zhishang Securities released a research report saying that the equity market's New Year's Eve market may have already started, compounding the hot commodity market led by precious metals, which may have a further impact on the asset shortage logic of the bond market. In a market environment where interest rate fluctuations have increased significantly, although swing trading strategies have advantages in theory, they are more difficult to operate in practice. Buying and holding coupon strategies may be more cost-effective due to relatively simple operating ideas and relatively neutral performance.

The text is as follows:

1. Weekly bond market observation

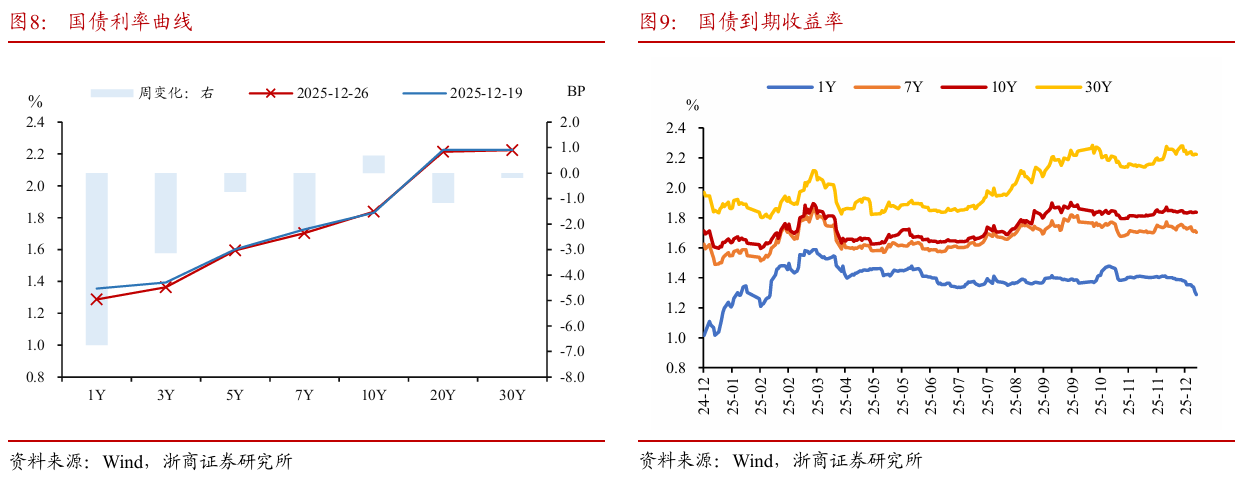

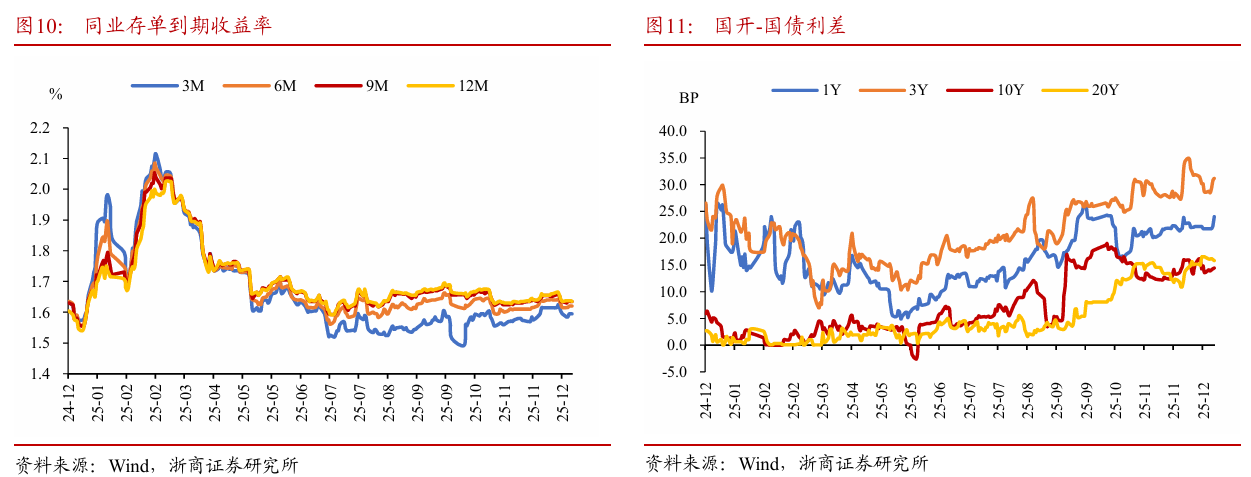

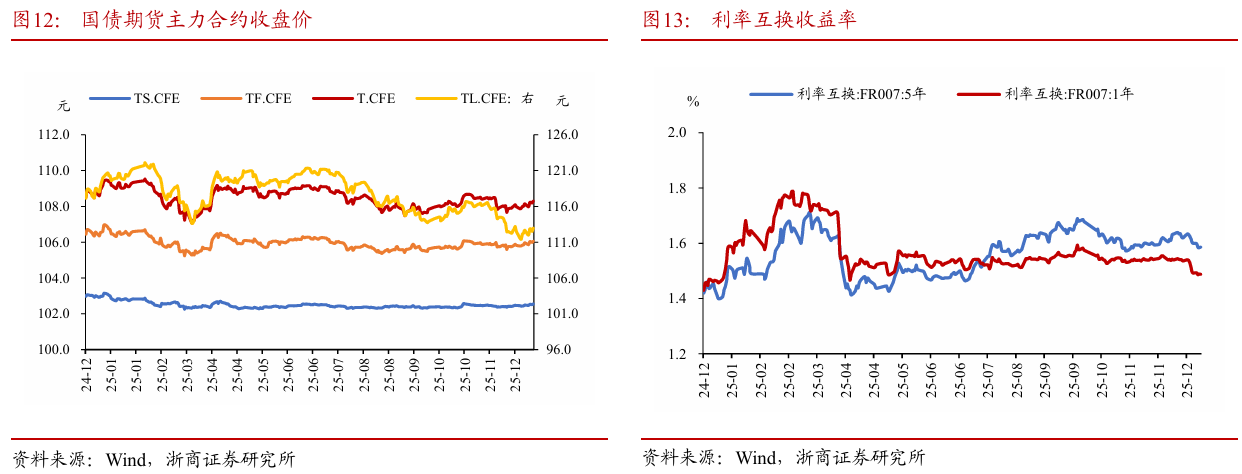

Over the past week (December 22, 2025 to December 26, 2025), 10-year treasury bond yields fluctuated in a narrow range. On December 22, LPR quotes remained unchanged in December, and cash yield fluctuated; on December 23, cash yield declined somewhat in an environment with abundant liquidity; on December 24, broad currency expectations fluctuated, and cash yield remained in a narrow range; on December 25, capital easing led short-term interest rates to decline, and medium- to long-term interest rates were still relatively weak; on December 26, the financial side remained relaxed, and market trading sentiment was weak, and the bond market continued to fluctuate. As of Friday's close, 10-year active treasury bonds closed at 1.8355%, and 30-year active treasury bonds closed at 2.2210%.

1.1 How to view the equity market's New Year's Eve market

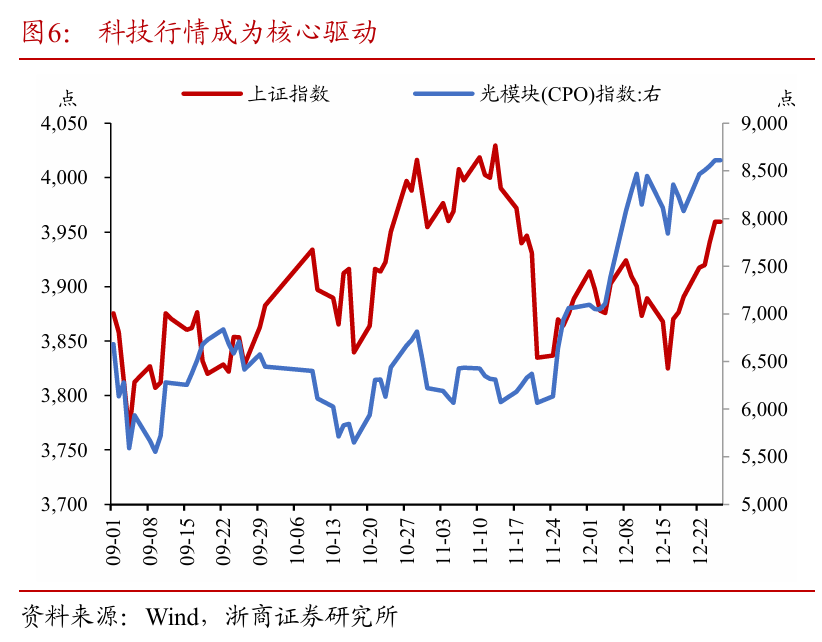

Since September, the equity market has continued to trade sideways, and the Shanghai Composite Index fluctuated widely between 3,700 and 4,100 points. From December 17 to 26, the Shanghai Stock Exchange broke out of the Eight Lianyang market, and the New Year's Eve market may have already started. We believe that the core asset market represented by the Mao Index at the end of 2020 may have some reference value for understanding the current equity market's New Year's Eve market.

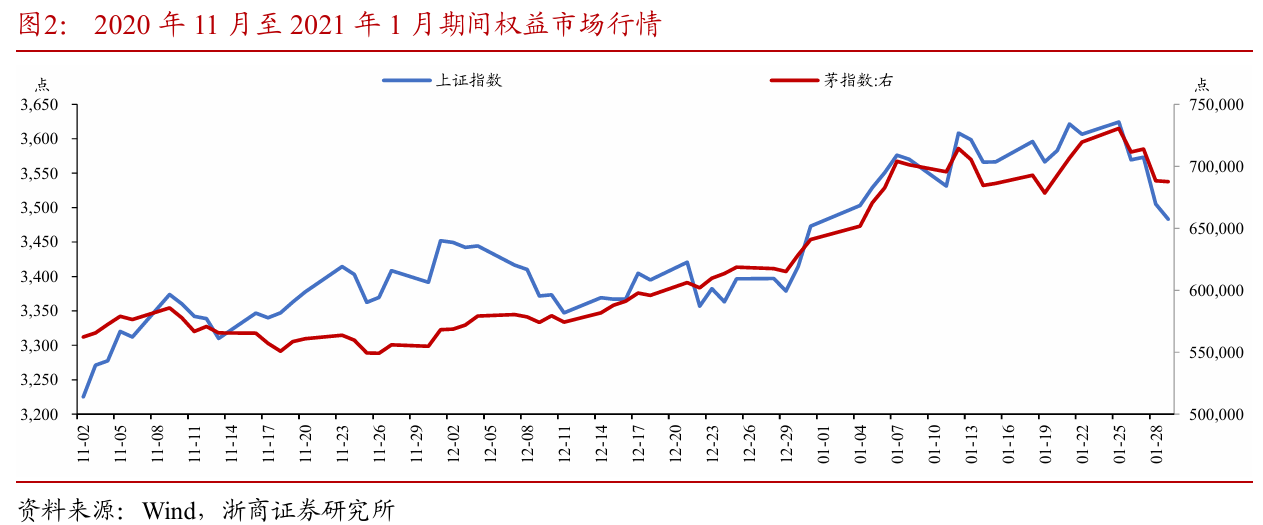

The core asset market drove the Shanghai Composite Index out of the New Year's Eve market. Looking back at the equity market's New Year's Eve market in 2020, it shows a distinct characteristic that the core asset market is the main driver. Represented by the Mao Index, the Mao Index closed at a phased low of 549136.41 points on November 26, 2020, then began a steady upward trend until closing at a high of 730658.39 on January 25, 2021, with an increase of 33.06% during the period. The Shanghai Composite Index started slightly later than the Mao Index and bottomed out and rebounded on December 11, 2020. It also closed at a phased high of 3624.24 points on January 25, 2021, with an increase of 8.28% during the period.

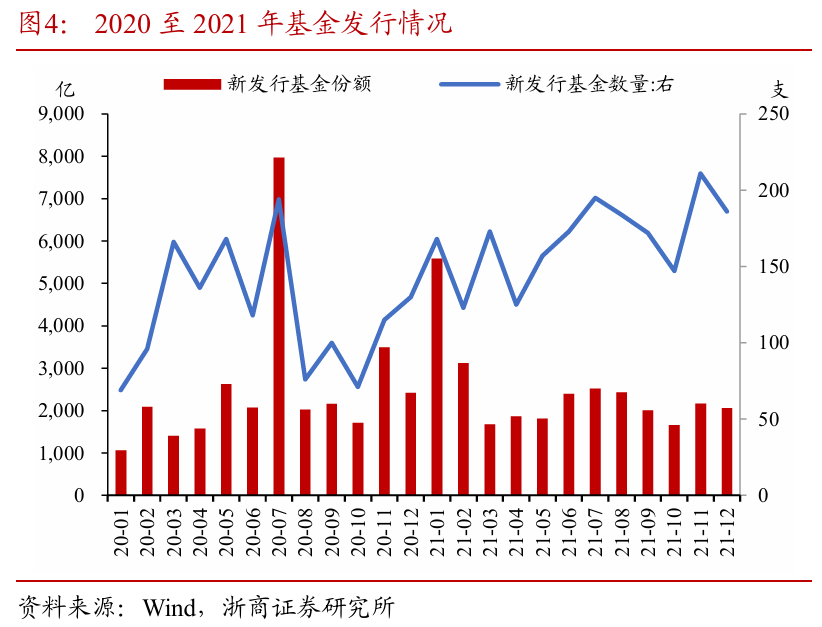

Multi-factor resonance is driving the equity market to strengthen. 1) In response to public health events, central banks around the world have generally begun monetary easing processes to form a macroeconomic environment with abundant liquidity. From December 2020 to January 2021, DR007 showed a downward trend and bottom fluctuation. The low interest rate environment helped increase the attractiveness of core asset valuations. 2) The macroeconomy is showing a K-shaped recovery trend. Leading companies rely on the competitive advantage of the industry and have more steady performance expectations. Investors' preference for performance stability has increased markedly, thus forming a “group-style” pursuit of leading companies. 3) The steady and high income level of public funds in 2020 gradually spawned a boom in fund issuance and subscription. In January 2021, 168 new funds were issued, with a total share of 558.66 billion shares. Demand for position opening forces public funds to prioritize core asset stocks with good liquidity and high performance stability, forming a positive cycle of fund issuance - purchase of core assets - rising stock prices - attracting more capital.

Compared to the present, we think there may be favorable factors that will also favor the equity market to break out of the New Year's Eve rally. 1) The low interest rate environment has been further strengthened. Market interest rates such as deposit interest rates and 10-year treasury bond yields have declined significantly from the end of 2020, further favoring the equity market valuation increase. 2) Similar to the leading trend in core assets in 2020, it currently shows clear characteristics of leading the rise in technology. If the main line is clear, it is easier to attract capital groups, thus forming a positive cycle of buying - rising - continuous buying - continuing to rise. 3) In recent years, macroeconomic policies have strengthened their attention and level of care for the equity market. The equity market, which has been rising steadily since the third quarter, may have had a strong effect on boosting investor confidence. Currently, the market may have gradually formed a consensus expectation that the equity market will be slow to bullish in 2026. 4) Under the calendar effect, public funds may reduce their holdings at the end of the year in order to protect profits or guarantee rankings, but the opposite may also be established. If peer institutions increase their holdings at the end of the year and the market is good, in order to prevent ranking performance from falling back, institutions that have not increased their holdings may also need to “passively increase their holdings” to follow the trend. 5) Recently, the RMB exchange rate has shown signs of continuous appreciation, which may be beneficial to RMB assets, further attracting incremental capital such as foreign capital to enter the market.

1.2 What is the impact of the equity market's New Year's Eve market on the bond market

The equity market may have started on New Year's Eve, and precious metals continue to be hot. Compared with that, the performance of bond assets is relatively weak. Asset scarcity was one of the important logics driving the previous bond bull market. Looking back, this logic may face weakening pressure.

From the perspective of asset price comparison, the performance of bond assets is relatively weak. The equity market began its main upward trend in the third quarter. After experiencing about 3 months of sideways trading fluctuations, it recently recorded eight consecutive increases. The New Year's Eve market may have already started. Investors are generally relatively optimistic about the long-term performance of the equity market in 2026. In the commodity market, bullish sentiment is relatively high in the short term, led by the precious metals market. Bank of Belarus may not have peaked yet. The possibility that the market will spread from silver to other metals such as copper and aluminum is not ruled out in the future. In contrast, the overall performance of the bond market was not outstanding, and it did not show superior performance compared to other varieties in terms of absolute return and risk retracement control.

The asset shortage logic may be under pressure to weaken. The equity market has relatively consistent bullish expectations. The New Year's Eve market may have already started, the commodity market has structural rotation opportunities, and the current asset shortage problem may have improved effectively. As far as the bond market is concerned, the previous influx of capital due to lack of assets may face outflow pressure, or have had a certain negative impact on the bond market.

1.3 Buy and hold coupon strategies or are more cost-effective

Due to increased volatility in the bond market, bond investment faces uncertainty, capital gains are more difficult to obtain, the importance of coupon income in investment may be further highlighted, and strategies for buying and holding high-interest credit bonds may be more cost-effective.

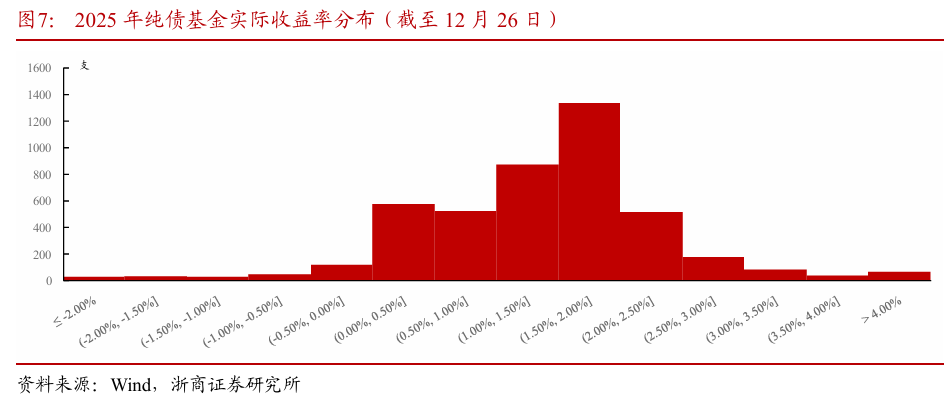

The average cumulative yield of pure debt funds in 2025 was 1.44%. As of December 26, using 4,157 pure debt funds in the entire market as research subjects, using changes in net fund value plus management fees and custodian fees to measure the actual yield of funds, statistics showed that the average annual actual yield of pure bond funds was 1.44%. The majority yield fell within the 1.50%-2.00% range, accounting for 32.14%, accounting for a total of 880 funds with a yield of more than 2%, accounting for 21.17%. Increased volatility in the bond market makes it harder for bond funds to achieve relatively impressive performance.

The strategy of buying and holding coupons may be cost-effective. Although swing trading can increase investment returns in non-trending markets, it requires high trading ability and market awareness. We consider a relatively simpler strategy of buying and holding coupons. If the investment target is a 3-year AAA short term note, the actual yield for the full year up to December 26 can reach 0.93%, ranking 76.80% among all debt bases when the investment target is a fixed-term virtual voucher structured based on the Chinese bond yield curve. If you invest in real bonds, taking into account the riding income brought about by shortening the holding period, the annual actual yield can reach 1.65%, ranking 43.50% of all debt bases. We believe that in a market environment where interest rate fluctuations have increased significantly, although swing trading strategies have advantages in theory, they are more difficult to operate in practice. Buying and holding coupon strategies may be more cost-effective due to relatively simple operating ideas and relatively neutral performance.

2 Asset performance in the bond market

3 Risk tips

Macroeconomic policies or marginal changes that exceed expectations may cause changes in asset pricing logic and lead to adjustments in the bond market;

Institutional behavior is unpredictable. When institutional behavior is drastically converged and negative feedback is formed, it may lead to adjustments in the bond market;

Risk of fluctuations in precious metals prices.

Nasdaq

Nasdaq 華爾街日報

華爾街日報