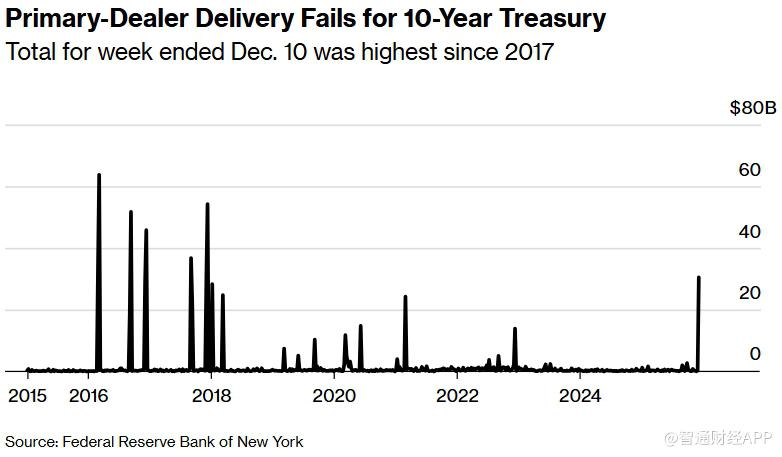

The downsizing of the Federal Reserve triggered a “supply shortage” and the scale of 10-year US debt settlement failure reached an eight-year high

Affected by the Federal Reserve's reduction in treasury bond holdings since 2022, there has been significant friction in the US Treasury bond market recently. According to the latest data, the scale of failed delivery of 10-year US Treasury bonds this month soared to the highest level in eight years, highlighting the imbalance between supply and demand for critical term US bonds in the repurchase market.

The Zhitong Finance App learned that according to data released by the New York Federal Reserve, as of December 10, the volume of transactions involving the latest 10-year US bonds that failed to be settled on schedule reached 30.5 billion US dollars, the highest since December 2017.

Delivery failures are concentrated at a time when interest rates on 10-year treasury bonds of this ten-year treasury bond have declined abnormally. This batch of bonds originated from the 42 billion US dollar auction held on November 12. In the repurchase market, some holders were willing to lend at negative interest rates, and the borrowers agreed to sell them back at a lower price the next day. In this environment, settlement failures are more likely to occur.

Generally speaking, before US bonds are re-tendered, it is not uncommon for related securities to have “special interest rates” in the repurchase market because the new supply is not yet in place. However, before the 10-year US bonds settled on December 15 were re-tendered, the shortage of securities in the market was clearly “unusual.”

Industry insiders pointed out that one of the key reasons is that the amount of US bonds that the Federal Reserve holds and can lend during this period has declined markedly. Jason Schuit, president of South Street Securities, said, “There are significantly fewer treasury bonds available to lend. As far as this 10-year treasury bond is concerned, the scale of the current round of purchases by the Federal Reserve is only half that of the previous three cycles. This directly caused a shortage of supply, which caused delivery failure.”

Specifically, in the November 10-year US bond auction, the Treasury sold 42 billion US dollars to private investors, and the Federal Reserve only added 6.5 billion US dollars to replace maturing debts; in the previous three quarters, under private market issuance of the same scale, the Federal Reserve's additional subscriptions reached 11.5 billion US dollars (February), 14.8 billion US dollars (May), and 14.3 billion US dollars (August), respectively.

This change is directly related to a significant decline in the maturity scale of open market accounts (SOMA) in the Federal Reserve System. On November 15, SOMA's mid-maturity treasury bonds were less than US$22 billion, while the corresponding amounts for February, May, and August ranged between US$45 billion and US$49 billion

The decline in the maturity scale of SOMA stems from the downsizing policy initiated by the Federal Reserve in mid-2022, where maturing treasury bonds are only reinvested when they exceed the monthly limit. The cap has been raised from $30 billion in June to $60 billion in September. Under this framework, the Federal Reserve's additional subscriptions to auctions have been reduced, thereby weakening the supply of borrowable securities in the repurchase market.

Market participants believe that this case shows that as the Federal Reserve continues to shrink, “structural tension” in the repurchase and settlement process of critical term US bonds may occur more frequently, posing a new test for the stability of the short-term capital market.

Nasdaq

Nasdaq 華爾街日報

華爾街日報