Royalty Management Holding And 2 Other Promising Penny Stocks For Your Watchlist

As the U.S. stock market wraps up a holiday-shortened week, major indices like the S&P 500 have reached new all-time highs, reflecting a period of steady gains. For investors willing to explore beyond established giants, penny stocks—often representing smaller or newer companies—can present intriguing opportunities. Despite their vintage name, these stocks remain relevant and can offer surprising value when backed by strong financial health and balance sheet resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.72 | $582.91M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.83 | $661.84M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8702 | $148.82M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.40 | $572.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.40 | $571.19M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.93 | $1.04B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $86.77M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Royalty Management Holding (RMCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Royalty Management Holding Corporation is a royalty company that acquires and develops assets in various markets, with a market cap of $42.63 million.

Operations: The company's revenue is entirely derived from its Unclassified Services segment, totaling $3.80 million.

Market Cap: $42.63M

Royalty Management Holding, with a market cap of US$42.63 million, demonstrates potential in the penny stock arena despite being unprofitable. The company has no debt and maintains a positive cash flow with a runway exceeding three years. It reported revenue of US$3.8 million entirely from its Unclassified Services segment, showing significant growth from the previous year but remains without meaningful revenue streams. Despite volatility and an inexperienced board, it offers some investor appeal through a quarterly dividend and is trading significantly below estimated fair value. Revenue is forecast to grow substantially at 51.82% annually.

- Click to explore a detailed breakdown of our findings in Royalty Management Holding's financial health report.

- Examine Royalty Management Holding's earnings growth report to understand how analysts expect it to perform.

Expensify (EXFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Expensify, Inc. offers a cloud-based expense management software platform serving both the United States and international markets, with a market cap of $142.35 million.

Operations: The company's revenue is derived entirely from its Internet Software & Services segment, totaling $143.91 million.

Market Cap: $142.35M

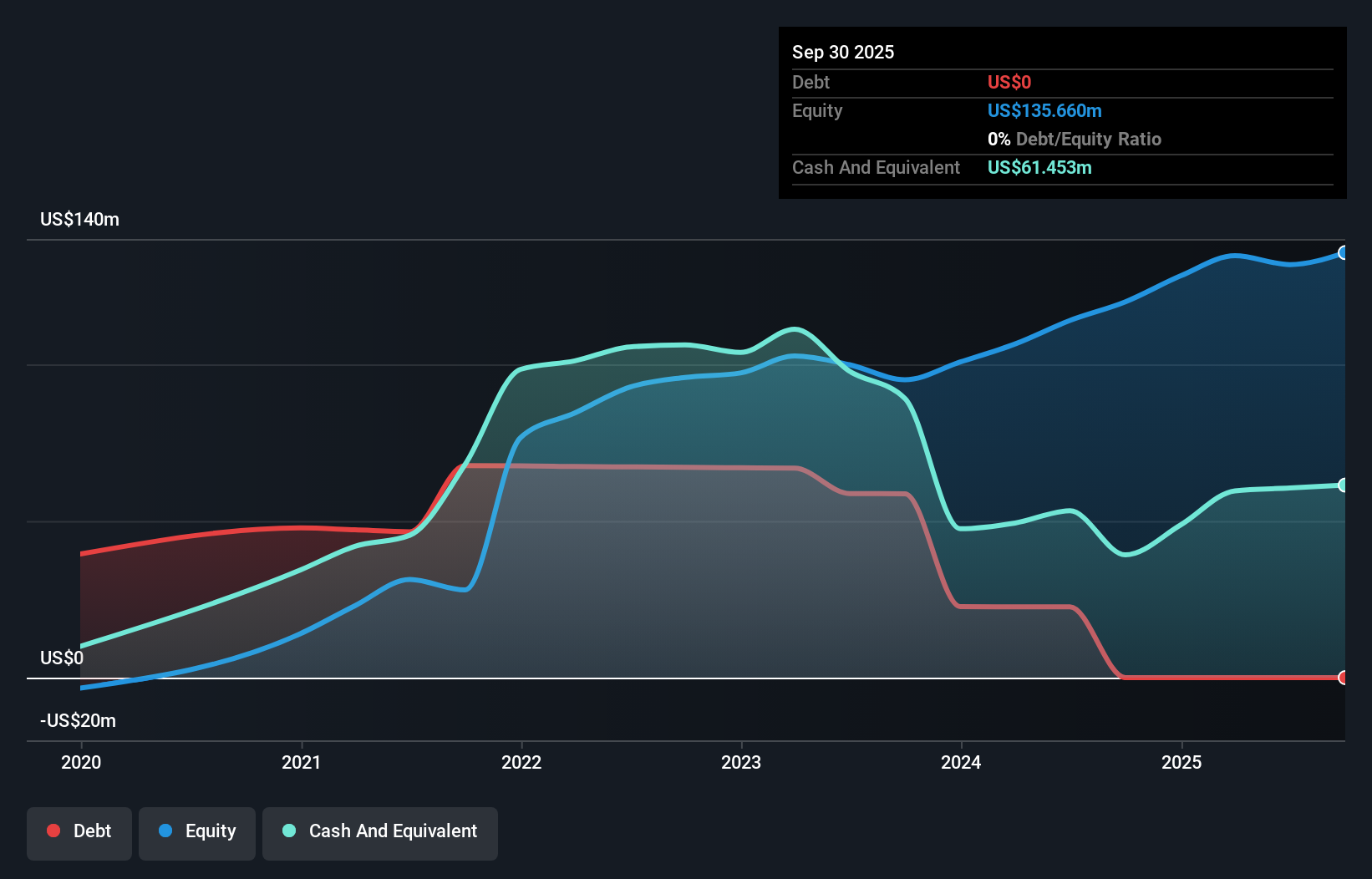

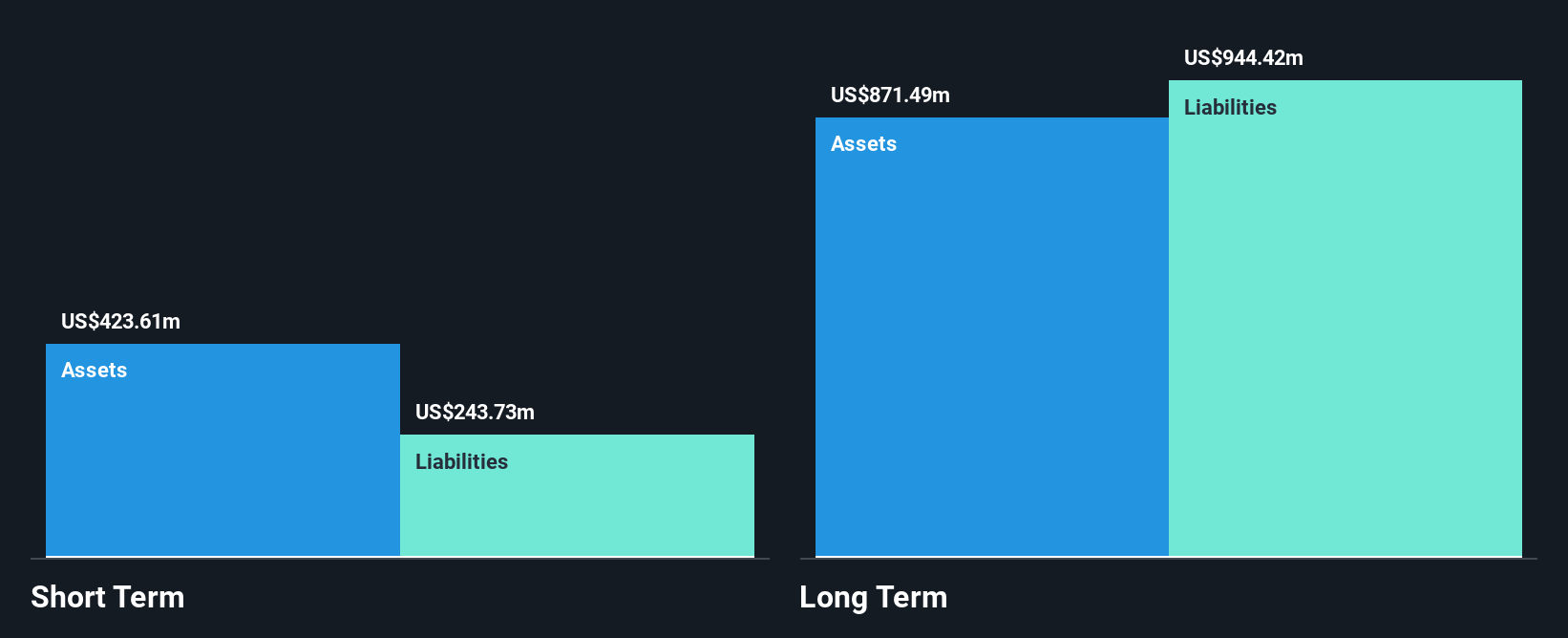

Expensify, Inc., with a market cap of US$142.35 million, presents a mixed picture in the penny stock landscape. Although unprofitable and facing increasing losses over the past five years, it remains debt-free and has sufficient cash runway for more than three years due to positive free cash flow. The company trades below its estimated fair value and offers good relative value compared to peers. Recent integrations with Uber for Business and partnerships like that with the Brooklyn Nets highlight its strategic efforts to enhance service offerings and brand visibility despite challenges in achieving profitability within the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Expensify.

- Gain insights into Expensify's outlook and expected performance with our report on the company's earnings estimates.

Gogo (GOGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gogo Inc. provides broadband connectivity services to the aviation industry both in the United States and internationally, with a market cap of $617.07 million.

Operations: The company's revenue primarily comes from its Gogo BA segment, generating $777.53 million.

Market Cap: $617.07M

Gogo Inc., with a market cap of US$617.07 million, is navigating the penny stock terrain amid several challenges and opportunities. While the company has shown revenue growth, it remains unprofitable and recently faced a legal setback with a US$22.7 million patent infringement ruling against it. Despite high debt levels and short-term assets not covering long-term liabilities, Gogo's management is experienced, and its cash runway appears sufficient for over three years due to positive free cash flow. The company's advancements in 5G technology could drive future revenue growth as it prepares for full service activation by the end of 2025.

- Jump into the full analysis health report here for a deeper understanding of Gogo.

- Explore Gogo's analyst forecasts in our growth report.

Make It Happen

- Embark on your investment journey to our 342 US Penny Stocks selection here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報