US Undiscovered Gems with Strong Potential for December 2025

As the U.S. stock market wraps up a holiday-shortened week, major indices like the S&P 500 are reaching new all-time highs, reflecting a positive sentiment despite broader economic uncertainties. In this environment of rising precious metal prices and steady interest rates, investors may find it worthwhile to explore small-cap stocks that offer unique growth potential and resilience amid fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Euroseas (ESEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Euroseas Ltd. is a company that offers ocean-going transportation services globally, with a market capitalization of $381.65 million.

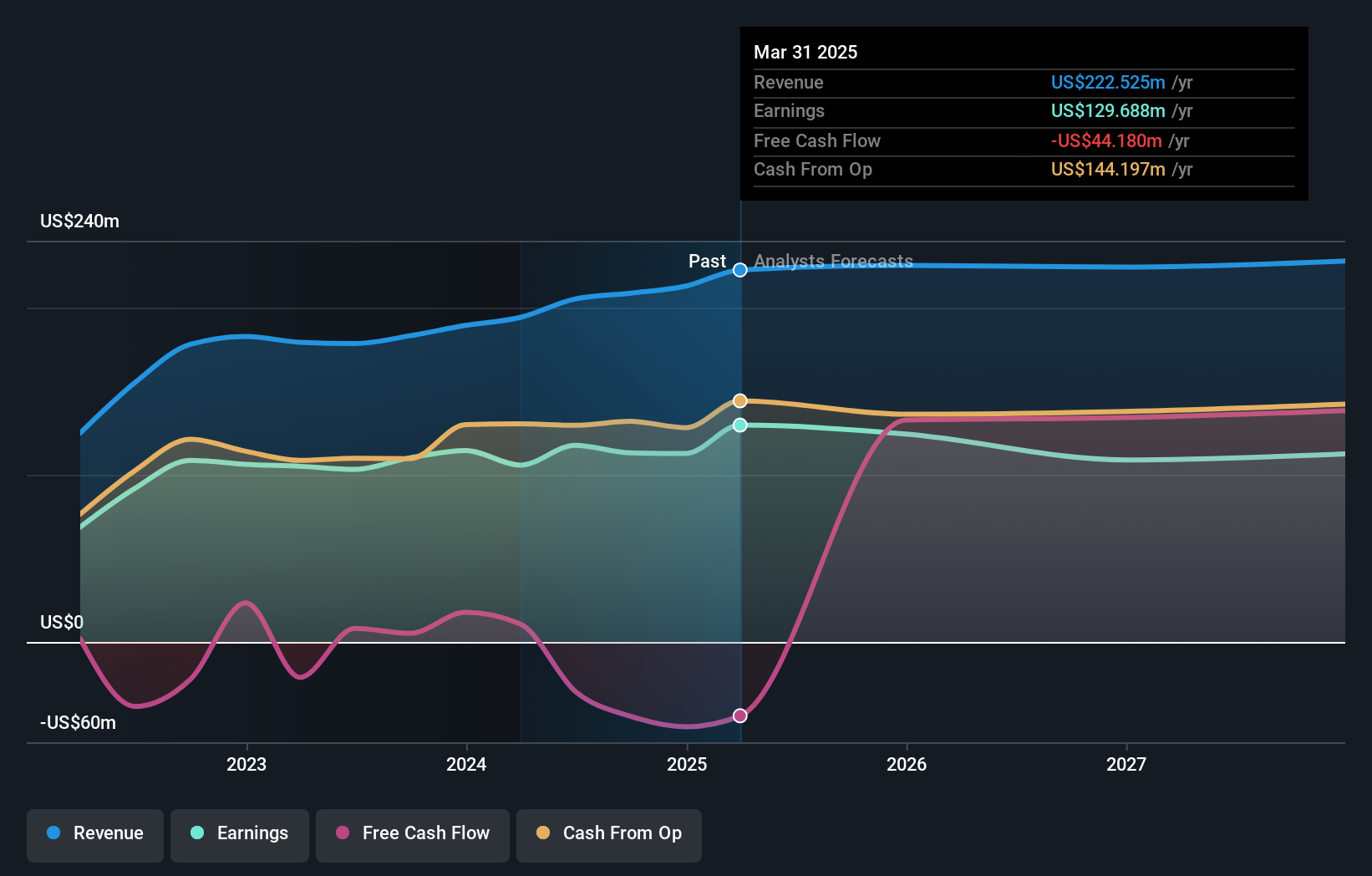

Operations: Euroseas generates revenue primarily from its transportation-shipping segment, amounting to $223.79 million.

Euroseas, a player in the shipping industry, presents an intriguing mix of opportunities and challenges. The company's debt to equity ratio has impressively decreased from 235% to 51.9% over five years, indicating improved financial health. Despite earnings growth of 6.9% last year outpacing the industry's -17.3%, future earnings are expected to decline by an average of 2.2% annually over three years due to potential market corrections and regulatory pressures on charter rates. Recent charters for its vessels could generate around US$75 million in EBITDA, enhancing revenue visibility through 2028 but also highlighting reliance on high charter rates amidst market volatility concerns.

Gibraltar Industries (ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets both in the United States and internationally, with a market capitalization of approximately $1.48 billion.

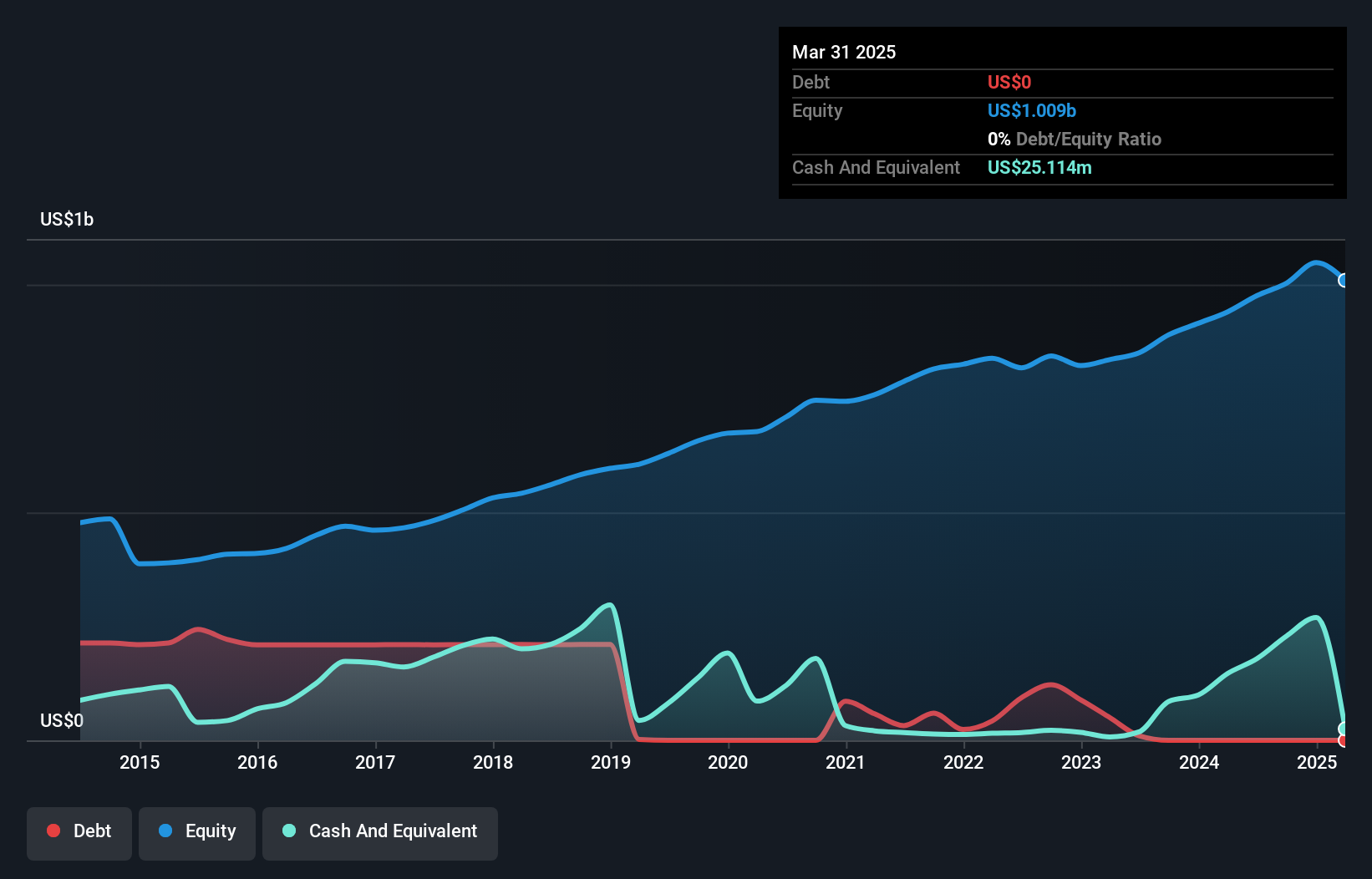

Operations: Gibraltar Industries generates revenue primarily from its residential segment, contributing $811.27 million, followed by agtech at $199.45 million and infrastructure at $87.69 million. The company has a market capitalization of approximately $1.48 billion and experiences variations in its net profit margin over different periods, reflecting changes in operational efficiency and cost management strategies across its diverse business segments.

Gibraltar Industries, a nimble player in the building products sector, has shown robust earnings growth of 26.3% over the past year, outpacing its industry peers. The company boasts high-quality earnings and remains debt-free, which positions it well against market volatility. Despite reporting a net loss of US$89 million for Q3 2025 due to strategic acquisitions like OmniMax International for US$1.335 billion, Gibraltar's sales climbed to US$310.94 million from US$277.13 million the previous year. With a P/E ratio of 10.9x below the market average and future earnings projected to grow at 7%, Gibraltar offers compelling value potential amidst ongoing transformations in its portfolio and operations.

- Delve into the full analysis health report here for a deeper understanding of Gibraltar Industries.

Understand Gibraltar Industries' track record by examining our Past report.

Spok Holdings (SPOK)

Simply Wall St Value Rating: ★★★★★★

Overview: Spok Holdings, Inc., with a market cap of $268.39 million, operates through its subsidiary Spok, Inc. to deliver healthcare communication solutions across the United States, Europe, Canada, Australia, Asia, and the Middle East.

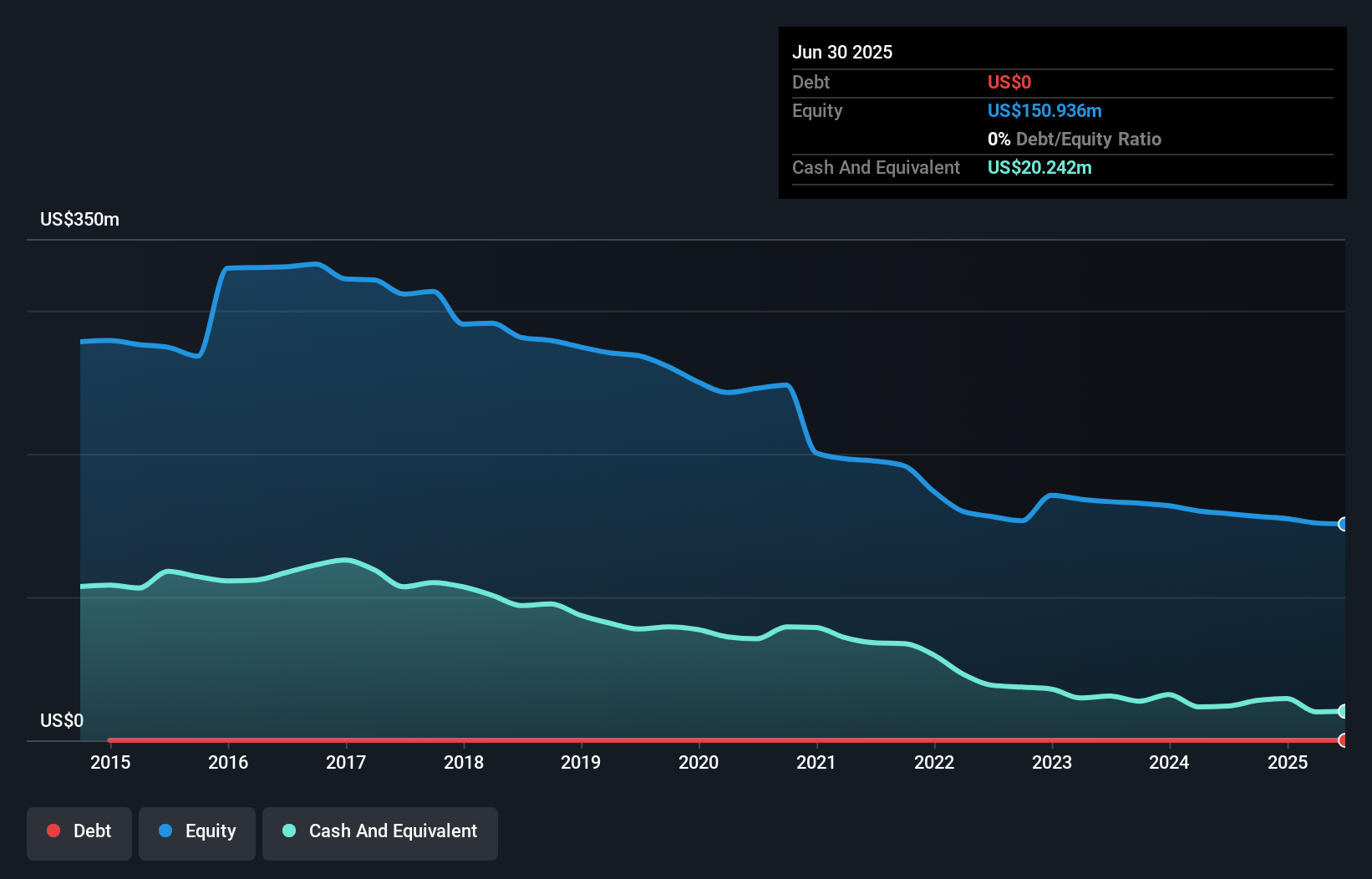

Operations: Spok Holdings generates revenue primarily from its Clinical Communication and Collaboration business, amounting to $139.74 million.

Spok Holdings, a nimble player in the telecom space, has been making waves with its solid financial footing. The company is debt-free and boasts high-quality earnings, reflecting its robust operational framework. Over the past five years, Spok's earnings have surged at an impressive 54.6% annually, although recent growth of 13% trails behind the broader industry’s pace. For the third quarter of 2025, Spok reported US$16.07 million in sales and US$3.2 million net income; both figures slightly lower than last year’s results for the same period but still showcasing resilience amidst market fluctuations.

Seize The Opportunity

- Discover the full array of 299 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報