Overseas bond market inventory at the end of the year: “logical disruption” in 2025, the AI bubble and supply frenzy are making 2026 unprecedentedly complicated?

When looking forward to major trends in the bond market (including various sovereign treasury bonds) at the end of 2024 or the beginning of 2025, no matter what, the factors affecting bond market transactions other than the factors that can be expected to affect bond market transactions, such as heavy inflation pressure and fiscal expansion after Trump's return to the White House, US bonds with high yields continue to attract global low-risk preference capital, and a surge in safe-haven demand due to tariffs. The core factors that shake up the bond market trading pattern can actually also be linked to the epoch-making wave of artificial intelligence (AI) Get involved in relationships.

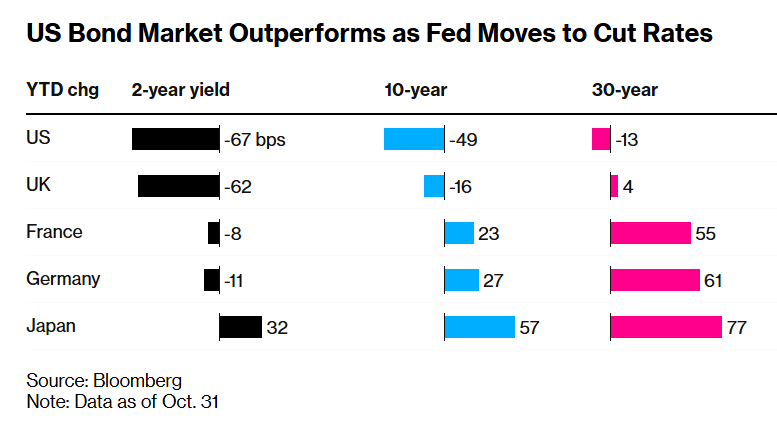

For the US bond market that traders have been focusing on for a long time in 2025, there are both “drastic fluctuations in stock prices” and an annual surprise “as stable as Mount Taishan.” The 10-year US Treasury yield, which has the title of the “anchor of global asset pricing”, fell sharply to around 3.8% in early April after falling US inflation and a frenzied influx of safe-haven funds. Following that, after Trump unleashed an unprecedented tariff bomb on “Liberation Day” and the “term premium” catalyst, it soared all the way to 4.6%. The downward trajectory of the second half of the year was shocked by the downward trajectory of the second half of the year — it actually continued to fall from a high level during the year to the current level of 4. Around 2%. The 30-year US Treasury yield trend can be described as dramatic. Considering the serious challenges it has faced in the past 12 months, it should have entered a sharp upward curve, but as of now, the asset has reached a yield level that is almost the same as at the beginning of the year.

As far as the European bond market is concerned, although all major European economies, including the United Kingdom, are facing their own “difficult experiences,” the overall price of treasury bonds of various matures (especially long-term periods of 10 years or more) continues to fall, driving long-term yields in the European bond market to continue to reach new highs. Basically, the various logics behind it are inseparable from the continuing turbulent political environment in European countries, and against the backdrop of the rapid rise of far-right forces, the financial sector has had to actively expand the scale of debt issuance on the basis of the increasingly high scale of sovereign debt.

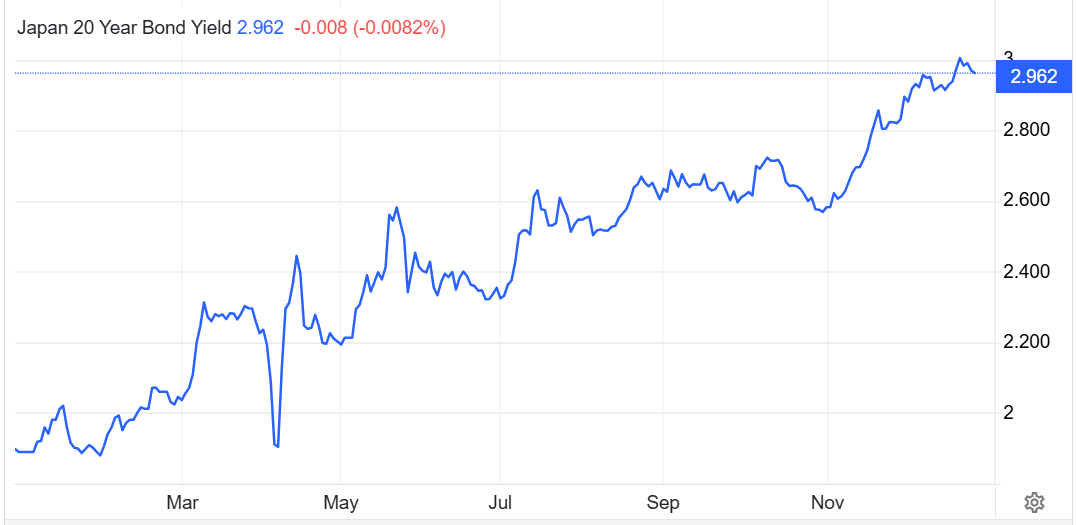

For the Japanese treasury bond market, which has bucked the trend and moved towards an interest rate hike cycle in recent years as the Bank of Japan began a “interest rate cut frenzy,” the two giant blades of interest rate hike expectations and the Japanese government's stimulatory finance can be described as forcing Japanese bond yields, which have been sluggish for a long time since the Abe era, to skyrocket.

Looking at the entire 2025 bond market trading pattern, for global bond market traders, the two core components of the 2025 credit bond market — high-rated corporate bonds (also known as investment-grade corporate bonds) and ABS (asset-backed bonds), known for “no shock” and “stable happy returns” for many years, are definitely the bond trading market that shocked them the most in 2025.

In the corporate bond trading market, especially when the AI bubble swept the world from the end of October to November, the long-term high-rated technology giant corporate bonds with Oracle and Facebook's parent company Meta as the core were fluctuating enough to match their stock price fluctuations. Among them, Oracle's cloud computing business revenue generation depended too much on the loss-making OpenAI and tech giants to build AI data centers through unprecedented debt issuance, and the yield on Oracle corporate bonds directly soared higher than “junk bonds” (also known as “junk bonds”) (also known as “junk bonds”) The yield used as the benchmark for high-yield bonds).

On the other hand, ABS, which is known for its stability and low volatility, and “high-yield corporate bonds,” which have been rejected by the market for many years, are comparable to “gold” in the bond market — that is, the safe-haven target in bonds. ABS and high-yield corporate bonds have rarely outperformed high-rated corporate bonds since November, and have been favored by global bond market traders in one fell swoop, driving a significant decline in yield.

As a result, a bold conjecture about the 2026 bond market surfaced: when investor sell-off fears triggered by the AI bubble hit together with the bond market supply frenzy, which is disrupting the inherent trading logic of the bond market since 2020, ABS, high-yield bonds, and 10-year or more US bonds, which have been rejected by the market for a long time in recent years, will soon usher in a “super bright moment” in 2026. This will also completely disrupt the recent bond market trading logic — In other words, the pattern where short-term US bonds and high-rated technology corporate bonds continue to be favored by traders will be completely disrupted.

The 30-year US bond will become the “most amazing” asset in 2025! Europe and Japan join hands to enter a trajectory of soaring yields

For short-term US bond assets (usually 2 years or less), this year can definitely be considered a “bull market year.” The overall price trend of US 2-year treasury bonds in 2025 is steadily rising, driven by the continued cooling of inflation, the crazy influx of safe-haven funds due to Trump's “Liberation Day” tariff policy into short-term US bonds, and expectations that the Federal Reserve will cut interest rates. Short-term yields are extremely sensitive to monetary policy expectations, so under the influence of “tariff fear+interest rate cut expectations,” US bond yields of 2-year terms and below have declined steadily this year.

If you buy US 2-year treasury bonds at a yield of around 4.5% at the end of 2023, you will not only be able to enjoy fixed income by the end of this year, but also the benefits brought about by the drastic price expansion. By the close of the US stock market on Wednesday, the 2-year US Treasury yield was hovering around 3.50%, which can be described as a steady decline from 4.2% since the beginning of the year — that is, bond prices have continued to rise.

Since Trump returned to the White House to assume US presidency, America's central primacy in the global bond market has been questioned time and time again. From comprehensive reciprocal tariff policies and tax cuts to huge budget deficits, to Trump's own ongoing criticism of the Federal Reserve's independence, many Wall Street investors have been sounding almost the same ominous alarm: “America's economic exceptionalism” is coming to an end, “sell all American assets” (Sell America), especially US Treasury bonds, which are facing huge budget deficit pressure and aggressive tariffs leading to a potential inflationary crisis.

However, despite this, global investors continued to pour into the US sovereign debt market, driving a huge rebound in the US bond market in the second half of this year — large Wall Street investment institutions that say “America's exceptionalism is already in the process of collapse” are actually taking advantage of the high yield period to frantically buy US debt.

2025 can be described as a “sharp fluctuation rare in history” for 10-year US Treasury assets. The 10-year US Treasury yield, which has the title of “the anchor of global asset pricing,” fell sharply to around 3.8% in early April after falling US inflation and a frenzied influx of global safe-haven funds. However, just a few days later, as Trump announced aggressive tariff measures for the world on the so-called “Liberation Day,” the “US economic exception theory” tends to collapse, inflation expectations are making a comeback, and Trump's continued pressure on the Federal Reserve since taking office caused the market to increasingly doubt the independence of the Federal Reserve. Coupled with tax cuts and deregulation measures in the “Big and American Act” led by the Trump administration, the market at the time seemed likely to drive the scale of debt issuance to become larger. That led to 10-year US Treasury yields shortly thereafter At one point, it soared to 4.6%, a high of around 4.6% during the year.

However, since the second half of the year, the 10-year US Treasury yield has unexpectedly entered a downward trajectory. Currently, it is hovering around 4.15%, mainly due to the fact that Trump's tariff stance cools down, inflation is still largely strictly controlled by the Federal Reserve under high interest rates, and expectations for a “Golden-style soft landing” continue to heat up, compounded by the huge flow of safe-haven funds brought about by the AI bubble that swept the world from the end of October to November (usually in large-scale panic events similar to the bursting of the Internet bubble, Long-term treasury bonds with higher yields are more attractive than short-term bonds), and global capital is once again flocking to 10-year and longer-term US bonds.

Furthermore, expectations of the Federal Reserve's interest rate cuts continue to heat up, the Treasury's tariff revenue increases, and the Trump administration's intention to cut the deficit through plans such as layoffs and to reduce financing costs and long-term asset risks by issuing short-term bonds rather than long-term bonds also drive long-term US bond yields to continue to decline. Compared with US bonds, the world's mainstream sovereign bond markets — European bonds and Japanese bonds, as well as Australian and New Zealand bonds, are sluggish. The US still seems to be a “less bad” investment choice in the outside world, the so-called “most” Clean dirty shirt”.

US 30-year treasury bonds, which have been overlooked by the market in recent years, can be called the “most amazing asset” of 2025. As 2025 comes to an end, unlike the continued rise in short-term US bonds and the sharp decline in 10-year US Treasury bonds, the “anti-decline performance” of 30-year US Treasury yields did not change at all from the beginning to the end of 2025 (around 4.8% at the beginning and end of the year) left traders astonished.

After disassembling the trend of 30-year US bonds, there was no significant decline or upward trend under the full-year benchmark: First, although the macroeconomic environment fluctuates sharply — inflation continues to rise above target, fiscal deficits widening, and market risk aversion may drive changes in yield, institutional investors (pension funds, insurance companies, mutual funds, etc.) have maintained strong demand for long-term bonds, providing important support for prices. These long-term funds need to match long-term liabilities through long-term assets, thus continuing to absorb potential supply of 30-year bonds in auctions and markets to offset potential supply stress and negative shocks. Second, increased safe-haven attributes and security preferences have also increased demand for ultra-long-term treasury bonds; when the “AI bubble theory” led to huge fluctuations in global equity bonds and rising monetary uncertainty such as the US dollar, the role of long-term US bonds as a “safe haven” was strengthened. Finally, due to repeated fluctuations in inflation expectations, “term premium” disturbances, and market uncertainty about the Fed's future interest rate path during some time this year, the downward impact of interest rate cut expectations on long-term yield was partially limited, so that although the yield fluctuated during the year, it did not generally break significantly above the level at the beginning of the year. This game between supply and demand and expectations together contributed to the “stability of the 30-year yield.”

In terms of European bonds, the main logic of the surge in German 10-year treasury bond yields is that the ruling coalition formed by the Coalition Party (CDU/CSU) and the Social Democratic Party (SPD) is not united and has only a very weak majority in parliament. Furthermore, the German government shouted the slogan “at any cost” to promote German military and defense construction and infrastructure renewal and construction — the scale of next year's bonds may reach a record 500 billion euros, leading to a sharp rise in full-term German bond yields, and the logic that the price of full-term British Treasury bonds continues to fall. It is similar to Germany's fiscal expansion, but it also includes the Bank of England's interest rate cut expectations that continue to cool down against the backdrop that UK inflation has already begun to pick up.

The logic of the continuous expansion of French 10-year treasury bond yields, in addition to being similar to the continuous expansion of the budget deficit and the scale of debt issuance throughout Europe, is mainly due to the continuous turbulent political environment in France — for example, frequent rotation of the French prime minister (four different people serve as prime minister within 1 year), leading to more and more doubts about French treasury bonds. Furthermore, currently France is basically in a “suspended parliament (suspended parliament) + minority government” state. The cost of political negotiations is high, and there is great uncertainty about legislation and budget progress, so there is great uncertainty about budget cuts, immigration, and overall welfare control. Instability at the policy implementation level has increased markedly.

The yield on Japanese treasury bonds, especially the yield on 20-year, 30-year, and 40-year long-term bonds, has repeatedly reached record highs. The main logic behind it differs from the US and Europe, mainly because the Bank of Japan's interest rate hike expectations continue to heat up, and the Takaichi Sanae government's huge incremental stimulus plan at the level of 10 trillion yen led to a disheartening “term premium” floating across the ocean from the US to Japan, and has completely taken the Japanese stock exchange market by storm.

According to the latest market news, Bank of Japan Governor Ueda Kazuo suggested that interest rates may be raised further next year by expressing growing confidence in the central bank's achievement of sustainable price growth; Japanese Prime Minister Takaichi Sanae said on Thursday that the total budget for the fiscal year beginning in April 2026 was about 122.3 trillion yen (786 billion US dollars), an increase of about 6.3% over the 115.2 trillion yen already disbursed this fiscal year. The increase in expenditure even exceeded the growth rate of inflation, setting the largest initial budget record in history. Given that Japan is still the most heavily indebted country among advanced economies, fiscal spending of this scale is bound to further boost long-term treasury bond yields, which have continued to soar since this year.

Oracle's yield “soared” from investment grade to junk level! AI bubble storm sweeps through credit bond market

Since the end of October, the “AI bubble rhetoric” has swept the global financial market. Coupled with the massive borrowing and issuance frenzy of US tech giants, including Meta, Amazon, and Oracle since the second half of 2025, and signs of panic and liquidity pressure in the private credit market, are deterring the flow of capital from the bond market that lends to the world's highest-rated companies. This trend may greatly drive up financing costs and drastically reduce global corporate profits, and add new selling pressure to the already tense and uneasy financial market.

The core of market anxiety focuses on the AI investment logic itself. Recently, the “AI circular investment” led by ChatGPT developer OpenAI has become increasingly exaggerated, and the unprecedented large-scale borrowing of AI data centers by giants such as Oracle jeopardizes financial fundamentals, causing the market to increasingly worry that “the AI bubble is about to burst”. After all, most investors still don't believe that OpenAI with annual revenue of less than 20 billion US dollars can bear 1.4 trillion US dollars in AI infrastructure expenses — although OpenAI has the ability to continuously raise 10 billion US dollars in financing, the market still places more importance on actual revenue generation. As time passed, market concerns about “the AI bubble is forming and not far from bursting” continued to heat up.

This sentiment is beginning to be reflected in mainstream institutional views. Research reports recently released by Goldman Sachs show that large technology companies that have invested the most money in the hope of winning this AI equipment competition may face a highly uncertain return on investment for quite some time. Goldman Sachs said that the story about AI is now at the “end of the prelude” — that is, it is now at the “end of the beginning” of the AI story in the market. The bull market where most of the value created by AI will be attributed to the AI language model and the general bullish market for all assets “associated with the AI concept” is likely to have come to an end, and the market's screening of the real beneficiaries will become more strict. Ed Yardeni, founder of Yardeni Research, recently even suggested that investors “reduce” their holdings of seven tech giants including Nvidia compared to the rest of the S&P 500 index. This is the first time since 2010 that he has changed his position on increasing his holdings in the major US technology sector.

Meanwhile, pressure on the debt side is rapidly building up. As of the first week of December, global technology companies had issued a record $428.3 billion in bonds in 2025, according to Dealogic data. Among them, the issuance scale of US corporate bonds reached 341.8 billion US dollars, while European and Asian technology companies issued 49.1 billion US dollars and 33 billion US dollars respectively. The scale of debt issuance in these three major markets has reached historic highs.

In the context of the heated AI computing power infrastructure competition, even high-rated technology companies with plenty of cash have to borrow money on a large scale to support related investments. Morgan Stanley predicts that the total investment in global hyperscale AI data centers will be about 2.9 trillion US dollars by 2028, of which more than half (about 1.5 trillion US dollars) will need to rely on external financing.

According to information, Amazon recently launched its first investment-grade bond issuance in three years, and plans to raise 15 billion US dollars; Oracle plans to fund its large-scale AI data center project in cooperation with OpenAI through huge debt financing — a debt financing transaction of about 38 billion US dollars is underway. This is also the largest AI infrastructure debt financing so far. Furthermore, the investment scale of the “Stargate” program, which is a joint venture between SoftBank and Oracle, is expected to exceed 400 billion US dollars over the next three years.

This kind of capital expenditure, which is almost a gamble, has put tremendous pressure on an otherwise stable balance sheet. Investors with a keen sense of smell in the bond market began to re-evaluate the risk of default by these tech giants, and the credit pricing system experienced severe shocks.

As the most intuitive weather vane for the “AI bubble theory,” the credit default swap (CDS) market has taken the lead in flashing a red light. Recently, Oracle's 5-year credit default swap (CDS) spread has almost doubled to 150 basis points in the past two months, which means it has soared to a high level since 2009. Even Microsoft's CDS spread has risen sharply from around 20.5 basis points at the end of September to about 40 basis points. Bond yields also show the “distortion” of credit ratings: the yield on Oracle's corporate bonds due in 2035 rose to 5.9%, surpassing the level of some high-quality “junk bonds,” suggesting that the market is pricing its credit risk away from investment-grade status.

The coupon interest rate for Japanese yen bonds issued by SoftBank in November has also reached 3.98%, a record high in 15 years, reflecting a substantial rise in financing costs.

For the world's largest cloud computing service providers such as Oracle, they not only have to bear interest pressure, but also face the structural risk that orders are highly dependent on a single major customer (such as OpenAI). John Stopford, head of multi-asset earnings at Ninety One, pointed out that when the borrowing boom and the supply of new bonds emerge at the same time, rising borrowing costs will directly reduce profit margins, and may eventually break the market's excessive imagination of the AI boom.

In a macroeconomic environment where AI borrowing frenzy has begun, the private credit market, which has recently experienced frequent thunderstorms, and the “AI bubble argument” continues to disrupt market risk appetite, those high-rated corporate bonds are historically low and seem to be the safest. Instead, they have recently become the asset most likely to be reduced by Wall Street institutions, or even shorted on a large scale.

Bank of America strategist Michael Hartnett, who has the title of “Wall Street's Most Promising Strategist,” made a bold prediction in his latest report: the “best deal” to enter 2026 will be to short the corporate bonds of “hyperscalers” (hyperscalers) that have invested heavily in the AI field. He believes that the debt pressure caused by the accelerated construction of AI data centers will become the new “Achilles' heel” for these tech giants.

“If the AI lending boom continues to heat up and a large number of new issues emerge in the market, then borrowers will have to pay a higher price. If it were more expensive for companies to borrow money, they would earn far less money, which in turn could completely burst the market's false boom bubble. ” John Stopford, head of multi-asset earnings at Wall Street asset management firm Ninety One, said in a report and added that he had reduced his fund's credit exposure to almost zero in the past few weeks.

2026 bond market trading keywords: long-term US bonds, high-yield bonds and ABS

According to Wall Street's top investment institutions' strategic outlook for the 2026 bond market, long-term US bonds in 2026 will have more investment prospects than short-term US bonds. The main logic behind it is that the rise in prices brought about by the tariff policy will eventually prove to be a temporary inflationary disturbance in the first half of 2026, that Trump's upcoming nomination of the Federal Reserve Chairman's position will be biased towards dovish, and that short-term US bonds have been overvalued and long-term US bonds will continue to be subject to “term premium” fluctuations caused by deficit expectations in 2025, not fully pricing the path of interest rate cuts and the Treasury's tendency to issue short-term US bonds — at least the market clearly shows that the Trump administration is unwilling to see long-term US bond yields continue to be high Furthermore, we can also see the Trump administration's intention to gradually reduce the budget deficit. Coupled with a long-term period around 4% yield, it is extremely attractive in 2026, when the “AI bubble storm” could strike at any time, so long-term US bonds in 2026 are more flexible than short-term bonds that have continued to be strong in recent years.

However, the trend of short-term US bonds with a term of 2 years or less in the first half of next year is likely to be stronger than long-term bonds, mainly due to the fact that the 40 billion US dollar monthly debt boost measures announced by the Federal Reserve in December will benefit short-term US bonds. The operation mainly buys short-term bonds (T‑Bills) to maintain sufficient reserves in the financial system and ease short-term interest rate pressure in the money market rather than large-scale quantitative easing (QE) in the traditional sense, but the term “the Federal Reserve participates in debt purchases” alone can greatly enhance the demand and liquidity of short-term US bonds in the short term.

Compared to global core sovereign bonds such as European bonds and Japanese treasury bonds, US debt, which has long held the title of “safe-haven plus high quality,” can be called “unique.” Compared to Europe and Japan, where the economic prospects are still uncertain, the US economy's “soft landing” trajectory is becoming more and more clear. “When you look at other alternatives, they all face serious challenges,” Ruben Hovhannisyan, a fixed-income fund manager from TCW, said of the excellent performance of long-term US bonds in the second half of the year. “The 'cleanest dirty shirt' analogy is very, very appropriate, and there isn't a very clear high-liquidity alternative that can replace long-term US debt.”

“Although the overall environment of the US market is becoming more chaotic and unusual, when you look at the data, the market narrative is not consistent with the price trend.” he emphasized. “Although the narrative logic of the end of 'American exceptionalism' still exists, US Treasury bonds are quite competitive and attract continued inflows of foreign capital. When you look at the global bond market as a whole and the differences in each economic cycle, there isn't a persuasive enough bond-market alternative story to easily tell.”

Daniel Ivascyn, fund manager from Pimco, recently stated: “Lower interest rate expectations in the US market and rising global economic uncertainty will fully push risk-averse investors who wait and see the currency to fully push the US Treasury bond market with fixed returns.” “As the Federal Reserve relaxes its policy, you'll see a situation where credit risk in some economies may continue to rise while your cash returns continue to decline. And this may continue to support high-quality long-term fixed income assets, such as 10-year US Treasury assets.”

Wall Street financial giant Morgan Stanley recently said that in 2026, the market trading logic may fully return to “bad news is bad news,” and that 10-year and more long-term US bonds, which have an advantage in price elasticity and yield, will return to the position of portfolio ballast stones in the 20 years before the pandemic. This also means that long-term US bonds are expected to enjoy the influx of safe-haven funds brought about by major mood swings such as the “AI bubble” in 2026, as well as the “Golden Girl style” of the US economy The “soft landing narrative” (that is, refers to the long-term institutional capital flow brought about by the US economy being lukewarm, just right, maintaining moderate “moderate growth” in GDP and consumer spending, and a long-term stable “moderate inflation trend”, while the benchmark interest rate is on a downward trajectory). According to the latest forecasts from Wall Street asset management giants Franklin Templeton Investments and TD Securities, the 10-year US Treasury yield by the end of 2026 may fall below 3.5%, which means that strong demand is expected to drive prices to continue to rise.

In contrast, the logic of European bonds is completely opposite — that is, short-term and long-term European bond yields are likely to move towards the classic curve of “steeper upward”, mainly because the ECB's interest rate cut cycle has basically stagnated, the attractiveness of US bonds is still stronger than the European continent where the economy is weak and the political situation is unstable, Germany's unprecedented scale of debt issuance, and French political chaos; more notably, the ECB's debt purchase framework (that is, PEPP and APP) will completely stop, which means that Europe's 2026 hyperscale bond supply will depend entirely on market demand, leading to the short-term European bond supply curve due to market demand Required Imbalances are sharpened rather than rationally sharpened.

Japan, on the other hand, is also likely to have both short-term and long-term treasury bonds. After all, the interest rate hike cycle continues to be suppressed, and the yield on long-term Japanese treasury bonds of 10 years or more driven by “term premiums” may continue to reach record highs until the Bank of Japan sends a signal to suspend interest rate hikes. As we all know, Japan's overseas assets are huge, so if the yield on Japanese treasury bonds soars in the short term, this may trigger a large-scale return of massive capital from the large amount of overseas assets that have already been profitable to Japanese yen assets embracing high yields. At that time, it may lead to a global collapse in global equity remittances similar to the “Black Monday” event in August 2024. This is worth being wary of investors.

For corporate bonds, which are one of the core parts of the credit bond market, the market may prefer high-yield bonds in 2026 — so-called “junk bonds,” especially the “soft landing+moderate interest rate cut” narrative, which is simply a macro-narrative tailored to high-yield bonds. The price of these high-yield corporate bonds is more stable than that of the ever-expanding investment-grade bond pricing logic led by tech giants such as Oracle, Microsoft, and Meta. There is no need to take into account the huge bear shock that the “AI bubble burst” narrative may bring, and as the US government shifts to the implementation and formal implementation of the “Big and Beautiful Act” and the huge far-right forces fueled by global populist sentiment, not only will the Trump administration focus on “making America great again,” but the world will also focus more on boosting the domestic economy, so the global stock market will be more focused on boosting the domestic economy. It will show broader diversified rotation characteristics, and future investment opportunities will no longer focus on AI — similar global economic growth logic and the “rotating bull market in the market sector” can be called a huge catalyst for high-yield bonds.

The global stock market crash caused by the AI bubble and the Oracle and Meta bond frenzy led to the collective collapse of high-rated technology corporate bonds. These negative trends, combined with the Federal Reserve's interest rate cut cycle, gave high-yield bonds and ABS, which had been looked down upon for a long time, an excellent opportunity for a rebound. Goldman Sachs said in its 2026 outlook report that although the overall balance sheets of technology companies are still strong, the global AI data center construction process is increasingly dependent on debt financing, which may make the credit market more vulnerable.

Goldman Sachs analysts believe that even if the global stock market continues to rise, it may be accompanied by rising stock volatility and widening credit spreads, similar to the scene on the eve of the collapse of the 1998-2000 tech bubble. Under this trend, high-rated bonds with valuations near historical highs may follow the decline in the stock market, while high-yield bonds usher in investment opportunities. Goldman Sachs believes that high-yield bonds with very little correlation with AI infrastructure may be “one of the core sources of fixed income” in 2026. Fundamentals (interest coverage, default rate, etc.) are still resilient, but the implicit premise is still “the selection of strategy/structure and individual securities is important.” Another Wall Street financial giant, Bank of America, suggests investors shift their positions from highly valued tech giants to assets such as international small and medium capitalization stocks, high-yield bonds, and gold.

Another credit fixed-income asset, ABS, may also outweigh high-rated corporate bonds in 2026. Morgan Stanley clearly regards MBS/ABS as its “highest confidence overload” for fixed income, and is particularly optimistic about high-rating/strong fundamentals ABS. Since 2025, although the overall earnings of ABS have fallen short of corporate bonds, the credit spread trend since November has been significantly superior to the overall corporate bond market, particularly significantly superior to the trend of technology corporate bonds, highlighting the value of a safe haven under the fear of the AI bubble. The advantages of ABS mainly come from a shorter period of time and extremely low fluctuation+stable cash flow due to structured credit enhancement/cash flow amortization. Compared with “AI-heavy capital expenses/more sensitive to financing narratives” investment-grade technology corporate bonds such as Oracle, Meta, and Microsoft, high-rated and short-term ABS is expected to show the alpha attributes of credit bonds in a context where the haze of the “AI bubble” is difficult to dissipate.

Nasdaq

Nasdaq 華爾街日報

華爾街日報