Exploring High Growth Tech Stocks In The US December 2025

As the U.S. stock market continues to reach new heights, with major indices like the S&P 500 setting all-time records, investor sentiment remains buoyant despite recent volatility in tech shares. In this thriving environment, identifying high growth tech stocks involves looking for companies that not only show robust revenue potential but also demonstrate resilience and adaptability amid shifting economic landscapes.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Palantir Technologies | 28.00% | 32.57% | ★★★★★★ |

| Kiniksa Pharmaceuticals International | 17.51% | 33.44% | ★★★★★☆ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.08% | 84.58% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Applied Optoelectronics (AAOI)

Simply Wall St Growth Rating: ★★★★★☆

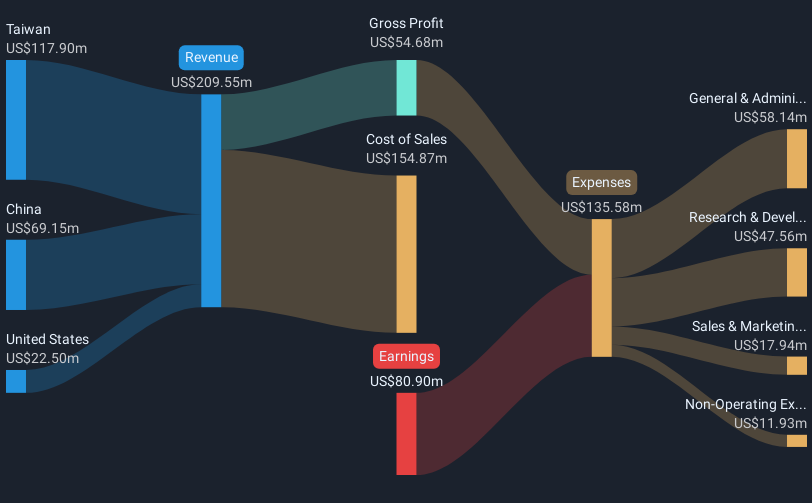

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market cap of $2.80 billion.

Operations: The company primarily generates revenue from its optical networking equipment segment, amounting to $421.71 million.

Applied Optoelectronics, a key innovator in the tech sector, recently unveiled a 400mW laser critical for AI data centers, highlighting its push into high-demand silicon photonics and co-packaged optics. This move is pivotal as it supports hyperscale customers needing robust, efficient light sources for advanced optical communications. Despite current unprofitability and a volatile share price, AOI's revenue is expected to surge by 43% annually. The firm also anticipates turning profitable within three years with earnings growth projected at an impressive 168.5% per year. These developments could significantly enhance AOI's market position by catering to the burgeoning needs of AI-driven data infrastructures while stabilizing its financial footing in the competitive tech landscape.

Agilysys (AGYS)

Simply Wall St Growth Rating: ★★★★☆☆

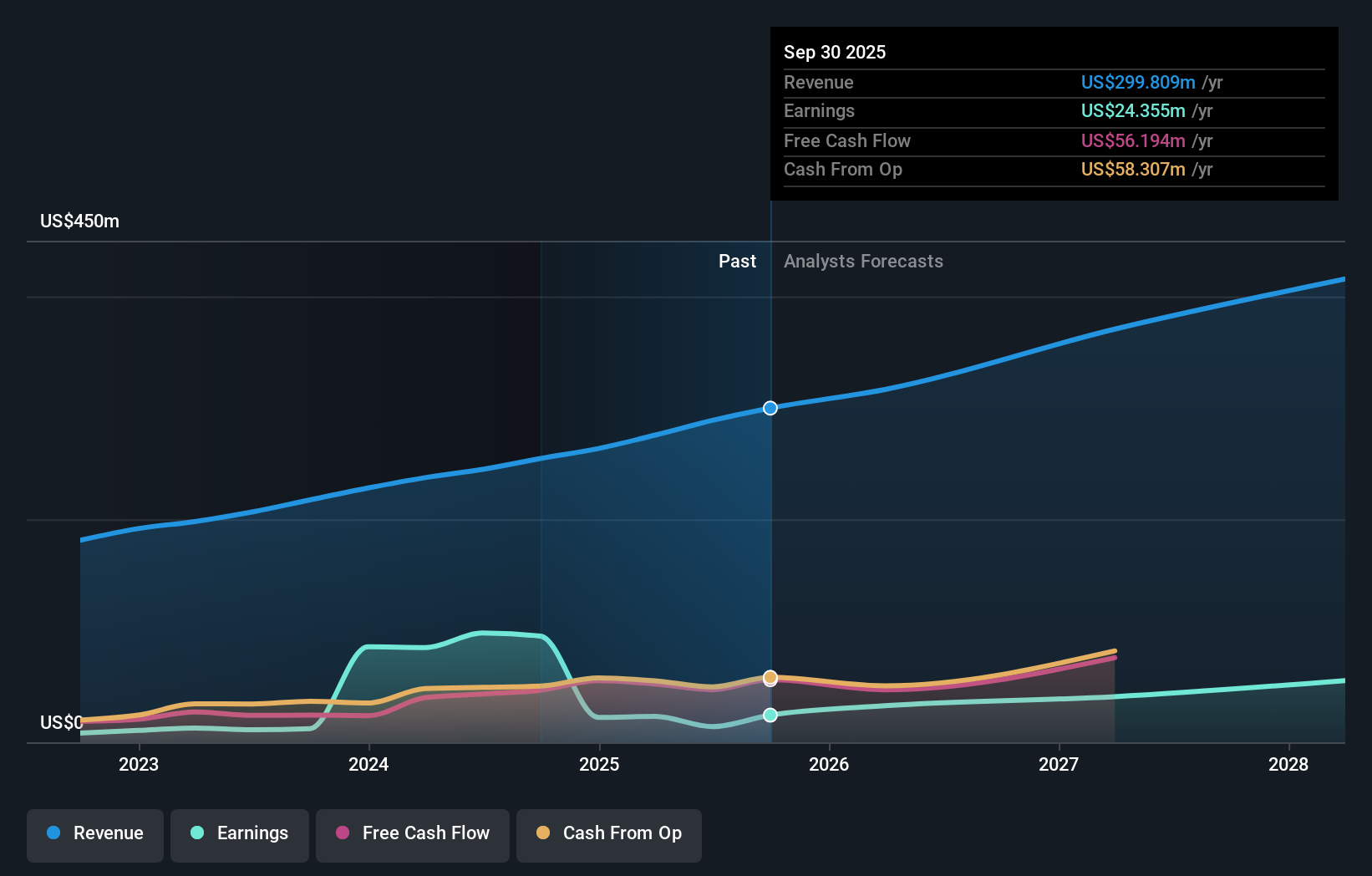

Overview: Agilysys, Inc. is a company that develops and markets software-enabled solutions and services for the hospitality industry across North America, Europe, the Asia-Pacific, and India with a market cap of $3.35 billion.

Operations: The company focuses on software solutions for the global hospitality industry, generating $299.81 million in revenue.

Agilysys is making significant strides in the tech landscape with its recent enhancements and client acquisitions, notably with IHG Hotels & Resorts and Streamsong Resort. The company's cloud-native InfoGenesis POS platform has become a global solution across IHG’s various hotel segments, demonstrating scalability and flexibility in high-demand service areas. Additionally, Agilysys Golf and the Mobile Caddie App are transforming golf course operations by integrating real-time scheduling and communication technologies that boost operational efficiency significantly. These innovations not only solidify Agilysys's position in hospitality technology but also reflect its commitment to advancing industry standards through substantial R&D investments, which have supported a robust annual revenue growth of 13.6% and an impressive earnings growth forecast of 29.4% per year.

- Navigate through the intricacies of Agilysys with our comprehensive health report here.

Gain insights into Agilysys' historical performance by reviewing our past performance report.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

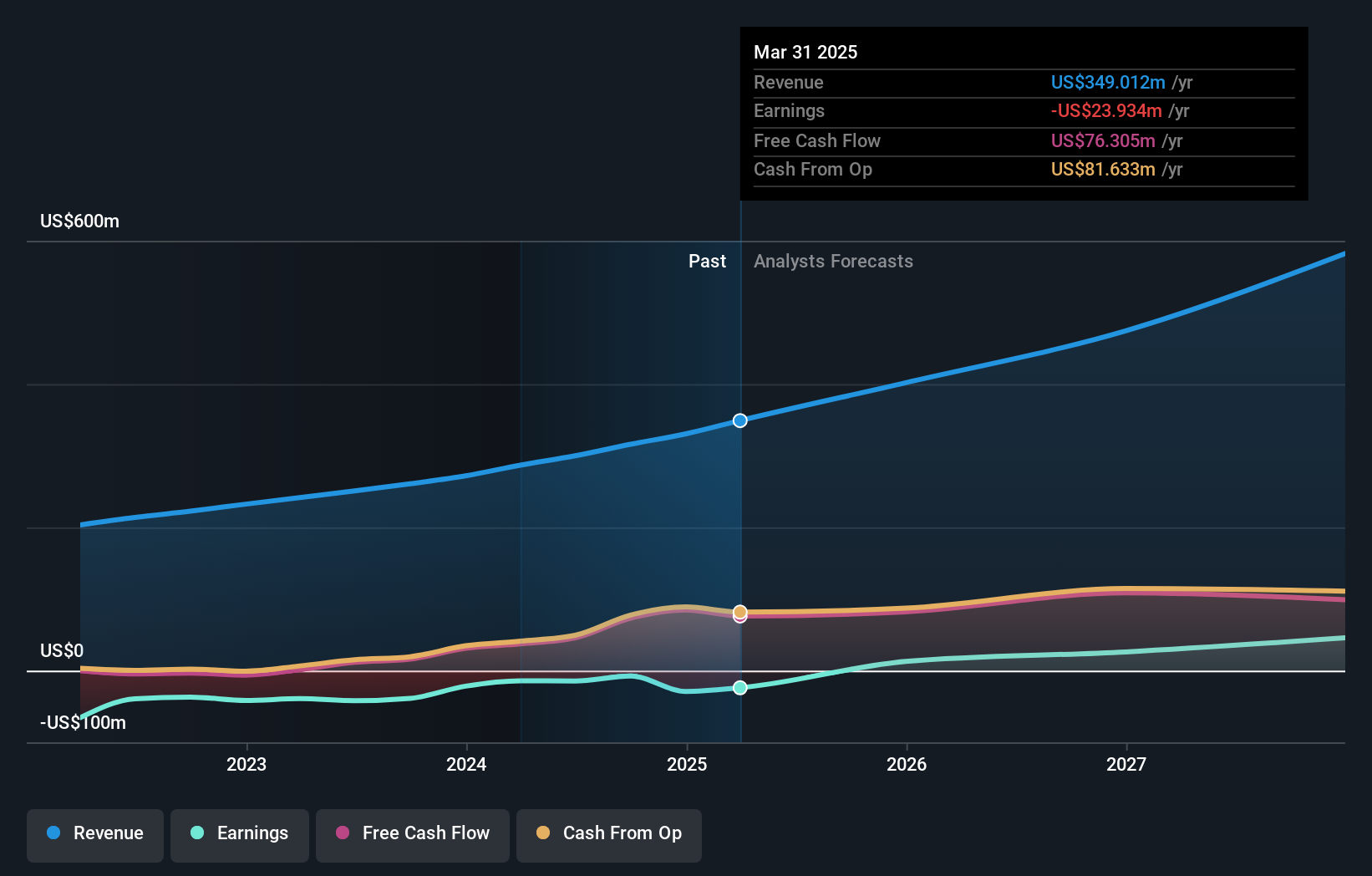

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of approximately $2.93 billion.

Operations: The company's primary revenue stream is from its software and programming segment, generating approximately $394 million. Its operations span multiple regions, offering cloud-native data management solutions.

AvePoint has demonstrated robust growth, particularly in its agentic AI governance capabilities with the recent launch of AgentPulse. This innovation addresses rising security risks and operational costs associated with AI agents, a crucial area as 75% of organizations using AI reported breaches last year. Financially, AvePoint's revenue growth is impressive at 17.3% annually, outpacing the US market average of 10.7%. Furthermore, its earnings are expected to surge by approximately 70.9% annually, significantly ahead of the market's 16.2%, reflecting strong operational execution and market demand for their specialized software solutions.

- Get an in-depth perspective on AvePoint's performance by reading our health report here.

Assess AvePoint's past performance with our detailed historical performance reports.

Where To Now?

- Take a closer look at our US High Growth Tech and AI Stocks list of 72 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報