Promising Penny Stocks To Watch In December 2025

As the U.S. stock market continues to reach new heights, with major indices like the Dow Jones and S&P 500 setting all-time records, investors are exploring diverse opportunities across various sectors. Penny stocks, often overlooked yet intriguing investment options, represent smaller or newer companies that can offer significant growth potential at lower price points. Despite their somewhat outdated label, these stocks remain relevant for those seeking hidden value in companies with solid financial foundations and promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.72 | $582.91M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.83 | $661.84M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8702 | $148.82M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.40 | $572.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.40 | $571.19M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.93 | $1.04B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $86.77M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ovid Therapeutics (OVID)

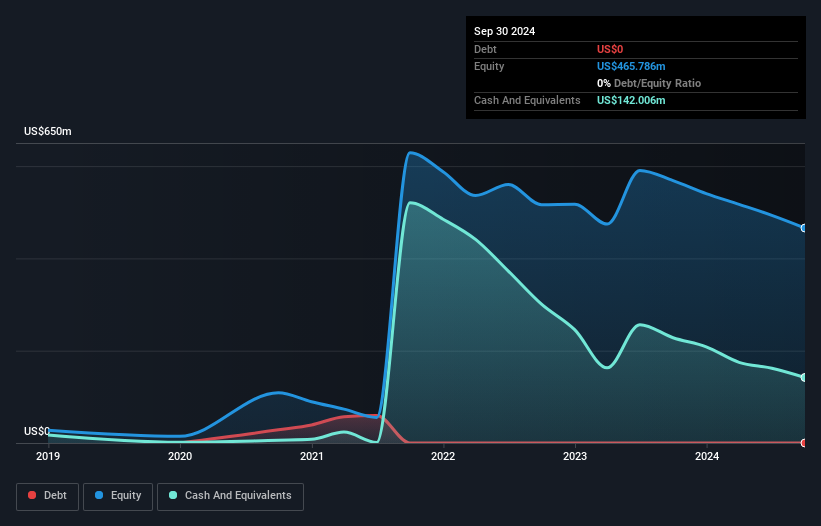

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ovid Therapeutics Inc. is a biopharmaceutical company focused on developing impactful medicines for epilepsies and seizure-related neurological disorders in the United States, with a market cap of $126.76 million.

Operations: Ovid Therapeutics generates its revenue from the Pharmaceuticals segment, totaling $6.61 million.

Market Cap: $126.76M

Ovid Therapeutics, a biopharmaceutical company with a market cap of US$126.76 million, is navigating the challenges typical of penny stocks. Despite being debt-free and having short-term assets exceeding liabilities, Ovid remains unprofitable with earnings forecasted to decline by 23.1% annually over the next three years. Recent strategic moves include a shelf registration filing for US$183.84 million and promising Phase 1 study results for its KCC2 direct activator program, OV350, which met primary safety and pharmacokinetic objectives. Leadership changes are underway as Meg Alexander prepares to assume the CEO role in January 2026 amid ongoing development efforts in their therapeutic pipeline.

- Unlock comprehensive insights into our analysis of Ovid Therapeutics stock in this financial health report.

- Learn about Ovid Therapeutics' future growth trajectory here.

EVgo (EVGO)

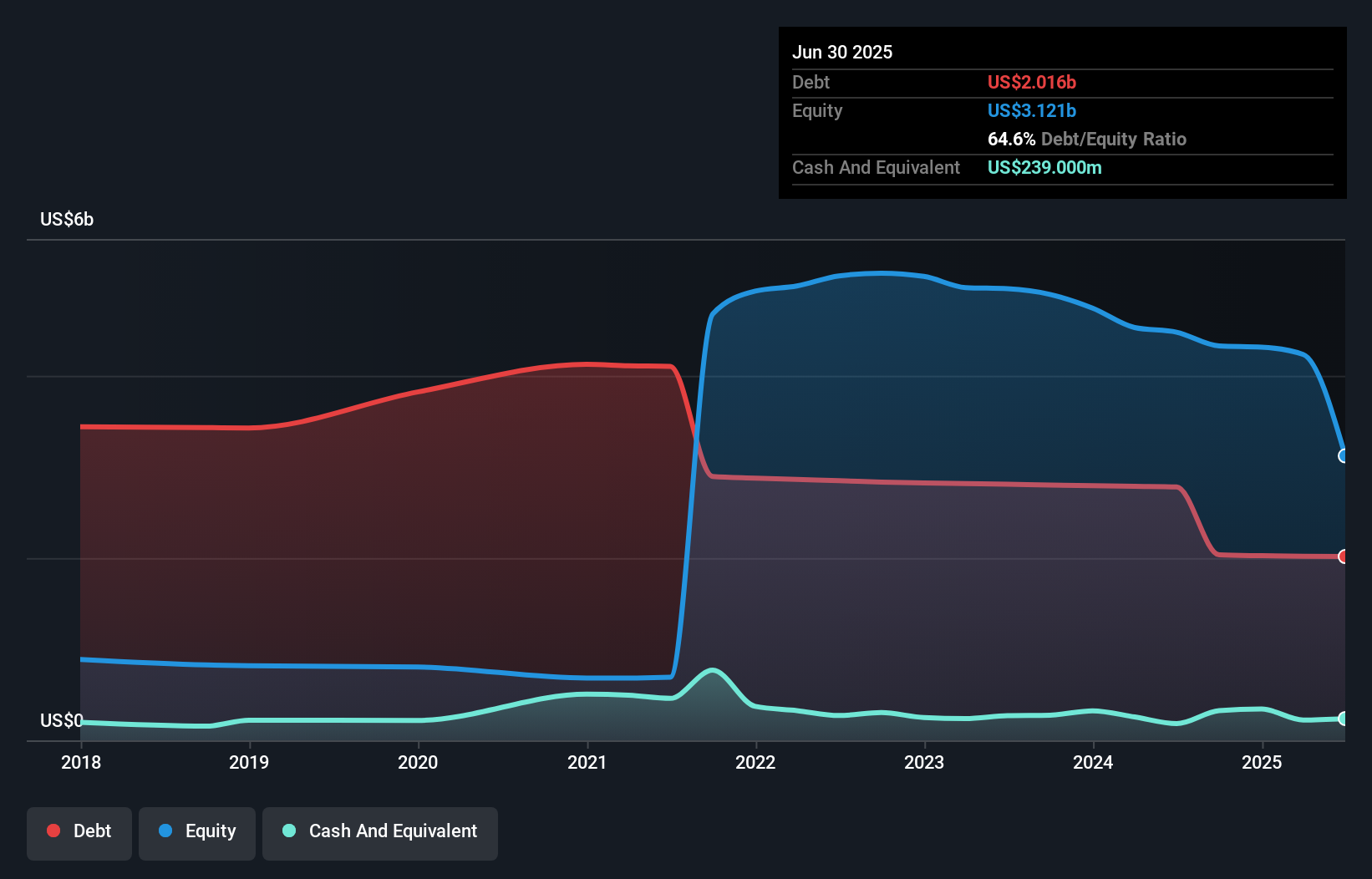

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EVgo, Inc. operates a direct current fast charging network for electric vehicles in the United States with a market cap of $982.46 million.

Operations: The company generates revenue from its retail segment, specifically gasoline and auto dealers, amounting to $333.13 million.

Market Cap: $982.46M

EVgo, Inc. is a penny stock with a market cap of US$982.46 million, operating within the electric vehicle charging sector. Despite generating revenue of US$333.13 million from its retail segment, the company remains unprofitable and is not expected to achieve profitability in the next three years. EVgo's short-term assets of US$284.7 million exceed its short-term liabilities but fall short against long-term liabilities of US$409.2 million, indicating financial strain despite having more cash than total debt. Recent developments include appointing Keefer Lehner as CFO and reiterating 2025 revenue guidance between US$350 million and US$365 million amidst ongoing losses.

- Dive into the specifics of EVgo here with our thorough balance sheet health report.

- Gain insights into EVgo's outlook and expected performance with our report on the company's earnings estimates.

Alight (ALIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alight, Inc. is a technology-enabled services company operating globally with a market capitalization of approximately $1.03 billion.

Operations: The company generates revenue primarily from its Employer Solutions segment, which accounts for $2.29 billion.

Market Cap: $1.03B

Alight, Inc. has a market capitalization of US$1.03 billion and generates substantial revenue from its Employer Solutions segment, totaling US$2.29 billion. Despite this, the company is unprofitable with a significant net loss and negative return on equity. Recent executive changes include appointing Rohit Verma as CEO and Greg Giometti as interim CFO, potentially signaling strategic shifts ahead. Alight's collaboration with IBM to integrate AI into its offerings highlights its focus on digital transformation but financial challenges remain evident with high debt levels and recent goodwill impairments impacting earnings significantly for the year 2025.

- Click here to discover the nuances of Alight with our detailed analytical financial health report.

- Gain insights into Alight's future direction by reviewing our growth report.

Turning Ideas Into Actions

- Take a closer look at our US Penny Stocks list of 342 companies by clicking here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報