3 Dividend Stocks To Consider With Yields Up To 4.6%

As the U.S. stock market continues to reach new heights, with major indices like the S&P 500 setting all-time records, investors are increasingly looking for stability and income in a dynamic environment. In this context, dividend stocks offer an attractive proposition by providing regular income streams and potential for capital appreciation, making them a compelling option amid the current market momentum.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.69% | ★★★★★★ |

| Preferred Bank (PFBC) | 3.02% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.35% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.60% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.24% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.93% | ★★★★★★ |

| Ennis (EBF) | 5.52% | ★★★★★★ |

| Dillard's (DDS) | 4.94% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.03% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.42% | ★★★★★★ |

Click here to see the full list of 115 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CVB Financial (CVBF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CVB Financial Corp. is a bank holding company for Citizens Business Bank, offering banking and financial services to small to mid-sized businesses and individuals, with a market cap of approximately $2.67 billion.

Operations: CVB Financial Corp.'s primary revenue segment is banking, generating approximately $509.49 million.

Dividend Yield: 4.1%

CVB Financial Corp.'s dividend payments have been reliable and stable over the past decade, with a current payout ratio of 54%, indicating sustainability. The company recently affirmed a US$0.20 per share dividend for Q4 2025, payable in January 2026. While CVBF's dividend yield is slightly below the top tier of U.S. payers, its earnings growth supports future coverage. Recent strategic moves include a merger with Heritage Commerce and ongoing share buybacks totaling US$43.5 million.

- Click to explore a detailed breakdown of our findings in CVB Financial's dividend report.

- Our valuation report unveils the possibility CVB Financial's shares may be trading at a discount.

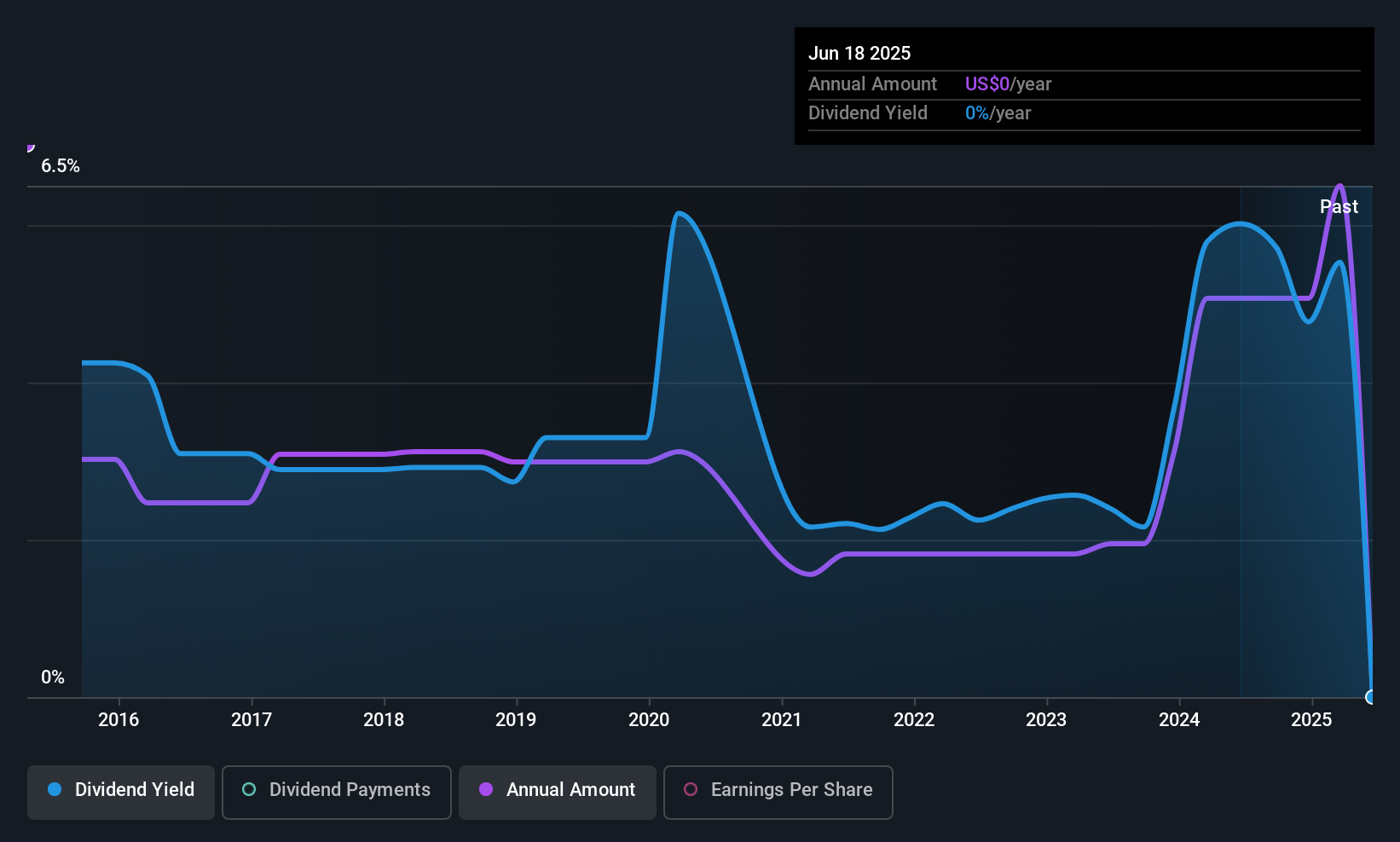

Ituran Location and Control (ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally, with a market cap of $860.40 million.

Operations: Ituran Location and Control Ltd. generates revenue from two primary segments: Telematics Products, contributing $93.38 million, and Telematics Services, accounting for $255.03 million.

Dividend Yield: 4.6%

Ituran Location and Control's dividend yield ranks in the top 25% of U.S. payers, although its track record is volatile. Recent dividends are covered by earnings (70.4% payout ratio) and cash flows (66%). The company declared a US$0.50 per share dividend for January 2026, totaling US$10 million. Earnings have grown steadily, with Q3 2025 revenue at US$92.28 million and net income at US$14.65 million, bolstered by a new service agreement with Renault in Latin America.

- Get an in-depth perspective on Ituran Location and Control's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Ituran Location and Control is trading behind its estimated value.

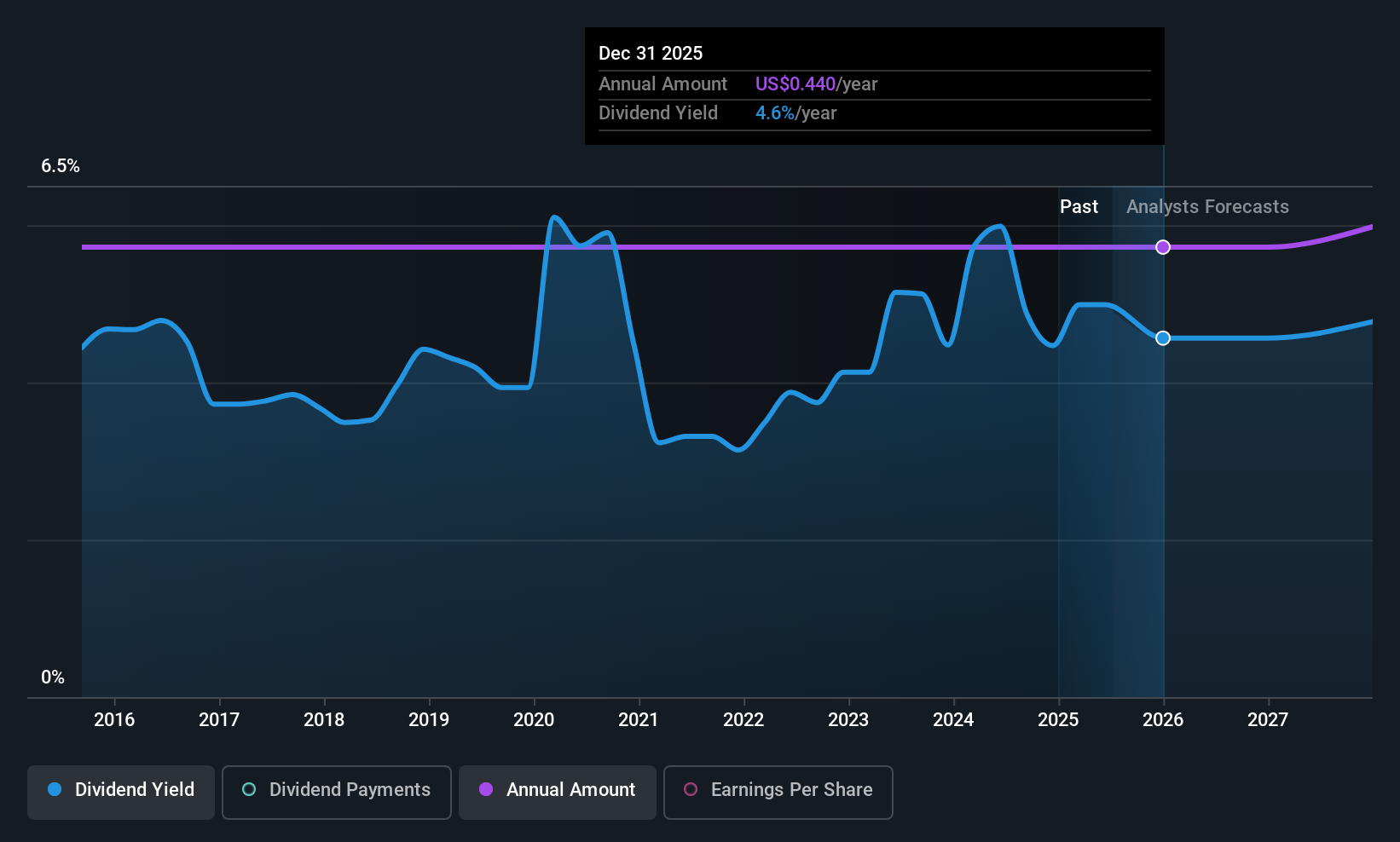

Valley National Bancorp (VLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp is the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services products with a market cap of approximately $6.65 billion.

Operations: Valley National Bancorp generates its revenue from segments including Consumer Banking ($367.09 million), Commercial Banking ($1.24 billion), and Treasury and Corporate Other ($130.09 million).

Dividend Yield: 3.7%

Valley National Bancorp's dividends are reliably covered by earnings, with a current payout ratio of 49.8% and forecasted to improve to 32.2% in three years. Despite stable dividend payments over the past decade, they have not increased, and the yield of 3.69% is below top-tier U.S. payers. Recent strategic appointments aim to bolster commercial banking growth across key regions, while net income for Q3 2025 rose significantly to US$163.36 million from US$97.86 million a year ago.

- Navigate through the intricacies of Valley National Bancorp with our comprehensive dividend report here.

- Our expertly prepared valuation report Valley National Bancorp implies its share price may be lower than expected.

Next Steps

- Click here to access our complete index of 115 Top US Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報