December 2025's Top Penny Stocks In Global

As December 2025 unfolds, global markets are experiencing a mix of economic signals, with interest rate adjustments and inflation reports shaping investor sentiment. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture attention due to their affordability and potential for growth. These stocks can offer compelling opportunities when backed by strong financials, making them an intriguing area for investors seeking hidden gems in the market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.255 | £488.14M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,621 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Hang Sang (Siu Po) International Holding (SEHK:3626)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hang Sang (Siu Po) International Holding Company Limited is an investment holding company involved in the manufacture and sale of apparel labels and packaging printing products, with a market cap of HK$664.24 million.

Operations: The company's revenue is primarily derived from its Printing segment with HK$56.03 million, followed by Food and Daily Necessities at HK$21.72 million, Restaurant Operation contributing HK$16.38 million, and E-cigarette generating HK$1.04 million.

Market Cap: HK$664.24M

Hang Sang (Siu Po) International Holding has recently turned profitable, reporting a net income of HK$2.66 million for the year ending June 30, 2025. Despite low return on equity at 12.8%, the company benefits from being debt-free and having short-term assets of HK$26.8 million that cover both its short-term and long-term liabilities. However, its share price remains highly volatile, with weekly volatility higher than most Hong Kong stocks. Recent changes in company bylaws indicate potential strategic shifts, but the board's inexperience could be a concern for investors seeking stability in governance practices.

- Dive into the specifics of Hang Sang (Siu Po) International Holding here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Hang Sang (Siu Po) International Holding's track record.

Vobile Group (SEHK:3738)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and internationally, with a market cap of HK$10.59 billion.

Operations: The company generates revenue of HK$2.68 billion from its software as a service offerings related to digital content asset protection and transactions.

Market Cap: HK$10.59B

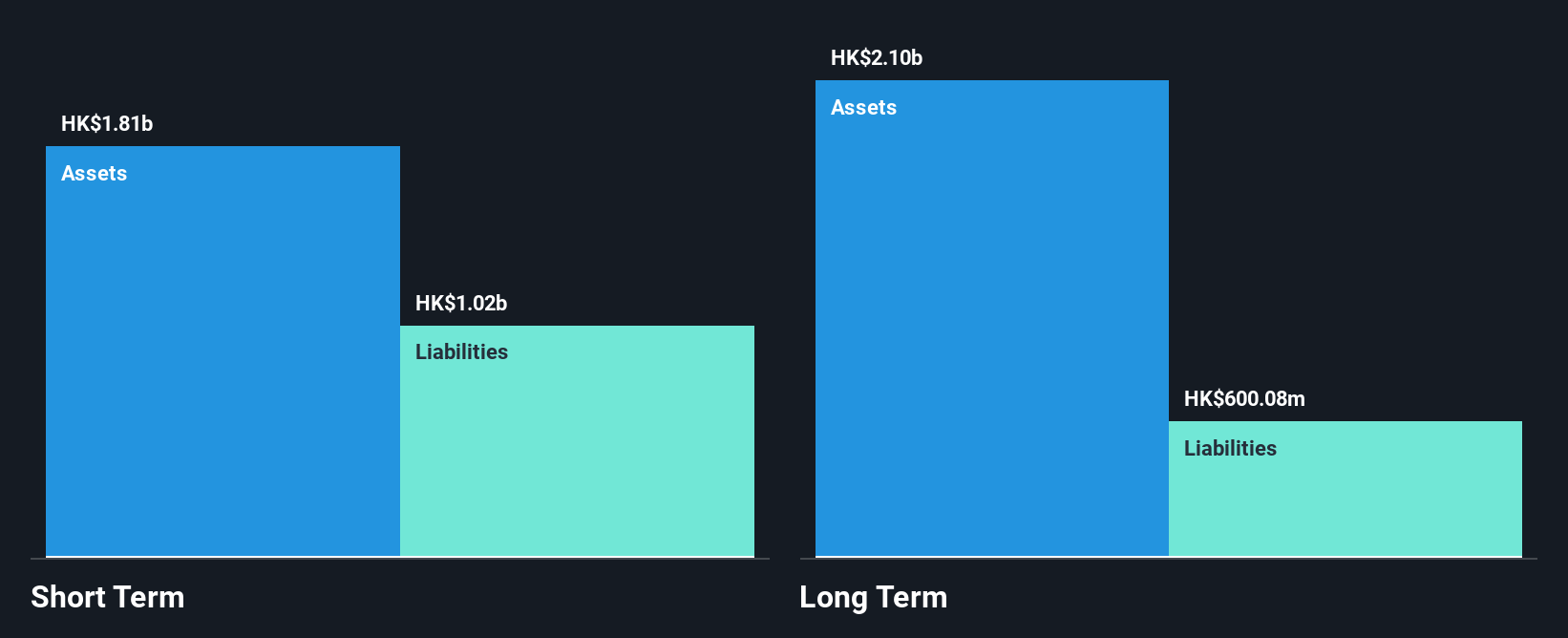

Vobile Group demonstrates a robust financial position, with short-term assets of HK$2.4 billion exceeding both its short-term and long-term liabilities. The company has shown significant earnings growth, with a remarkable increase of 4431.4% over the past year, outpacing the software industry average. While its net debt to equity ratio is satisfactory at 16%, operating cash flow coverage remains weak at 0.2%. Recent results indicate strong revenue growth, particularly in Mainland China and monthly recurring revenue up by approximately 28%. Despite these positives, return on equity is low at 7%, suggesting room for improvement in profitability efficiency.

- Unlock comprehensive insights into our analysis of Vobile Group stock in this financial health report.

- Examine Vobile Group's earnings growth report to understand how analysts expect it to perform.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.87 billion, offers integrated solutions in design, construction, production, and services both within China and internationally.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥3.87B

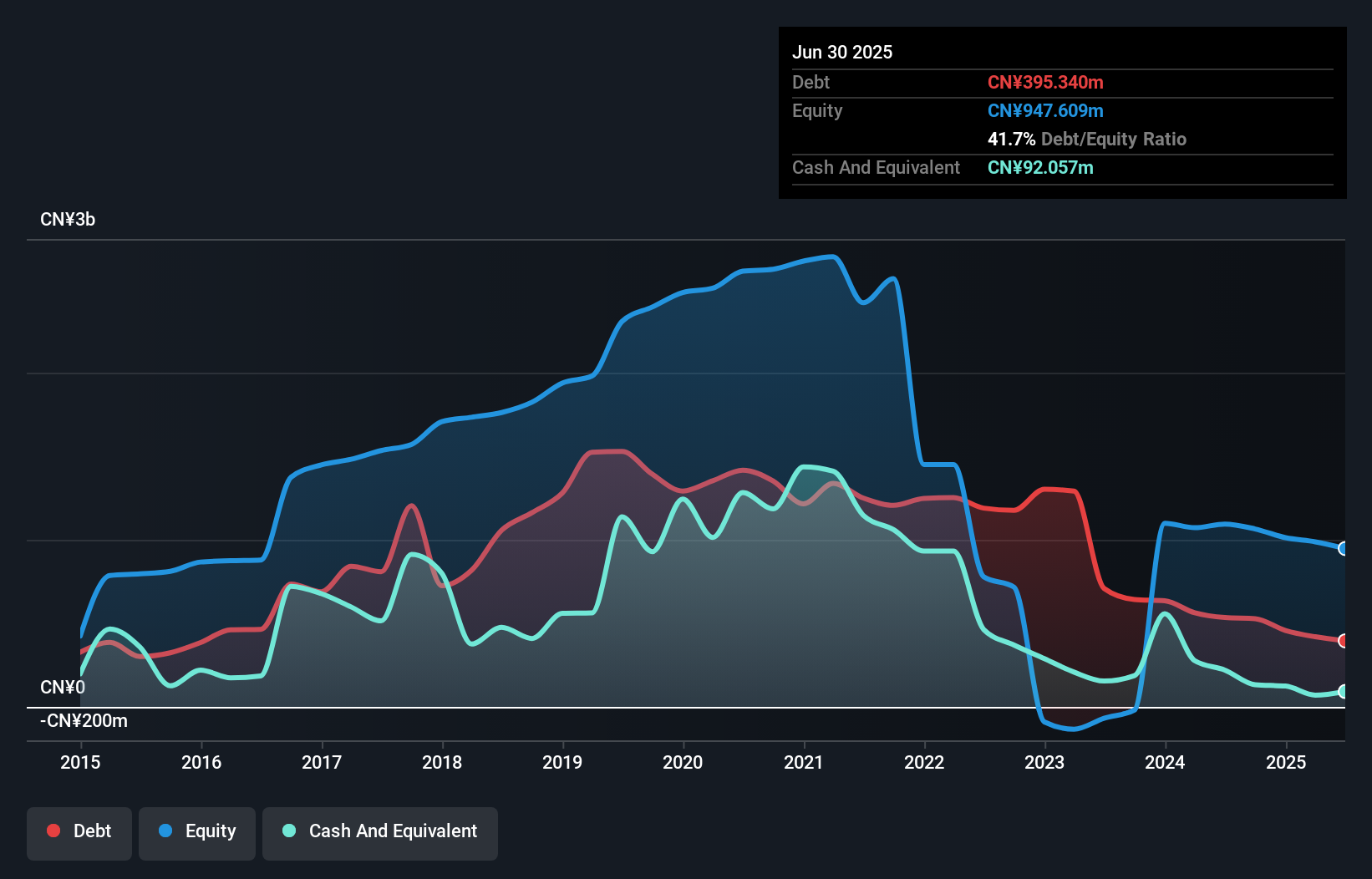

Shanghai Trendzone Holdings Group Ltd. maintains a stable financial footing with short-term assets of CN¥1.4 billion surpassing both its short-term and long-term liabilities. Despite being unprofitable, the company has managed to reduce its debt to equity ratio from 51.6% to 40.6% over five years, indicating improved financial management. The recent acquisition of a 5.2% stake by Qingdao Xinhuan Huikun Equity Investment Partnership for approximately CN¥180 million reflects investor interest, though the stock's high volatility may pose risks for investors seeking stability in penny stocks investments.

- Get an in-depth perspective on Shanghai Trendzone Holdings GroupLtd's performance by reading our balance sheet health report here.

- Gain insights into Shanghai Trendzone Holdings GroupLtd's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Investigate our full lineup of 3,621 Global Penny Stocks right here.

- Ready For A Different Approach? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報