3 European Stocks Estimated To Be Undervalued By Up To 46%

As the European market experiences a lift, with the pan-European STOXX Europe 600 Index rising by 1.60% due to signs of steady economic growth and looser monetary policy, investors are increasingly on the lookout for undervalued stocks that could offer significant upside potential. In this environment, identifying stocks trading below their intrinsic value can be an attractive strategy for those seeking opportunities amidst stable economic indicators and favorable monetary conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €72.60 | €142.21 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.38 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.31 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.81 | 49.9% |

| Hemnet Group (OM:HEM) | SEK170.90 | SEK337.18 | 49.3% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.34 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN30.625 | PLN60.10 | 49% |

| Allcore (BIT:CORE) | €1.345 | €2.66 | 49.4% |

We'll examine a selection from our screener results.

Metrovacesa (BME:MVC)

Overview: Metrovacesa S.A. is a real estate development company in Spain with a market cap of €1.39 billion.

Operations: Metrovacesa's revenue is primarily derived from its residential segment, generating €516.37 million, with an additional €38.88 million coming from its tertiary operations.

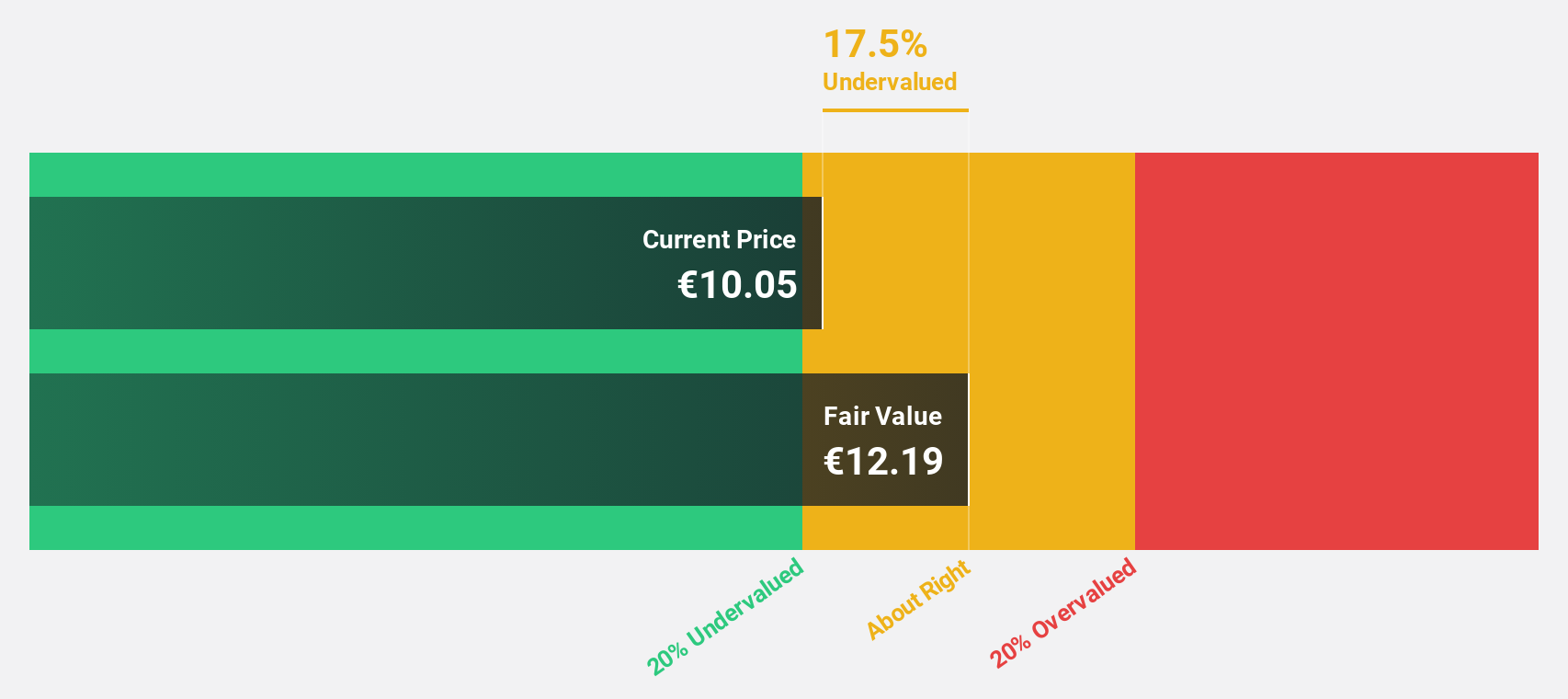

Estimated Discount To Fair Value: 20.6%

Metrovacesa is trading at €9.18, significantly below its estimated fair value of €11.57, indicating a potential undervaluation based on cash flows. Despite its volatile share price and low forecasted return on equity of 4.8% in three years, the company is expected to become profitable within the same period with earnings projected to grow at 37.91% annually. Revenue growth is forecasted at 6.6% per year, outpacing the broader Spanish market growth rate of 4.7%.

- In light of our recent growth report, it seems possible that Metrovacesa's financial performance will exceed current levels.

- Click here to discover the nuances of Metrovacesa with our detailed financial health report.

GN Store Nord (CPSE:GN)

Overview: GN Store Nord A/S offers hearing, audio, video, and gaming solutions across Denmark, Europe, North America, and globally with a market cap of DKK15.18 billion.

Operations: The company's revenue segments include Hearing at DKK7.16 billion and Enterprise at DKK6.78 billion.

Estimated Discount To Fair Value: 46%

GN Store Nord is trading at DKK104.25, significantly below its estimated fair value of DKK193.1, making it potentially undervalued based on cash flows. Despite a challenging year with declining sales and net income in the third quarter, earnings are forecast to grow at 23.6% annually over the next three years, surpassing the Danish market's growth rate. However, revenue growth remains modest and return on equity is expected to be low at 10.3%.

- Insights from our recent growth report point to a promising forecast for GN Store Nord's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of GN Store Nord.

Atal (WSE:1AT)

Overview: Atal S.A. is involved in the construction and sale of residential real estate as well as the rental of commercial properties in Poland, with a market cap of PLN2.33 billion.

Operations: The company's revenue is primarily derived from its development activities, amounting to PLN1.03 billion, with additional income from rental services totaling PLN10.46 million.

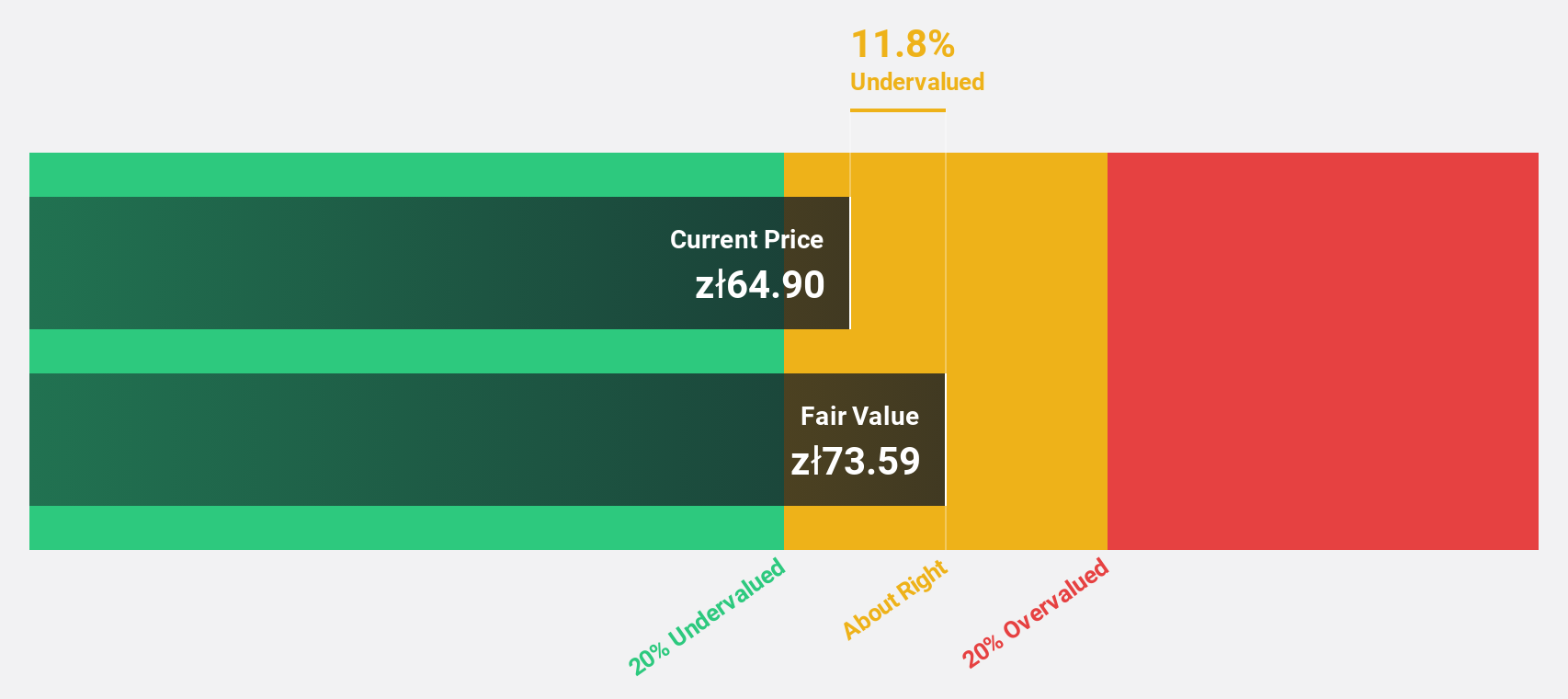

Estimated Discount To Fair Value: 43.8%

Atal is trading at PLN53.9, well below its estimated fair value of PLN95.96, suggesting potential undervaluation based on cash flows. Despite a decrease in net income to PLN131.46 million for the first nine months of 2025, earnings are projected to grow significantly at 28.56% annually over the next three years, outpacing the Polish market's growth rate. However, high non-cash earnings and an unsustainable dividend yield pose concerns about financial health and cash flow coverage.

- Our expertly prepared growth report on Atal implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Atal's balance sheet health report.

Where To Now?

- Embark on your investment journey to our 191 Undervalued European Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報