European Dividend Stocks To Consider For Your Portfolio

As European markets show signs of steady economic growth and benefit from looser monetary policies, the pan-European STOXX Europe 600 Index has seen a notable rise, reflecting investor optimism. In this environment, dividend stocks can be an attractive option for those seeking regular income streams, as they often provide stability and potential returns even amid fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.05% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.64% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.12% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

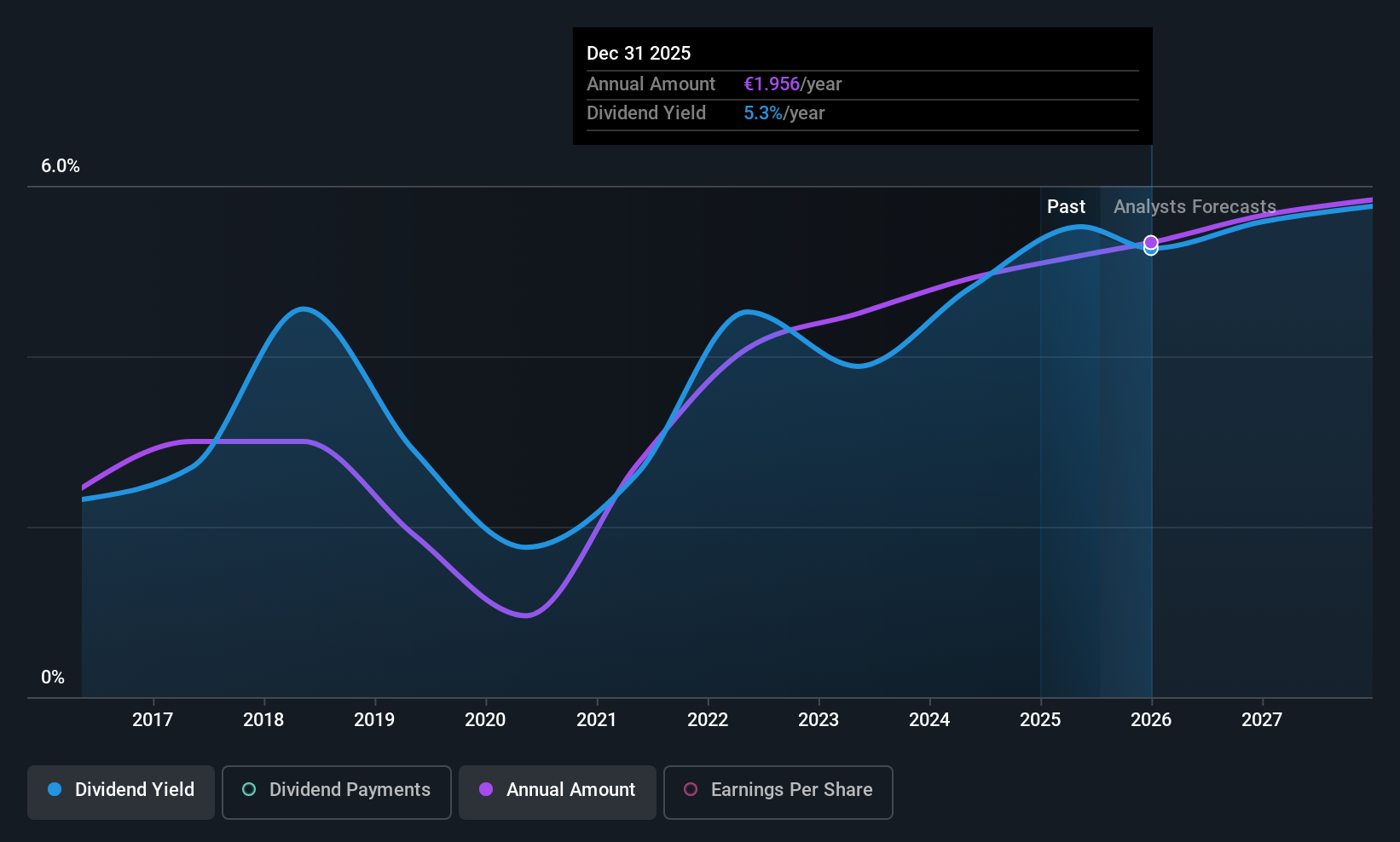

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA specializes in steel wire transformation and coating technologies globally, with a market cap of €1.89 billion.

Operations: NV Bekaert SA generates revenue through its key segments: Rubber Reinforcement (€1.68 billion), Steel Wire Solutions (€1.08 billion), Specialty Businesses (€584.04 million), and Bridon-Bekaert Ropes Group (€561.23 million).

Dividend Yield: 5%

NV Bekaert's dividend payments are covered by earnings and cash flows, with payout ratios of 56.7% and 38.8% respectively, indicating sustainability despite a volatile history over the past decade. The company trades at a good value compared to peers and industry benchmarks, though its current yield of 4.99% is lower than top-tier Belgian dividend payers. Recent guidance forecasts €3.7 billion in sales for fiscal year 2025, reflecting potential growth prospects amidst market inclusion in the Euronext 150 Index.

- Get an in-depth perspective on NV Bekaert's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that NV Bekaert is priced lower than what may be justified by its financials.

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE is involved in construction projects and has a market cap of €9.20 billion.

Operations: Strabag SE's revenue is primarily derived from its North + West segment (€7.46 billion), South + East segment (€7.33 billion), and International + Special Divisions (€3.48 billion).

Dividend Yield: 3.1%

Strabag's dividends are well covered by earnings and cash flows, with payout ratios of 34.9% and 34.4%, respectively, despite a volatile dividend history over the past decade. The stock trades at a significant discount to its estimated fair value, suggesting potential value for investors. Recent projects like the Fehmarn Sound Crossing and Emonika development highlight Strabag's active engagement in substantial infrastructure initiatives across Europe, which may support future revenue growth despite current volatility in share price.

- Click here to discover the nuances of Strabag with our detailed analytical dividend report.

- Our valuation report here indicates Strabag may be undervalued.

Voxel (WSE:VOX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Voxel S.A. operates in Poland, offering medical services, and has a market capitalization of PLN 1.27 billion.

Operations: Voxel S.A.'s revenue is primarily derived from three segments: Diagnostics - Medical Services and Sales of Radiopharmaceuticals at PLN 418.70 million, IT & Infrastructure - IT Products and Laboratory Equipment at PLN 166.89 million, and Therapy - Neuroradiosurgery at PLN 14.48 million.

Dividend Yield: 4%

Voxel's dividends are supported by earnings and cash flows, with payout ratios of 48.8% and 63.9%, respectively, though their dividend history has been unreliable over the past decade. The stock is trading at a significant discount to its estimated fair value, offering potential value despite a lower-than-average yield in Poland's market. Recent earnings reports show growth in sales and net income, reflecting positive operational performance which could underpin future dividend stability if sustained.

- Click to explore a detailed breakdown of our findings in Voxel's dividend report.

- In light of our recent valuation report, it seems possible that Voxel is trading behind its estimated value.

Taking Advantage

- Access the full spectrum of 195 Top European Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報