Exploring High Growth Tech Stocks In Asia For Your Portfolio

The Asian market has been experiencing mixed economic signals, with Japan's recent interest rate hike marking the highest level in 30 years and China's economy showing signs of lackluster growth despite efforts to stimulate demand. In this context, identifying high-growth tech stocks requires a focus on companies that demonstrate robust innovation and adaptability to navigate these dynamic market conditions effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Ruijie Networks (SZSE:301165)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ruijie Networks Co., Ltd. focuses on the research, development, design, and sales of network equipment, network security products, and cloud desktop solutions both in China and internationally with a market cap of CN¥65.62 billion.

Operations: Ruijie Networks generates revenue through the sale of network equipment, network security products, and cloud desktop solutions. The company operates both domestically in China and internationally.

Ruijie Networks has demonstrated robust growth, with a notable 24% annual increase in revenue and an impressive 37.9% projected annual earnings growth over the next three years. Recent amendments to its bylaws and a successful APAC Partner Summit highlight proactive governance and strategic market engagement. The company's commitment to innovation is evident from its significant R&D investments which align with its revenue trajectory, ensuring sustained advancement in competitive tech landscapes. These factors collectively underscore Ruijie's potential to maintain its upward trajectory amidst dynamic market conditions.

- Click here to discover the nuances of Ruijie Networks with our detailed analytical health report.

Review our historical performance report to gain insights into Ruijie Networks''s past performance.

eWeLLLtd (TSE:5038)

Simply Wall St Growth Rating: ★★★★★★

Overview: eWeLL Co., Ltd. specializes in creating cloud-based business support services for visiting nursing stations across Japan, with a market capitalization of ¥39.34 billion.

Operations: The company's primary revenue stream comes from providing services to home-visit nursing stations, generating ¥3.19 billion.

eWeLL Co.,Ltd. stands out in Asia's high-growth tech landscape, with a notable 21.5% annual revenue growth and an impressive 22.8% projected earnings growth per year. The company's strategic emphasis on R&D is reflected in its substantial investment, aligning closely with its revenue streams to foster innovation and market competitiveness. Recent initiatives, including increased dividend payouts and positive earnings calls, underscore eWeLL's proactive financial management and commitment to shareholder value amidst dynamic industry conditions. These elements collectively suggest a promising trajectory for eWeLL in the evolving tech sector.

- Take a closer look at eWeLLLtd's potential here in our health report.

Explore historical data to track eWeLLLtd's performance over time in our Past section.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★★

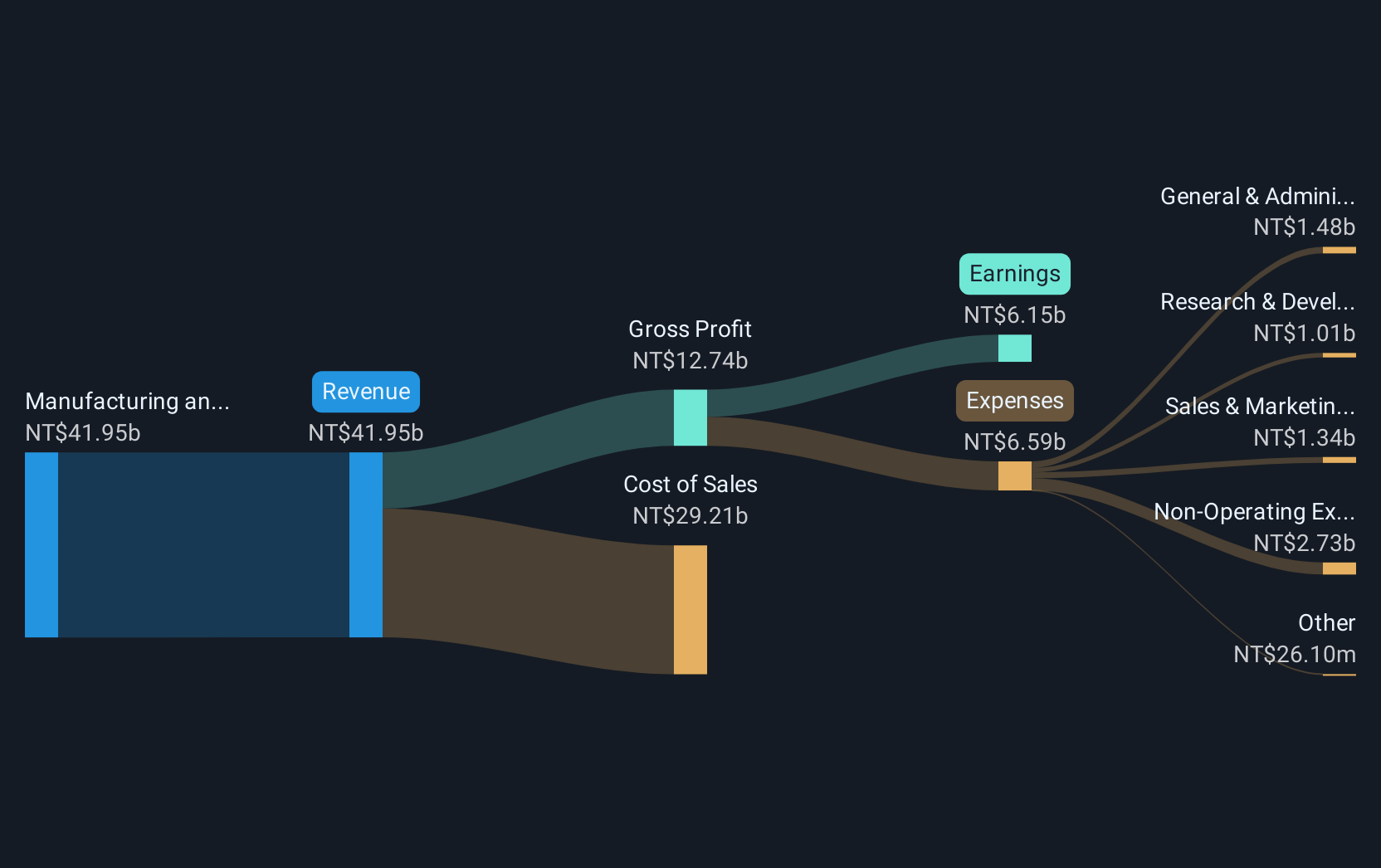

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that specializes in the design, manufacturing, processing, and distribution of printed circuit boards with a market capitalization of NT$325.11 billion.

Operations: The company primarily generates revenue through the manufacturing and sales of printed circuit boards, with reported revenues of NT$53.45 billion.

Gold Circuit Electronics has demonstrated robust growth, with a 69% increase in third-quarter revenue and a doubling of net income compared to the previous year. This performance is part of a broader trend where its annual revenue and earnings growth rates stand at 29.4% and 37.2%, respectively, significantly outpacing the industry averages. The firm's commitment to innovation is evident from its R&D investments, crucial for maintaining its competitive edge in the fast-evolving tech sector in Asia. With such strong financial health and strategic focus on research, Gold Circuit Electronics is well-positioned to capitalize on future technology demands.

Taking Advantage

- Unlock our comprehensive list of 186 Asian High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報