Asian Penny Stocks To Watch In December 2025

As the Bank of Japan raises its benchmark interest rate to a 30-year high, Asian markets are navigating a complex landscape influenced by shifting monetary policies and economic signals. Amid these developments, penny stocks—often seen as speculative but still holding potential for growth—remain an intriguing area for investors. These smaller or newer companies, when underpinned by solid financial health, can offer unique opportunities for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.98 | THB894M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.78 | HK$2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.71 | HK$20.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$53.4B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 967 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Inkeverse Group (SEHK:3700)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People's Republic of China, with a market cap of HK$1.99 billion.

Operations: The company generates revenue primarily from its Live Streaming Business, which amounts to CN¥5.99 billion.

Market Cap: HK$2B

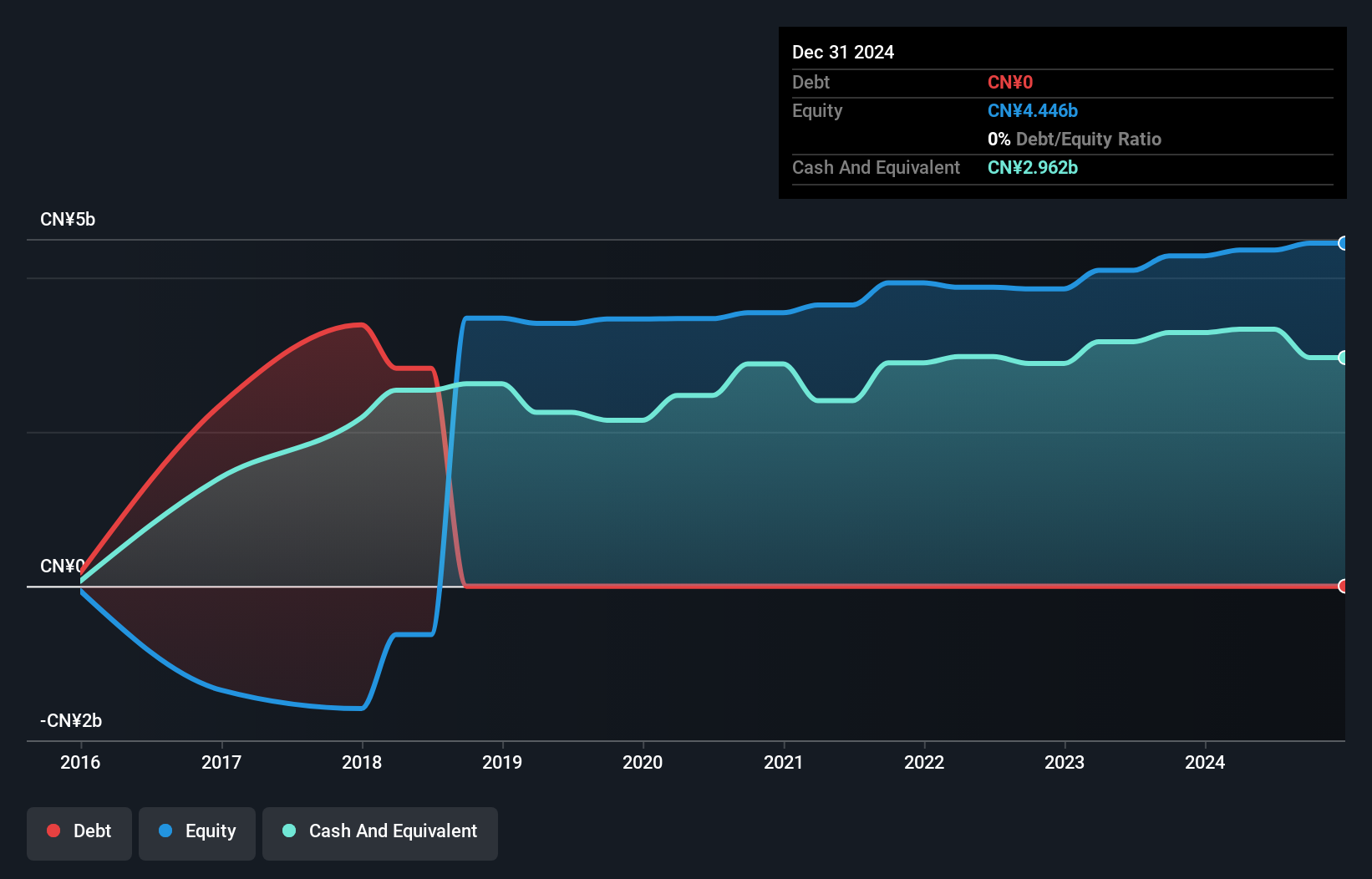

Inkeverse Group Limited, with a market cap of HK$1.99 billion, generates CN¥5.99 billion in revenue from its Live Streaming Business in China. The company is debt-free, providing financial stability and eliminating concerns over interest payments. Its Price-To-Earnings ratio of 5.9x suggests potential undervaluation compared to the Hong Kong market average of 12.1x. Despite stable weekly volatility and improved profit margins (5.1% vs last year's 4.4%), recent negative earnings growth presents challenges against industry benchmarks. The experienced management team (average tenure of 4.8 years) and strong asset coverage over liabilities bolster its operational resilience amidst these hurdles.

- Navigate through the intricacies of Inkeverse Group with our comprehensive balance sheet health report here.

- Gain insights into Inkeverse Group's historical outcomes by reviewing our past performance report.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market capitalization of SGD753.17 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, which generated CN¥4.32 billion, followed by Heating Power at CN¥194.94 million and Waste Treatment at CN¥27.89 million.

Market Cap: SGD753.17M

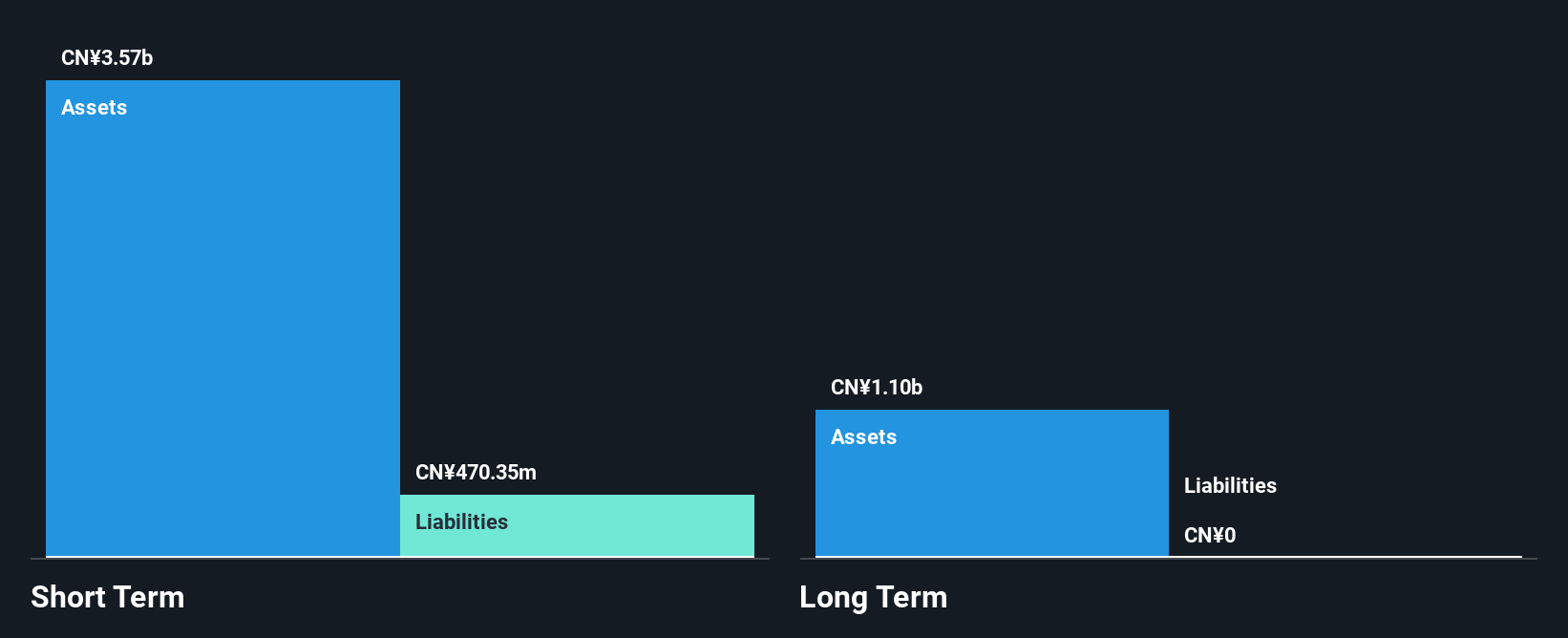

China Sunsine Chemical Holdings Ltd., with a market cap of SGD753.17 million, primarily derives its revenue from the Rubber Chemicals segment, generating CN¥4.32 billion. The company has adopted a dividend policy to pay annual dividends of at least 40% of net profit after tax, subject to financial conditions and board approval. Recent expansion plans include significant capacity increases in Hengshun and Weifang plants for IS and MBT projects, expected to commence production by late 2025 or early 2026. With no debt on its balance sheet and stable weekly volatility, China Sunsine offers a financially sound investment profile amidst industry growth challenges.

- Click here to discover the nuances of China Sunsine Chemical Holdings with our detailed analytical financial health report.

- Review our growth performance report to gain insights into China Sunsine Chemical Holdings' future.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry and has a market cap of CN¥4.87 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥2.42 billion.

Market Cap: CN¥4.87B

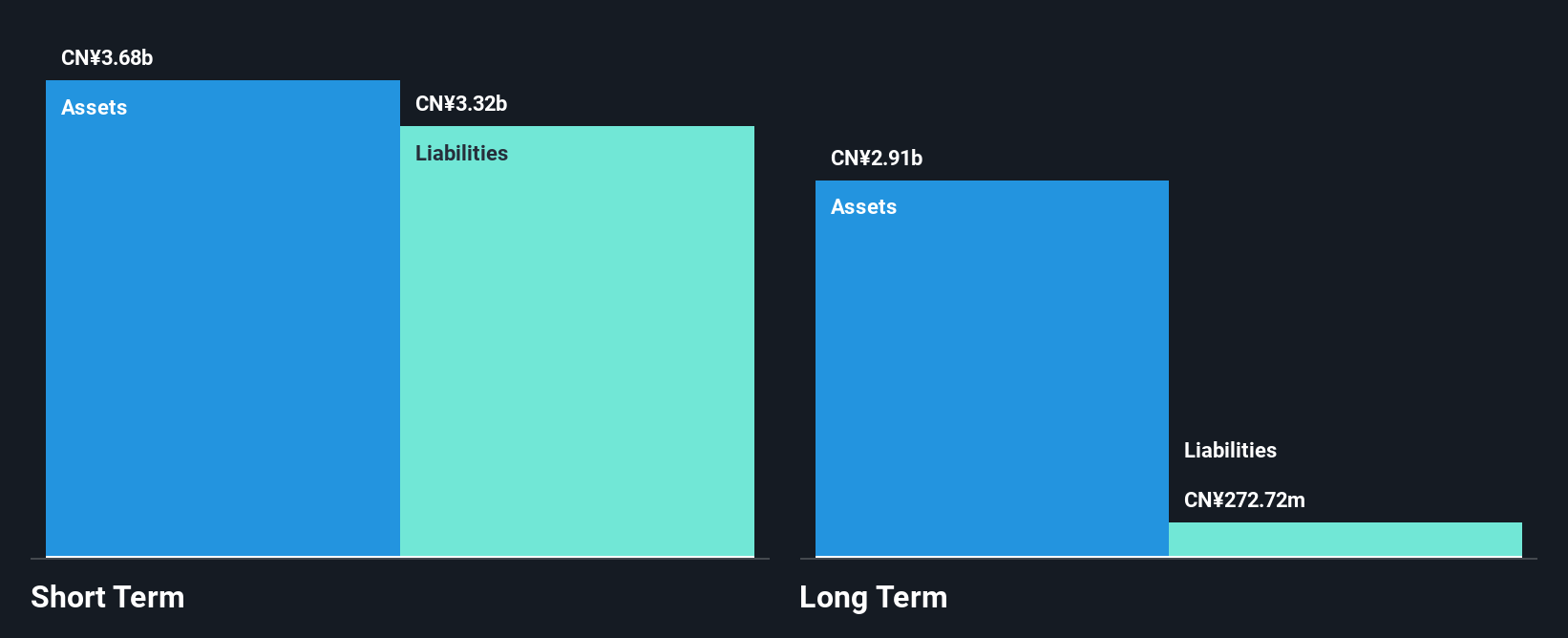

Zhejiang Reclaim Construction Group has shown financial resilience with a reduced debt-to-equity ratio from 59.1% to 14.9% over five years, and its short-term assets of CN¥3.7 billion comfortably cover both short and long-term liabilities. Although unprofitable, the company has narrowed losses by 38.6% annually over five years, supported by a cash runway exceeding a year based on current free cash flow trends. Recent governance changes include board elections and amendments to the articles of association, reflecting potential strategic shifts as it reported net income of CN¥37.52 million for the first nine months of 2025 against prior losses.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Reclaim Construction Group.

- Learn about Zhejiang Reclaim Construction Group's historical performance here.

Turning Ideas Into Actions

- Reveal the 967 hidden gems among our Asian Penny Stocks screener with a single click here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報