Asian Dividend Stocks To Consider In December 2025

As we approach December 2025, the Asian markets are experiencing a period of adjustment, with Japan's recent interest rate hike marking a significant shift in monetary policy not seen in decades. Amidst this backdrop, dividend stocks can offer investors potential stability and income, making them an attractive option for those navigating these evolving economic conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.20% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.82% | ★★★★★★ |

| NCD (TSE:4783) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.73% | ★★★★★★ |

Click here to see the full list of 1021 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

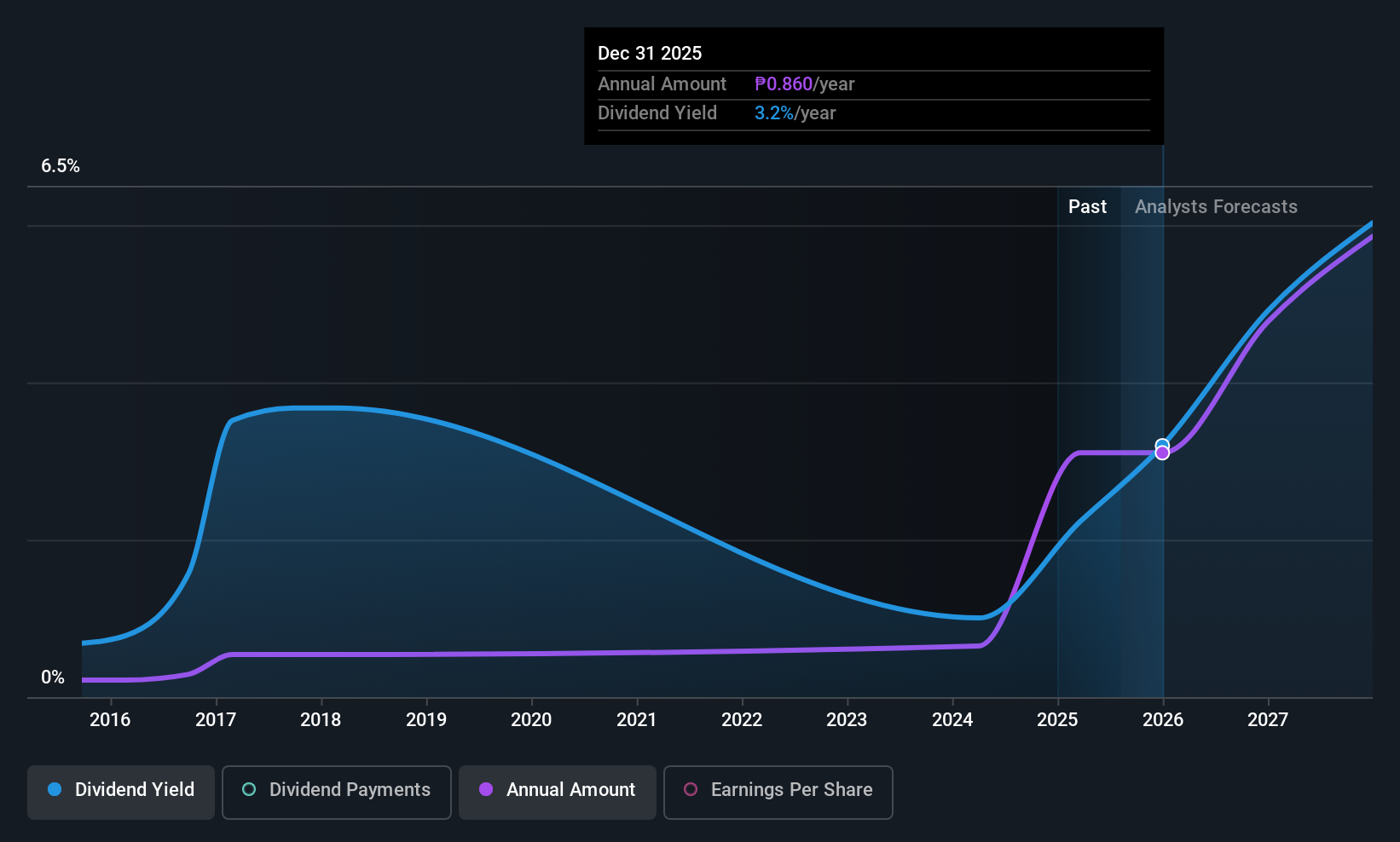

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DigiPlus Interactive Corp., with a market cap of ₱73.68 billion, operates as a digital entertainment company in the Philippines through its subsidiaries.

Operations: DigiPlus Interactive Corp.'s revenue is primarily derived from its Retail Group at ₱89.54 billion, followed by the Casino Group at ₱540.79 million, and the Network and License Group at ₱356.10 million, with additional contributions from Property and Other Investments totaling ₱51.23 million.

Dividend Yield: 5.3%

DigiPlus Interactive's dividend sustainability is supported by a low payout ratio of 27.4% and cash payout ratio of 31.6%, indicating dividends are well covered by earnings and cash flows. However, its dividend track record has been volatile over the past decade, with payments experiencing significant fluctuations. The company's recent earnings showed growth in sales and revenue but a decrease in quarterly net income, highlighting potential challenges for consistent dividend reliability despite strong coverage metrics.

- Get an in-depth perspective on DigiPlus Interactive's performance by reading our dividend report here.

- Our expertly prepared valuation report DigiPlus Interactive implies its share price may be lower than expected.

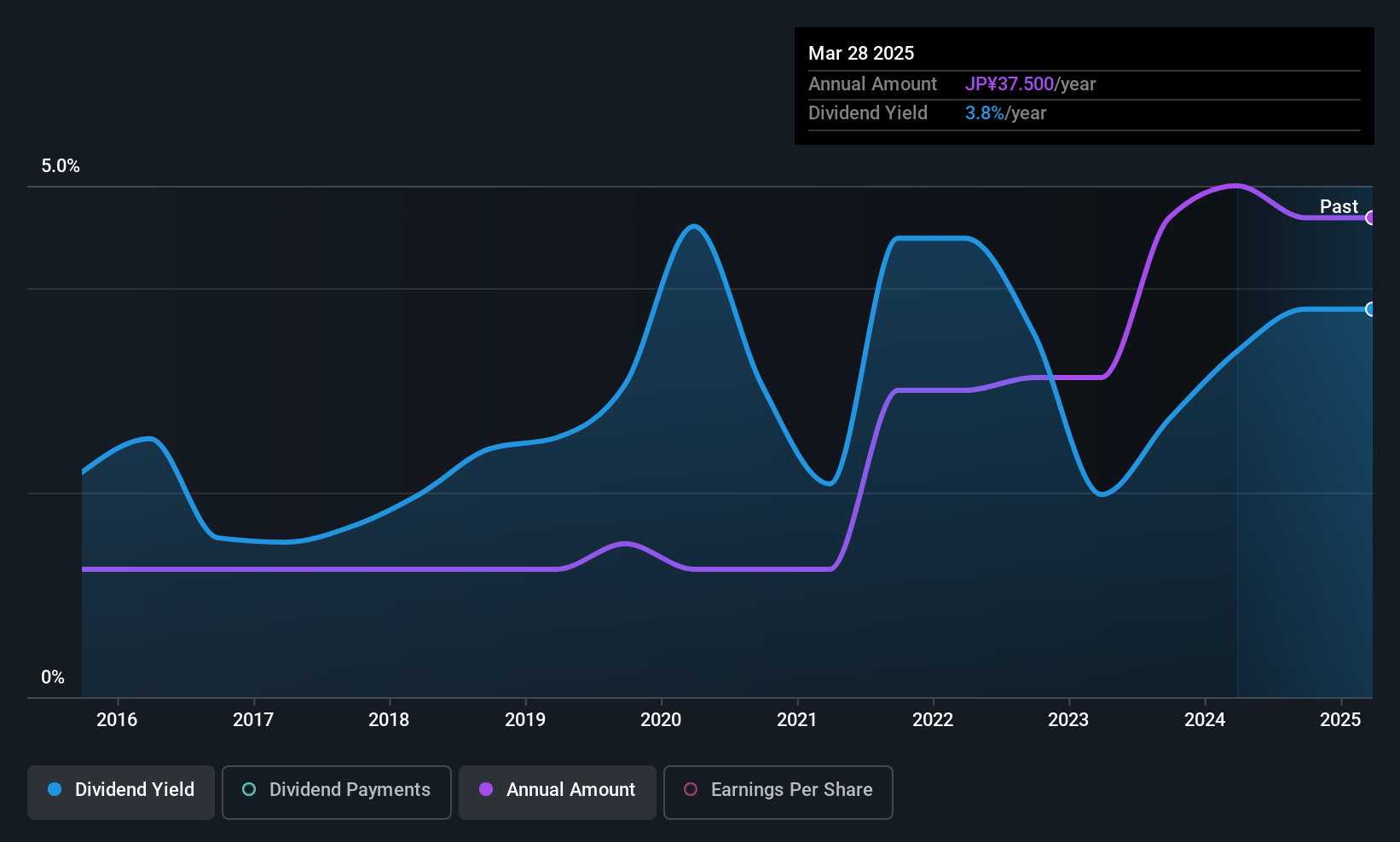

Y.A.C. Holdings (TSE:6298)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Y.A.C. Holdings Co., Ltd. operates in the mechatronics, display, industrial machinery, and electronics sectors both in Japan and internationally, with a market cap of ¥19.51 billion.

Operations: Y.A.C. Holdings Co., Ltd.'s revenue is primarily derived from its Semiconductor and Mechatronics segment at ¥10.90 billion, followed by Environment and Infrastructure at ¥8.75 billion, and Medical Care at ¥5.16 billion.

Dividend Yield: 3.8%

Y.A.C. Holdings' dividend policy has recently shifted towards a progressive approach, considering business growth investments and financial position. Despite a high payout ratio of 81.4%, dividends are covered by earnings and cash flows, with a cash payout ratio of 59.8%. However, the dividend track record is volatile, evidenced by a recent decrease from ¥35 to ¥20 per share. The company announced a share buyback program for up to ¥1 billion to enhance shareholder value.

- Take a closer look at Y.A.C. Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility Y.A.C. Holdings' shares may be trading at a premium.

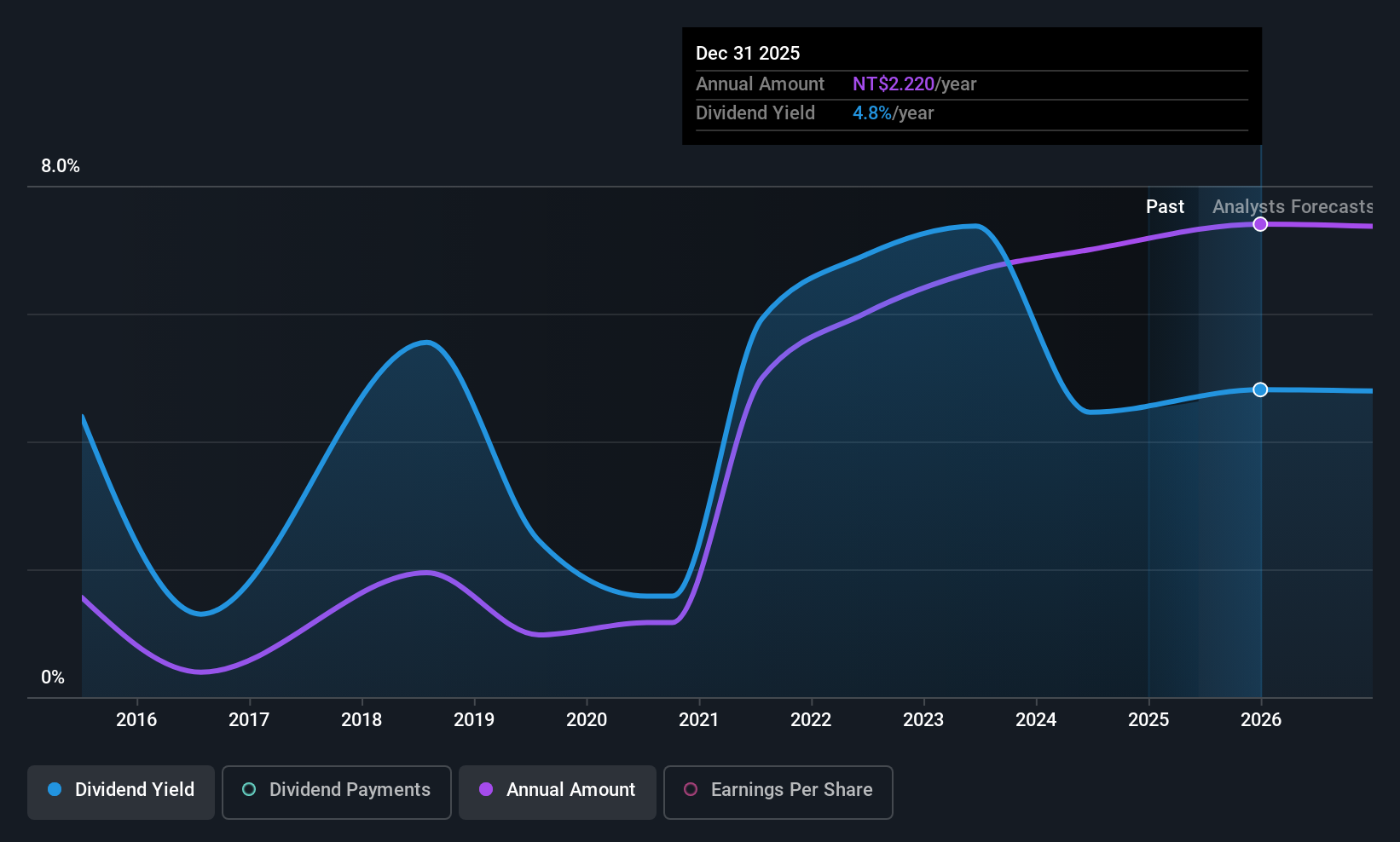

Goldsun Building Materials (TWSE:2504)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldsun Building Materials Co., Ltd. operates in Taiwan and Mainland China, producing and selling premixed concrete, cement, and calcium silicate board, with a market cap of NT$45.31 billion.

Operations: Goldsun Building Materials Co., Ltd.'s revenue primarily comes from its Taiwan Premix Division, generating NT$19.57 billion, and its Ready-Mixed Cement Business in Mainland China, contributing NT$992.72 million.

Dividend Yield: 7.3%

Goldsun Building Materials' recent earnings report shows increased sales and net income, yet its dividend reliability remains questionable due to volatility over the past decade. While offering a high yield of 7.27%, dividends are not well-supported by cash flows, reflected in a cash payout ratio exceeding 1000%. The current payout ratio suggests dividends are covered by earnings, but sustainability concerns persist as payments have been historically unstable despite some growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Goldsun Building Materials.

- Our valuation report unveils the possibility Goldsun Building Materials' shares may be trading at a discount.

Key Takeaways

- Gain an insight into the universe of 1021 Top Asian Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報