What Suburban Propane Partners (SPH)'s 2035 Debt Refinance Means For Shareholders

- Suburban Propane Partners, L.P. has completed a private offering of US$350 million in 6.500% Senior Notes due 2035, with net proceeds of about US$344.3 million earmarked, together with revolving credit borrowings, to redeem its 5.875% senior notes due 2027 and cover related costs.

- By refinancing shorter‑dated 2027 notes with longer‑maturity 2035 debt, the partnership is reshaping its debt schedule and potentially increasing financial flexibility for its core propane and renewable fuel initiatives.

- We’ll now explore how replacing 2027 notes with longer‑dated 2035 debt may influence Suburban Propane Partners’ investment narrative and risk profile.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Suburban Propane Partners Investment Narrative Recap

To own Suburban Propane Partners, you need to believe its mature propane franchise can keep funding distributions while newer renewable fuel projects gradually matter more. The new 6.500% 2035 notes modestly reshape its balance sheet but do not materially change the key near term catalyst around renewable natural gas execution or the main risk from high leverage and interest coverage pressure.

The recent completion of the US$350.0 million 2035 senior notes offering ties directly to that leverage question, since it extends maturities while keeping interest costs elevated. Set against 2025 full year net income of US$106.57 million and an ongoing US$0.325 per unit quarterly distribution, this refinancing sits at the heart of how comfortably Suburban Propane can fund both growth in cleaner fuels and its current payout.

Yet investors should be aware that, despite the extended maturity profile, the combination of relatively high leverage and interest obligations could still...

Read the full narrative on Suburban Propane Partners (it's free!)

Suburban Propane Partners' narrative projects $1.5 billion revenue and $132.3 million earnings by 2028. This implies a 1.0% yearly revenue decline and a $35.2 million earnings increase from $97.1 million today.

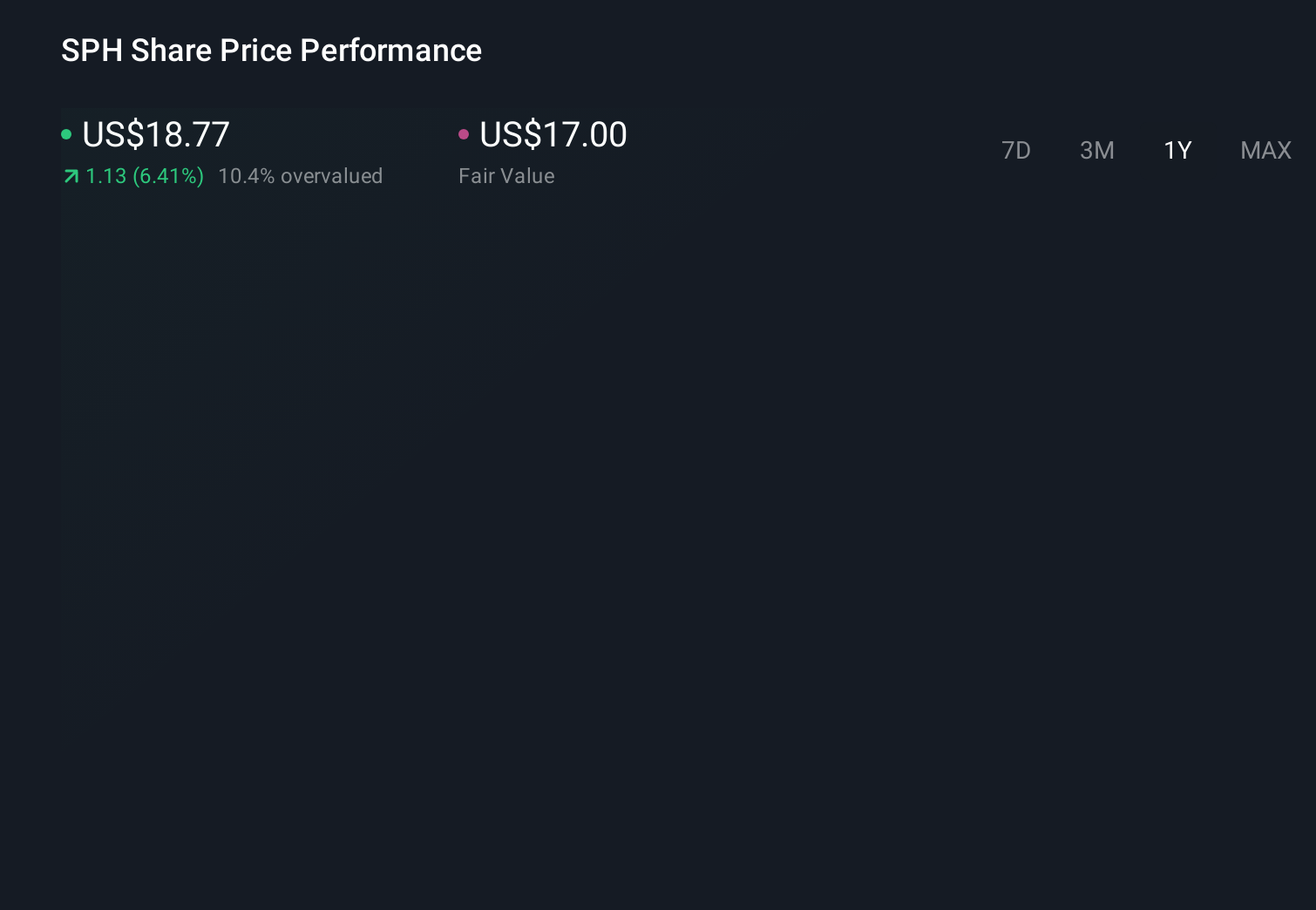

Uncover how Suburban Propane Partners' forecasts yield a $17.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member currently pegs fair value at US$17.00, underscoring how a single view can differ from market pricing. Against that backdrop, the partnership’s elevated leverage and interest coverage constraints put a sharper focus on how its new 2035 debt might influence future financial resilience and income stability.

Explore another fair value estimate on Suburban Propane Partners - why the stock might be worth as much as $17.00!

Build Your Own Suburban Propane Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Suburban Propane Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suburban Propane Partners' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報