There is no “quick-acting medicine” in yen! The Bank of Japan's gradual austerity is difficult to reverse the structural decline, and Wall Street sings empty and loud

The Zhitong Finance App learned that after the Bank of Japan's latest interest rate hike failed to provide a continuous boost to the yen, voices that are bearish on the yen are getting louder and louder, which further strengthens the market view that there is no “quick fix” for the structural weakness of the yen. Strategists at institutions such as J.P. Morgan Chase and BNP Paribas expect that by the end of 2026, the yen may depreciate to 160 yen or even weaker per dollar. Factors driving this judgment include the still huge spread between the US and Japan, negative real interest rates, and continued capital outflows. These institutions believe that as long as the Bank of Japan continues to adopt progressive austerity and the risk of fiscally driven inflation persists, this trend will be difficult to reverse.

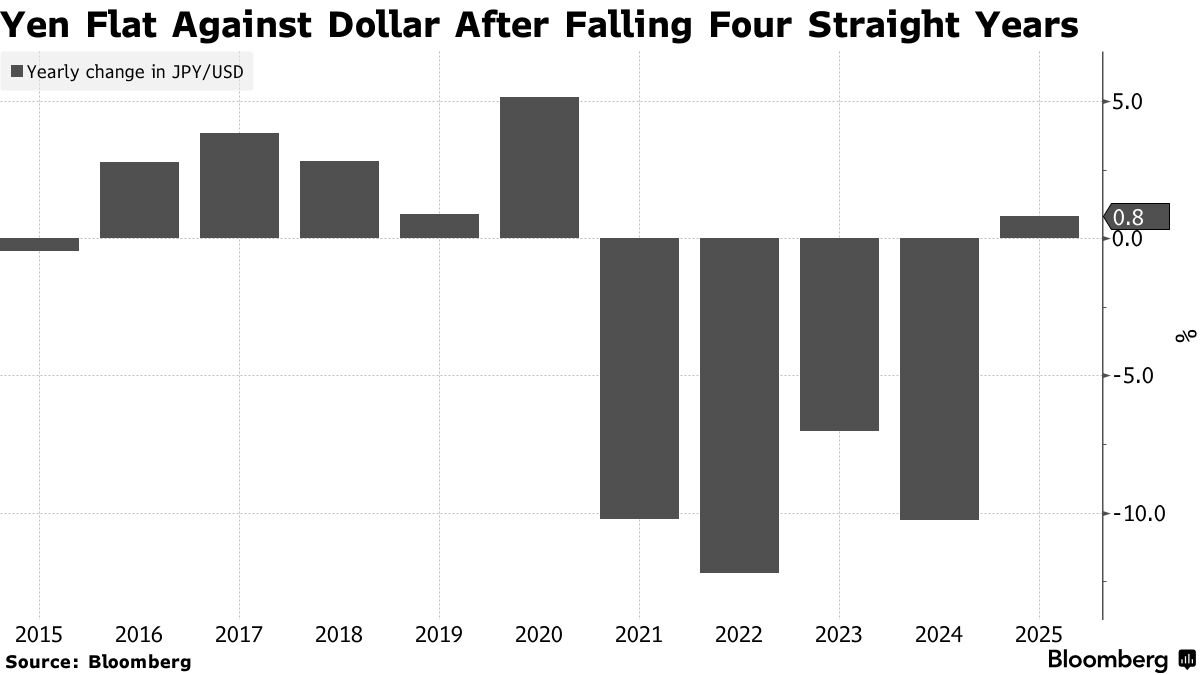

Since this year, the exchange rate of the yen against the US dollar has barely achieved a slight increase of less than 1% after four consecutive years of decline. Previously, the market hoped that the Bank of Japan's interest rate hike and the Federal Reserve's interest rate cut would jointly drive a reversal of the yen trend, but the actual results were disappointing. In April of this year, the dollar fell below the 140 mark against the yen, but then lost momentum against the backdrop of uncertainty about US President Trump's tariff policy and rising fiscal risks caused by domestic political changes in Japan. Currently, the dollar is trading around 155.70 against the yen, which is not far from this year's low of 158.87 — and this level is almost the same as in January at the beginning of the year.

Junya Tanase, Japan's chief foreign exchange strategist at J.P. Morgan Chase, said, “The fundamentals of the yen are quite weak, and there won't be much change next year.” He gave one of Wall Street's most pessimistic predictions. It is expected that the USD/JPY exchange rate will reach 164 by the end of 2026. He pointed out that cyclical forces may further harm the yen next year, and the impact of the Bank of Japan's tightening policy will be weakened as the market takes higher interest rate expectations into other regions.

Overnight index swaps show that the market has yet to fully price the Bank of Japan's next rate hike, which is expected to be until September at the earliest. Meanwhile, inflation remains above the Bank of Japan's target level of 2%, which continues to put pressure on Japan's treasury bonds.

The return of arbitrage trading has also become a new headwind. The strategy of borrowing low-yielding yen and investing in high-yield currencies such as the Brazilian real or Turkish lira makes it more difficult for the yen to rebound. According to data from the US Commodity Futures Trading Commission (CFTC), in the week ending December 9, leveraged funds were bearish on the yen to the highest level since July 2024, and basically maintained these positions in the following week.

risk appetite

Parisha Saimbi, an emerging Asian foreign exchange and interest rate strategist at BNP Paribas, said that next year's global macro environment should be “relatively favorable to risk sentiment, and in this environment, arbitrage strategies will usually be favorable.” She expects the USD/JPY exchange rate to rise to 160 by the end of 2026. She added that steady demand for arbitrage, the cautious Bank of Japan, and the US Federal Reserve, which may be more hawkish than expected, may keep the dollar exchange rate high against the yen.

Japan's outflow of foreign investment is another source of pressure. The net purchase amount of Japanese retail investors allocating overseas stocks through investment trusts hovered around the ten-year high of 9.4 trillion yen (about 60 billion US dollars) set last year, highlighting the continued preference of households for overseas assets. Analysts believe this trend is likely to continue until 2026 and continue to suppress the yen.

Capital outflows at the corporate level may be a more enduring driver. Shusuke Yamada, Japan's chief foreign exchange and interest rate strategist at Bank of America Securities, pointed out in a report earlier this month that Japan's OFDI has maintained a steady pace in recent years and is hardly affected by cyclical factors or changes in interest spreads. It is particularly noteworthy that the scale of foreign mergers and acquisitions of Japanese companies has risen to a multi-year high this year.

Tohru Sasaki, chief strategist at Fukuoka Financial Group, said, “There has been almost no change in the weak yen situation. The point is that the Bank of Japan has not actively raised interest rates, and real interest rates are still deeply negative.” He expects the USD/JPY exchange rate to reach 165 by the end of 2026. “I think the Federal Reserve has basically completed the cycle of cutting interest rates. If the market starts to fully take this into account, it will also be another factor driving up the USD/JPY exchange rate.”

However, there are still some yen observers who are convinced that as the Bank of Japan continues to promote policy normalization, the yen will strengthen in the longer term. Goldman Sachs Group anticipates that within the next ten years, the yen may eventually rise to the level of 1 US dollar to 100 yen, but it also admits that there are multiple negative factors in the short term.

As the yen approaches the level that had previously caused an official downturn, market concerns about the risk of intervention are once again heating up. Japanese officials, including Finance Minister Katayama Satsuki, have increased their warnings about what they call “excessive and speculative” foreign exchange fluctuations. However, analysts pointed out that it is difficult to lift the yen out of its slump with intervention measures alone. Wee Khoon Chong, Asia Pacific senior market strategist at Bank of New York Mellon said, “Overall, the market remains tight and volatile, and 'smooth operation' alone may not change the trend of yen depreciation.” “In the short term, the focus of the market will remain on the Japanese government's upcoming fiscal strategy.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報