Evaluating SES AI (NYSE:SES) After New Drone Battery Partnership and Upcoming Battery World Update

SES AI (NYSE:SES) just put two weighty catalysts on the table: a Korea based manufacturing collaboration aimed at NDAA compliant drone batteries, and its upcoming Battery World update on AI driven cell technology and capacity.

See our latest analysis for SES AI.

Those drone and AI battery headlines are landing against a backdrop where SES AI’s share price return has quietly shifted higher, with a roughly 10 percent 3 month share price return and a 1 year total shareholder return near 190 percent, but a still negative 3 year total shareholder return showing how early and volatile this story remains.

If this kind of battery and drone momentum has your attention, it could be worth scanning other aerospace and defense names using aerospace and defense stocks to see what else may be aligning for potential growth.

But with SES AI still loss making and trading nearly 50 percent below the average analyst price target, are investors looking at an underappreciated growth story or a stock already pricing in tomorrow’s breakthroughs?

Most Popular Narrative Narrative: 32.0% Undervalued

With the most followed narrative pointing to a fair value of $3.00 against a last close of $2.04, the implied upside is sizeable and growth driven.

Integration of the Molecular Universe AI platform into both energy storage and EV applications gives SES AI a unique edge as AI driven materials discovery accelerates innovation cycles, improves battery safety, and enables differentiation in high value markets supporting future margin expansion and earnings growth.

Want to see what kind of revenue ramp, margin reset, and future earnings multiple are being baked into that number? The narrative spells it out. Click through to unpack the full valuation logic hiding behind that headline upside.

Result: Fair Value of $3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on smooth UZ Energy integration and rapid Molecular Universe adoption, with any execution stumble or AI underperformance likely to challenge that valuation path.

Find out about the key risks to this SES AI narrative.

Another Angle on Valuation

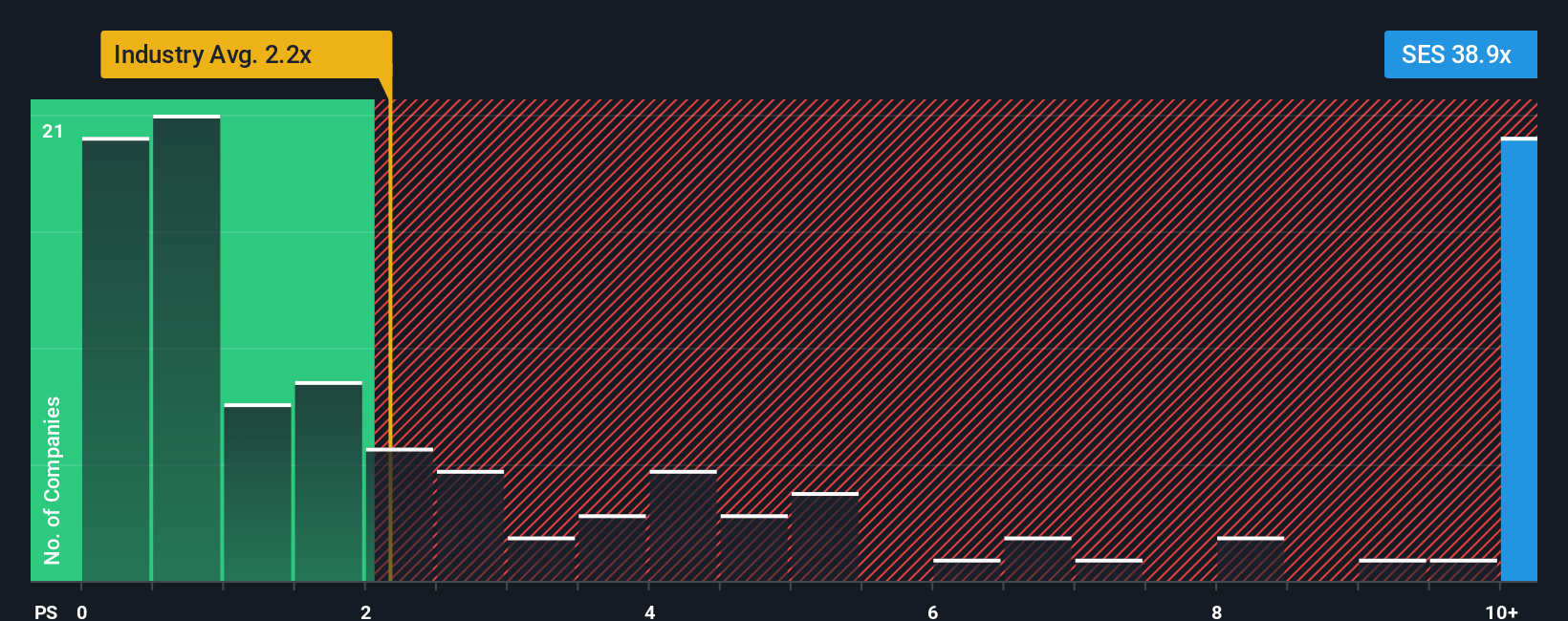

That $3.00 fair value rests heavily on growth assumptions, but today’s price already bakes in a rich sales multiple. SES trades on a 40.3x price to sales ratio versus 2.2x for the US Electrical industry and 23.6x for peers, even if a 46.2x fair ratio suggests some headroom.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SES AI Narrative

If you see this differently or want to dig into the numbers yourself, you can quickly build a personalized view in just minutes, Do it your way.

A great starting point for your SES AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover more stocks that fit your strategy before the market fully catches on.

- Capture early stage momentum by scanning these 3622 penny stocks with strong financials that already show solid balance sheets and improving fundamentals before the crowd notices.

- Ride the next wave of automation and productivity gains by targeting these 24 AI penny stocks positioned at the heart of the AI transformation.

- Explore potential upside with these 901 undervalued stocks based on cash flows that trade below their cash flow based fair value while quality remains intact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報