Asian Growth Companies With High Insider Ownership December 2025

As the Asian markets navigate a complex landscape marked by Japan's significant interest rate hike and China's mixed economic signals, investors are increasingly focused on identifying resilient growth opportunities. In this context, companies with high insider ownership often stand out as they may indicate a strong alignment of interests between management and shareholders, potentially offering stability amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Ganfeng Lithium Group (SZSE:002460) | 26.7% | 46.5% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's explore several standout options from the results in the screener.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation, with a market cap of ₩12.85 trillion, operates in power generation facilities, industrial facilities, construction machinery, engines, and construction sectors across Korea and globally.

Operations: The company's revenue segments include power generation facilities, industrial facilities, construction machinery, engines, and construction operations across various regions including Korea, the United States, Asia, the Middle East, and Europe.

Insider Ownership: 38.2%

Doosan's earnings are forecast to grow significantly, outpacing the Korean market, despite revenue growth trailing behind. The company recently turned profitable and trades below its estimated fair value. However, interest payments remain a concern as they aren't well-covered by earnings. Recent product announcements at CES 2026 highlight Doosan's focus on AI-driven energy solutions and automation technologies, underscoring its commitment to innovation in rapidly evolving industries.

- Get an in-depth perspective on Doosan's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Doosan's current price could be quite moderate.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a company that manufactures, processes, and sells laptop computers and telecommunication products globally, with a market capitalization of NT$1.02 trillion.

Operations: The company's revenue primarily comes from The Electronics Sector, which generated NT$3.90 billion.

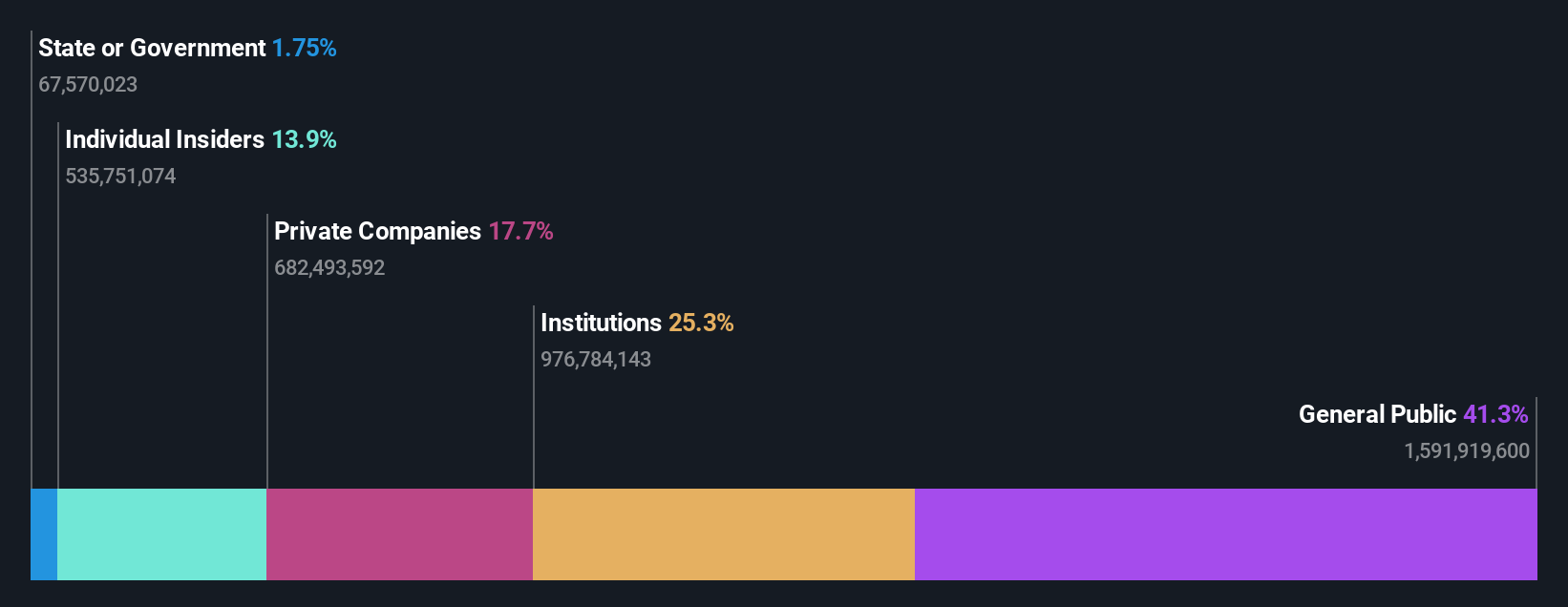

Insider Ownership: 13.9%

Quanta Computer's revenue is forecast to grow at 27% annually, surpassing the Taiwanese market average. Despite a slight dip in recent quarterly net income, earnings grew by 26.9% over the past year and are expected to increase by 15.49% annually. The stock trades at a favorable price-to-earnings ratio of 14.8x compared to the local market's 20.4x, with analysts predicting a potential price rise of 32.8%.

- Click to explore a detailed breakdown of our findings in Quanta Computer's earnings growth report.

- In light of our recent valuation report, it seems possible that Quanta Computer is trading behind its estimated value.

Caliway Biopharmaceuticals (TWSE:6919)

Simply Wall St Growth Rating: ★★★★★★

Overview: Caliway Biopharmaceuticals Co., Ltd., along with its subsidiaries, focuses on developing drugs for aesthetic medicine and chronic inflammation, with a market cap of NT$244.27 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to NT$34.99 million.

Insider Ownership: 24.3%

Caliway Biopharmaceuticals is poised for significant growth, with revenue expected to increase by 121.8% annually, outpacing the Taiwanese market. Despite recent financial challenges, including a net loss reduction from TWD 532.69 million to TWD 432.11 million over nine months, the company anticipates profitability within three years. The recent buyback plan and preclinical advancements in obesity treatment underscore strategic initiatives aimed at enhancing shareholder value and long-term growth potential amidst high insider ownership dynamics.

- Take a closer look at Caliway Biopharmaceuticals' potential here in our earnings growth report.

- According our valuation report, there's an indication that Caliway Biopharmaceuticals' share price might be on the expensive side.

Turning Ideas Into Actions

- Investigate our full lineup of 631 Fast Growing Asian Companies With High Insider Ownership right here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報