3 Asian Stocks That May Be Trading Below Their Estimated Value

As the Bank of Japan raises its benchmark interest rate to a 30-year high and China's economic indicators reveal mixed signals, investors are closely watching the Asian markets for potential opportunities. In this environment, identifying stocks that may be trading below their estimated value can provide a strategic edge, especially when considering factors like interest rates and economic growth trends.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xizang Gaozheng Civil Explosives (SZSE:002827) | CN¥39.70 | CN¥77.76 | 48.9% |

| Takara Bio (TSE:4974) | ¥808.00 | ¥1575.00 | 48.7% |

| Shuangdeng Group (SEHK:6960) | HK$14.97 | HK$29.65 | 49.5% |

| NEXON Games (KOSDAQ:A225570) | ₩12270.00 | ₩24531.27 | 50% |

| Kuraray (TSE:3405) | ¥1601.00 | ¥3165.02 | 49.4% |

| KIYO LearningLtd (TSE:7353) | ¥691.00 | ¥1378.97 | 49.9% |

| Forth Corporation (SET:FORTH) | THB5.65 | THB11.11 | 49.2% |

| CURVES HOLDINGS (TSE:7085) | ¥807.00 | ¥1578.17 | 48.9% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.43 | 49.5% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥264.78 | CN¥516.05 | 48.7% |

Here's a peek at a few of the choices from the screener.

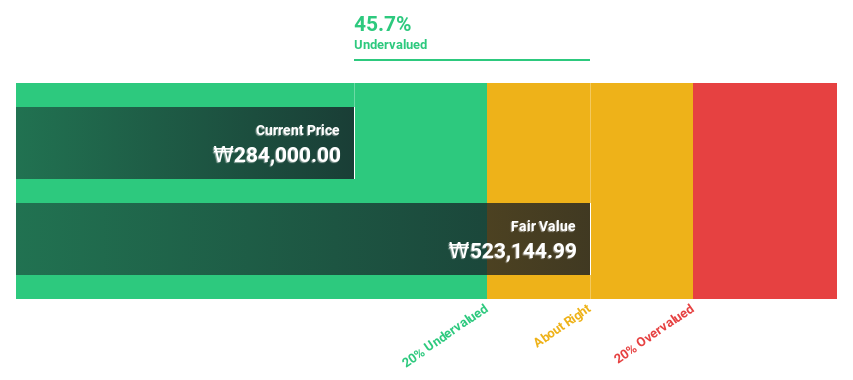

Doosan (KOSE:A000150)

Overview: Doosan Corporation, along with its subsidiaries, operates in power generation facilities, industrial facilities, construction machinery, engines, and construction sectors across Korea and globally; it has a market cap of approximately ₩12.85 trillion.

Operations: Doosan's revenue primarily stems from its operations in power generation facilities, industrial facilities, construction machinery, engines, and the construction sector across various regions including Korea, the United States, Asia, the Middle East, and Europe.

Estimated Discount To Fair Value: 22%

Doosan's stock is trading at ₩811,000, significantly below its estimated fair value of ₩1,039,540.18. Despite slower revenue growth forecasts compared to the Korean market and high volatility in share price, Doosan has returned to profitability this year with earnings projected to grow significantly over the next three years. Recent announcements highlight Doosan's commitment to AI-driven industries and clean energy solutions, potentially bolstering future cash flows amidst ongoing technological innovations.

- Our expertly prepared growth report on Doosan implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Doosan's balance sheet health report.

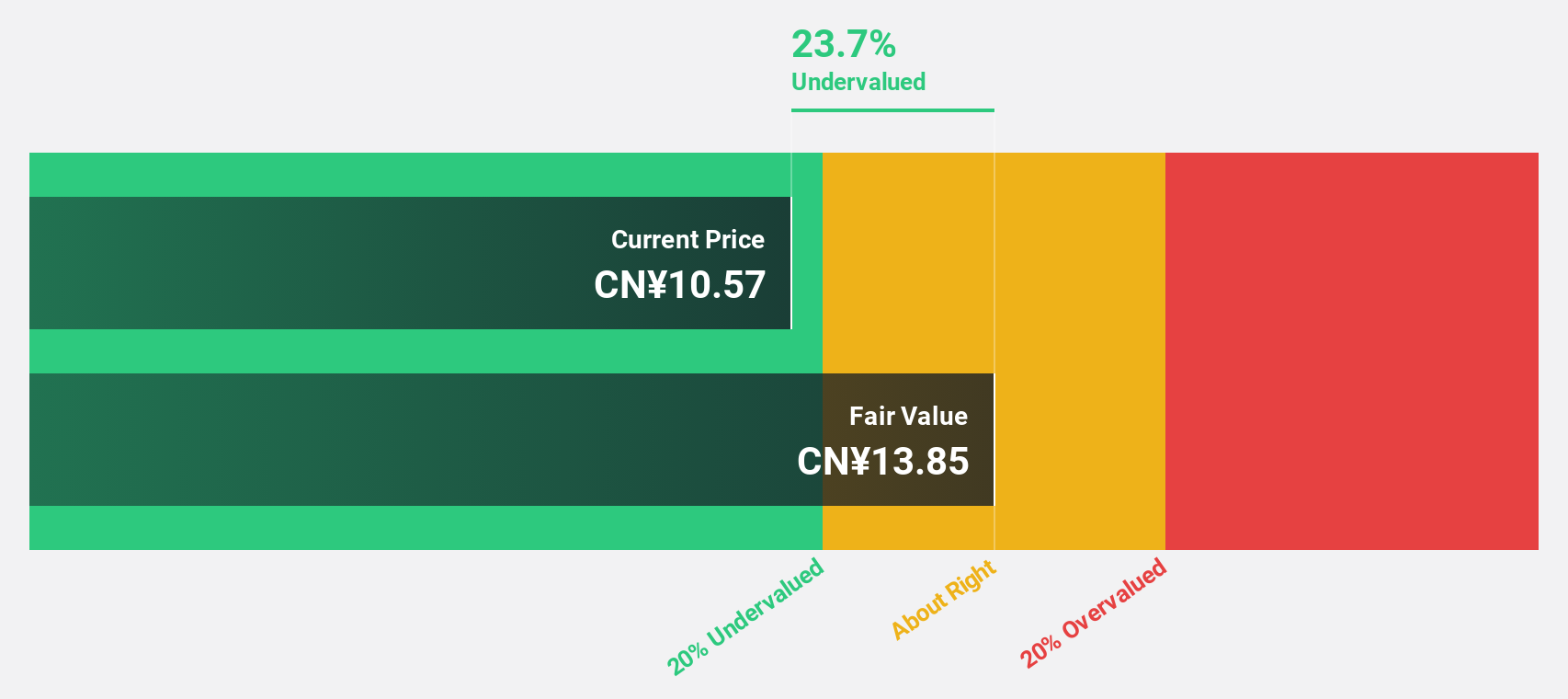

Shenzhen Noposion Crop Science (SZSE:002215)

Overview: Shenzhen Noposion Crop Science Co., Ltd. engages in the research, development, manufacturing, distribution, and technical servicing of pesticides and fertilizers both in China and internationally with a market cap of CN¥10.93 billion.

Operations: Shenzhen Noposion Crop Science Co., Ltd. generates revenue through its research, development, manufacturing, distribution, and technical services related to pesticides and fertilizers in both domestic and international markets.

Estimated Discount To Fair Value: 19%

Shenzhen Noposion Crop Science is trading at CNY 11.04, below its estimated fair value of CNY 13.63, reflecting a potential undervaluation based on cash flows. Despite high debt levels and a dividend not fully covered by free cash flow, the company's earnings are expected to grow significantly at 34.7% annually over the next three years, outpacing the Chinese market average. Recent private placements raised CNY 1.45 billion, potentially enhancing financial flexibility amidst governance changes.

- Our comprehensive growth report raises the possibility that Shenzhen Noposion Crop Science is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Shenzhen Noposion Crop Science.

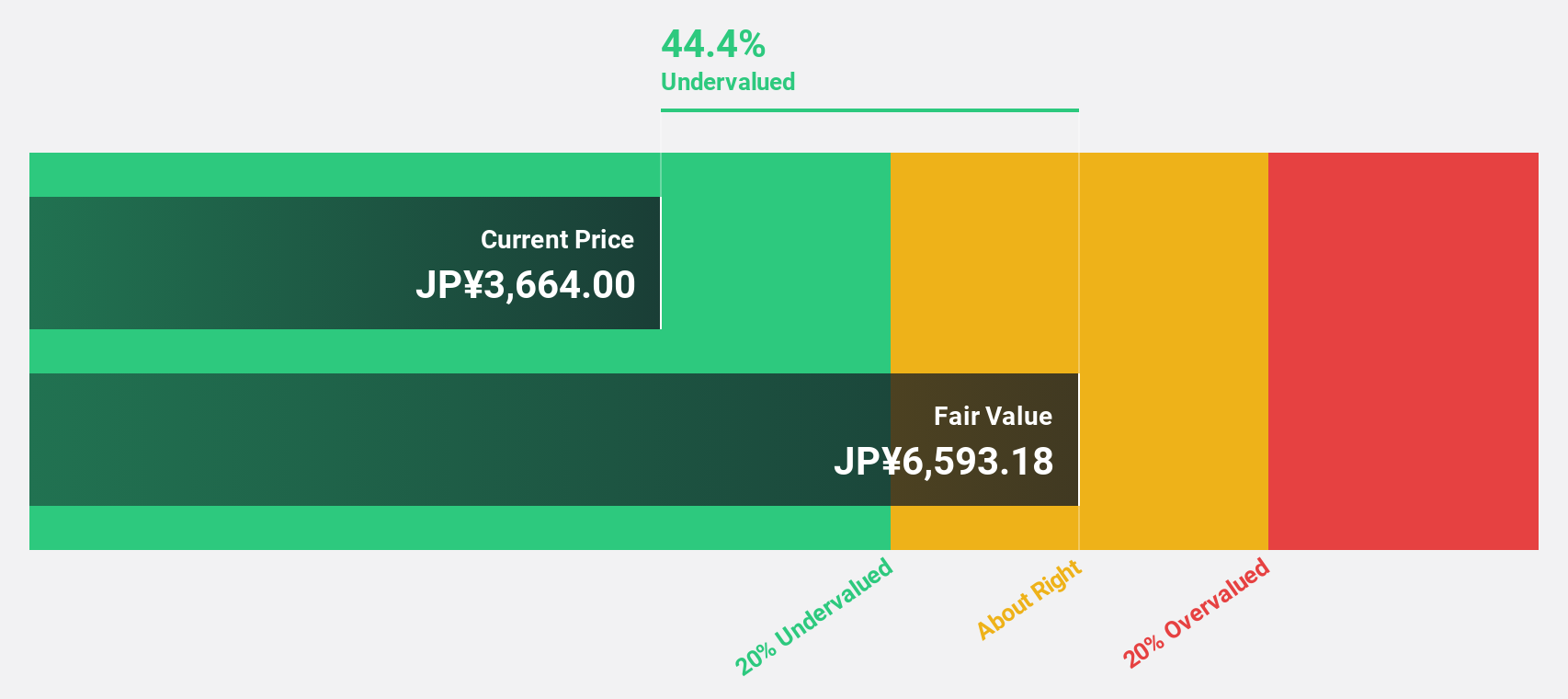

H.U. Group Holdings (TSE:4544)

Overview: H.U. Group Holdings, Inc., along with its subsidiaries, operates in the healthcare sector across Japan, the United States, Europe, and internationally; it has a market cap of approximately ¥1.91 billion.

Operations: The company's revenue is derived from three main segments: Healthcare Related Service at ¥30.96 million, Clinical Test Drugs Business at ¥65.16 million, and Inspection and Related Service generating ¥156.20 million.

Estimated Discount To Fair Value: 47.8%

H.U. Group Holdings is trading at ¥3,441, significantly below its estimated fair value of ¥6,592.59, suggesting undervaluation based on cash flows. Despite a dividend not fully covered by earnings and low forecasted return on equity of 7.1%, the company expects robust earnings growth of 36.5% annually over the next three years, surpassing the Japanese market average. Recent guidance confirmed improved profit expectations due to asset sales and share buybacks totaling ¥4.99 billion enhance shareholder value.

- The growth report we've compiled suggests that H.U. Group Holdings' future prospects could be on the up.

- Dive into the specifics of H.U. Group Holdings here with our thorough financial health report.

Seize The Opportunity

- Access the full spectrum of 270 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報