Seagate (STX) Valuation Check After Nasdaq-100 Entry, AI Storage Momentum and Dividend Hike

Seagate Technology Holdings (STX) just earned a spot in the Nasdaq 100, a milestone that typically boosts liquidity and visibility, and it comes as AI driven storage demand is already powering a strong run.

See our latest analysis for Seagate Technology Holdings.

All of this lands on top of an already powerful backdrop, with a roughly 230 percent year to date share price return and a more than fivefold three year total shareholder return suggesting momentum is still very much building rather than cooling.

If Seagate’s AI driven surge has you rethinking where the next leg of growth could come from, this is a good moment to explore other high growth tech and AI stocks via high growth tech and AI stocks.

With shares already up more than 220 percent over the past year and trading just below fresh analyst targets, the key question now is simple: Is Seagate still undervalued by the market, or is future AI driven growth already fully priced in?

Most Popular Narrative Narrative: 4.0% Undervalued

With Seagate last closing at $285.27 against a most popular narrative fair value near $297, the story hinges on how long AI era margins can hold.

The Fair Value Estimate has risen slightly to approximately $297 per share from about $289, reflecting modestly stronger long term growth and earnings assumptions.

The Future P/E has risen moderately to roughly 23.4x from about 22.7x, indicating a somewhat higher valuation multiple applied to forward earnings expectations.

To see what kind of revenue trajectory, margin reset, and future earnings multiple are needed to support that higher fair value line in the sand, review the full narrative.

Result: Fair Value of $297.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat outlook could be tested if trade policy uncertainty, or a sharper than expected SSD competitive push, slows hyperscaler HDD demand.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another Lens On Valuation

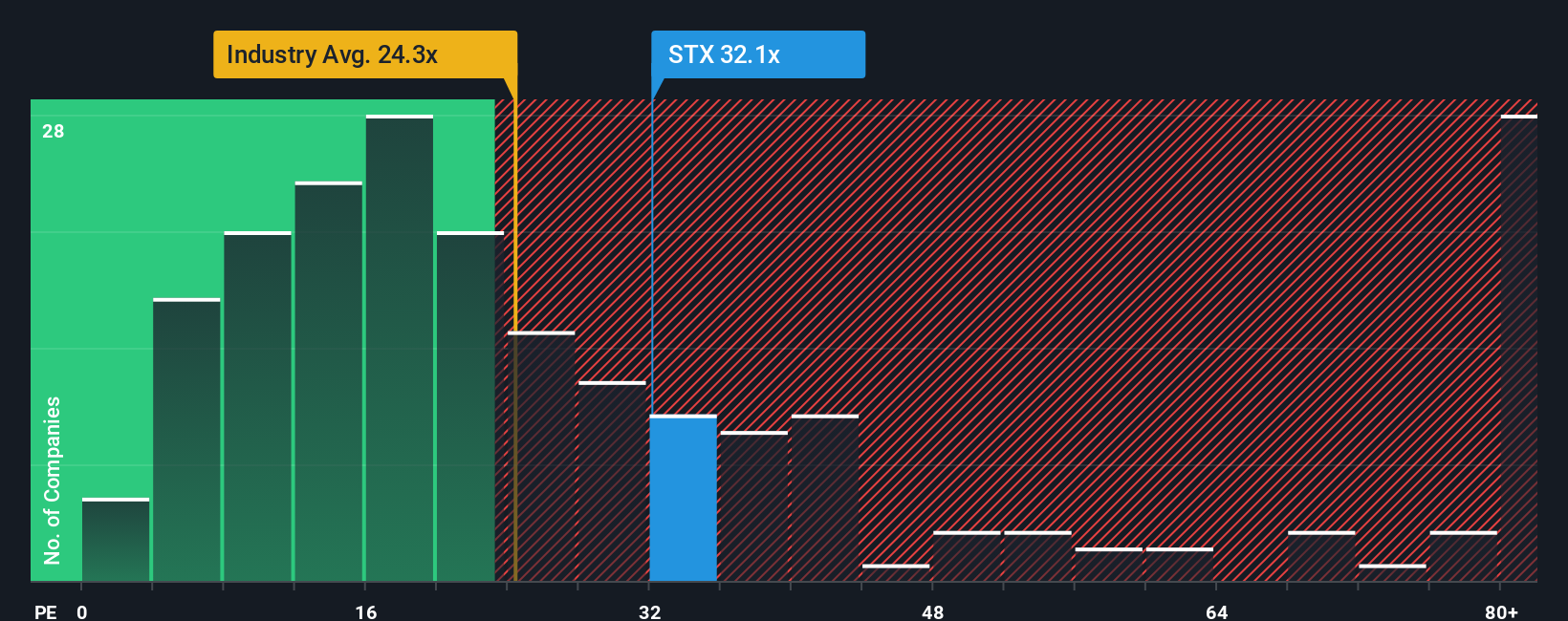

While the narrative fair value suggests Seagate is about 4 percent undervalued, its 36.3x price to earnings ratio tells a more stretched story compared with 23x for the broader tech sector and a 16.7x peer average, and even sits slightly above a 36.2x fair ratio baseline.

That premium multiple implies investors are already paying up for a lot of future AI upside, leaving less room for error if margins or growth disappoint. The real question is whether this is justified conviction or creeping valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seagate Technology Holdings Narrative

If this view does not fully align with your own, or you would rather dig into the numbers yourself, you can build a custom Seagate thesis in just a few minutes by starting with Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by using the Simply Wall Street Screener to uncover fresh opportunities you will not want to overlook.

- Capture early stage potential by scanning these 3622 penny stocks with strong financials that already show stronger balance sheets and fundamentals than typical speculative names.

- Position yourself for the next AI surge by focusing on these 24 AI penny stocks shaping automation, data processing, and intelligent infrastructure worldwide.

- Strengthen your portfolio’s core with these 901 undervalued stocks based on cash flows that appear mispriced based on future cash flows, before the broader market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報